Contents

Based on my analysis, Blackstone Inc. (BX) should richly reward long-term shareholders. Investors should consider the current share price weakness as a window of opportunity.

I last reviewed BX in my April 25, 2022 Consider Blackstone For Alternative Asset Exposure guest post at Dividend Power; prior BX posts are accessible in the Archives section of my site.

When I wrote my guest post, BX had just released its Q1 2022 results. I now revisit BX following the release of Q2 and YTD2022 results on July 21.

Business Overview

I strongly encourage investors unfamiliar with BX to review the company's website and Part 1 of the FY2021 10-K.

The 'Our Businesses' section of BX's website has a menu of the areas in which BX invests.

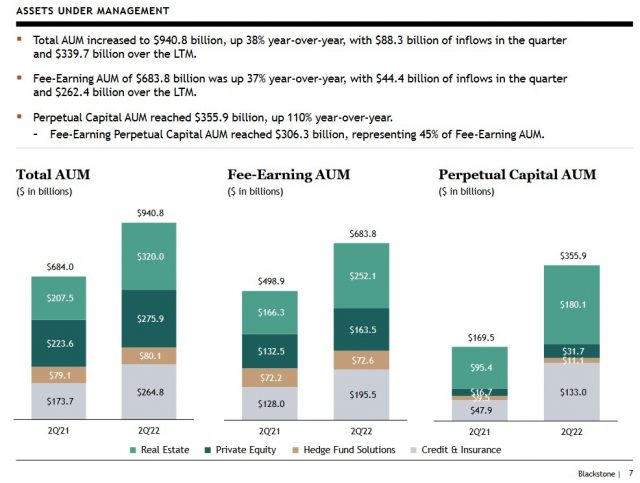

At the end of Q2 2022, BX had $940.8B in total Assets Under Management (AUM) versus $880.9B at FYE2021.

The most current Form 13-F is as of the end of Q1 2022 (March 31, 2022). This SEC filing reflects the companies in which BX has invested.

Page 18 of 20 in BX's Q2 2022 Supplemental Financial Data reflects its Investment Records as of June 30, 2022. Three columns are labelled Multiple on Invested Capital (MOIC). A good explanation of MOIC is found here.

Financials

Recent Transactions

BX opportunistically deploys funds raised from investors. Press Releases give investors a good sense of BX's level of activity.

