Contents

CME Group Inc. (CME) is an appealing long-term growth stock with a unique attractive dividend which is missed by stock screeners.

Summary

- CME reported Q4 and FY2018 results on February 7, 2018. Despite strong results, its share price continues to be bid lower having dropped from a ~$196 high set in November.

- Its unique dividend policy is such that investors who rely solely on stock screeners without delving into the numbers will very likely exclude CME as a potential investment.

- Management has indicated that independent surveys reveal that CME has the best customer service levels when compared to its peer group on a global basis.

- Despite the~10.7% pullback from CME’s 52 week high and the recent ~7% increase in the quarterly dividend I am prepared to patiently wait on the sidelines before acquiring additional shares.

Introduction

I strongly suspect a significant number of do-it-yourself investors rely on stock screeners to try and identify investment opportunities. While stock screeners are certainly helpful, they can often generate incomplete information. If, for example, you included a ‘dividend yield’ metric in excess of 2.00% in your search your results would exclude CME Group Inc. (CME).

In my August 5, 2018 article entitled ‘Here is an Example of How Stock Screeners Can Be Misleading’ I purposely did not disclose the name of company being analyzed in my ‘non-subscriber’ version of the article.

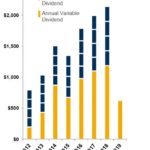

CME’s unique dividend policy was instituted in 2012. This policy includes a ‘special dividend’ component; it distributed $1.9, $2.6, $2, $2.9, $3.25, and $3.5 per share in the form of a ‘special dividend’ in FY2012 – 2017.

Source: CME – Q4 and FY2018 Earnings Commentary – February 7, 2018

Source: CME – Goldman Sachs US Financial Services Conference – December 4, 2018

Had you had using a stock screener to identify investment opportunities, CME’s dividend in 2017 would have been reflected as $0.66/quarter or $2.64/year. Add on the ‘special dividend’, however and you get a total 2017 dividend of $6.14.

If you had been looking for an investment opportunity in February 2018 when CME was trading in the $165 range, stock screeners would have indicated that CME’s dividend yield was $0.70/quarter or $2.80/year thus giving you a forward dividend yield of ~1.70%.

On December 5, 2018, however, CME declared a $1.75 ‘special dividend’ which was disbursed January 16, 2019. I had been expecting a ‘special dividend’ closer to $3 based on the ‘special dividend’ disbursed in recent years but CME’s Board of Directors clearly felt that $1.75 was more appropriate given some of the initiatives CME has on the go.

If we add the $1.75 special dividend to the $0.70/quarter or $2.80/year we get a total dividend in 2018 of $4.55. If you had been interested in acquiring CME shares in February 2018 when shares were trading in the $162 range and conservatively anticipated a $1.75 special dividend at the end of the year, your forward dividend yield on the basis of ~$162/share would have been ~2.8%. That level might have piqued the interest of investors who viewed a ~1.70% dividend yield as being far too low for their liking.

Business Overview

My previous article restricted content to subscribers, and therefore, I include a Business Overview component in this article for the benefit of all readers.

CME was founded in 1898 as a not-for-profit corporation. It demutualized and became a shareholder-owned corporation in 2000 and has evolved considerably subsequent to becoming a shareholder-owned corporation.

Anyone remotely interested in CME as a potential investment is highly encouraged to review the Business and Risk Factors section of CME’s 2017 Form 10-K which is the most current 10-K as at the time of the post.

In a nutshell, CME's products and services are designed to provide businesses around the world with the means to effectively manage risk. Its offerings provide:

- The widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals through its exchanges;

- Electronic trading globally on the CME Globex platform;

- Clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives through its clearing house, CME Clearing;

- Hosting, connectivity and customer support for electronic trading through co-location services;

- Side-by-side trading of exchange-listed and privately negotiated markets through the CME Direct platform;

- Clearing and settlement services for exchange-traded contracts, as well as for cleared swaps;

- Regulatory reporting solutions for market participants through CME’s global repository services in the US, UK, Canada and Australia;

- A wide range of market data services including live quotes, delayed quotes, market reports and a comprehensive historical data service.

