Contents

Rollins (ROL) might not be a glamorous business but it is a leader in the somewhat recession resistant highly fragmented pest control industry.

I last reviewed ROL in this August 26, 2023 post at which time I stated that recent changes positioned it for faster growth. I followed up that post with a very brief September 7, 2023 post in which I disclosed an increase in my ROL exposure.

At the time I wrote both posts, ROL's latest results were for Q2 2023. We now have ROL's recently released Q1 2024 results thus prompting me to revisit this existing holding.

Business Overview

Through its family of brands, ROL provides pest control, termite services and wildlife removal to residential and commercial customers. Item 1 and 1-A in Part 1 in ROL's FY2023 Form 10-K provide a comprehensive business overview.

The industry is highly fragmented with relatively low barriers to entry. At one end of the spectrum, we have owner operators who have essentially bought themselves a job. At the other end of the spectrum, we have ROL which provides essential pest and wildlife control services and protection against termite damage, rodents and insects to more than two million residential and commercial

customers from more than 800 Company-owned and franchised locations in ~70 countries. At FYE2023, ROL had 19,031 employees of which ~17,100 were located in the United States, with ~15,420 employees at US branch offices.

ROL's strategy is to continually improve unit costs. This is accomplished by increasing route density in each regional market in which it operates. To achieve higher density, it complements its organic growth with multiple tuck-in acquisitions; it has extensive experience acquiring companies of all sizes. Over the last 3 years, ROL has completed ~90 - ~100 acquisitions; it completed 24 acquisition in FY2023 and 12 in Q1 2024.

The M&A pipeline remains healthy and ROL is actively evaluating acquisition opportunities, both domestically and internationally, and remains on track to deliver at least 2% of growth from M&A activity in 2024.

The company focuses on improving technician productivity and reducing operating costs. Rising fuel costs have a significant impact on the bottom line thus the importance of route density and the minimization of technician downtime; it has invested in route optimization technology which I touched upon in my February 20, 2023 post.

In my November 19, 2022 post, I touched upon how ROL had successfully integrated a recruiting software platform to allow its hiring managers to more efficiently recruit and engage with potential new candidates. This talent recruitment platform makes it easier for prospective team members to explore open positions on ROL's career portals; applicants can now apply for open positions in just a few minutes and can easily do so from a mobile device. In addition, ROL's hiring managers can more easily pre-screen candidates, communicate with them and schedule interviews in a more streamlined way.

A continued focus on efficiency initiatives are key to ROL's strategy and are beyond what smaller industry participants can do.

Acquisitions are an important component of ROL's growth plans but it also has a strong focus on accelerating recurring organic growth.

Financials

Q1 2024 Results

Material related to ROL's Q1 2024 results released on April 24 is accessible here.

In Q1, revenue rose ~14% to $0.748B. ROL delivered 7.5% organic growth despite some unfavorable and erratic weather in January compared to last year.

ROL generated double-digit revenue growth across all major service lines. Residential revenue increased 16.5%, Commercial rose 11.4%, and Termite was up 11.7%.

ROL reported margin improvement in Q1 as it executed its pricing strategy, leveraged its cost structure, and drove efficiencies throughout the business; the gross margin of 51.2% was up 90 bps relative to Q1 2023.

It invested in incremental sales staffing and marketing activities ahead of peak season and is well staffed on the technician and customer support front.

On the commercial side of the business, ROL is leveraging analytics to identify areas in the market where opportunity warrants additional resources.

In addition, safety remains an important area of focus. In Q1, it reported higher driving safety scores and fewer recorded safety incidents relative to Q1 2023.