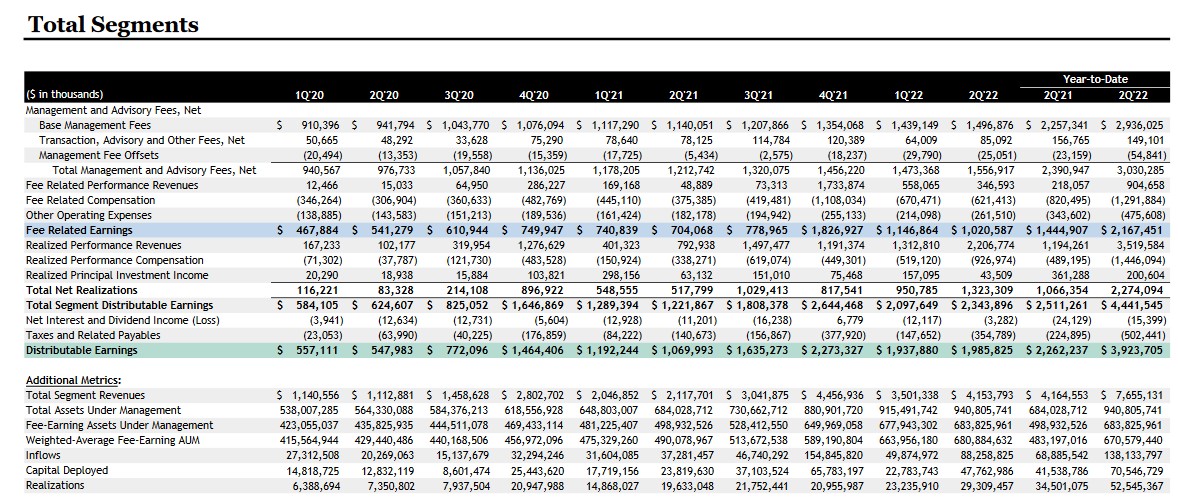

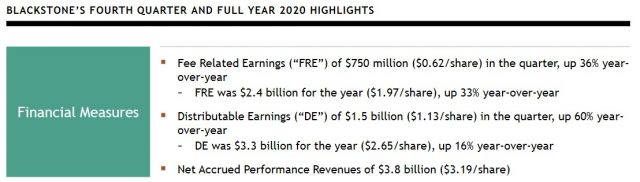

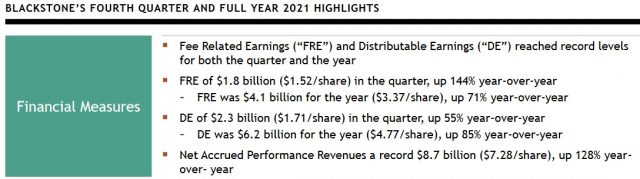

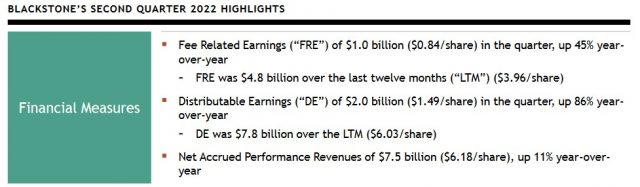

Despite BX having been active, capital markets activity, in general, has slowed dramatically. US IPOs are down over 90% YoY and commodity prices have soared although they now appear to be backing off from their highest levels. Despite these challenging conditions, BX nearly doubled its distributable earnings (DE) year-over-year to ~$2B. This most recent quarter was one of the two best quarters in BX's history. These impressive results were driven by a 45% growth in fee-related earnings and record realizations.

During the quarter, BX raised $88B of inflows amid the market chaos. This amount is BX's second highest quarter ever and equals BX's TOTAL assets under management (AUM) when it went public in 2007. Furthermore, inflows over the past 12 months reached $340B and drove a 38% increase in AUM to $941B.

In addition, BX is about midway through the largest fundraising cycle in its history. This fundraising from its limited partners will provide BX with an unprecedented $170B of dry powder capital.

Q2 2022 and YTD2022 Results

BX's Q2 and YTD2022 results are accessible here. Additional information is found in the accompanying Supplemental Financial Data.

