Contents

NKE was our 29th largest position when I analyzed our holdings in my FFJ Portfolio Holdings Review: April 2021 post. Shares are held in a 'Core' account within the FFJ Portfolio.

On May 27, 2021, I wrote 5 NKE out-of-the-money covered call options contracts and collected $1.29/share or $645 before fees; I disclosed this trade in my May 28, 2021 post. In this Nike stock analysis, I explain why I have closed these contracts at a loss.

Although I have incurred a loss, I expect this to be offset by the option premiums from my $250 Visa (V), $405 Mastercard (MA), and $230 CME Group (CME) out-of-the-money covered calls. These option contracts all expire July 16th and I am reasonably confident the share price of these 3 stocks will remain below their respective strike price. If this happens, I retain 100% of the option premium and the underlying shares.

Nike - Stock Analysis - Financials

Q4 and FY2021 Results

NKE's FY2021 10-K is not yet available as I write this post but the 8-K is accessible here.

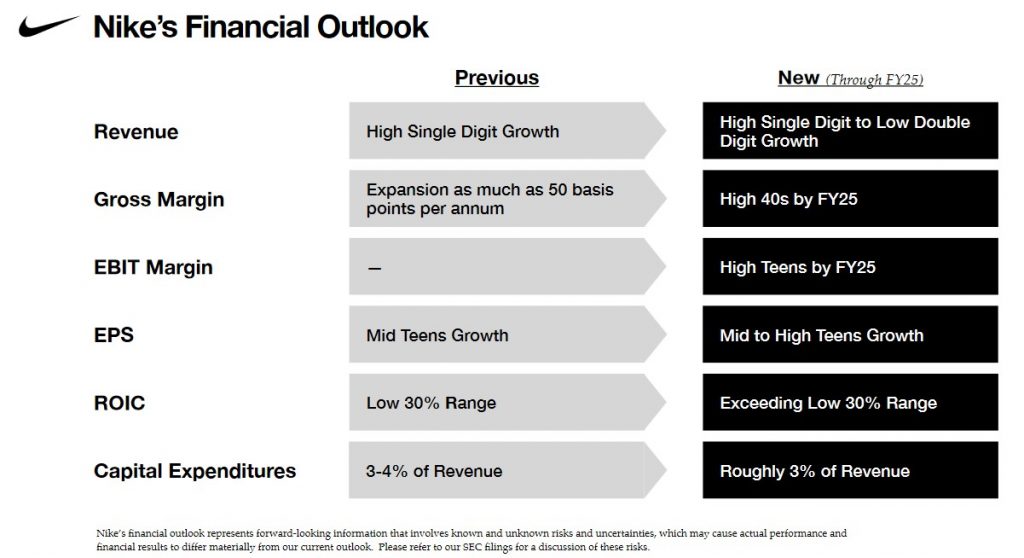

Financial Outlook Through FY2025

Looking at NKE's financial outlook for the next few years it is readily apparent NKE expects to continue to 'fire on all cylinders'.

Nike - Options - July 16, 2021 Expiry

When I wrote these contracts, NKE's share price was $137. I knew NKE would be releasing Q4 and FY2021 results on June 24th and expected the share price to 'pop'. My thought was that a $150 strike price would be sufficient that come July 16th, the options would expire.

This backfired!

The share price jumped above my $150 strike price following the release of NKE's Q4 and FY2021 results.

Following this surge, I was cautiously optimistic the share price would slowly retrace to below $150 before July 16th. Shares, however, are now trading at ~$162.

We hold NKE shares in a taxable account and will incur a taxable capital gain if the shares are called away. I do not wish to incur any taxable capital gains because this will negatively impact our Registered Retirement Savings Plan (RRSPs) withdrawals in 2021 as part of our RRSP 'meltdown' strategy.

I have, therefore, closed out my 5 contracts for $11.44/share or $5720 plus nominal commission versus the $645 received when I wrote the contracts. My loss is $5075 plus commission.

Offsetting this loss is the profit I expect to make if the V, MA, and CME out-of-the-money covered calls all expire worthless on July 16th. In addition, I benefit from the ~$25 share price appreciation (~$162 vs ~$137 when I wrote the options contracts) although I know NKE's share price can easily drop from its current level.

NOTE: The RRSP 'meltdown' strategy entails the withdrawal of funds on an annual basis over the next several years before we reach the age of 71; this is the mandatory age at which RRSPs must convert to a Registered Retirement Income Fund (RRIF). If we do not 'meltdown' our RRSPs, our minimum mandatory RRIF withdrawals will be at the highest marginal tax rate.

