Contents

I consider Genuine Parts' (GPC) valuation to be compelling. This is a very different conclusion than that reached when I last reviewed it in this December 3 2022 post.

2023 Investor Day

On March 23, GPC held its 2023 Investor Day in which it provided a strategic update on its key growth initiatives and outline its long-term financial targets.

GPC is a top distributor of automotive and industrial parts yet GPC estimates it only has an ~8% market share of the $200B+ addressable automotive market and a ~6% market share of the $150B+ addressable industrial market.

The following shows the extent of GPC's strong financial results over the 2001 - 2022 timeframe.

Source: GPC Investor Day Presentation - March 23, 2023

In FY2013, GPC generated ~$14B in annual revenue; this figure includes just under $0.5B in annual revenue from S.P. Richards Company, a business products wholesaler that GPC sold to an investor group in 2018.

In FY2022, GPC generated ~$22.1B in annual revenue of which 62% and 38% were derived from its automotive and industrial segments, respectively. Of its FY2022 annual revenue, ~77% was generated in North America, ~14% in Europe, and ~9% in Australasia.

Source: GPC Investor Day Presentation - March 23, 2023

The Automotive Parts Group distributes automotive replacement parts, accessories and service items throughout the U.S., Canada, Mexico, Australasia, France, the U.K., Ireland, Germany, Poland, the Netherlands, Belgium, Spain and Portugal. In North America, more than 725,000 parts are sold primarily under the NAPA brand name.

The Industrial Parts Group is represented by Motion Industries in North America and Mi Asia Pac in Australasia. This group provides access to more than 19 million industrial replacement parts and supplies for more than 200,000 MRO (maintenance, repair and operations) and OEM (original equipment manufacturer) customers in all types of industries. These include equipment and machinery, food and beverage, primary metals, pulp and paper, mining and automotive, among others.

Industry dynamics favour GPC's scale-enabled service levels. I expect GPC will continue to use its cost advantages to boost sales.

Aftermarket auto-part retailers serve DIY and professional clients. The faster-growing professional-client category accounts for more than 80% of GPC's automotive segment. This group of customers depends on high levels of part availability and rapid delivery to minimize 'downtime' at automotive shop repair bays. GPC also benefits from the increase in miles driven and average vehicle age.

Similar dynamics prevail in its industrial parts group. Clients need to receive replacement parts quickly, particularly when failures result in costly downtime. This segment's customers depend on parts availability and GPC's trained staff for assistance in locating the needed component and rapid delivery.

By spreading infrastructure and inventory investments over a large sales base, GPC derives a cost advantage over small peers. Its service levels also reinforce GPC's brand intangible asset which smaller rivals can not duplicate.

The following images show the extent to which GPC blankets the US market.

Source: GPC Investor Day Presentation - March 23, 2023

Source: GPC Investor Day Presentation - March 23, 2023

Please visit the company's website and read Part 1 in the FY2022 Annual Report and Form 10-K if you are unfamiliar with GPC.

Acquisitions

While GPC has grown organically, mergers and acquisitions are key to its growth. At any given time, GPC has 125 active discussions across its global acquisition pipeline.

On average GPC had deployed ~$0.27B in bolt-on capital per year during the 2015 – 2022 timeframe.

Financials

Q4 and FY2022 Results

Given that GPC's Q1 2023 ends on March 31, I dispense with a review of its Q4 and FY2022 financial results. However, I provide links to GPC's Q4 2023 Earnings Release, FY2022 Annual Report and Form 10-K, and Q4 2023 Earnings Presentation if you wish to review this material.

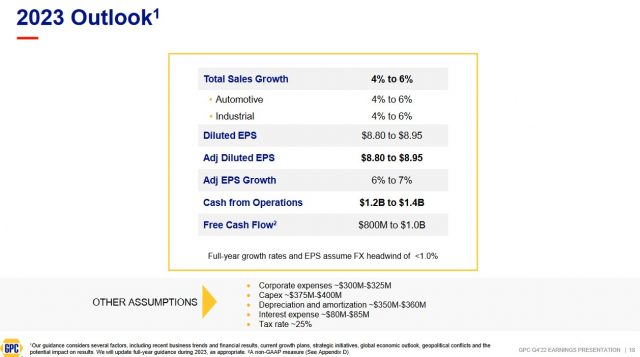

FY2023 Outlook

The following is GPC's FY2023 outlook that was presented on February 23 when Q4 and FY2022 results were released.

