Summary

Summary

- Hormel held its Investor Day June 15, 2017 wherein it provided a great overview of the company`s growth opportunities.

- HRL`s long-term targets are 5% top-line growth, 10% bottom-line growth, and margins in the top quartile of its peers by 2020.

- It is one of a few companies which have increased the annual dividend for 50+ consecutive years thus placing it in the exclusive Dividend King group of companies.

- HRL`s stock price has retraced from a high set in August 2016. Current valuation levels are now reasonable.

Introduction

I distinctly remember being at a friend’s house when I was about 6 years old and his mother serving us lunch. Having never seen or eaten SPAM and, being young with not much of a filter between my brain and mouth, asking my friend’s mother whether the plate set in front of me was meant for the family dog. To this day, I have never eaten SPAM!

The subject of today`s post is Hormel Foods Corporation (NYSE: HRL). My knowledge about HRL was limited to SPAM. It was not until recently when a fellow blogger suggested I might be interested in looking into HRL. I did and on June 16, 2017, I pulled the trigger and acquired HRL shares for the FFJ Portfolio.

This post addresses what appeals to me about this company.

Hormel Investors’ Day

If you are a current investor, or are remotely interested in learning more about HRL after reading this post, I strongly suggest you watch segments (or all) of the Investor Day Presentation. There is just no possible way this post can provide the same level of detail as what is provided during the various segments of Investor Day.

Fast forward to the 25:30 mark for a brief introduction before HRL’s President and CEO begins his segment of the presentation at the 26:30 mark. The Investor Day is broken up into various 20 – 25 minute blocks wherein the Head of each business segment presents. Their presentations are followed by presentations by the Group VP of Corporate Strategy, the SVP/CFO, and the President and CEO.

I recognize your time is valuable so it is highly unlikely you are going to watch the entire 6 hour 11 minute 8 second presentation. If time does not permit, you may want to fast forward to the 5 hour, 48 minute and 45 second mark for the President and CEO’s wrap-up; that portion of the presentation is only 9 minutes long but is well worth watching.

Hormel’s Evolution

If you are unfamiliar with HRL and its progress since its humble beginnings in 1891, see here.

It operates under the following 5 business segments.

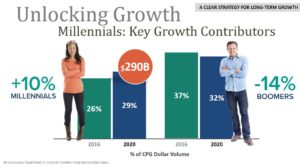

You may associate HRL with its meat protein related products. HRL, however, recognizes that consumer tastes are changing and new markets present opportunities which necessitate the need for it to adapt. As a result, HRL is expanding its product line to include non-meat protein products and flavor enhancers.

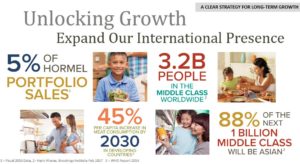

HRL also recognizes that it needs to become a more global food company. There are countries outside North America where the demographics are far more favorable to HRL (younger population, larger population, higher level of population growth, growing middle-class).

Today, HRL has grown into a global company with products marketed in more than 75 countries such as China, Japan, Australia, South Korea, and the Philippines.

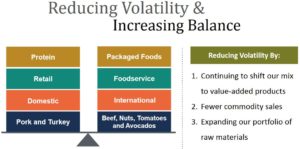

HRL has also recognized that it needs to reduce the volatility in its business.

It has taken appropriate steps in this regard by building a moat in a highly fragmented industry. HRL has focused heavily on adding only top name brands to its portfolio and investing heavily in advertising. Various strategic acquisitions, including the purchase price, in recent years consist of:

- Wholly Guacamole in 2012 – $0.22B

- Skippy Peanut Butter in 2013 – $0.7B

- Muscle Milk in 2014 – $0.45B

- Applegate organic deli meats in 2015 – $0.775B

- Justin’s organic peanut butter in 2016 – $0.286B

Not only has it made strategic acquisitions, it has also divested itself of non-strategic assets.

HRL has also invested heavily in modernizing its supply chain.

HRL`s evolution which is currently underway has the following goals being front and centre.

Dividends and Stock Splits

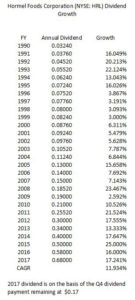

Given HRL`s status as a Dividend King, I would be remiss in not addressing HRL`s dividend and stock split track record.

In January 2016, HRL joined a handful of companies which has consistently increased its annual dividend for over 50 years. The company’s website has readily accessible dividend and stock split data dating back to 1990.

If you wish to use HRL’s calculator to determine price appreciation/depreciation over a specific period of time, go here.

Valuation

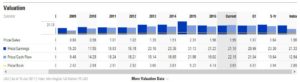

The current mean FY2017 adjusted EPS estimates from various brokers is $1.65 and the consensus is for $1.71 in 2018.

HRL is currently trading at $33.95. Using the adjusted EPS estimates reflected above, I get forward PE ratios of 20.58 and 19.85 for 2017 and 2018, respectively. While these valuation levels are superior to those in 2013 – 2016, they are several basis points higher than those evidenced in 2009 – 2012.

In my opinion, it is entirely possible we may encounter a market correction within the year. I cannot, however, be entirely certain about this. All I can do is analyze a company and decide whether I think it is reasonably valued or not. Based on my analysis, I view HRL as fairly valued.

Hormel Foods Corporation Stock Analysis – Final Thoughts

I like the transformation HRL has been undertaking over the past few years and am optimistic about its growth potential.

HRL has retraced from highs set in March 2016 and given my optimism about the company, I decided to initiate a position in HRL by acquiring 400 shares on June 16, 2017. These shares are held in the FFJ Portfolio and since I foresee no need for these funds at any stage in the future, all dividends will be automatically reinvested.

I am not concerned about daily price fluctuations so if a market correction does happen, I won`t lose sleep about today`s purchase. In fact, I may add to my position if HRL`s stock price drops for reasons other than a permanent deterioration in the business.

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: At the time of writing this post I am long HRL.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.

I bought J M Smuckers (thank for your article on SJM) it is down to $115. Would you keep dollar cost averaging? It has been on my watch list for ever. But was never sure when to pull the trigger. Don’t have more $$$ to plough into Hormel, plus SJM looks like a better value. Your thoughts

I didn’t even know hormel had dividends.

This is some great info.

Devaughn,

Glad you found this post helpful. Keep coming back. You may find some of the other companies I analyze to also be of interest to you. Cheers.