Contents

Rollins, Inc. (ROL) might not be a recognizable name. Mention Orkin, however, and that is a different story. I think just about everyone in North America has at least seen the Orkin logo at some point.

ROL acquired Orkin for $62 million in 1964; the evolution of Rollins is found here.

Today, ROL is North America's largest pest-control business. It has operations spanning 47 US states, Canada, and other regions of the globe and in FY2021 it generated revenue of ~$2.424B.

While this review is based on Rollins (ROL) Q1 2022 results released on April 27, 2022, you may want to review my November 18, 2021 post beforehand.

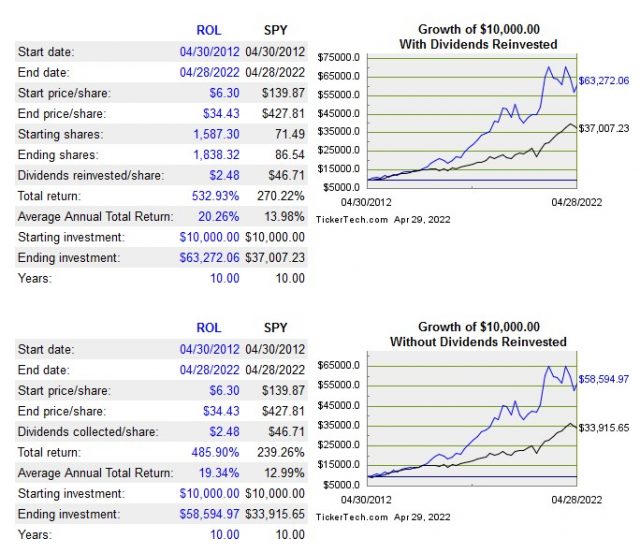

Historical investment performance does not dictate future performance. Past success, however, gives investors some comfort that management knows what it takes to generate attractive investment returns. The following shows the approximate current value of a $10,000 investment made on April 28, 2012 relative to the broad S&P500 index.

Source: www.tickertech.com

Industry Overview

The industry is highly fragmented with significant potential for consolidation. It is further characterized by a range of structural drivers, including increasing pest prevalence due to urbanization, globalization and climate change, decreasing societal tolerance of pests due to cultural change, increased purchasing power and increasing health and safety regulation.

ROL's major competitors consist of Ecolab, Rentokil, Terminix, and Anticimex.

- I wrote a guest post about Ecolab in early February 2022.

- In mid-December 2021, Rentokil-Initial announced its intent to acquire Terminix for ~$6.7B. An update about the proposed acquisition was provided in mid-March 2022.

- EQT bought Anticimex in 2012 and subsequently expanded it through 240 add-on acquisitions. In mid-2021, EQT extended its investment in Anticimex by selling the pest control company to a new fund focused on longer-term investments. The deal valued Anticimex at about 5.9 billion euros ($7.2B) including debt.

Business Overview

FY2021 marked ROL's 24th consecutive year of increased revenues.

A very high-level overview of ROL is accessible here. Section 1 of the FY2021 10-K is also worth reviewing.

US Securities and Exchange Commission (SEC) Investigation

In my November 18, 2021 post I share why I am not concerned about the SEC's investigation into how ROL established accruals and reserves at period-end and the impact of those accruals and reserves on reported earnings.

On the Q1 2022 earnings call, management discloses that ROL reached a settlement agreement with the SEC on April 18th. The settlement fully resolves the SEC's investigation into certain adjustments to accruals and reserves and their impact on reported EPS in Q1 2016 and Q2 2017.

ROL paid an $8 million civil penalty, which was fully accrued in Q3 and Q4 2021.

Under terms of the settlement, ROL neither admits nor denies the SEC's findings.

The settlement completes the SEC's investigation and there will be no restatement of ROL financials related to this matter.

ROL took this matter very seriously and hired outside consultants to evaluate and strengthen its financial reporting. This included improving processes, procedures, and supporting documentation, that impact financial results.

To strengthen its controls and procedures to prevent a recurrence of such an accounting issue, ROL hired a Chief Accounting Officer in October 2021 and added two retired E&Y partners to its audit committee.

It has also hired and added several experienced accounting personnel to further strengthen the accounting and finance teams. ROL is also actively searching for a CFO to further improve this area.

Acquisitions

As noted earlier, ROL generated revenue of ~$2.424B in FY2021. In comparison, ROL reported annual revenue of ~$0.533B in FY1996. This growth has been organic and via multiple acquisitions. Over the last three years, ROL has completed ~100 acquisitions, including 39 acquisitions in 2021. In the prior 3 years, ROL averaged 30 acquisitions per year.

ROL's acquisition strategy targets high-quality, profitable businesses with strong leadership that would benefit from incremental growth capital and have the potential to achieve margin expansion through cost and revenue synergies.

