Contents

Summary

- FDX reported strong Q3 results on March 20th but the March 22nd announcement by the US government of ~$60B of tariffs on Chinese products hit the US equities hard and FDX’s stock price dropped ~5%.

- Amazon will be competing head on with FDX. While this can be perceived as a significant risk to FDX, it can also be viewed from a positive perspective.

- FDX is clearly concerned about the protectionist stance adopted by Trump. The extent to which tariffs imposed on China will negatively impact FDX remains to be seen.

- The uncertainty as to the outcome of the decisions coming out of the White House has recently heightened volatility in the North American markets. This will likely have continued negative impact on stock prices (including FDX).

- I expect further pullback in FDX’s stock price and am prepared to acquire more shares given my favorable long-term outlook on the company.

Introduction

On March 23, 2017 I published my first FedEx (NYSE: FDX) stock analysis entitled A Lesson in Long-Term versus Short-Term Thinking; at the close of business on March 22nd FDX was trading at ~$195.53.

My thought was that FDX would likely rise to the $220 level at some stage in FY2018; never did I imagine the stock price would rise to just above $274! Based on my analysis, I initiated a position. The acquired shares, however, are not held in the FFJ Portfolio but rather in accounts for which I restrict the amount of information I disclose.

Here we are, a year later and:

- FDX released its Q3 2018 results on March 20, 2018;

- FDX’s stock price plunged ~$12.8 or 5.15% on March 22nd after Trump announced that tariffs would be imposed on Chinese products;

Given the above, I thought it would be a good time to revisit FDX.

Amazon as a Competitor

Concern has certainly been raised as to the extent Amazon’s (NASDAQ: AMZN) expansion into the courier industry will impact FDX and United Parcel Service (NYSE: UPS). I agree Amazon will certainly capture business from FDX and UPS but I view Amazon’s entry into this space as a positive sign.

Firstly, if Amazon is prepared to enter this industry it means there is money to be made. Secondly, the world is becoming increasing global meaning there will be an increased need to ship products. Thirdly, online shopping will continue to grow which will require the need for more package deliveries.

FDX is well aware of the threat from Amazon and is investing heavily in modernizing its fleet of aircrafts. In addition, FDX announced the official opening of its new FedEx Shanghai International Express and Cargo Hub located at Shanghai Pudong International Airport in January 2018. This facility will provide greater connectivity and convenience to the FedEx global network and overseas markets for customers in eastern China, particularly those shipping to the US and Europe.

So while Amazon’s entry into the courier industry will impact FDX, you must remember that FDX has a ~47 year head start. FDX understands the business and it is well aware of the risks it faces. This is why it is continually investing in the business to make it more efficient and to provide a better customer experience; this includes the future use of drones for delivery purposes.

Business Overview

I highly recommend you watch a couple of videos which explains the magnitude of FDX’s operations and growth expectations.

Source: FedEx Corporation – Investor Relations Roadshow Presentation March 21, 2018

E-commerce, including B2B e-commerce, and global trade growth are increasing the demand for FDX’s services. It is, therefore making continuous significant enhancements to its global operations. This includes the integration of TNT into FedEx Express which is expected to be substantially complete by the end of May 2020.

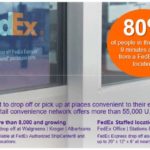

In addition, FDX has entered into a long-term alliance agreement with Walgreens (NASDAQ: WBA) for FedEx OnSite. It has also recently executed a new agreement with Walmart (NYSE: WMT) in which FedEx Office locations are expected to be installed in 500 Walmart stores within two years.

Source: FedEx Corporation – Investor Relations Roadshow Presentation March 21, 2018

Source: FedEx Corporation – Investor Relations Roadshow Presentation March 21, 2018

Impact of the Tax Cuts and Jobs Act (TCJ) on FDX

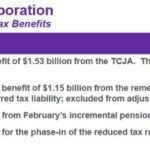

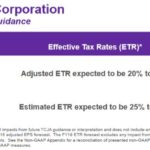

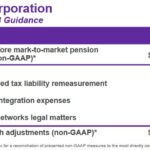

The following images highlight the impact of the TCJ on FDX. While FDX acknowledges the benefits from the implementation of the TCJ, there is concern some of these benefits will be offset by increased taxes due to tariffs.

Source: FDX Q3 2018 Earnings Review - March 20, 2018

Q3 2018 Results and Guidance for Q4 2018

On March 20, 2018, FDX released its Q3 2018 results. GAAP and adjusted earnings per share (EPS) were strong relative to the same period in FY2017 and the market responded positively.

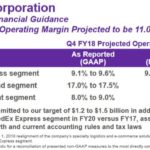

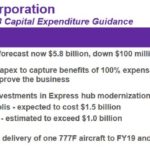

FDX has increased its FY2018 earnings outlook due to foreign tax benefits from its international corporate structure, the benefits from U.S. tax reform and improved operating performance. In addition it has amended its capital spending forecast for FY2018 to $5.8B, a $0.1B reduction from the prior forecast.

