Summary

Summary

- This high quality Canadian insurance company has grown successfully through multiple acquisitions and is now one of Canada’s largest P&C insurance companies (~17% market share).

- Growth opportunities in Canada are limited in that the top 5 P&C insurers in Canada have a 48% market share.

- In 2017, it expanded into the US market but strategically decided to enter the US specialty insurance market thus avoiding direct competition with much larger and well entrenched P&C companies.

- At the time of the US acquisition management indicated that it expected to restore its capital structure to a 20% the debt-to-total capital ratio within 2 years. Once achieved I fully expect this company to make further acquisitions in the US specialty insurance market.

- While definitely a wonderful company, I am of the opinion that this company’s stock is now priced to perfection.

All figures are expressed in CDN dollars unless otherwise noted.

Introduction

The subject company is Canada’s largest provider of property and casualty (P&C) insurance and it is also a provider of specialty insurance in North America. It serves more than five million personal, business, public sector and institutional clients through its Canadian and US Offices.

This company traces its roots to 1809. In the late 1950s, however, it was acquired by one of the largest insurance companies in the Netherlands.

In 2004, the company went public with a listing on the TSX; the Dutch parent retained 70% ownership.

In 2009, the Dutch parent needed to raise equity to shore up its financial position as a result of some challenges it encountered at the height of the Financial Crisis. The Dutch parent divested itself of its 70% interest and the Canadian entity amended its name.

This company is a proven industry consolidator having made 16 successful P&C acquisitions since 1988; 8 have been made after 2000.

In fiscal 2017 it generated ~$10B in total annual premiums and reported having a ~17% share of Canada’s P&C market.

In 2017, it acquired a pure-play specialty lines insurer in the US. This specialty insurance company focuses on small to midsized businesses and sells specialty products that solve the unique needs of particular customers or industry groups including accident and health, technology, ocean and inland marine, public entities, and entertainment. The distinct products and tailored coverages are provided to a broad customer base across the U.S. (ie. healthcare, tuition reimbursement, surety, management liability, financial services, specialty property, environmental and financial institutions). This acquired company is relatively small; it reported ~$1.1B in Direct Premiums Written in 2017.

A key reason for this company’s expansion into the US specialty insurance market is that the Canadian Property and Casualty (P&C) insurance industry has been undergoing consolidation and there is little room for further expansion. The top 20 P&C insurers in Canada have an 84% market share. In 2009, the top 5 had a 36% market share. In 2017, the top 5 had a 48% market share.

Given this company’s acquisition track record, it would be fair to presume that further acquisitions in the U.S. specialty insurance market is highly probable. This, however, is unlikely to transpire for at least another 2 years as the focus is on fully integrating the recently acquired specialty insurer and in restoring the capital ratios to target levels; at the time of the 2017 acquisition, management specifically stated the plan was to reduce the debt-to-total capital ratio below the 20% target level within 24 months.

In addition, management specifically stated at the time of the 2017 US acquisition that the plan is to:

- expand the company’s future potential by combining the acquired company’s strengths with the acquirer’s data, claims and digital expertise;

- diversify the business and geographic mix.

I have not analyzed this company since May 2017 and given that its stock price has risen roughly 16% within the past month I thought it would be an opportune time to revisit this company.

Full disclosure: In January 2007 I initiated a position in this company and have periodically added to my position; all shares are held in undisclosed accounts. I do, however, hold shares in this company in the Financial Freedom is a Journey portfolio.

Business Overview

My May 7, 2017 Intact Financial Corporation (TSX: IFC) article in which I review the OneBeacon acquisition can be found here.

I will dispense with a Business Overview but strongly recommend you review a highly informative Investor Presentation which was updated August 7, 2018. This presentation provides a very good high level overview.

NOTE: Within this presentation the acronym DPW is used. DPW is Direct Premiums Written.

Q2 2018 Financial Results

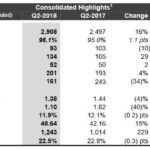

IFC released is Q2 results on July 31st.

Source: IFC – Q2 Review of Peformance Presentation – August 1 2018

A high level recap of the results for each Line of Business can be found in the Press Release.

Credit Ratings

IFC’s current credit ratings can be found here. Moody’s rates IFC A1 which is the top tier of the upper medium grade within the investment grade category. Fitch rates IFC AA- which is one notch higher than the Moody’s rating; it is the lowest tier within the high-grade category.

These ratings certainly appeal to a conservative investor such as me.

Dividend and Dividend Yield

IFC’s dividend history can be found here.

As recently as July 6th, IFC was trading at $92.64. The $0.70 quarterly dividend ($2.80/year) yielded ~3% on the basis of that day’s closing stock price. IFC, however, has surged to close at ~$107 on August 17th thus reducing the dividend yield to ~2.6%. I am not a yield chaser and am quite comfortable with the reduced dividend yield.

I fully expect IFC will distribute its 4th consecutive $0.70 quarterly dividend at the end of December 2018. In keeping with the dividend increases of recent years, I envision IFC’s quarterly dividend being increased to ~$0.74/~$0.75.

Valuation

The consensus adjusted EPS forecast for FY2018 from 15 analysts is $5.72 (FY2017 was $5.82). For the first 6 months of the year, IFC has generated $2.23 of adjusted EPS versus $2.86 for the first 6 months in FY2017. I recognize FY2017 results did not include a full year of OneBeacon within the IFC group of companies but I question how IFC is going to be able to achieve $3.49 in adjusted EPS in the second half of FY2018 so as to reach the $5.72 full year consensus estimate.

If we do go on the assumption that IFC will achieve $5.72 that means it is currently trading at a forward PE of ~18.70. This level is consistent with historical levels.

If IFC were to only achieve adjusted earnings of ~$5 (I am giving IFC the benefit of the doubt that the last 6 months of the current fiscal year will generate results that are superior to the first half of the current fiscal year) then I get a forward adjusted PE of ~21.4 on the basis of the current ~$107 stock price. This level is slightly elevated relative to historical results.

In my opinion, investors are pricing this great insurance company to perfection. The ~$14.40 surge in IFC’s stock price in just a little over 1 month has made IFC somewhat rich. I have no intention of acquiring additional shares at this juncture and will patiently wait for IFC to give back some of its recent gains.

Final Thoughts

I view IFC as a very well managed insurance company.

In my opinion, the strategic acquisition of US specialty insurer OneBeacon was an excellent move. The opportunities for growth in Canada are somewhat limited and to try and enter the conventional P&C business in the US would be much too difficult.

I fully expect IFC will expand its US specialty insurance business within the next 2 years by which time IFC’s capital structure should have been restored to the target level (70% equity to total capital and 20% debt to total capital).

While I am of the opinion IFC is a very well managed company, the recent ~$14.40 surge in stock price has now resulted in the stock being priced to perfection.

I am being extremely cautious as I perceive the North American equity market as ripe for some form of pullback. I have absolutely no idea when this will occur but am of the opinion something will happen within a year at which time I would revisit IFC with the view of potentially adding to my existing position.

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long IFC.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.