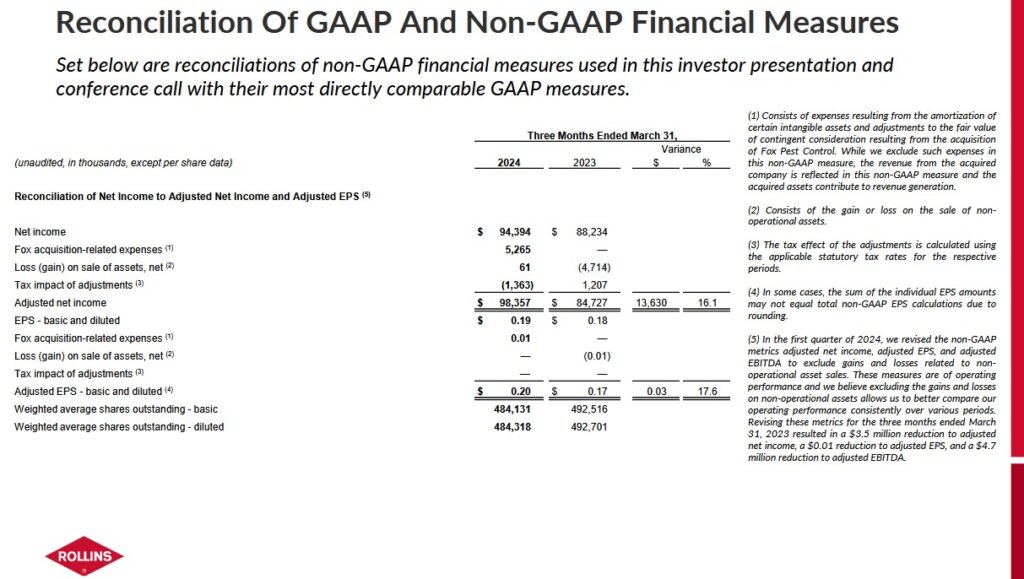

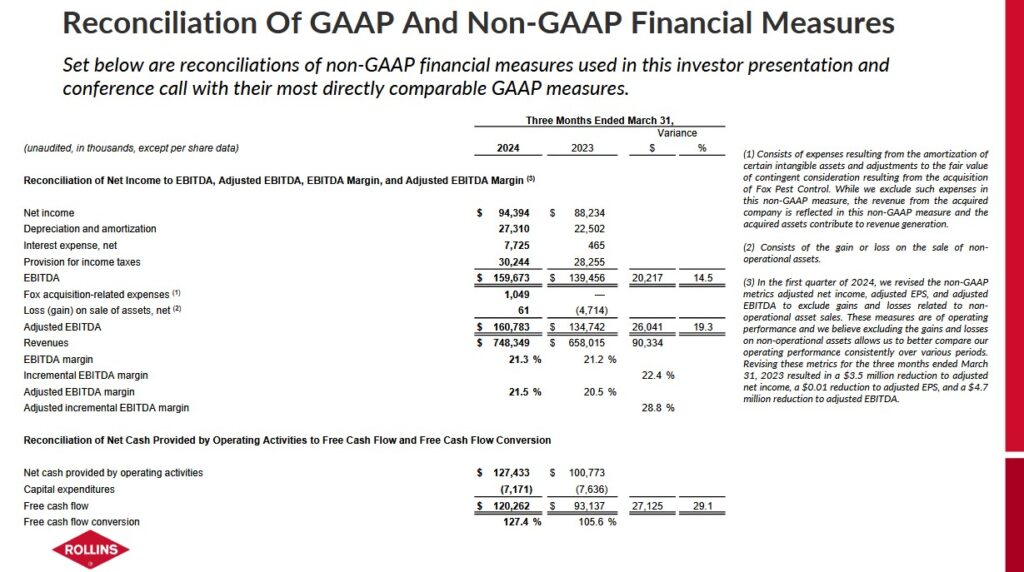

The following provides a reconciliation of ROL's GAAP and non-GAAP financial measures.