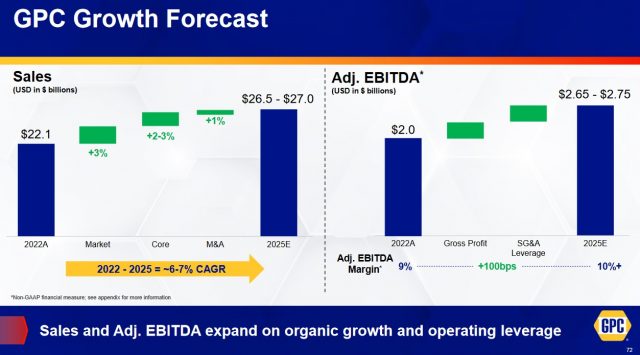

FY2025 Financial Targets

At its 2023 Investor Day, GPC provided its FY2025 financial targets and indicated that it plans to achieve EBITDA segment margins of 10%+ for automotive, 12%+ for industrial, and 10%+ for GPC in total by 2025.

It also provided the following financial targets.

Source: GPC Investor Day Presentation - March 23, 2023

Source: GPC Investor Day Presentation - March 23, 2023

Credit Ratings

GPC’s unsecured long-term debt ratings remain unchanged from the time of my December review.

- Moody’s: Baa1 (stable outlook)

- S&P Global: BBB (stable outlook)

Moody’s rating is the top tier of the lower medium grade. S&P Global’s rating is the middle tier of the lower medium grade. Both ratings are investment grade and are defined as an obligor having ADEQUATE capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Both ratings are satisfactory for my purposes.

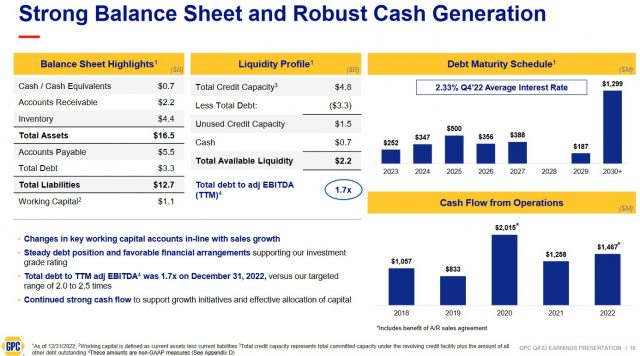

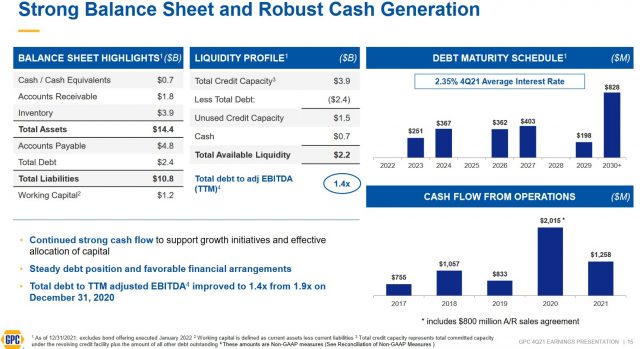

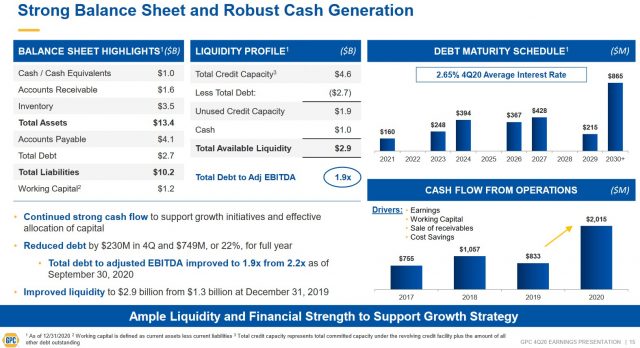

Key Balance Sheet and cash generation metrics for the 3 most recent fiscal years are provided below. GPC's 1.7x debt to adjusted EBITDA compares favourably to the targeted range of 2 - 2.5x.

Source: GPC - Q4 2022 Earnings Presentation

Source: GPC - Q4 2021 Earnings Presentation

Source: GPC - Q4 2020 Earnings Presentation

Dividend and Dividend Yield

My interest lies in an investment's total potential shareholder return over the long term and I have no objection if a company distributes no/little dividend if funds can be retained in the company to generate attractive long-term investor returns.

Having said this, dividend metrics matter to some readers.

GPC is a company that has:

- distributed a cash dividend to shareholders every year since going public in 1948; and

- increased its dividend for 67 consecutive years.

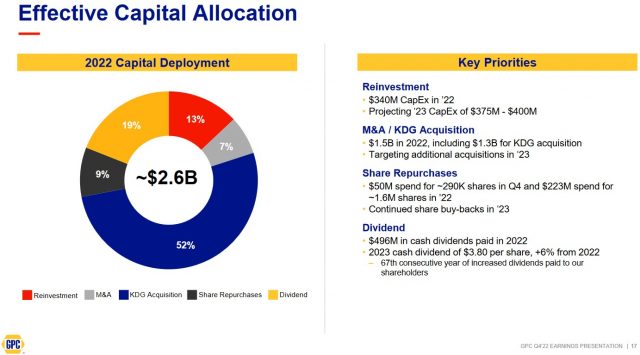

We see that in FY2022, the dividend was just under 20% of GPC's capital allocation.