While I am not remotely interested in investing in alternate currencies such as Bitcoin, there are many investors interested in this space. In mid-December 2017, CME launched Bitcoin Futures. If you are interested in obtaining a high level overview I encourage you to check this page. A series of FAQs can also be found at this page on CME’s site.

On March 29, 2018, CME announced that it had reached an agreement to acquire NEX Group plc for $5.5B with a 50% cash component (listen to CME Group Chairman and CEO Terry Duffy discuss the acquisition of NEX Group plc, bringing together cash, futures and OTC marketplaces).

On November 2, 2018, CME announced that it had completed its acquisition of NEX Group plc. The combined company will enable clients worldwide to trade futures, cash and over-the-counter (OTC) markets, optimize portfolios and analyze data to efficiently manage risk and capture opportunities. The acquisition is expected to be immediately accretive to adjusted cash EPS and creates a company with pro forma 2017 annual revenue of $4.3B. CME has begun integrating NEX’s business operations and anticipates run-rate cost synergies of $0.2B annually by the end of 2021.

Given the magnitude of this acquisition it does not surprise me that CME lowered the ‘special dividend’ to $1.75 from the previous year’s $3.50; the focus is most likely on retaining an appropriate level of liquidity to service the NEX Group integration related expenses and to repay debt. Once this integration has been completed and run-rate cost synergies are being realized I anticipate that the ‘special dividend’ will be increased from the recent $1.75.

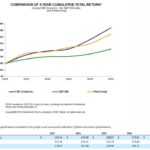

5 Year Total Return Comparison vs. Peer Group

In my August 5, 2018 article, I included the following image.

Source: CME – 2017 10-K as at December 31, 2017

This is the cumulative 5 year total return provided to CME shareholders relative to the cumulative total returns of the S&P 500 index and a customized peer group consisting of CBOE Holdings, Inc., Intercontinental Exchange Group, Inc. and Nasdaq, Inc.. I provide it again for the benefit of all readers .

CME has not yet issued its FY2018 10-K, and therefore, the information provided above is the most current information provided by CME as at the time of this post.

10 Year CME Performance vs NASDAQ 100

CME’s return has surged in recent years. The following graph, however, understates CME`s outperformance because the data does not include all the ‘special dividends’ that have been distributed over the past decade.

Source: TickerTech

Q4 and FY2018 Financial Results

I highly recommend you review this earnings commentary as well as CME’s Q4 and FY2018 financial statements.

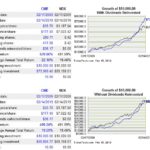

The consolidated statement of income on a quarterly basis going back to Q1 2016 (GAAP and non-GAAP) can be found here.

While CME’s Q4 and FY2018 presentation has not yet been uploaded to its site as at the time of this article, CME’s most recent presentation (December 4, 2018) delivered at Goldman Sachs U.S. Financial Services Conference shows average daily volume (ADV) growth and momentum.

Source: CME – Goldman Sachs US Financial Services Conference – December 4, 2018

2019 Guidance

CME does not provide EPS guidance. The consensus adjusted diluted EPS estimate from 17 brokers, however, calls for FY2019 adjusted EPS of $7.11 versus adjusted diluted EPS of $6.82 in FY2018; GAAP EPS in FY2018 amounted to $5.71.

Credit Ratings

Not everyone looks at a company’s credit rating before initiating an investment nor do they even look at a company’s credit rating when they hold a position. I am, however, risk averse so I like to see how the major ratings agencies view the credit risk of an existing holding or a potential holding.

CME’s ratings have not changed subsequent to my August 5th article and are not under review.

In fact, Moody’s indicated that CME’s recent reduced annual variable dividend was credit positive and it also indicated that the acquisition of NEX is credit positive.

Moody’s initiated coverage in July 2008 and assigned an unsecured long-term debt credit rating of Aa3. This rating has remained unchanged since such time. This rating is the lowest tier of the High grade category.

S&P Global has assigned an AA- unsecured long-term debt credit rating since February 2012. This rating is the lowest tier of the High grade category.

Ratings such as those assigned to CME give a conservative investor like me great comfort that the company has a very strong capacity to meet its financial commitments.