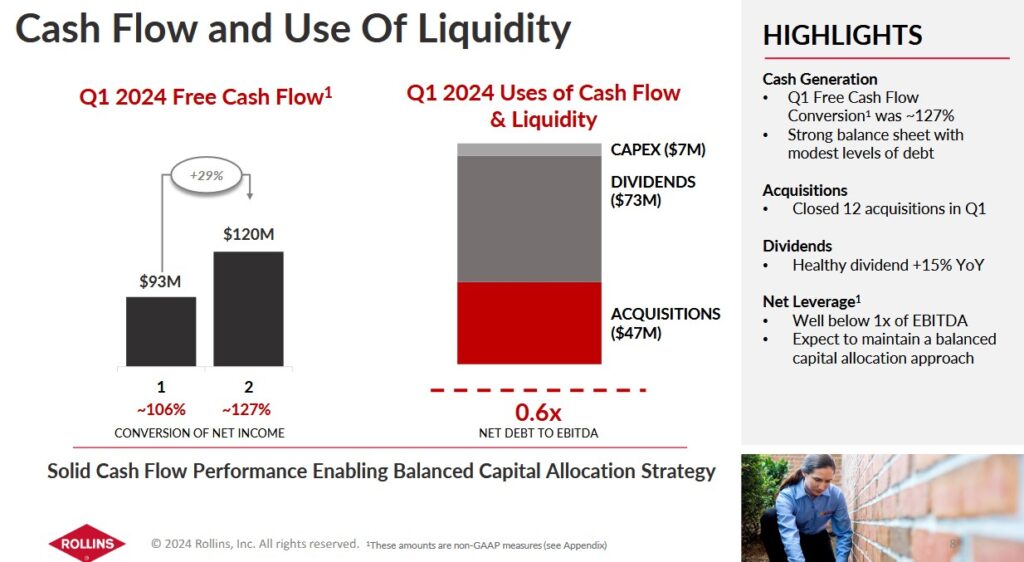

The following reflects ROL's cash flow and use of liquidity in Q1 2024.

Unearned Revenue

The current portion of unearned revenue at FYE2018 - 2023 was ~$0.116B, ~$0.123B, ~$0.131B, ~$0.145B, ~$0.158B, and ~$0.172B. At the end of Q1 2024, it had ~$0.186B.

This unearned revenue represents the receipt of customer funds before the rendering of services. It is recognized over the next 12-month period. Once the services are provided, the liability reduces and ROL reports the appropriate revenue and related expenses on its Income Statement.

At FYE2021, FYE2022, and FYE2023, ROL had long-term unearned revenue of $23.5 million, $29.9 million, and $37.7 million respectively. At the end of Q1 2024 it was 36.9 million. The majority of unearned long-term revenue is recognized over 5 years or less with immaterial amounts recognized through 2034.

As noted in prior ROL posts, investors need to account for this when looking at ROL's current ratio (current assets/current liabilities) and quick ratio (current assets minus materials and supplies/current liabilities). If we deduct ~$0.186B of the current portion of unearned revenue from ~$0.592B of total current liabilities on March 31, ROL has ~$0.406B of current liabilities. Its current assets, however, amount to ~$0.424B of which ~$0.326B is cash and cash equivalents and trade and finance receivables.

Operating Cash Flow (OCF) and Free Cash Flow (FCF)

Depreciation often serves as an indicator of how much needs to be invested to maintain assets in good operating condition.

ROL is not a capital intensive business and its annual CAPEX differs considerably from its annual depreciation and amortization. In FY2021 - FY2023, its annual CAPEX was 27.2, 30.6, and 32.5 million. On the other hand, its annual depreciation and amortization during this same time frame was 86.6, 91.3, and 99.8 million. HOWEVER, ROL's acquisitions (net of cash acquired during FY2021 - FY2023) was 146, 119, and 367 million. Since ROL does not need to spend money on CAPEX, it can deploy money toward acquisitions to grow the business.

In FY2014 - FY2023 and Q1 2024, ROL generated OCF of (in millions of $): 194, 196, 227, 235, 299, 320, 436, 402, 466, 528, and ~127.

In FY2014 - FY2023 and Q1 2024, ROL generated FCF of (in millions of $): 165, 157, 193, 211, 272, 292, 413, 375, 435, 496, and ~120.

ROL's FCF conversion typically exceeds 100%. In Q1, the conversion rate was 127.4% versus 105.6% in Q1 2023.

