Summary

Summary

- On October 25th Visa reported strong Q4 and 2017 earnings. Growth was experienced in payments volume, cross-border volume, and processed transactions.

- V reported a broad list of accomplishments and initiatives in process including the integration of the European operations which is proceeding ahead of plan.

- While V increased the quarterly dividend ~18% to $0.195/share/quarterly, the dividend income is secondary to capital appreciation potential.

- V is definitely not on sale but if your investment time horizon is several years you may want to nibble at V while you wait for a long overdue market correction at which time you can increase your exposure.

Introduction

On January 12, 2017 I wrote my first post about VISA Inc. (NYSE: V). This post was followed by my January 18, 2017 post in which I wrote that Low or No Dividend Yield Companies Belong in Your Portfolio.

I wrote my January 18, 2017 post because I was perplexed as to why so many investors have been gravitating toward an investment “strategy” focused almost exclusively on companies with eye popping dividend yields.

My experience has taught me to view high dividend yield stocks with a great deal of skepticism. I found such stocks:

- experience a greater likelihood of a dividend cut than low dividend yield stocks;

- exhibit a lower probability of any meaningful form of capital appreciation;

- are likely to underperform in a rising interest rate environment.

I set a goal several years ago to retire before the typical retirement age in Canada (typically the mid 60s); my wife retired at 52 and I retired at 56. In order to achieve this goal, I decided I would invest in high quality companies with competitive advantages. At no point in time did I set a minimum dividend yield criteria. Had I set a minimum dividend yield threshold I would have never acquired a sizable portion of our existing V holdings on March 28, 2008; additional V shares have been added over the years.

VISA’s Suite of Products

I had a rudimentary knowledge of VISA long before it changed its name from Chargex. My understanding of VISA, however, was broadened when as a member of my former employer’s Global Transaction Banking team, I became familiar with VISA Payables Automation (VPA). It was then that I gained a greater appreciation as to how the VISA network could be used for far more than your typical retail transaction.

Even as I became familiar with VPA, I never fully comprehended the magnitude and speed at which technological advancements would positively impact V. If your understanding of V is somewhat limited and you are wondering how V will succeed in a rapidly changing environment, you may wish to look here.

Over the course of my banking career I observed how the use of cash as a method of payment was on the decline. This has been confirmed by countless studies which suggest that by 2020, the Internet of Things (IoT) will consist of more than 20.4 billion devices, including mobile phones, wearable technology, home appliances and cars. Each device is a potential way to pay without the use of cash. Essentially, V is enabling new payment opportunities with legitimacy and security in mind.

Here are a couple examples of revolutionary V products.

- “mVISA is a QR-based mobile payment solution that brings the benefits of easy and secure digital commerce to financial institutions, merchants and consumers in emerging markets. It is live in India, Kenya and Rwanda and roll out to merchants and consumers in Egypt, Ghana, Indonesia, Kazakhstan, Nigeria, Pakistan and Vietnam is on the docket.”

- “VISA Direct provides a secure, seamless, and fast method for disbursing, for example, insurance and health claim reimbursements. The benefit of this solution is that consumers often do not have their bank routing and account numbers on hand when requesting a payment. As a result, the default method of payment is the issuance of a cheque. Visa Direct addresses this issue in that the remittance of funds is made over the Visa Network directly to any eligible US debit or prepaid card.”

Our VISA Investment

On March 28, 2008, within 1 month of the March 2008 IPO, I acquired shares for one of our retirement accounts.

Readers may recall the environment certainly was not conducive for what was, at the time, the largest IPO. Some predicted the biggest risk to V was that a worldwide recession would reduce the use of both debit and credit cards.

V’s stock price essentially remained steady until late 2011 by which time we had adapted to the new post Financial Crisis environment. Once everyone realized the world had not come to an end, V’s stock price began its steady upward trajectory.

At no point in time when I made our initial, and subsequent, V purchases did I ever imagine V would acquire V Europe. I strongly suspect that as the European operations are integrated into V, further dramatic growth will be evidenced.

Q4 and Fiscal 2017 Financial Results

V reported Q4 and FY 2017 results on October 25, 2017. The Q4 conference call presentation can be accessed here.

V’s extensive list of accomplishments and initiatives in process can be found in the transcript of the conference call. Please refer specifically to pages 3 and 4.

2018 Forecast

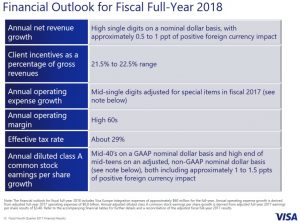

V’s 2018 forecast is as follows:

Dividend Yield

Dividend Yield

I suspect many investors do not put V on their radar screen as a potential investment because the dividend yield is typically sub 1%. I recognize investors have different investing goals and objectives so V will not suit everyone.

Even though V’s dividend yield is a paltry sub 1 %, I suggest you look at V’s dividend track record. V‘s next quarterly dividend of $0.195 payable December 5, 2017 represents a >18% increase from the previous $0.165 quarterly dividend; the new dividend results in V’s dividend payout ratio being in a very conservative 20% – 25% range.

Valuation

I have no empirical evidence to support my opinion but I strongly suspect a huge percentage of investors rely heavily on stock screeners to narrow the universe of companies to a manageable number of companies worthy of some research. The most commonly used metrics are likely the PE ratio and dividend yield and the parameters many investors likely set would exclude V from the search results.

Looking at the search results, V has appreciated considerably from its 52 week low. The PE at the time this article in being written is in excess of 40 and the forward PE is in excess of 27.

I would typically pass on investing in any company with some of the metrics currently exhibited by V. In the case of V, however, I would initiate a small position if I did not currently own any shares. Readers should keep in mind that I intend to own V for a very long time and my (and my wife’s) game plan is to transfer our shares to our daughter when our time on this planet ends. I suspect that many years (hopefully) from now our daughter will look at V’s stock chart and the somewhat current rich valuation will be a non-issue.

If, however, you are an investor who views holding an investment for 2 – 3 years as “long-term” then this might not be the right time to invest in V. I recognize the US economy is performing well but I have this nagging suspicion that a market correction (it could be temporary) will occur before 2018 comes to an end. Even investors such as David Einhorn, Seth Klarman, and Paul Singer, are puzzled by the strength of the market and view a market correction as being overdue.

VISA Stock Analysis – Final Thoughts

Your personal financial situation might be entirely different from mine; I previously wrote about our Registered Retirement Account Meltdown Strategy.

In my/my wife’s case, we will need to withdraw V shares from our Registered Retirement Savings Plans, pay tax, and to reinvest the net V proceeds in additional V shares held in non-registered accounts. The same will be done with our MasterCard (NYSE: MA) shares.

Depending on your goals and objectives you may want to seriously consider investing in V if you are not already a shareholder. Just be prepared to hold the shares for the long-term as I am in no position to assure you that V will escape unscathed if/when we ever get a market correction.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I and long V and MA.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.