Free Cash Flow (FCF)

CME consistently generates strong free cash flow which enables it to have a unique dividend structure. In FY2010 – 2017, it generated ~$1.2B, ~$1.18B, ~$1.08B, ~$1.15B, ~$1.15B, ~$1.4B, ~$1.62B, and ~$1.76B in free cash flow.

Valuation

At the time of my August 5, 2018 article, CME was trading at $161.63 (August 3, 2018 close of business) after having pulled back from a high of $174.36 in early June 2018.

In that article I indicated that CME had reported $11.94 in diluted GAAP EPS in FY2017 but earnings were distorted by the one-time $2.41B benefit received from the recognition of a reduction in deferred tax liabilities as a result of the Tax Cut and Jobs Act of 2017. When one-time items are backed out, CME generated $4.77 in diluted EPS.

Based on FY2017 full year adjusted diluted EPS of $11.94 and the current $161.63 share price, I arrived at a 13.54 adjusted PE; this was extremely attractive but I knew the results were distorted by the significant one-time item. I also knew that a PE of 33.89 using $4.77 in diluted EPS was not realistic so I decided to use earnings guidance from multiple analysts to determine whether CME was reasonably valued.

Guidance called for a mean adjusted EPS level of $6.68 for FY2018. Using the current stock price of $161.63, I arrived at a forward adjusted PE of ~24.2 which was certainly not inexpensive but was below the 5 year average of ~26.2 as reported by Morningstar.

Subsequent to that article, CME rose to a high of $197.08 in November 2018 at which time I viewed shares as being grossly overvalued.

Shares have subsequently pulled back to ~$174 so let’s look at CME’s current valuation based on forward adjusted guidance from multiple analysts.

CME has now reported FY2018 $5.71 diluted EPS and $6.82 in adjusted diluted EPS. Using the current ~$174 share price I get a PE of 30.47 and an adjusted PE of 25.5.

With guidance from multiple analysts calling for adjusted FY2019 EPS of $7.11 and the current ~$174 share price we now get a forward adjusted PE of ~24.47 which is fairly close to the current 5 year average PE of 24.4 as reported by Morningstar.

Dividend, Dividend Yield and Dividend Sustainability

CME’s recent announcement of a 7% increase in its quarterly dividend can be found here and CME’s dividend history can be found here.

In FY2018, CME declared $1.6B in dividends which includes the annual variable dividend of $0.624B.

CME has returned more than $11.2B to shareholders in the form of dividends since implementing the variable dividend policy in early 2012.

As mentioned earlier, CME appears as a sub 2% dividend yielding stock when stock screeners are used. If we factor in the annual variable dividend, however, CME`s dividend yield it typically in excess of 2.5%.

When we combine the $1.75 ‘special dividend’ CME distributed in mid January with the $0.75/share quarterly dividend investors can expect to receive in FY2019, we get a total dividend of $4.75; this is assuming you held CME shares as at December 28, 2018. With CME currently trading at ~$174 the dividend yield is closer to 2.7% versus the 1.7% reported by stock screeners.

Investors should also consider that the recent ‘special dividend’ was most likely lower than that of recent years because CME just closed the recent significant NEX Group acquisition. There are considerable costs associated with this acquisition so CME`s Board of Directors most likely opted to approve a lower special dividend from that approved in 2016 and 2017 ($3.25 and $3.50).

Final Thoughts

I like CME as a long-term investment and am pleased to see that its share price has retraced to a more reasonable level from the $196 level of November 2018. In general, however, the very recent rapid broad run-up in share prices witnessed over the past couple of months makes me hesitant to acquire additional shares in any company; irrational exuberance seems to have found its way back into the market judging from the manner in which shares prices have been behaving of late.

I intend to acquire additional CME shares but will patiently wait for the share price to retrace to the high $160s level. A price of ~$168, for example, would give us a forward adjusted PE level of ~23.6 based on consensus FY2019 adjusted earnings estimates of $7.11 from several brokers.

I know this is not much different from the current forward adjusted PE of ~24.47 but I think we can expect another market pullback in the not too distant future which will allow us to pick up shares in the high $160s.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CME.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.