Contents

In July 2022, Rollins (ROL) announced its Board had approved the company's 2023 CEO succession plan. In August 2022, ROL named a new CFO. Since such time, the quality of financial information has improved.

I last reviewed ROL in this February 20, 2023 post at which time the company had just released its Q4 and FY2022 results. Subsequently, ROL has:

- completed the $339.3 million acquisition of Fox Pest Control at the beginning of April; this is ROL's second-largest acquisition. Details of this acquisition are provided on page 9 in the Q2 Form 10-Q;

- released its Q2 and YTD2023 financial results on July 27 (Form 8-K);

- enhanced its capital structure by refinancing its $0.175B revolving credit facility with 2 banks to a $1B revolving credit facility with 8 banks that matures in February 2028;

- filed a shelf registration in early June that allows ROL to issue up to $1.5B billion of primary securities.

I think some significant changes are likely to transpire over the coming quarters that will significantly change the company's growth trajectory. I can not envision that ROL would change its credit facility to the magnitude reflected above AND submit a filing with the SEC to issue up to $1.5B billion of primary securities unless significant growth is likely to occur soon.

Business Overview

Through its family of brands, ROL provides pest control, termite services and wildlife removal to residential and commercial customers in 71 countries.

Item 1 and 1-A in Part 1 of ROL's FY2022 Form 10-K provide a comprehensive business overview.

Fox Pest Control Acquisition

On recent earnings calls with analysts, ROL's management has stated the plan is to double the size of ROL over the coming decade. The Fox Pest Control acquisition, the 2nd largest in ROL's history, is a good start!

In April, management shared its expectations that Fox would add $90 - $100 million of revenue and $18 - $22 million of EBITDA to its FY2023 results. Fox contributed $39.4 million of revenue and $2.2 million of net earnings from April 1, 2023 - June 30, 2023 and management now expects FOX to deliver financial performance at the high end of both ranges.

Credit Facility Expansion and Shelf Registration

Acquisitions are an important component of ROL's growth plans. It has a robust acquisition pipeline and is continually evaluating domestic and international acquisition opportunities. In addition, the company has a strong focus on accelerating recurring organic growth.

In my prior post, I provided commentary about Rentokil Initial plc's (RTO) acquisition of Terminix; the annual revenue of the combined company exceeds $6B. ROL's revenue for the first half of FY2023, in comparison, is ~$1.48B.

This is a highly fragmented industry with a few large participants (Ecolab, Rentokil, and ROL). I am certain ROL's management does not want the company to become a mid-tier industry participant.

On the Q2 earnings call, management stated there is no immediate need for the $1.5B shelf registration. Over the last 3 years, however, ROL has completed ~100 acquisitions, including 31 in 2022 (39 in 2021). With the expansion of its credit facility and shelf registration, I envision we might witness a greater number of sizable acquisitions.

The shelf filing also allows ROL to work proactively with the Rollins family should they decide to divest a portion of their holdings at some point in the future. A control group that includes members of ROL’s Board of Directors and management has a majority ownership interest. This group holds directly, or through indirect beneficial ownership, in the aggregate, ~51% of ROL's outstanding common shares as of December 31, 2022.

Financials

Q2 and YTD2023 Results

A link to ROL's July 27 earnings release is provided at the beginning of this post. The following are links to ROL's Q2 2023 Form 10-Q and Q2 2023 Earnings Presentation.