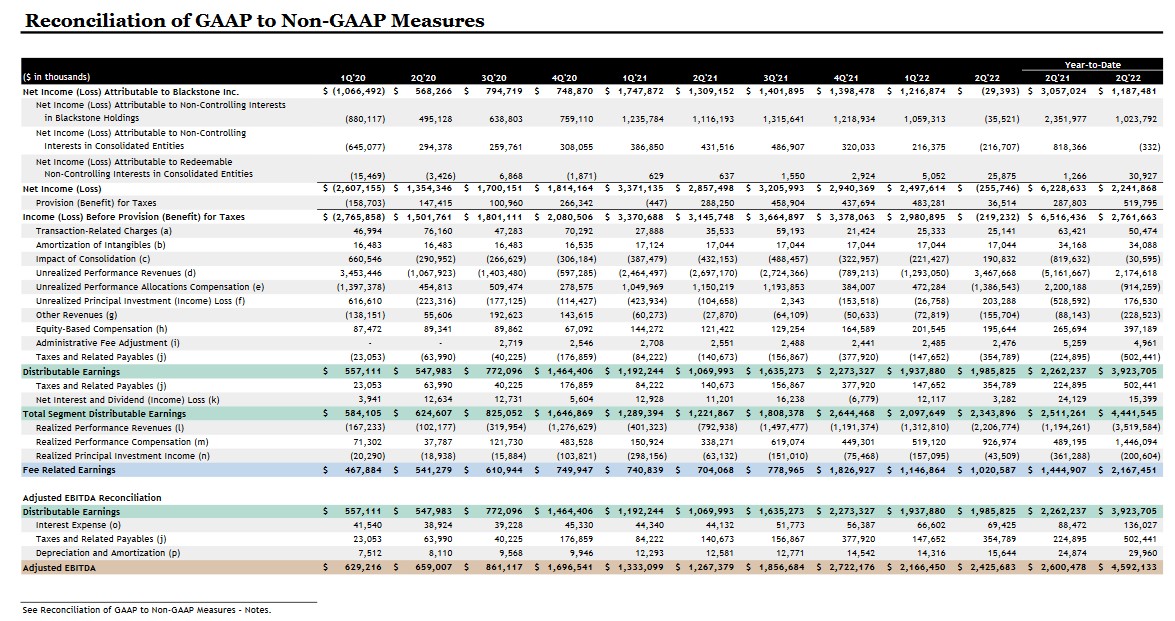

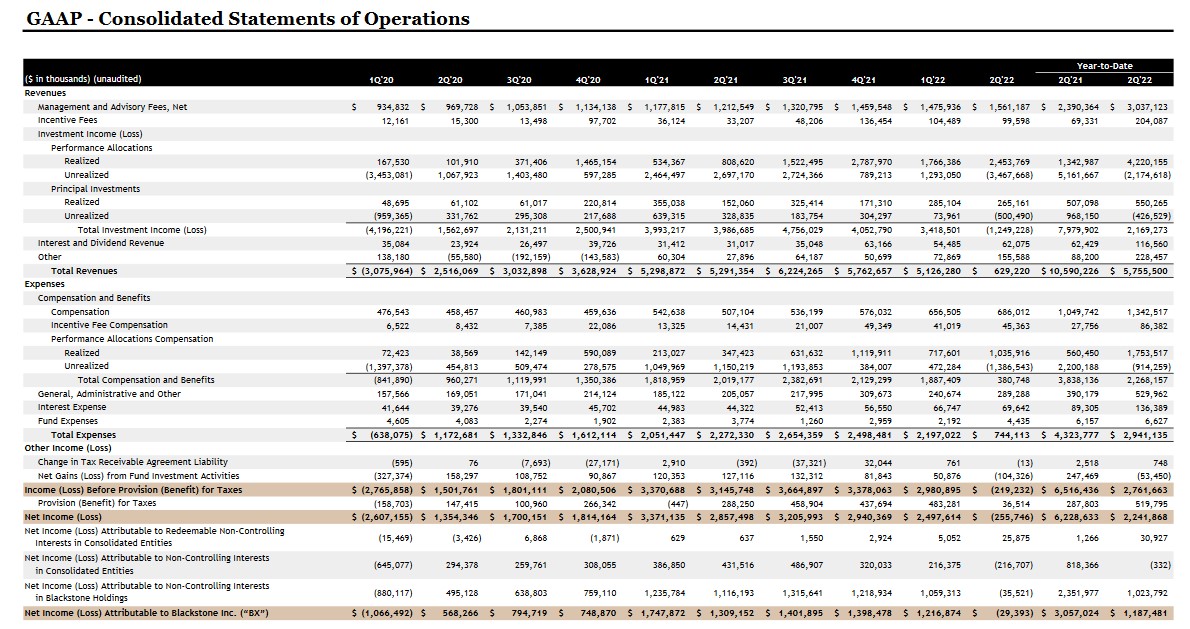

Although BX reported a GAAP Net Loss of $0.256B in Q2 of which $0.029B was attributable to BX, the YTD GAAP Net Profit is $2.2B of which $1.2B is attributable to BX.

Investors who typically rely on GAAP earnings to assess a company's performance might view BX's results as weak. Asset managers such as BX and Brookfield Asset Management (BAM-a.TO and BAM), however, use distributable earnings (DE) as a metric to more accurately compare current versus historical performance.

DE more accurately reflects earnings that are available for distribution to shareholders. It is a pre-tax non-GAAP financial measurement and it differs from Economic Net Income because it only includes the cash-generating portion of the performance and investment-related revenues and compensation expenses. Investors use DE as a proxy for cash earnings. However, DE includes some non-cash expenses – equity compensation from annual employee grants as well as depreciation.