On April 14, 2022, ROL announced the acquisition of NBC Environment which is headquartered in the UK. This acquisition closed on April 1, 2022 and now gives ROL full coverage within the UK, including multiple locations within Scotland.

Financials

Q1 2022 Results

Please refer to ROL's Q1 2022 Form 10-Q, Form 8-K and Earnings Presentation.

ROL's residential, commercial and termite businesses all presented strong growth for the quarter. Residential grew 10.2% (5.8% organic), commercial grew 9.1% (7.9% organic), and termite grew 13.3% (8.5% organic). Total growth was 10.3% (7.0% organic).

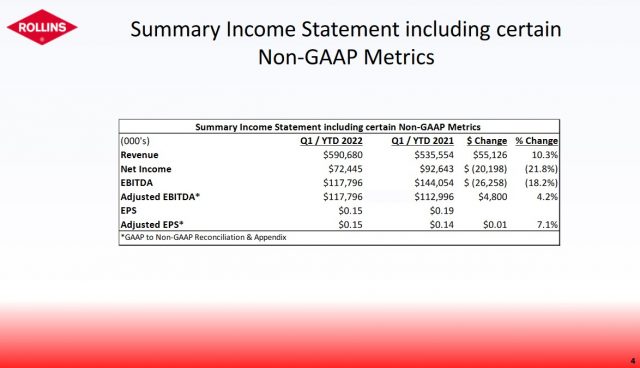

Management has provided adjusted EBITDA for comparison purposes due to the impact of the $31 million gain on the sale of several properties in Q1 2021. Q1 EBITDA 2022 was $117.8 million or 4.2% over Q1 2021 adjusted EBITDA of $113 million.

Q1 2022 adjusted diluted EPS was $0.15 versus $0.14 in Q1 2021.

In Q1 2022, ROL's gross margin fell ~1.2% to 50% from Q1 2021.

Fleet-related expenses were a strong headwind in Q1, 2022 with fuel and vehicle repairs being ~$4.6 million and ~$1.2 million higher than in Q1 2021. Combined, these fleet expense increases equated to seven-tenths of a point in additional cost.

Service salaries were up four-tenths of a point, while pest control materials and supplies were up $2.9 million or one-tenth of a point.

Fuel increases were driven by a 42% increase in the average price paid per gallon in Q1 2022 versus Q1 2021.

The increase in fuel prices along with customer growth resulted in a 55% increase in total fuel cost for the quarter.

The service wages increase was a combination of COVID sick time taken and overtime paid to cover work for employees off sick with COVID. In January, the reported number of employees testing positive for COVID-19 increased 154% over January 2021.

Additional overtime pay required to complete service calls and cover for COVID cases contributed to a 21% increase over Q1 2021.

On a positive note, sales, general and administrative (SG&A) expenses in Q1 2022 and Q1 2021 were flat at ~30.3%.

In Q1 2022, ROL increased its Term Loan. The purpose of this increase is to place ROL in a strong position to act quickly on either potential acquisitions or stock repurchases as opportunities may arise.

Unearned Revenue

At the end of Q1 2022, ROL has $156.5 million in unearned revenue versus $145.1 million at the end of Q1 2021. This represents customer funds ROL has received in advance of services being rendered. This is a current liability because ROL will provide services within the coming 12 months. Once the services are provided, the liability is reduced and ROL reports the appropriate revenue and related expenses on its Income Statement.

As noted in my previous post, investors need to account for this when looking at ROL's current ratio (current assets/current liabilities) and quick ratio (current assets minus materials and supplies/current liabilities).

Inclusion of Additional Metrics

In the Valuation section of my August 7th post I explain that due to the consistently high volume of acquisitions and hence high amortization expense related to these acquisitions, it is not practical to value ROL based on Earnings per Share (EPS). This is because Depreciation and Amortization are such a significant component of the 'Adjustments to reconcile net income to net cash provided by operating activities' in the Condensed Consolidated Statement of Cash Flows.

Management is clearly of the same opinion and in 2021 it started to present the following metrics:

- Earnings before interest, taxes, depreciation and amortization (EBITDA)

- Free Cash Flow

The rationale for presenting these additional metrics is to more properly illustrate ROL's strong ability to generate cash.

ROL uses the simple approach to define free cash flow, which is net cash provided by operating activities less the purchase of equipment and property.

Adjusted EBITDA

The Q1 2022 Form 8-K includes adjusted EBITDA on page 8 of 10.

Free Cash Flow (FCF)

In FY2011 - FY2021, ROL generated FCF of (in millions of $): 136, 123, 144, 165, 157, 193, 211, 272, 292, 413, and 375.

FY2022 Guidance

Guidance is difficult to obtain because management does not provide it. Furthermore, very few brokers cover ROL; only 5 brokers provide FY2022 and FY2023 estimates and only 2 provide FY2024 estimates.