Nike - Stock Analysis - Credit Ratings

Many investors appear to give little consideration to risk. I often see investors in various Facebook groups or on YouTube, discussing investments where the company's domestic senior unsecured credit ratings are 'non-investment grade speculative' or 'highly speculative'. These are DEBT ratings. Holding common shares carries greater risk!

NKE is a company where I don't have to worry much about the risk of default.

Moody's currently rates NKE's domestic senior unsecured long-term debt A1 and S&P Global rates it AA-. Moody's rating is the top tier of the 'upper-medium grade' investment-grade category. S&P Global's rating is one notch higher at the bottom tier of the high-grade investment-grade category.

Moody's rating defines NKE as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

S&P's rating defines NKE as having a VERY STRONG capacity to meet its financial commitments with its rating differing from the highest-rated obligors only to a small degree.

Dividend and Dividend Yield

Investors do not invest in NKE primarily for dividend income; NKE's $1.10 annual dividend yields ~0.68% based on the current ~$162 share price.

It distributed its 3rd consecutive quarterly $0.275 quarterly dividend on July 1st and the next dividend at this level will be distributed at the beginning of October. I think we can expect a $0.02 - $0.025 increase in the dividend payable at the beginning of January 2022 if NKE's historical dividend increases are indicative of future dividend increases.

NKE should have no difficulty in servicing this higher dividend since it generates ample operating cash flow and free cash flow.

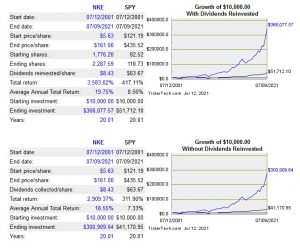

Despite NKE's razor-thin dividend yield, there is no denying dividends help grow an investor's wealth. In fact, investing prudently over a lifetime can generate enough wealth to invest in dividend growth stocks that provide the opportunity to maintain and/or improve your standard of living....even when you decide to take a 'well' day...as in 'well, I just don't want to work anymore'.

The problem, however, is that many investors fixate on a company's dividend track record and dividend yield and 'can't see the forest for the trees'.

In my opinion, it is far better to look at an investment's potential overall return. Hopefully, the glaring disparity between NKE's overall return and that of the S&P 500 over a 20-year timeframe demonstrates why it is better to look at the 'big picture'.

Naturally, when a stock like NKE has a sub 1% dividend yield, it becomes increasingly important not to overpay!

The weighted average number of outstanding shares in FY2011 - 2021 (in millions rounded) is: 1,943, 1,879, 1,833, 1,812, 1,769, 1,743, 1,692, 1,659, 1,618, 1,592, and 1,609.

Nike - Stock Analysis - Valuation

When I wrote the $150 July 16th out-of-the-money covered calls

- NKE was trading at ~$137;

- the FY2021 adjusted diluted EPS projections from 34 brokers were a mean and low/high range of $3.14 and $3.00 - $3.37; and

- the forward adjusted diluted PE was ~40.65 if NKE's share price reached $150 and it achieved earnings at the top end of this range.

In addition, the FY2022 adjusted diluted EPS projections from 34 brokers were a mean and low/high range of $3.96 and $3.42 - $4.99. This is a very wide range so if NKE's share price reached $150 and we used the $3.96 mean estimate as opposed to the high estimate, the forward adjusted diluted PE was ~37.88. While this valuation is lower than the valuation using FY2021 estimates, I still thought NKE was richly valued.

Now, the current FY2022 mean adjusted diluted EPS and low/high range from 29 brokers are $4.36 and $4.12 - $4.80. With shares trading at ~$162, the forward adjusted diluted PE is ~37.2 using the mean estimate and ~33.75 using $4.80.

The current FY2023 mean adjusted diluted EPS and low/high range from 26 brokers are $5.10 and $4.83 - $5.59. With shares trading at ~$162, the forward adjusted diluted PE is ~31.76 using the mean estimate and ~29 using $5.59.

NKE is a great company and its financial outlook over the next few years is wonderful. Nevertheless, I still think shares are richly valued.

Nike - Stock Analysis - Final Thoughts

When I wrote my FFJ Portfolio – June 2021 Report I thought I would let my NKE shares get called away thus resulting in an influx of $75,000. Upon further reflection, the retention of my NKE shares is preferable. I have, therefore, closed my NKE options at a loss; the loss will likely be offset by the gains from the other covered call contracts set to expire on July 16th.

As noted earlier, I do not want to generate taxable capital gains because this will negatively impact my RRSP 'meltdown' strategy. The plan is to just hold shares held in taxable accounts and to delay any tax liability related to capital gains as long as possible.

I think NKE is currently overvalued and do not intend to immediately add to my position. If we get a broad market correction and NKE is caught in the downdraft, however, I intend to acquire additional shares.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long NKE.

Disclaimer: I do not know your individual circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.