Contents

Summary

Summary

- On October 27th Chevron reported Q3 earnings of $2B versus $1.3B in Q3 2016. Results included a $0.675B gain on an asset sale and a $0.22B asset write-off.

- Q3 sales and other operating revenues were $34B compared to $29B in Q3 2016.

- In FY2016, CVX indicated its intent to sell $5B - $10B of assets in 2016 and 2017. It has now sold $7.7B of assets. No significant asset sales are slated for Q4.

- CVX’s dividend is a key priority. A dividend increase in 2018, however, is unlikely.

- CVX is far more volatile than XOM. Investors wishing to benefit from stability and potential for greater upside in the oil & gas industry would be wise to consider owning shares in both companies.

Introduction

I recently provided my opinion on Exxon Mobil (NYSE: XOM) subsequent to the release of its Q3 results.

In this post I provide my opinion on Chevron Corporation (NYSE: CVX) which released its Q3 results on October 27, 2017.

Shares of both companies are held in the FFJ Portfolio and in retirement accounts.

Business Overview

Most readers are likely familiar with CVX but may not be fully aware that its earliest predecessor, Pacific Coast Oil Co., was incorporated in 1879 in San Francisco. CVX’s history can be viewed here.

CVX ranks #19 from an annual revenue perspective on the Fortune 500 list.

It has an impressive natural gas, heavy oil, conventional, deep water, liquefied natural gas, and shale project portfolio with locations in various regions of the world.

CVX’s Investor Presentation is available here. It is a quick way to gain a better understanding of the extent of its operations.

Q3 and Fiscal 2017 Financial Results

CVX reported Q3 and YTD 2017 results on October 27, 2017. Readers are strongly encouraged to review the News Release and Presentation which accompanied the Q3 conference call.

CVX, which does not hedge oil output, demonstrated that it is still at the mercy of market gyrations. Rising oil and natural gas prices boosted Q3 profits by ~50%. This underscores CVX’s reliance on commodity markets for its financial results as opposed to technological improvement or cost cuts.

Of note, was Chevron’s decision to cancel the sale of its Bangladesh Upstream operations. At one point, CVX intended to sell this asset to Chinese firm Himalaya Energy Co Ltd., and therefore, it suspended any related depreciation. When the decision was made not to sell the asset, CVX had to reinstate the depreciation which amounted to ~$0.22B.

CVX has been one of the Permian Basin’s largest acreage holders since the 1930s. It is not until very recently that it has begun to aggressively develop these oil reserves. On the October 27, 2017 conference call, CVX’s Chairman and CEO reiterated that the Permian Basin is a very important component of CVX’s portfolio. While 2018 production goals have yet to be forecast, CVX intends to grow aggressively in the region.

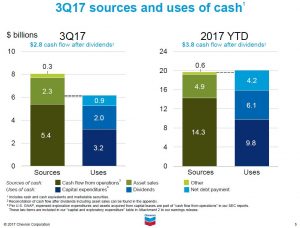

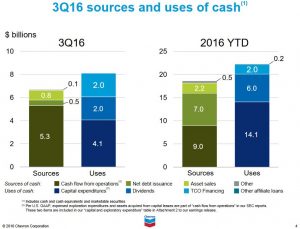

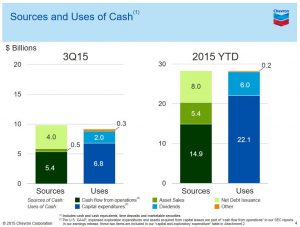

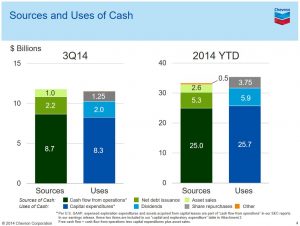

It appears CVX is making considerable effort to be disciplined and to show growth. I draw to your attention the portion of the Q3 2014 – 2017 presentations showing the dramatic YoY changes in sources and uses of cash. Look at the YTD results for each year and note the changes in the various categories.

(Source: CVX 2014 - 2017 Q3 Investor presentations)

(Source: CVX 2014 - 2017 Q3 Investor presentations)

Clearly, CVX’s cash flow metric and CVX’s ability to maintain its dividend is a concern. CVX is clearly aware of this, and therefore, unlike prior years, the first page of CVX’s Q3 presentation highlighted the change in cash flow after dividends.

(Source: CVX Q3 Investor presentation)

(Source: CVX Q3 Investor presentation)

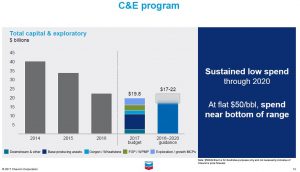

In CVX’s Q3 presentation, attention was raised to the dramatic reduction in capital and exploratory spend and operating, selling, general and administrative expenses. (Source: CVX Q3 Investor presentation)

(Source: CVX Q3 Investor presentation)

(Source: Chevron Investor Presentation September 2017)

(Source: Chevron Investor Presentation September 2017)

In addition, CVX is not averse to divesting of assets that are not going to generate positive cash flow in the immediate future.