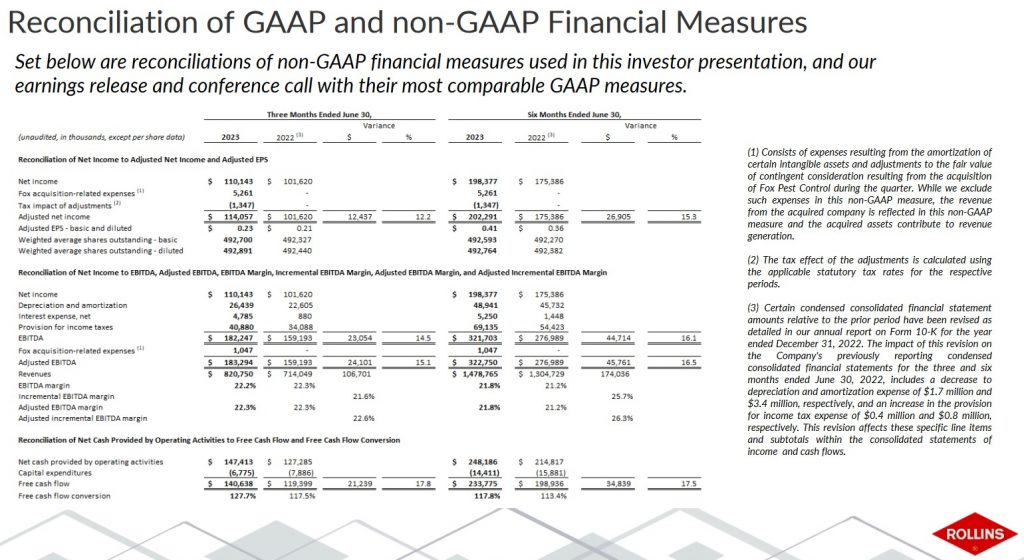

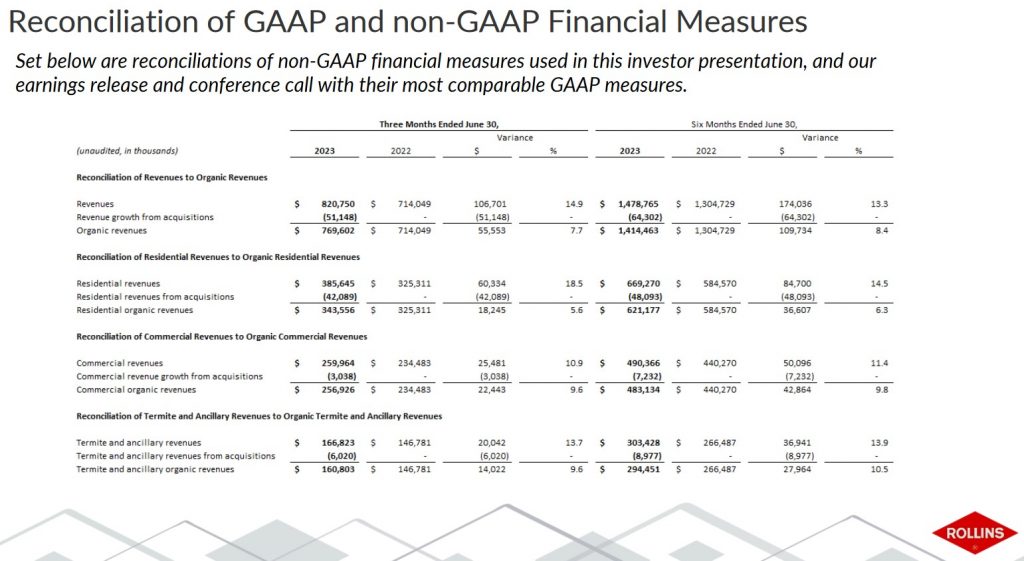

In Q2, ROL delivered ~15% YoY revenue growth. Organic revenue was up ~8% in the quarter and acquisitions drove the other 7% of the total revenue growth in the quarter.

Gross margin was ~53% in Q2.

An adjusted EBITDA margin of 22.3% was pressured primarily by higher insurance premiums and casualty loss developments on 4 legacy auto cases.

GAAP earnings were $0.22/share. Excluding certain expenses related to the Fox acquisition, adjusted earnings were $0.23/share.

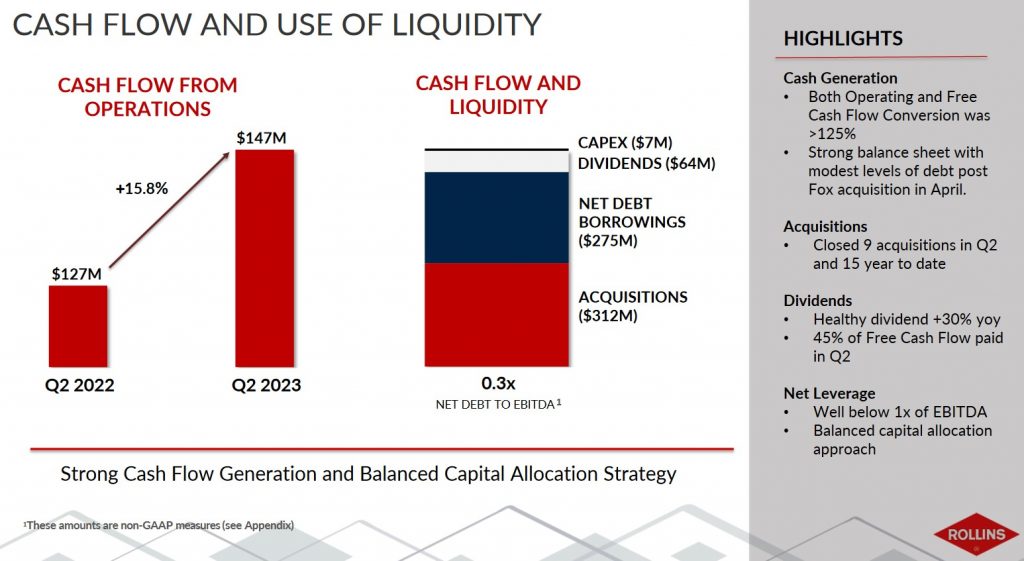

ROL also delivered a ~16% improvement in operating cash flow (OCF) while free cash flow (FCF) was up ~18% versus Q2 2022.