Return On Invested Capital (ROIC)

In FY20214 - FY2023, ROL's ROIC (%) was 30.56, 30.84, 30.64, 29.31, 33.92, 16.18, 19.56, 24.71, 24.0, and 25.12. We also see that ROL's Revenue growth during the same time frame is (in billions of $) 1.412, 1.485, 1.573, 1.674, 1.822, 2.015, 2.161, 2.424, 2.696, and 3.073. For a company in a line of business that is not glamorous like the high tech sector, it is worth noting that it has more than doubled its top line in a decade!

High quality companies often generate a high ROIC. If a company generates a high ROIC, it needs to invest less to achieve a certain growth rate thus reducing the need for external capital.

A company that generates $0.15/profit for every $1 invested, for example, achieves a ROIC of 15%. I consider a ~15%+ ROIC to be a reasonable minimum threshold because most of the time, a company's cost of capital will be lower than this level. In the last decade, ROL's ROIC has exceeded 15%.

When a company consistently generates a high ROIC over the long term and it is growing its revenue, it can reinvest a portion of its profits under favorable conditions thereby leading to a compounding effect. I would much rather invest in a growing company that can reinvest to create greater shareholder value than to invest in a company that has limited growth opportunities and thus chooses to distribute a growing dividend.

FY2023 Guidance

Management does not provide guidance.

Risk Assessment

No rating agency rates ROL's debt.

Details of ROL's lease commitments and debt facilities are in Notes 8 in the Q1 2024 Form 10-Q.

ROL's new Credit Agreement contains a financial covenant restricting its ability to permit the consolidated total net debt to EBITDA ratio to exceed 3.50 to 1.00. ROL may, however, elect to temporarily increase the financial covenant level to 4.00 to 1.00 following certain acquisitions; this ratio is calculated as of the last day of the most recent fiscal quarter.

ROL complied with applicable debt covenants as of March 31, 2024.

Dividend and Dividend Yield

In FY2017 - FY2023, ROL distributed ~$122, ~$152.7, ~$153.8, ~$160.5, ~$208.7, ~$211.6, and ~$264.3 million of dividends. In Q1, it distributed ~$72.6 million.

ROL's dividend history reflects the declaration of a 'special variable dividend' which is now eliminated.

On April 23, 2024, ROL declared its third consecutive $0.15 quarterly dividend. I expect one more quarterly dividend at this level to be declared in late July. In late October, I expect the quarterly dividend to be increased to $0.17. If this materializes, the next 4 dividend payments should total $0.64 calculated as follows: (($0.15 x 2) + ($0.17 x 2)). With a $44.77 share price at the April 29 market close, the forward dividend yield is ~1.43%.

Investment decisions based on dividend metrics is a fundamentally flawed way to invest. Investors should focus on an investment's total potential long-term investment return (keeping in mind the level of risk). The bulk of ROL's future total investment return is likely to continue to be predominantly in the form of capital appreciation.

In 2012, ROL's Board authorized the purchase of up to 5 million shares of the company’s common stock. After adjustments for stock splits, the total authorized shares under the share repurchase plan are 16.9 million shares.

On September 6, 2023, ROL entered into an underwriting agreement with LOR, Inc. (a company controlled by Mr. Gary W. Rollins and certain members of his family) and Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC, as representatives of the several underwriters relating to the offer by LOR of 38,724,100 shares of ROL's common stock, at a public offering price of $35.00/share. In connection with the Offering, LOR granted the Underwriters an option to purchase up to an additional 5,785,714 shares of Common Stock. The Offering, including the sale of the Optional Shares, closed on September 11, 2023. ROL did not sell any shares in the Offering and did not receive any proceeds from the Offering. In addition, ROL completed the repurchase of 8,724,100 of the shares of Common Stock offered in the Offering for ~$0.3B at $34.39/share.

ROL did not repurchase shares on the open market in FY2022 and FY2023 and Q1 2024. It did, however, repurchase shares from employees for the payment of their taxes on restricted shares that vested and repurchased $10.8 million and $7.1 million in FY2023 and FY2022, respectively.

