Mastercard (NYSE: MA) released its Q3 2018 results October 30, 2018.

Mastercard and VISA have recently agreed to pay $5.54B – $6.24B to a class of more than 12 million merchants who accept the payment networks’ cards in the largest-ever class-action settlement of a U.S. antitrust case. This brings to an end one litigation matter that has gone on for well over a decade. One other unresolved legal issue remains and will likely drag on much longer.

At the time of my previous MA article (February 2, 2018), I viewed MA’s shares as richly valued. Based on the recent ~17% pullback from its 52-week high and estimated earnings for FY2018, I deem MA to be back to within its historical valuation range and have acquired additional shares for the FFJ Portfolio.

Summary

- Mastercard reported Q3 and YTD2018 results on October 30th. Despite decent results shares pulled back further.

- MA shares are rarely in bargain territory and you will be waiting a long time if you want to acquire shares at a sub-20 PE.

- Don’t get hung up as to which company (Mastercard vs VISA) is better. Invest in both.

Introduction

MasterCard (NYSE: MA), currently held in the FFJ Portfolio, released its Q3 results October 30th. Despite decent results, dysfunctional Mr. Market promptly lopped ~$3.30/share from MA’s share price before the end of the October 30 trading session.

In my February 1, 2017, July 31, 2017, and November 1, 2017 articles I explained my rationale for investing in MA and indicated it was one of my strongest conviction holdings.

In my November 1st article I indicated:

‘You will very rarely find MA “on sale” (unless a market correction occurs). In my opinion, if you have a long-term investment time horizon, you may want to periodically acquire MA shares. Should the markets implode and MA experiences a dramatic drop in price you should seriously consider “loading up the truck”.’

I also pointed out that:

‘I want to benefit from the global payment trends and I see owning shares in MA and V as a great way to accomplish this; I am not averse to periodically acquiring additional shares (within reason) in both companies despite their low dividend yield and habitually rich valuation.’

At some stage of the game, however, a great company does not always mean a great valuation. This is how I felt when I wrote my February 2, 2018 article.

At the time of my February article, MA had just reported FY2017 diluted EPS of $3.65 and adjusted diluted EPS of $4.58. Based on the February 1, 2018 $172.93 closing stock price I arrived at a PE of ~47.38 and an adjusted diluted PE of ~37.76.

EPS were expected to grow in the mid 20% range giving us a forward diluted EPS of ~$4.50 and a forward adjusted diluted EPS of ~$5.73 based on adjusted diluted earnings. The mean consensus from 37 brokers, however, was a forward EPS of ~$5.81 based on adjusted diluted earnings.

Using the $172.93 stock price as at the time of my February 2nd article and my earnings estimates of $4.50 and $5.73, I arrived at a diluted PE of ~38.43 and an adjusted diluted PE of ~30.18.

While MA is a company in which I have invested for the long-term and I would like others to also view MA in a similar manner, I just could not justify recommending MA as an investment based on the numbers at hand.

Subsequent to my February 2nd article, MA continued to generate decent results but its stock price went parabolic and rose to a shade over $225 by early October. If I felt MA was overvalued in February, I viewed it as even more overvalued at the beginning of October.

Now that MA has pulled back ~17% to ~$187.75 and Q3 results have just been released I view this an opportune time to once again review MA.

US Merchant Litigation

Anyone thinking of investing in MA or Visa (NYSE: V) should be fully aware of their dispute with retailers which began in 2005 when both companies were still owned by banks. Merchants had accused MA and V of violating antitrust laws by illegally inflating swipe fees (aka interchange) that merchants pay on every purchase transaction and which banks use to fund consumers’ credit-card rewards.

Very recently, MA and V have agreed to pay $5.54B – $6.24B to a class of more than 12 million merchants who accept the payment networks’ cards in the largest-ever class-action settlement of a U.S. antitrust case; this dollar range is in line with the amounts MA and V previously set aside to cover the costs of the litigation.

This recent settlement, however, only addresses the monetary damages associated with the lawsuit. The next fight between retailers and the world’s biggest payment networks has to do with MA’s and V’s business practices. Any changes to their business practices could include reductions in interchange fees and this ongoing litigation has the greatest potential risk to future earnings for the U.S. businesses of MA and V; the earlier settlement (2013) was once valued at ~$7.25B, but was reduced after many large retailers such as Walmart, Starbucks, and Lowe’s opted out.

I strongly suspect these large companies, which have been ferociously litigating for so many years, are not going to give up easily. I strongly suspect this legal matter is going to drag on for quite some time.

Q3 2018 Financial Results

MA’s October 30th Earnings Release can be found here.

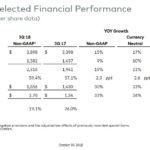

Source: MA – Q3 Earnings Presentation – October 30, 2018

On the October 30th call with analysts, MA indicated it continues to see solid overall growth. It is, however, monitoring the potential impacts related to fiscal stimulus reductions, rising interest rates, and the increased trade barriers as these could slow global economic growth. In addition, it is monitoring the impact of a stronger U.S. dollar on cross-border flows and the economic weakness in some emerging market countries.