The following provides a reconciliation of ROL's GAAP and non-GAAP financial measures.

Source: ROL - Q2 2023 Earnings Presentation

An important part of ROL's culture is its dedication to continuous improvement; it constantly looks to improve service levels and operating efficiencies.

There are opportunities for margin expansion and management is currently evaluating several streamlining efforts.

Safety is one particular area ROL has identified that requires improvement. This was a disappointing area in Q2 2023 as it continued to experience higher settlements associated primarily with auto accidents.

ROL has ramped up efforts to significantly reduce automobile accidents. Its drivers now utilize an app that begins monitoring driving behaviours once any ROL vehicle is in motion. This app detects unsafe driving maneuvers, such as acceleration, braking, distractions and speed and then converts these data into an industry-accepted FICO driving score from 100 to 850, with 850 being the best. If drivers score below 710, they are 30% more likely to have a collision than those with higher scores.

ROL is working hard to increase driver safety awareness by coaching and training those with lower scores while recognizing and rewarding those with higher/highest scores.

ROL has also proactively increased customer acquisition-related efforts during Q2. It has strategically invested more heavily in advertising when compared with prior quarters.

The following reflects ROL cash flow and use of liquidity in Q2 2022 and 2023.

Source: ROL - Q2 2023 Earnings Presentation

Unearned Revenue

The current portion of unearned revenue at FYE2018 - 2022 was ~$0.116B, ~$0.123B, ~$0.131B, ~$0.145B and ~$0.158B. At the end of Q2 2023, this amounted to ~$0.183B.

This unearned revenue represents the receipt of customer funds before the rendering of services. It is recognized over the next 12-month period. Once the services are provided, the liability reduces and ROL reports the appropriate revenue and related expenses on its Income Statement.

At FYE2021 and FYE2022, ROL had long-term unearned revenue of $23.5 million and $29.9 million, respectively. At the end of Q2 2023, this amounted to $35 million. The majority of unearned long-term revenue is recognized over 5 years or less with immaterial amounts recognized through 2033.

As noted in prior ROL posts, investors need to account for this when looking at ROL's current ratio (current assets/current liabilities) and quick ratio (current assets minus materials and supplies/current liabilities). If we deduct ~$0.183B of the current portion of unearned revenue from ~$0.576B of total current liabilities on June 30, ROL has ~$0.393B of current liabilities. Its current assets, however, amount to ~$0.464B of which ~$0.369B is cash and cash equivalents and trade and finance receivables.

Free Cash Flow (FCF)

In FY2011 - FY2022, ROL generated FCF of (in millions of $): 136, 123, 144, 165, 157, 193, 211, 272, 292, 413, 375, and 435. In the first half of FY2023, ROL's FCF was ~233.8.

ROL's FCF conversion typically exceeds 100%. In the first half of FY2023, the conversion rate was 117.8%.

FY2023 Guidance

Management does not provide guidance.

Credit Ratings

No rating agency rates ROL's debt.

Details of ROL's lease commitments and debt facilities are in Notes 7 and 9 in the Q2 2023 Form 10-Q.

ROL's new Credit Agreement contains a financial covenant restricting its ability to permit the consolidated total net debt to EBITDA ratio to exceed 3.50 to 1.00. ROL may, however, elect to temporarily increase the financial covenant level to 4.00 to 1.00 following certain acquisitions; this ratio is calculated as of the last day of the most recent fiscal quarter.

ROL complied with applicable debt covenants as of June 30, 2023.

Dividend and Dividend Yield

In FY2017 - FY2022, ROL distributed ~$122, ~$152.7, ~$153.8, ~$160.5, ~$208.7, and ~$211.6 million of dividends. In the first half of FY2023, it distributed ~$128 million.

ROL's dividend history reflects the declaration of a 'special variable dividend'; ROL has eliminated this 'special variable dividend'.

ROL will distribute its 4th consecutive $0.13 quarterly dividend on September 8. I envision ROL will increase the quarterly dividend by ~$0.03 when it declares the next dividend in late October.

If this increase materializes, the 4 quarterly dividend distributions (after the $0.13 distribution in September) will total $0.64. With shares currently trading at ~$39.40, the forward dividend yield will likely be ~1.6%

At the time of my November 19, 2022 post, shares were trading at $42.46 and the forward dividend yield was ~1.22%.

When I reviewed ROL in my February 20, 2023 post, shares were trading at $36.30. I envisioned 2 more $0.13 quarterly dividends and an increase to ~$0.16in October. On this basis, I expected the next 4 quarterly dividend payments would total $0.58 ((2 x $0.13)+(2 x $0.16)) thus giving us a ~1.6% forward dividend yield.