(Source: CVX Q3 Investor presentation)

(Source: CVX Q3 Investor presentation)

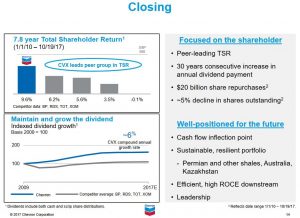

In fact, in FY2016, CVX indicated its intent to sell $5B - $10B of assets in 2016 and 2017. In Q3, CVX closed the sale of its Canadian refining and fuels marketing business and the Upstream assets and reported a gain of $0.675B. Through 7 quarters it has now sold $7.7 billion of assets and no significant asset sales are projected for Q4.

CVX has also indicated that in mid-2018 it expects to close the sale of its South African assets to Glencore.

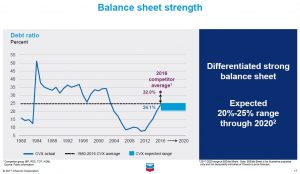

Readers may have noticed CVX had net debt issuance of ~$20.3B in FY 2014 – FY2016. In early 2016 Moody’s downgraded CVX’s credit rating to Aa2 with a stable outlook. Despite this downgrade, CVX’s debt ratio ranks favorably relative to many of its peers.

(Source: Chevron Investor Presentation September 2017)

(Source: Chevron Investor Presentation September 2017)

The following provides CVX’s outlook regarding its Free Cash Flow after dividends in 2020 based on different price ranges per barrel.

(Source: Chevron Investor Presentation September 2017)

(Source: Chevron Investor Presentation September 2017)

Dividend, Dividend Yield, and Dividend Payout Ratio

CVX’s dividend track record can be found here.

On the October 27, 2017 analyst call, CVX’s CEO specifically stated:

“ Including our fourth quarter declared dividend of $1.08, we've now increased the annual per-share cash payout 30 years in a row, a record that is very important to us.”

(Source: CVX Q3 Investor presentation)

(Source: CVX Q3 Investor presentation)

CVX has been challenged to a far greater extent than XOM subsequent to the downturn in the oil & gas industry. Investors had every right to be concerned about a possible CVX dividend cut in 2015 and early 2016. The dividend yield was in excess of 4% and without asset sales and the issuance of new debt, a dividend cut was not out of the realm of possibility.

I suspect CVX’s Board of Directors is acutely aware of what can happen when a Fortune 100 company cuts its dividend (ie. General Electric). For this very reason, I don’t think CVX is at risk of cutting its dividend. At the same time, I think investors are somewhat optimistic if they expect CVX to increase its dividend prior to 2019.

CVX continues to operate in a challenging environment. While the dividend is extremely important, it was also extremely important when CVX held it constant for 10 quarters in a row. I suspect CVX will not rush into a dividend increase at the risk of undoing some of the great work that has gone on for the past couple of years.

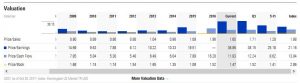

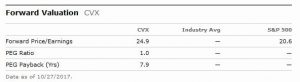

Valuation

CVX has not yet provided guidance to 2018 earnings. If we use consensus expectation from 15 brokers of $4.08 for FY2017 EPS and $5.01 from 24 brokers for 2018 and a current price of $113.54 (close of business October 27, 2017) we arrive at a PE of ~27.82. The forward PE is ~22.66 which is still high based on historical levels; Morningstar reflects a forward PE of ~25.

CVX hit a 52 week low ~$103 in late July and quickly ran up to ~$120 in mid-October. I see no rational reason for such a dramatic uptick in such a short period. It appears investor sentiment was somewhat similar when the stock pulled back ~$5 when Q3 results were released.

I suspect further weakness will be evidenced until such time as CVX releases FY2017 results and 2018 projections.

Chevron Stock Analysis - Final Thoughts

I view CVX as a core holding and it is included in my FFJ Master Stock List.

It is a far more volatile stock than XOM with a beta in excess of 1.2 versus that for XOM which is ~0.8. It is for this very reason that I own shares in both companies. I get stability with XOM and I have the opportunity to experience greater upside when things go well for CVX; XOM also enables me to offset CVX’s price drop if results fail to meet market expectations.

CVX has a far greater risk of cutting its dividend than XOM but management has repeatedly stated the importance of its dividend. I, therefore, suspect the dividend will not be cut and management will continue to do whatever is required to avoid a cut. Having said this, I think investors are optimistic if they expect CVX to increase its dividend prior to 2019.

In my opinion, the time to invest in CVX is when all is not well. Despite the changes made over the past couple of years, CVX is still “not out of the woods”. Progress has, however, definitely been made. Management has taken the appropriate course of action over the past couple of years to adapt to much lower oil & gas prices. Non-core assets have been or are slated to be divested, costs have been driven down, and new projects are now producing revenue. This might, therefore, be an opportune time to invest in CVX.

The operative word, however, is CAUTION. The bull market has had quite a lengthy run. An increasing number of sophisticated investors are expressing concern about a market correction. CVX is a volatile stock so should a market correction occur you can likely expect a significant retracement in CVX’s stock price. I, therefore, suggest that the accumulation of CVX shares be done on a very gradual basis. If the market experiences a long overdue correction and CVX’s stock price takes a dramatic hit, then I would go on a shopping spree.

On a final note, just as I recommended with XOM, treat CVX as a long-term investment. Be prepared to hold the shares through multiple economic cycles.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CVX and XOM.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.