DE increased 86% YoY to ~$2.0B in Q2 or $1.49/share. This was driven by strong growth in Fee Related Earnings (FRE) and net realizations; FRE measures profits from revenue received on a recurring basis and is not subject to future realization events. Net realizations rose over 2.5 fold to a record $1.3B.

The overall effect of the current environment will slow realizations in the near term. BX's performance revenue potential, however, continues to build. Invested performance revenue eligible AUM grew 39% YoY to a record $487B. In addition, net accrued performance revenues on the balance sheet stand at $7.5B or over $6/share. While this is down from a record level in Q1, primarily due to realizations, this store of value is still up 11% YoY and is up nearly threefold from the same period 2 years ago.

Management fees grew 28% YoY to a record ~$1.6B in Q2 and were up ~6% sequentially from Q1. Combined with ~$0.347B of fee-related performance revenues generated by a variety of perpetual vehicles, total fee revenues exceeded $1.9B up 51% YoY. Fee-related earnings increased 45% YoY to $1B, reflecting the strong growth in fee revenues.

Source: BX - Q2 2022 Supplemental Financial Data - July 21, 2022

Source: BX - Q2 2022 Supplemental Financial Data - July 21, 2022

Outlook

For FY2022, BX expects its full-year margin to be ~55%. This reflects an expansion of over 200 bps in 2 years and 900 bps in 4 years.

BX has been preparing for an environment of rising rates and a normalization of market multiples. Based on its experience with its global portfolio, BX concluded inflation would be higher and more persistent than many believe. These views have led BX to own floating rate debt hard assets with shorter duration income streams and high-quality companies with pricing power and with limited exposure to input costs.

Three reasons BX expects market conditions will remain challenging and inflation that could stay higher for longer than most expect are:

- Central banks will have to combat inflation while trying to minimize the negative impact on economies;

- Europe is also facing the most severe impacts of the war in Ukraine in terms of dislocations in energy markets and the global food supply; and

- Covid headwinds in Asia will likely remain a headwind to growth.

All these challenges create significant uncertainty for markets but economic softening along with corporate margin pressure will very likely be prevalent.

BX, however, is uniquely positioned to navigate these uncertainties on behalf of its investors and knows the importance of having long-term committed capital. The vast majority of its AUM is under long-term contracts or in perpetual structures. This will enable BX to avoid the large decreases in AUM experienced by many other money managers in this environment.

BX's model also provides it with the advantage of patience to buy assets and the flexibility to sell when the time is right.

Despite being well positioned, BX expects market volatility will likely lead to muted realizations for some time. However, FRE will continue to provide a meaningful contribution to earnings. Conversely, market dislocation creates attractive opportunities for BX to deploy its significant dry powder and its long-duration fund structures give it the ability to take advantage of opportunities as they emerge.

In March, for example, BX launched fundraising for its new global real estate flagship with a target of $30.3B. This is 50% larger than its predecessor and would represent the largest private equity or real estate private equity drawdown fund ever raised. In only 3 months, BX closed on $24.4B, with the remaining capacity already fully allocated.

BX's private equity secondary flagship fund is on track to reach its target of ~$20B, the largest secondaries vehicle ever raised.

BX has much on the go from a fundraising perspective and is confident in its $150B aggregate target for drawdown strategies.