On the conference call, MA noted that:

- in the U.S., economic growth remains positive and low unemployment and healthy consumer confidence has helped business;

- overall conditions in Europe remain stable as unemployment continues to decline. Consumer confidence remains strong in the Nordic region but there are political concerns in the UK, Italy, and Turkey;

- MA is waiting to see how the economic and fiscal policy agendas develop as the new administrations take office in Brazil and Mexico.

- There are currently a few potential headwinds in Asia. While consumer sentiment remains relatively positive in Asia, there is concern in that trade tensions are weighing on business sentiment with same being most notable in China, Japan, and Korea.

Some members of the investment community have expressed concern that Q3 revenue growth was largely being driven by rebates and incentives and not by transaction volumes; payments processors and card companies use rebates and incentives to forge alliances with banks and merchants, which then pass on these incentives to customers who begin using their networks for transactions.

In my opinion, there is nothing to be concerned about the manner in which MA has increased its revenue in Q3 and I think looking at a quarter in isolation is somewhat short-sighted. If this was a recurring theme then I would view this as a strike against MA.

Valuation

MA’s diluted EPS and adjusted diluted EPS for the first 3 quarters of FY2018 are $4.73 and $4.94 respectively; comparable results for FY2017 were $3.43 and $3.44.

In Q3 MA generated $1.82 of diluted EPS and $1.78 of adjusted diluted EPS. If we conservatively estimate that MA will generate $1.80 in diluted EPS and $1.76 in adjusted diluted EPS in Q4, we get estimated FY diluted EPS of $6.53 and estimated FY adjusted diluted EPS of $6.70.

Based on the October 30th closing stock price of ~$187.75 we arrive at a forward PE of ~28.75 and a forward adjusted PE of ~28. These levels are ever so slightly lower than the 5 year average PE of ~29.

So how do the current figures compare with those at the time of my February 2nd article? Well, have a look at the Introduction section of this article.

In my opinion, MA was overpriced at the time of my February 2nd article but MA’s valuation now appears to be closer to its historic norm.

Credit Ratings

Moody’s rates MA’s unsecured long-term debt A2 and S&P Global rates it A; these ratings are unchanged from the time of my previous articles.

Both ratings are the middle tier of the Upper Medium Grade category and are satisfactory for an investor such as me who has a low tolerance for risk.

Historical Performance

MA started trading as a publicly traded entity on May 25, 2006.

I recognize past performance does not predict future performance but I get a greater sense of comfort investing in a company with a proven track record of being able to outperform the index than I do from a company which has not.

I show MA’s performance relative to the S&P 500 over three different timeframes. Having said this, I checked out timeframes and MA continually outperformed the S&P500.

Source: Tickertech

Dividend, Dividend Yield, and Dividend Payout Ratio

MA’s dividend history can be found here and its stock split history can be found here.

Investors focusing their investment decisions very heavily, or exclusively, on dividend income will most likely exclude MA as a potential investment given its ~0.53% dividend yield; MA is a stock more suited for investors seeking long-term capital gains with a smattering of dividend income.

The $1.00/share annual dividend represents a dividend payout ratio of ~15% based my estimated forward diluted EPS of ~$6.53. I envision MA will continue to generate strong Free Cash Flow and servicing the dividend will be a non-issue.

Share Repurchases

I indicated that MA’s dividend takes somewhat of a back seat to capital gains. There capital gains have been partially achieved through the repurchase of a significant number of shares over the years.

Share count as at FYE2008 was 1,301 million shares.

As at the end of FY2016 and 2017, share count was 1,101 million and 1,072 million respectively.

Here we are…end of Q3 and the weighted-average shares outstanding is down to 1,050 million!

Final Thoughts

There are some industries out there where the top 2 or 3 companies own a commanding market share and despite all the challenges they face…they just seem to continually print money. MA and V are examples of two companies that fit this description.

Some people will debate whether V is better than MA or MA is better than V. Quite frankly, I don’t really care and this is why I have chosen to own both.

I do not yet know what MA has forecast for 2019 but my instinct tells me that earnings will be higher in 2019 just like 2018 earnings will be higher than 2017, and 2017 earnings were higher than 2016 earnings…and so on and so on.

The outstanding legal matter I reference earlier in this article…sure, that is a huge cloud hanging over MA and V but I envision this legal matter dragging on for a few more years. During that time, these two companies will continue to print money. Even after they come to a settlement I expect them to continue to be highly profitable.

With the recent pullback from the $225.35 52-week high and the earnings I anticipate MA will generate this year and in the future, I decided to acquire another 150 shares for the ‘side accounts’ segment of the FFJ Portfolio on October 30th; the FFJ Portfolio currently holds 400 shares at an average cost of ~$124.

There are also 22 MA shares that were acquired some time ago that have been sitting in an investment account. I am taking these 22 shares and am also moving them into FFJ Portfolio ‘side accounts’ thus bringing this portfolio’s MA exposure to 572 shares.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long MA and V.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.