During FY2023, ROL also issued $2.0 million of shares to employees in connection with the Employee Stock Purchase Plan.

Stock Splits

ROL has had stock splits over the years. The most recent was a 3-for-2 stock split announced on October 27, 2020.

Valuation

The high amortization expense related to multiple acquisitions makes it impractical to value ROL using Earnings per Share (EPS). This is because Depreciation and Amortization are significant components of the 'Adjustments to reconcile net income to net cash provided by operating activities' in the Condensed Consolidated Statement of Cash Flows.

Management agrees and in 2021 it started to present the following metrics:

- Earnings before interest, taxes, depreciation and amortization (EBITDA)

- Free Cash Flow

The rationale for presenting these additional metrics is to more properly illustrate ROL's strong ability to generate cash.

ROL uses the simple approach to define free cash flow, which is net cash provided by operating activities less the purchase of equipment and property.

ROL's OCF and FCF are:

- FY2018 - ROL generated ~$299 million and ~$272 million in OCF and FCF.

- FY2019 - ROL generated ~$320 million and ~$292 million in OCF and FCF.

- FY2020 - ROL generated ~$436 million and ~$413 million in OCF and FCF.

- FY2021 - ROL generated ~$402 million and ~$375 million in OCF and FCF.

- FY2022 - ROL generated ~$466 million and ~$435 million in OCF and FCF.

- FY2023 - ROL generated ~$528 million and ~$496 million in OCF and FCF.

When I wrote my February 20, 2023 post, ROL had just reported OCF and FCF of ~$466 million and ~$435 million in FY2022. I then approximated ROL's valuation based on OCF and FCF:

- OCF/share of ~$0.95 ($0.466B/492.4 million shares). Using the $36.30 share price, the valuation based on OCF was ~38.2.

- FCF/share of ~$0.88 ($0.435B/492.4 million shares). Using a $36.30 share price, the valuation based on FCF was ~41.3.

In FY2023, it reported OCF and FCF of ~$528 million and ~$496 million. ROL's valuation based on OCF and FCF is:

- OCF/share of ~$1.08 ($0.528B/490.13 million shares). Using the current $44.77 share price, the valuation based on OCF is ~41.5.

- FCF/share of ~$1.01 ($0.496B/490.13 million shares). Using a current $44.77 share price, the valuation based on FCF is ~44.3.

Final Thoughts

ROL was not a top 30 holding when I completed my 2023 Year End FFJ Portfolio Review.

On June 10, 2021, I initiated a 500 share position @ ~$33.14 in one of the 'Core' accounts in the FFJ Portfolio. I subsequently acquired another 100 shares on September 7, 2023 @ ~$34.86 in the same account. With the reinvestment of the dividend income, my exposure is currently 609 shares.

Looking at ROL from a P/E perspective will lead an investor to view it as being grossly overvalued. It is, however, preferable that we look at ROL from a FCF and a ROIC perspective. Furthermore, we need to consider that ROL is a leader in the highly fragmented pest control industry and management's plan is to double the company's revenue over the coming decade. If it continues to generate an Operating Margin in the mid to upper teens as it has over the past several years, investors should be aptly rewarded.

In addition, there are other considerations to factor into a decision to invest in ROL.

- Cockroaches, termites, rats, etc. don't really care about the state of the economy and the financial situation of ROL's residential and commercial customers. This makes ROL somewhat recession resistant;

- ROL is very focused on efficiency and cost control;

- The FCF conversion ratio is consistently above 100%. I see no reason why this should change;

- The company consistently generates high ROIC; and

- ~80% of its business is recurring.

ROL is not a glamorous business but this does not bother me in the least. I intend to opportunistically increase my exposure, however, remain hopeful we will experience a broad market correction. If/when this occurs, I hope ROL's valuation improves at which time I will compare its attractiveness relative to other opportunities. Now, however, I continue to be cautious and am deploying very little money.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long ROL.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.