Credit Ratings

ROL's debt is not rated by any rating agency.

Details of ROL's debt facilities are provided in Note 9 on pages 13 and 14 of 38 in the Q1 Form 10-Q.

To comply with applicable debt covenants, ROL must maintain at all times a leverage ratio of not greater than 3:1. The Leverage Ratio is calculated as of the last day of the most recent fiscal quarter-end. ROL complies with this covenant at the end of Q1 2022 and expects to maintain compliance throughout FY2022.

Dividend and Dividend Yield

We see from ROL's dividend history that its dividend policy is unique in that it includes the annual distribution of a 'special dividend' just before every December 31st fiscal year end; the dividend history uses different terminology (unspecified, annual, irregular) for these special dividends under the 'frequency' column.

On April 26, 2022, ROL's Board approved a regular cash dividend of $0.10/share. This represents a 25% increase over the dividends paid in June 2021.

The upcoming dividend is to be paid on June 10th, 2022 to shareholders of a record at the close of business on May 10th, 2022.

The current quarterly dividend is $0.10/share. If ROL were to distribute a $0.12/share 'special dividend' in December 2022, the total annual distribution would be ~$0.52/share. Based on the current ~$33.50 share price, the dividend yield would be ~1.55%.

I continue to expect the bulk of ROL's future total investment return will be predominantly in the form of capital appreciation.

ROL repurchased $10.7 million, $8.3 million, and $10.0 million of common stock for the years ended December 31, 2021, 2020 and 2019, respectively, from employees for the payment of taxes on vesting restricted shares.

The number of shares outstanding for the past ~8 years has been relatively stagnant at ~491 - ~492 million shares.

Stock Splits

ROL has had stock splits over the years with the most recent being a 3 for 2 stock split that was announced on October 27, 2020.

When a company initiates a stock split, the number of outstanding shares increases and the price per share decreases. However, the value of the company does not change. As a result, stock splits help make shares more affordable to smaller investors. It also provides greater marketability and liquidity in the market.

In 2012, ROL's Board authorized the purchase of up to 5 million shares of the Company’s common stock. After adjustments for stock splits, the total authorized shares under the share repurchase plan are 16.9 million shares. ROL did not purchase shares on the open market in FY2018 - FY2021. There remain 11.4 million shares authorized to be repurchased under prior Board approval.

Valuation

ROL has elected to provide EBITDA and FCF going forward. I, however, prefer to use Operating Cash Flow (OCF) and FCF to gauge its valuation.

- FY2018 - ROL generated ~$299 million and ~$272 million in OCF and FCF.

- FY2019 - ROL generated ~$320 million and ~$292 million in OCF and FCF.

- FY2020 - ROL generated ~$436 million and ~$413 million in OCF and FCF.

- FY2021 - ROL generated ~$402 million and ~$375 million in OCF and FCF.

At the end of Q1 2022, ROL generated ~$87.5 million and ~$79 million in OCF and FCF. ROL's business is somewhat stable but I expect FY2022 OCF and FCF to be marginally lower than in FY2021 if the Q1 headwinds persist.

I conservatively estimate ROL will generate ~$360 and ~$320 in OCF and FCF in FY2022. Using these projections, I get:

- OCF/share of ~$0.73 ($0.36B/492.3 million shares). Using the current ~$33.50 share price, the valuation based on OCF is ~46.

- FCF/share of ~$0.65 ($0.32B/492.3 million shares). Using the current ~$33.50 share price, the valuation based on FCF is ~52.

Even if I have slightly understated ROL's projected OCF and FCF, ROL looks to be somewhat expensive.

Final Thoughts

On June 10, 2021, I initiated a 500 share position at ~$33.14/share in one of the 'Core' accounts within the FFJ Portfolio. While it is not a top 30 holding nor has it increased in value over the timeframe in which I have been a shareholder, I still like the company; my final thoughts reflected in the November 18, 2021 post are unchanged.

This is a highly fragmented industry. Smaller industry participants might be struggling in this economic environment and many small and mid-sized independently owned operators may be looking for an exit strategy; ROL's financial strength makes it a potential acquisitor.

Some investors may have some reservations about investing in a company where ROL’s management has a substantial ownership interest (see Risks Related to our Capital and Ownership Structure on page 15 of 215 in the FY2021 Form 10-K). I, however, consider this a strength in that management is running the company with the long-term in mind and is not trying to appease the investment community.

Gary W. Rollins, Chairman and CEO, clearly knows how to run a successful business. Were this not the case, Forbes would not rank him as the 509th on its World's Wealthiest Billionaires with an estimated net worth of ~$5.5B as of April 29, 2022. By investing in ROL I hope to capitalize on Mr. Rollins proven ability to create wealth.

As mentioned in my recent Danaher post: FOLLOW THE MONEY!

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long ROL and ECL.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.