Summary

Summary

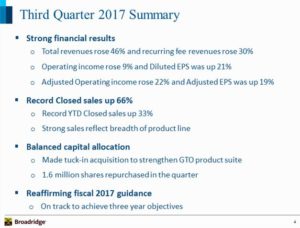

- This Broadridge Financial stock analysis is based on Q3 2017 and 9 month YTD results and forecast for the remainder of the current fiscal year.

- Broadridge Financial continues to grow its business and the NACC acquisition made in mid 2016 is already making significant contributions.

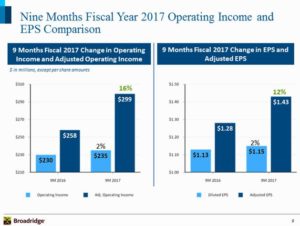

- Adjusted net earnings increased 11% to $0.174B of the current FY compared to $0.156B for the prior year period (9 months).

- Diluted EPS increased 2% to $1.15 compared to $1.13 for the prior year period (9 months).

- Adjusted EPS increased 12% to $1.43 from $1.28 for the prior year period (9 months).

- Trends in Capital Markets, Wealth Management, Asset Management, and Corporate Issuers present significant long-term growth opportunities for BR.

Introduction

This is a follow up to my February 9, 2017 Broadridge Financial (NYSE: BR) post. At the time I wrote that post, BR was trading at $68.18. This price was very similar to the price I had paid in August 2016 to acquire additional BR shares; BR is currently trading at $71.07.

Should you be unfamiliar with BR, I suggest you review BR’s March 14, 2017 presentation made at Barclays Emerging Payments Forum.

In my February 9, 2017 post I indicated BR had acquired the North American Customer Communications (“NACC”) business of DST Systems, Inc. (NSYE: DST). Upon acquiring this business, BR renamed the NACC business “Broadridge Customer Communications” and integrated it into BR’s Investor Communication Solutions segment. By doing so, BR created North America’s premier customer communications technology platform for print and digital solutions to banks, broker-dealers, mutual funds and corporate issuers.

At the time of my February post, Google Finance reflected a PE of 26.89. Generally I would hesitate to recommend a stock valued at this level but based on my analysis I concluded BR had a forward PE of sub 22 and that growth prospects supported a slightly elevated PE.

BR recently released its Q3 results. I, therefore, thought it would be an opportune to revisit BR.

Q3 2017 Results and Outlook for Remainder of Fiscal 2017

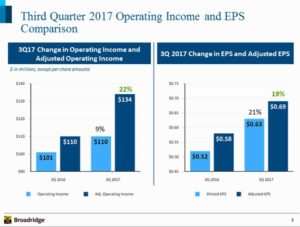

BR released its Q3 2017 and YTD results and its forecast for the remainder of the current fiscal year on May 10, 2017; its Earnings Release can be found here.

I enclose the following images from BR’s Q3 2017 Earnings call with analysts since they are currently only accessible if you view the webcast and you do not have the time to do so.

I also encourage you to listen to the webcast which can currently be accessed at:

While it is 55 minutes in length, it is well worth listening to.

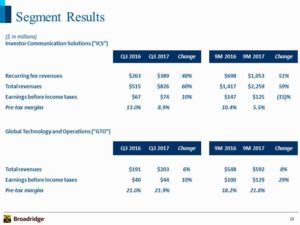

On several occasions during the conference call, management stressed how successful the NACC acquisition has been to date. This is borne out in the dramatic growth in YTD revenue.

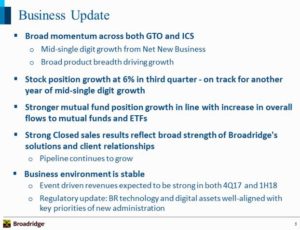

BR continues to “fire on all cylinders” and is seeing strong demand for its solutions and services. There have been no new “significant wins” but rather “a bunch of singles”. Furthermore, BR is not dependent on any single product for its growth. In essence, growth is well balanced.

BR likes “spin-offs” and IPOs because this increases the size of the pool of companies requiring its services; BR has witnessed an increase in both these areas as well as dramatic growth in the number of individual investors. In essence conditions have, and continue to be, favorable for BR’s growth.

One thing I truly like about BR is that customer satisfaction is a key performance related metric in that all associates are tied to measurable customer satisfaction levels. In addition, over 50% of all BR associates can only earn a bonus if customer satisfaction levels increase.

BR continues to focus on offering more services to clients in an industry which is extremely focused on driving costs out of the process. This puts BR in a strong position for future growth.

Rather than develop products and services to dramatically help its clients drive out costs, BR is focused on “bite sized” enhancements to its product/service offering. Once again, I strongly encourage readers to listen to the webcast where Richard Daly (President and CEO) explains the reasoning for this approach. Should you not have time to listen to the entire webcast, you may wish to start listening at the 35 minute mark which is when the Q&A period with analysts begins.

