Contents

Enbridge Inc. (ENB) is a value stock investors should consider as a long-term investment. It has significantly de-leveraged, it offers an attractive dividend yield, and it has promising long-term prospects.

Summary

- ENB recently released Q4 and FY2018 results and provided guidance for FY2019 and FY2020.

- The company has made considerable progress in deleveraging its balance sheet within the past year.

- ENB has now revised lower its long-term leverage target range to 4.5xs with the plan showing that ENB should come down to ~4.3xs after Line 3 is completed.

- Moody’s upgraded ENB’s senior unsecured long-term debt rating from Baa3 to Baa2 in January 2019. This new rating is now one notch below that assigned by S&P Global Ratings.

- In November 2018, ENB terminated its DRIP because it had made substantial progress on its funding and asset sales plan thus allowing it to meet any remaining equity requirement for the balance of its currently secured growth program.

- In December 2018, ENB announced a ~10% increase to its quarterly dividend ($0.738 from $0.671) and a similar increase is projected for FY2020; the dividend has grown at an average compound annual growth rate of 12.1% over the past 20 years.

Introduction

All dollar values expressed in this article are in CDN dollars unless otherwise noted.

In my August 5, 2017 article for subscribers I disclosed that I had initiated a 400 share position in Enbridge Inc. (ENB) for the FFJ Portfolio. I initiated this position despite its structure being difficult to understand and a considerable amount of leverage being employed. I did this because I liked that ENB operates in a highly regulated industry which results in significant barriers to entry; I view it much like a toll road.

I certainly didn’t like ENB’s degree of leverage but I also viewed this high degree of leverage as another barrier to entry.

Fast forward to my August 4, 2018 article and I indicated ENB had taken steps to address my concerns regarding its leverage. I liked that that ENB had a renewed focus on the low risk pipeline and utility businesses and the following priorities:

- the strengthening of credit metrics as industry leading growth capital spend moderates and new projects generate significant EBITDA;

- long-term Consolidated Debt to EBITDA target of 5.0x by end of 2018;

- possible further balance sheet strengthening from additional asset sale proceeds.

I then wrote this November 3, 2018 article in which I stated that by carrying out its strategic priorities many ENB shareholders, who had become frustrated with the performance of their ENB investment, would be rewarded if they just remained patient.

Following the integration of Spectra Energy, ENB laid out the following strategic initiatives at the beginning of FY2018.

- deliver strong results for the first full year after the deal;

- move to a pure pipeline-utility business model because that is where ENB excels;

- sell non-core assets and accelerating deleveraging;

- streamline the business, drive efficiency, and simplify the corporate structure;

- execute the secured capital program which was key to growing cash flow;

- replenish secured growth beyond 2020.

If we now look at ENB’s scorecard for FY2018 we see that it has achieved what it said it would do…and more.

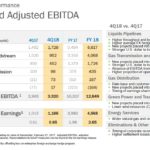

This image shows the extent to which ENB’s adjusted earnings before interest, taxes, depreciation and amortization, distributable cash flow, and adjusted earnings improved relative to FY2017 results.

Source: ENB - Q4 2018: Financial Results & Business Update – February 15, 2019

Look at pages 6 – 10 of this presentation to see the extent to which ENB performed on its other 5 strategic initiatives.

I like the direction in which ENB is headed and I have mentioned in my previous articles that I think shareholders will be well rewarded over the long-term. In fact, I have put my money where my mouth is and on the basis of my analysis for the August 4, 2018 article I acquired another 500 shares for the FFJ Portfolio. I then acquired another ~200 shares later in August.

Total ENB shares held as at the time of this article now stands at 1,150 but with ENB’s shares currently trading hands at $47.40, ENB does not fall within my top 30 holdings.

The dividends from these ENB shares are being automatically reinvested through my discount broker to acquire additional ENB shares so my ENB exposure will increase on a quarterly basis without my involvement.