Source: FDX Q3 2018 Earnings Review - March 20, 2018

On March 20th, FDX provided the following projections regarding the remainder of FY2018.

Source: FDX Q3 2018 Earnings Review - March 20, 2018

The threat of Trump instructing the Office of the U.S. Trade Representative to impose tariffs has been in the news for quite some time. This topic was addressed on FDX’s March 20th Q3 conference call with analysts. FDX’s Chairman and CEO commented that history has repeatedly demonstrated that protectionism is counterproductive to economic growth. The better approach is to encourage open markets and free exchange of products and services and to reduce barriers to trade.

On March 21st, FDX presented its Macroeconomic Trends. This presentation, however, was based on an analysis conducted as at March 1st which was before Trump’s instruction to the Office of the U.S. Trade Representative.

Source: FedEx Corporation – Investor Relations Roadshow Presentation March 21, 2018

On March 22nd, Trump announced that he had instructed the Office of the U.S. Trade Representative to draw up a list of tariffs on ~$60B of Chinese products with an emphasis on sensitive technologies. It, therefore, remains to be seen just to what extent FDX’s macroeconomic trends forecast is impacted if foreign countries retaliate.

Depending on the magnitude of the tariffs and when they are imposed, I think FDX could be challenged to achieve its projections. In all likelihood, the introduction of tariffs will likely have a greater negative impact on FDX’s FY2019 results versus those for FY2018 since FDX’s fiscal year end is May 31st.

Credit Ratings

Moody’s rates FDX Baa2 and S&P Global rates it BBB. Both ratings are at the mid-point of the lower medium grade category. These ratings are acceptable from my perspective.

Valuation

When I wrote my previous FDX article in March 2017, the projected adjusted diluted EPS range for FY2017 was $11.85 - $12.35. With the stock trading at $195.53 at the time, I arrived at a forward adjusted diluted PE range of ~15.83 - ~16.5.

On June 20, 2017, FDX released its FY2017 results and provided FY2018 earnings guidance. At the time it projected adjusted diluted EPS in the range of $13.20 - $14 and the stock was trading at ~$209. This gave us a forward adjusted diluted PE range of ~14.93 - ~15.83.

On the basis of Diluted EPS before mark-to-market pension adjustments (non-GAAP), FDX had projected $12.45 - $13.25 thus giving us a forward adjusted diluted PE range of ~15.77 - ~16.79.

Subsequently, the TCJ was enacted and changes were made to the TNT integration expenses (see revisions reflected in the Q3 2018 Results and Guidance for Q4 2018 section of this article). FDX has indicated we can now expect FY2018 adjusted diluted EPS in the range of $15 - $15.40. With the stock currently trading at $236.27 we get a forward adjusted PE range of ~15.34 - 15.75.

Based on guidance for Q4 2018, FDX expects diluted EPS before mark-to-market pension adjustments (non-GAAP) of $17.90 - $18.30. This gives us a forward adjusted diluted PE range of ~12.9 - ~13.2.

Regardless of the figures used, I am satisfied that FDX is currently fairly valued at $236.27.

Dividend, Dividend Yield, Stock Splits, and Dividend Payout Ratio

Details on FDX’s historical stock splits, stock dividends, and recent stock repurchase programs can be found here and its dividend history can be found here.

Following the April 4th dividend payment, the next dividend will be declared in June and will be payable in July. Due to the recently announced tariffs which will likely negatively impact FDX, I suspect FDX’s Board of Directors will be far more conservative with any 2018 dividend increase; in 2016 ($0.25/quarter to $0.40/quarter) and 2017 ($0.40/quarter to $0.50/quarter) FDX increased its dividend 60% and 25% respectively.

With the stock trading at $236.27 as at the close of business on March 22nd, the current $2/year dividend yields ~0.85%.

Final Thoughts

Trump’s March 22nd announcement clearly rattled markets and FDX’s stock price dropped ~$12.75 or ~5% from the previous day’s close.

There now is a profound fear that the introduction of tariff will trigger a trade war with China, the world’s second largest economy; U.S. trade groups have been urging Trump to halt the tariff plan, warning that it would trigger a chain reaction of negative consequences for the U.S. economy.

In my opinion, investors should view the pullback in FDX’s stock price as a positive. FDX is a great long-term investment and acquiring additional shares on weakness, on the condition the investment is being made for the long-term, is recommended.

In my opinion, FDX will adapt and thrive even once Amazon enters its space. Secondly, Trump will not be in the Oval Office forever and hopefully the next President of the United States will be somewhat more rational and will realize that imposing tariffs will only elicit retaliatory action.

Until such time as Trump is replaced, FDX will need to adapt and to operate in the ‘new environment’. I am confident FDX will be able to weather the storm. It has been in business for nearly 5 decades and it has gone through multiple economic cycles. Short-term results may suffer but FDX’s powerful network is here to stay.

I anticipate further pullback in FDX’s stock price over the short-term and will periodically add to my position on further weakness.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected]

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: Long FDX, WMT, UPS.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.