This low dividend yield is likely to dissuade some investors from investing in ROL. Investors, however, should focus on an investment's total potential long-term investment return. The bulk of ROL's future total investment return is likely to continue to be predominantly in the form of capital appreciation.

In 2012, ROL's Board authorized the purchase of up to 5 million shares of the company’s common stock. After adjustments for stock splits, the total authorized shares under the share repurchase plan are 16.9 million shares. It did not repurchase shares on the open market in FY2021, FY2022, and the first half of FY2023. 11.4 million additional shares may still be purchased under the share repurchase program.

The number of shares outstanding for the past ~8 years has been relatively stagnant at ~491 - ~492 million shares. The diluted weighted average shares outstanding in Q2 2023 was almost 493 million.

NOTE: There could be changes regarding share repurchases should the Rollins family decide to divest a portion of their holdings in the future.

Stock Splits

ROL has had stock splits over the years. The most recent was a 3-for-2 stock split announced on October 27, 2020.

Valuation

The high amortization expense related to multiple acquisitions makes it impractical to value ROL using Earnings per Share (EPS). This is because Depreciation and Amortization are significant components of the 'Adjustments to reconcile net income to net cash provided by operating activities' in the Condensed Consolidated Statement of Cash Flows.

Management agrees and in 2021 it started to present the following metrics:

- Earnings before interest, taxes, depreciation and amortization (EBITDA)

- Free Cash Flow

The rationale for presenting these additional metrics is to more properly illustrate ROL's strong ability to generate cash.

ROL uses the simple approach to define free cash flow, which is net cash provided by operating activities less the purchase of equipment and property.

ROL's Net Cash Provided by Operating Activities (OCF) and FCF are:

- FY2018 - ROL generated ~$299 million and ~$272 million in OCF and FCF.

- FY2019 - ROL generated ~$320 million and ~$292 million in OCF and FCF.

- FY2020 - ROL generated ~$436 million and ~$413 million in OCF and FCF.

- FY2021 - ROL generated ~$402 million and ~$375 million in OCF and FCF.

- FY2022 - ROL generated ~$466 million and ~$435 million in OCF and FCF.

In the first half of FY2023, ROL generated ~$248.2 million and ~$233.8 million in OCF and FCF. If we conservatively estimate that ROL will just double these numbers for FY2023, we are looking at ~$496.4 million and ~$467.6 million in OCF and FCF.

If the 493 million diluted weighted average shares outstanding in Q2 2023 remain relatively constant over the remainder of the current fiscal year, ROL's valuation based on OCF and FCF is:

- OCF/share of ~$1.00 ($0.496B/493 million shares). Using a $39.40 share price, the valuation based on OCF is ~39.4.

- FCF/share of ~$0.95 ($0.468B/493 million shares). Using a $39.40 share price, the valuation based on FCF is ~41.5.

When I wrote my November 19, 2022 post, ROL had generated OCF and FCF of ~$342.5 million and ~$320 million in the first 3 quarters of FY2022. I projected ROL's FY2022 OCF and FCF to be ~$450 million and ~$420 million. Using these estimates I arrived at a rough approximation of ROL's valuation based on OCF and FCF:

- OCF/share of ~$0.91 ($0.45B/492.4 million shares). Using a $42.46 share price, the valuation based on OCF was ~46.7.

- FCF/share of ~$0.85 ($0.42B/492.4 million shares). Using a $42.46 share price, the valuation based on FCF was ~50.

When I wrote my February 20, 2023 post, ROL had just reported OCF and FCF of ~$466 million and ~$435 million in FY2022. Using these historical results and the current $36.30 share price, I arrived at a rough approximation of ROL's valuation based on OCF and FCF:

- OCF/share of ~$0.95 ($0.466B/492.4 million shares). Using the $36.30 share price, the valuation based on OCF was ~38.2.

- FCF/share of ~$0.88 ($0.435B/492.4 million shares). Using a $36.30 share price, the valuation based on FCF was ~41.3.

ROL's valuation based on estimated FY2023 OCF and FCF is relatively similar to when I wrote my February post at which time I considered shares to be reasonably valued.

Final Thoughts

Approximately 80% of ROL's business is recurring thereby making it somewhat easier to gauge how the company is likely to perform going forward.

I anticipate ROL will ramp up its growth over the coming quarters given the significant increase in its credit arrangements and management's plan to double in size over the coming decade.

I currently hold 506 shares in a 'Core' account in the FFJ Portfolio; this holding is nowhere close to being in the top 30.

Although ROL shares are not inexpensive, I intend to acquire additional shares within the next 72 hours.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long ROL.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.