Now that ENB has released its Q4 and FY2018 results on February 15, 2019 I am taking this opportunity to quickly review the company to determine whether I should make another lump sum purchase.

Q4 and FY2018 Financial Results

Material related to ENB’s Q4 and FY2018 Earnings can be accessed here and its December 31, 2018 10-K can be accessed here.

The following are but a few key images extracted from ENB’s Q4 and FY2018 Earnings Presentation. I highly recommend you review all pages for more details.

Source: ENB – Q4 and FY2018 Earnings Presentation – February 15, 2019

Of significance in FY2018 is the sale of assets which was in excess of $8B. ENB had initially targeted the sale of $3B of assets but it hit that target by May 2018. It was clear there was a big appetite for assets so ENB capitalized and ended up executing far more than originally anticipated which enabled it to deleverage quicker than originally forecast thus giving it additional financial flexibility.

The sale of these assets has allowed ENB to, within one year, become the pure play utility-pipeline model it had targeted.

Debt to EBITDA has come down to 4.7xs at FYE2018 which is below the original 5xs target the company had set for 2018 and certainly far lower than ~6xs reported in 2016.

ENB has now revised lower its long-term leverage target range to 4.5xs with the plan showing that ENB should come down to ~4.3xs after Line 3 is completed.

2019 Outlook and Beyond

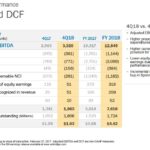

While it is all well and good to see how a company has performed, it is doubly important to get a glimpse into the company’s future. The Q4 and FY2018 Earnings Presentation provides a few pages on this topic but I include the following images for quick access.

Source: ENB – Q4 and FY2018 Earnings Presentation – February 15, 2019

Credit Ratings

In my November article I indicated:

‘ENB is making the appropriate strategic decisions to reverse the deteriorating trend in its credit ratings. Once most of its 2019 Strategic Growth Projects have been completed and are generating revenue I envision an upgrade in ENB’s credit ratings will occur in 2021 or 2022.’

With the progress ENB has made in the past year I now see that on January 25, 2019 Moody’s upgraded ENB’s senior unsecured long-term debt rating from Baa3 to Baa2 (middle tier of the ‘lower medium grade’ category).

S&P Global Ratings continues to rate ENB’s senior unsecured long-term debt BBB+ (the top tier of the ‘lower medium grade’ category); this rating is now one notch higher than Moody’s assigned rating versus two as at the time of my November 2018 article.

Valuation

Distributable Cash Flow (DCF) is the metric on which management focuses.

If we go back to my August 7, 2017 article, ENB was trading at $52.57 and 2018 adjusted EPS expectations from multiple brokers was $2.56 thus giving us a forward PE of ~20.54. At the time of that article, management projected DCF of $3.60 - $3.90/share. Using the $52.57 price, the forward Price/DCF range was ~13.48 - ~14.6.

At the time of my August 4, 2018 article, ENB’s TSX listed shares were trading at $46.53 (August 3, 2018 close of business). Q2 results was on track to achieve financial guidance for 2018 with the outlook for DCF/share expected to be in the upper half of the guidance range of $4.15 - $4.45/share.

On an EPS basis, the consensus mean adjusted EPS estimate from 8 brokers was $2.49. The disparity in earnings projections, however, was once again significant ($2.19 - $2.70). Using the $46.53 stock price and the consensus mean adjusted EPS estimate I arrived at a forward adjusted PE of ~18.7. (~17.2 – ~21.25 range).

Using the DCF metric ($4.15 to $4.45/share) I arrived at a forward Price/DCF range of ~10.46 - ~11.2.

The Q2 guidance remained unchanged as at the end of Q3 and when I wrote my November 3, 2018 article, ENB had closed at $41.19 on November 2, 2018. Using $4.15 - $4.45/share in DCF, I arrived at a forward Price/DCF range of ~9.26 - ~9.93.