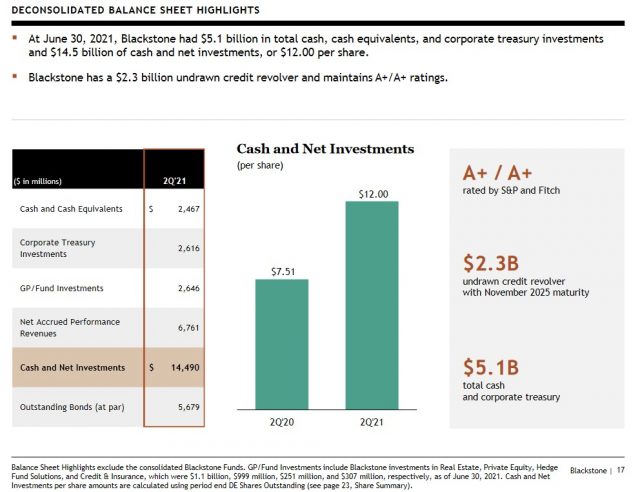

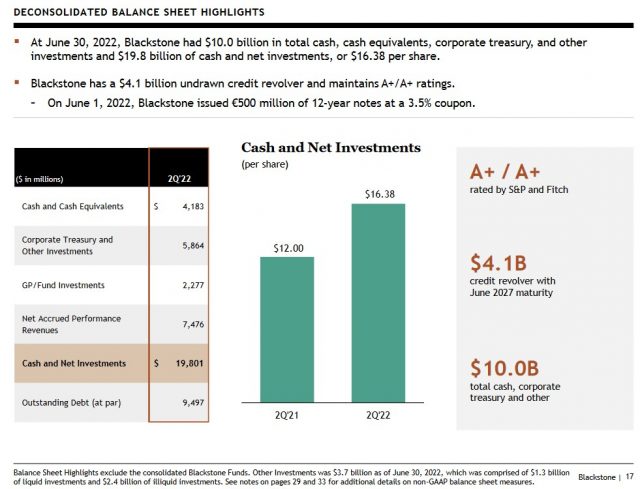

Credit Ratings

BX's senior unsecured domestic long-term debt ratings are in the top tier in the upper-medium-grade investment-grade tier. There is no change from prior reviews.

- S&P Global assigns an A+ long-term unsecured debt credit rating with a stable outlook; and

- Fitch assigns an A+ long-term unsecured debt credit rating with a stable outlook;

These ratings define BX as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

BX's current deconsolidated Balance Sheet highlights are as follows.

Source: BX - Q2 2022 Investor Presentation - July 21, 2022

BX's deconsolidated Balance Sheet highlights when I initiated my BX position and wrote my first BX post on August 27, 2021 are found below. While the credit ratings remain the same, we see very significant improvements in just under 1 year.

Dividend and Dividend Yield

On July 21, 2022, BX declared a $1.27/share quarterly dividend payable on August 8. This quarterly dividend is less than that declared the previous 2 quarters. BX's dividend policy, however, clearly spells out that its quarterly dividend will fluctuate.

BX's dividend policy is based on DE:

'Our intention is to pay to holders of common stock a quarterly dividend representing approximately 85% of The Blackstone Group Inc.’s share of Distributable Earnings, subject to adjustment by amounts determined by our board of directors to be necessary or appropriate to provide for the conduct of our business, to make appropriate investments in our business and funds, to comply with applicable law, any of our debt instruments or other agreements, or to provide for future cash requirements such as tax-related payments, clawback obligations and dividends to shareholders for any ensuing quarter. The dividend amount could also be adjusted upward in any one quarter.'

I appreciate that we have our respective goals and objectives. Investors who heavily favour investments with attractive dividend metrics might view this fluctuation with a level of apprehension. Making investment decisions based heavily on such metrics, however, are flawed. Any investor seeking to maximize total potential long-term shareholder return while taking into consideration risk should also consider capital gains potential and tax implications.

In many cases, capital retention might enable a company to build its business to generate long-term investment returns that will far outweigh any return a shareholder can expect to receive from dividend income.

Furthermore, novice investors often overlook the tax implications of dividend income.

Depending on an investor's circumstances, capital gains may be the most optimal form of investment return. If a company can retain earnings to generate superior investment returns and a shareholder does not actively trade their shares, any tax obligation can be postponed well into the future.

Although BX's quarterly dividend fluctuates, it does distribute a dividend because it is a capital-light business. Despite the distribution of ~85% of quarterly DE, BX retains sufficient earnings that, when combined with money raised from institutional and sovereign investors, can easily fund an increase in AUM.

The magnitude of share buybacks is heavily dependent on whether there is a meaningful deterioration in BX's share price relative to the true underlying value.