Source: GPC - Q4 2022 Earnings Presentation

GPC's dividend history is accessible here.

At the time of my prior review, GPC's quarterly dividend was $0.895/share and I anticipated a $0.03 - $0.04 increase to be declared in early March. Shares were trading at ~$187.30 and using the midpoint of this range, I anticipated the new $0.93/share quarterly dividend would yield ~2%.

GPC, however, increased its quarterly dividend by ~6.15% to $0.95, an increase above the 20-year average increase of 5.8%.

The first quarterly dividend at this new level is scheduled to be distributed on April 3. Having just acquired additional shares at ~$155.80, the dividend yield based on my recent purchase price is ~2.44%.

GPC's weighted average shares outstanding in FY2012 - FY2022 are (in millions of shares) 156, 156, 154, 152, 150, 148, 147, 146, 145, 144 and 142.3.

The company expects to remain active in its share repurchase program. However, the amount and value of shares repurchased will vary and is at the discretion of the Board.

Valuation

Before the release of Q3 and YTD2022 results on October 20, 2022 GPC's share price was ~$155. Management's adjusted diluted EPS guidance was $7.80 - $7.95 ($7.875 mid-point) thus giving us a forward adjusted diluted PE of ~19.7.

When I last reviewed GPC, the share price has risen to ~$187.30. Management's revised guidance for FY2022 was $8.29 - $8.39 of diluted EPS and $8.05 - $8.15 of adjusted diluted EPS. On this basis, GPC's valuation on a GAAP basis (using the $8.34 mid-point) was ~22.46 and ~23.1 (using the $8.10 mid-point) on an adjusted basis.

GPC's forward-adjusted diluted PE levels using broker estimates were:

- FY2022 - 13 brokers - mean of $8.17 and low/high of $8.10 - $8.28. Using the mean estimate, the forward-adjusted diluted PE is ~23.

- FY2023 - 13 brokers - mean of $8.60 and low/high of $8.30 - $9.13. Using the mean estimate, the forward-adjusted diluted PE is ~21.8.

- FY2024 - 6 brokers - mean of $9.22 and low/high of $9.00 - $9.68. Using the mean estimate, the forward-adjusted diluted PE is ~20.3.

Fast forward to March 23 and GPC has reiterated FY2023 diluted and adjusted diluted EPS guidance of $8.80 - $8.95. Using my recent ~$155.80 purchase price, the forward diluted and adjusted diluted PE range is ~17.4 - ~17.7.

GPC's forward-adjusted diluted PE levels using current broker estimates and my purchase price are:

- FY2023 - 11 brokers - mean of $8.93 and low/high of $8.85 - $9.17. Using the mean estimate, the forward-adjusted diluted PE is ~17.45.

- FY2024 - 11 brokers - mean of $9.54 and low/high of $9.31 - $10.09. Using the mean estimate, the forward-adjusted diluted PE is ~16.33.

- FY2025 - 4 brokers - mean of $10.55 and low/high of $10.00 - $11.25. Using the mean estimate, the forward-adjusted diluted PE is ~14.77.

At its March 23 Investor Day, GPC outlined its long-term financial targets; it is targeting $11.00 - $11.50 in diluted EPS in FY2025. Using this range and my recent ~$155.80 purchase price, the forward diluted PE range is 13.55 - 14.16. I consider this to be an attractive valuation. Furthermore, this valuation is the lowest I have seen in the years in which I have been a GPC shareholder; I initiated a position on July 24, 2017.

Final Thoughts

I like GPC's long-term outlook in that it is a dominant participant in the automotive parts and industrial parts industries yet its market share in each is below 10%. It has a successful acquisition track record and with 125 opportunities in the acquisition pipeline at any given time, I envision its market share could grow to the 'low teens' over the next few years.

GPC's FY2013- FY2022 diluted PE ratios have been 18.65, 23.68, 18.51, 20.63, 21.26, 19.32, 19.49, 323.97, 24.90, and 20.85. The ridiculously high PE in FY2020 is because GPC recorded a ~$506.7 million Goodwill impairment charge and a ~$192.5 million net loss from discontinued operations. GPC's GAAP and non-GAAP FY2023 EPS outlooks are identical and are attractive relative to historical levels. If management's FY2025 financial targets are attained (I have no reason to think otherwise), then GPC's current valuation is compelling.

Given my long-term outlook for GPC, I have acquired an additional 100 shares @ ~$155.80 in a 'Core' account in the FFJ Portfolio thus bringing my total exposure to 450 shares.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long GPC.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.