On an EPS basis, the consensus mean adjusted EPS estimate from 9 brokers was $2.62. The disparity in earnings projections, however, was significant ($2.50 - $2.97). Using the $41.19 stock price and the consensus mean adjusted EPS estimate I arrived at a forward adjusted PE of ~15.72 (the ~13.9 - ~16.5 range was not as wide as at the time of my August 4th article).

ENB is now trading at $47.40 (February 15, 2019 close of business) and adjusted earnings projections for FY2019 range from $1.90 - $3.27 with a mean of $2.52 thus giving us a forward adjusted PE of ~18.81. This $1.37 disparity suggests to me that not all the brokers have updated their numbers so I am hesitant to rely on this adjusted PE.

We see that ENB’s management has reaffirmed financial guidance for 2019 and 2020, with a DCF midpoint of $4.45/share for FY2019 and $5.00/share for FY2020.Using the current $47.40 stock price we get a forward Price/DCF of ~10.65 for FY2019 and ~9.48 for FY2020.

Valuation is less attractive than at the time of my November 3, 2018 article but still fairly reasonable given the outlook for ENB over the next few years.

Dividend, Dividend Yield and Dividend Payout Ratio

ENB announced on November 2, 2018, that it was suspending its dividend reinvestment and share purchase plan (DRIP) until further notice. The rationale for this was that ENB had made substantial progress on its funding and asset sales plan thus allowing it to meet any remaining equity requirement for the balance of its currently secured growth program.

ENB’s historical dividend track record can be found here.

Enbridge has paid dividends for over 64 years to its shareholders. In December 2018, it announced a ~10% increase to its dividend per share, increasing the quarterly dividend to $0.738 from $0.671. This translates into $2.952 dividend per share on an annualized basis for 2018.

Over the past 20 years, the dividend has grown at an average compound annual growth rate of 12.1%.

With ENB trading at $47.40/share this new annual dividend provides investors with a ~6.23% dividend yield.

ENB has also reaffirmed expected dividend growth of 10% in 2020 and has provided guidance of longer term 5 - 7% DCF per share CAGR post-2020. I recognize much can happen between now and 2020 but it looks like investors can tentatively expect ENB’s annual dividend to rise to ~$3.247 in FY2020.

I indicated in my November 3, 2018 article that ENB’s dividend yield is typically higher than the yield I receive from the other stocks I own. I would normally not invest in a company with such a high dividend yield but I fully recognize that I cannot compare ENB with the low dividend yield companies in my portfolio because of the significant differences in the nature of these businesses. A more appropriate comparison can be made with other high dividend yielding stocks.

- Brookfield Renewable Partners L.P. (BEP)

- AT&T (T)

- Brookfield Property Partners L.P. (BPY)

- Enbridge (ENB)

- BCE (BCE)

- Total S.A. (TOT)

- Brookfield Infrastructure Partners L.P. (BIP)

- The Canadian Imperial Bank of Commerce (CM)

When I look at the names reflected above I see that ENB’s dividend yield is really not out of the ordinary when compared to other reasonably ‘steady eddy’ companies.

The $2.952/year dividend is ~66% of 2019’s projected $4.45/share DCF. This is slightly higher than ENB’s conservative <65% dividend payout ratio target but I am fully confident ENB’s dividend is not at risk.

Final Thoughts

It is hard not to be impressed with the progress ENB has made within the past couple of years and especially within the past year.

ENB is not within my top 30 holdings and although I like the direction in which it is headed and the degree of dividend income generated, I do not envision this becoming a top 30 holding for me. I am more inclined to increase my exposure to companies that fall within my top 20 and to a lesser degree a couple of the companies that fall within my top 20 – 30 before I start acquiring more ENB shares (other than by auto dividend reinvestment).

Having said this, if you are looking for dividend income from a stock that is reasonably valued you may wish to look into ENB. I strongly suspect that once it completes some of its major projects we may not see ENB available at the current valuation.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long ENB, T, BEP, BPY, BIP, BCE, TOT, and CM.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.