As far as BR’s acquisition strategy goes, BR is presented with roughly 10 acquisition opportunities per year. Only 1 or 2, however, may meet BR’s stringent acquisition criteria:

- The target company must be a strategic fit;

- BR must be confident it will be a better owner of the asset being acquired than the current owner;

- Every acquisition must be able to meet a minimum return “bar”.

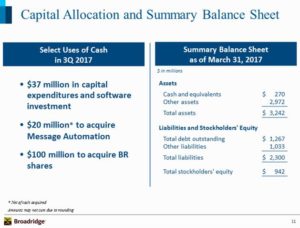

BR’s long-term debt has increased dramatically in the last few years as a result of its string of acquisitions and repurchase of its shares.

As at its fiscal YE 2102 (page 25 of 100), LTD was $524MM, Treasury Shares was $580MM, and Goodwill and Intangible Assets was $923MM.

As at March 31, 2017, LTD was $1.142B, Treasury Shares was $1.292B, and Goodwill and Intangible Assets was $1.645B.

While BR’s risk profile has changed within the last few years as a result of this additional debt, it continues to meet all conditions under its credit facilities. In addition, interest rates on the new debt taken on in recent years have actually come down from debt incurred within the first few years of being a stand-alone entity.

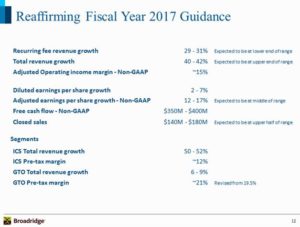

I also note that FCF levels in 2012 – 2016 were $0.244B, $0.22B, $0.334B, $0.365B, and $0.362B. For the 9 months ending March 31st 2016 and 2017, FCF amounted to $0.093B and $0.105B. BR’s FCF guidance for the full FY2017 is $0.35B – $0.4B. On May 10, 2017, BR reiterated that this target remains unchanged.

Given the above, I am comfortable with BR’s current debt levels.

Valuation

As previously noted, BR closed today at $71.07. Google Finance reflects a PE of 27.77 which implies an EPS level of $2.56. FY2016’s Diluted EPS was $2.53 and management has forecast 2 – 7% growth giving us a range of $2.58 – $2.71. If we use the mid-point of this range ($2.645) then we get a PE closer to 26.9.

From an Adjusted Diluted EPS perspective, BR achieved $2.73 in FY2016. Management has reiterated that it expects this metric to grow 12 – 17% in FY2017 giving us a range of $3.06 – $3.19 or a mid-point of $3.125. This is slightly lower than the mean estimate of $3.14 from 6 brokers.

If I use today’s closing price of $71.07 and an Adjusted Diluted EPS of $3.125 I get a 22.74 forward PE. This is slightly higher than the forward PE of 21.85 I calculated in my February 9th post. Having said this, I do not view this new level as entirely excessive based on BR’s growth potential.

Dividends

The following reflects BR’s dividend history for the past few years.

While the $1.32 annualized dividend works out to a sub 2% dividend yield based on the current price of $71.07, BR has the wherewithal to steadily and conservatively grow its dividend.

It is not for me to tell others how to manage their investments but I notice an increasingly greater number of investors who are chasing yield. One recent post I read provided a lengthy list of US listed companies with dividend yields in excess of 5%; several companies had dividend yields in the double digits.

I performed a quick review of the financial statements for at least a dozen of the companies on this list. In my opinion, investors in these companies are taking undue risk of dividend cuts or a permanent impairment to their capital.

Personally, I would much rather invest in a low dividend yield company like BR where I have some level of confidence that the dividend is sustainable and there is a strong possibility of future increases on at least an annual basis.

Before you completely rule out BR because of its low dividend yield you may want to read my Low or No Dividend Yield Companies Belong in Your Portfolio post.

Broadridge Financial Stock Analysis – Final Thoughts

While definitely not “on sale”, I continue to view BR as a “buy”. My reasons for this recommendation are that it:

- caters to companies continually seeking ways to cut costs through the use of technology;

- has competitive advantages which include a strong focus on customer service;

- has significant market share in the lines of business in which it operates;

- has adequate cash flow to service its debt obligations;

- has a track record of rewarding shareholders with stock buybacks and dividend increases.

In BR’s May 10, 2017 conference call, the President and CEO stated that while it is imperative the business be managed with short-term objectives in mind, the company is very clearly focused on the long-term. In this regard, I suggest investors conduct their own due diligence and decide whether this is a company worthy of being held in a portfolio for several years.

I have owned BR shares (not in the FFJ Portfolio) from the time BR was spun-off from ADP in 2007. I have no intention of parting ways with these shares and, at the moment, intend to acquire more shares within the next 30 days. I would also make a much larger purchase should we experience a market correction and BR gets caught in the downdraft.

Note: I appreciate the time you took to read this article and hope you got something out of it. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: At the time of writing this post I am long a few hundred shares of NYSE: BR. This holding represents ~0.4% of our overall holdings and not just the FFJ Portfolio.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.