BX is hyper-focused on capital allocation. I have no concern when I see an increase in the number of outstanding shares. My interest lies in knowing that the underlying value of each share shall likely appreciate over the long term.

Valuation

I typically look at diluted EPS, adjusted diluted EPS, and free cash flow metrics to value most of the companies I analyze. These metrics, however, do not accurately reflect BX's performance.

BX uses Distributable Earnings (DE) and Fee Related Earnings (FRE) to more accurately measure its performance; these, and other terms, are defined at the end of the Q2 2022 Earnings Presentation and within the FY2021 Form 10-K.

The very manner in which BX operates makes it virtually impossible to estimate future DE and FRE. Furthermore, BX does not provide guidance.

The reason BX is not easy to value is that it raises large pools of capital from clients for deployment thus resulting in multiple multi-billion-dollar acquisitions annually. Because it continually makes sizable investment transactions (acquisitions or divestitures) earnings estimates can quickly become outdated.

Some of the acquired assets are meant to be perpetual holdings. In other cases, BX uses its expertise to improve the performance of the companies in which it invests with the intent of monetizing these assets as part of its capital recycling programs. It is not, therefore, unusual to see wide swings in YoY GAAP results.

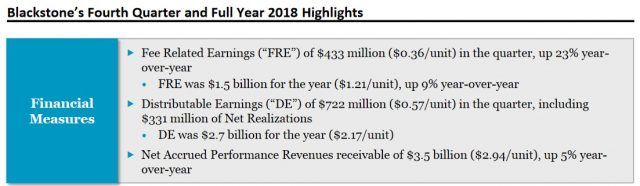

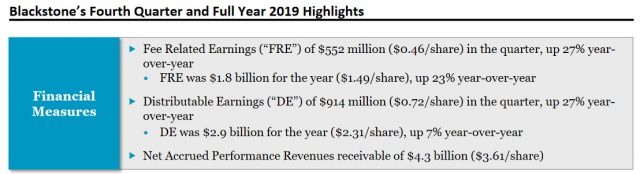

Looking at DE and FRE results extracted from the FYE 2017 - FY2021 and Q2 2022 Earnings Presentations, however, we can see that BX generates impressive results.

Final Thoughts

Investors unfamiliar with BX undoubtedly reacted negatively to its Q2 earnings release when they saw a loss on a GAAP basis. Investors, however, need to delve into the numbers to understand that Q2 was a relatively decent quarter.

Some asset managers will experience challenges in this environment. We must not, therefore, view all asset managers equally. BX's reputation sets it apart from many of its peers. The sheer magnitude of its operations and sources of capital enables it to enter transactions most other asset managers would not even be able to contemplate.

Furthermore, asset managers such as Franklin Resources, BlackRock, and T. Rowe Price focus more heavily on traditional asset classes like equity, fixed-income, balanced and money market funds. BX (and BAM), however, are alternative asset managers that focus on less-liquid alternative investments like private equity, credit alternatives, real estate, and hedge funds.

In my opinion, Blackstone should richly reward long-term shareholders. Consider the current share price weakness as a window of opportunity.

I did! My most recent purchase was on July 21 at $94.83/share.

When I wrote my guest post at Dividend Power following the release of Q1 2022 results, I held 1008 BX shares in a 'Core' account within the FFJ Portfolio. I have taken advantage of the subsequent occasional share price pullback to increase my exposure to 1219 shares.

I had no BX exposure before August 2021. When I completed my January 2022 Investment Holdings Review, however, BX was my 22nd largest holding. Despite acquiring more shares following that review, BX had slipped to my 26th largest holding at the time of my Mid-2022 Investment Holdings Review.

As an aside, many who wish to establish a career in the investment industry view BX as an enviable place in which to gain experience. How enviable? Well...there were 42,000 applicants for summer analyst positions in 2022 of which only 250 were selected!

BX investors should also take comfort knowing that BX employees own ~50% of the total number of outstanding shares. Employees, therefore, are highly committed to the company’s success.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long BX and BAM-a.TO.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.