I last reviewed West Pharmaceutical (WST) in this April 11, 2018 post. It is perpetually overvalued but within the last couple of months, it has fallen out of favour with investors. I now consider out of favour West Pharmaceutical to be a buy.

In recent posts, I mention the purchase of a second home and my liquidity, therefore, being much lower than I anticipated. I am not, therefore, looking to make any significant equity investments. I am, however, open to initiating a new position and/or adding to existing positions in profitable companies that have temporarily fallen out of favour with the broad investment community if they:

- are growing;

- generate strong free cash flow (FCF);

- have a strong competitive position; and

- have no/minimal debt

Business Overview

WST, founded in 1923, is a leading global manufacturer in the design and production of technologically advanced, high-quality, integrated containment and delivery systems for injectable drugs and healthcare products. Products include a variety of primary packaging, containment solutions, reconstitution and transfer systems, and drug delivery systems, as well as contract manufacturing and analytical lab services. Customers include the leading biologic, generic, pharmaceutical, diagnostic, and medical device companies in the world.

It has 2 Operating segments.

- Proprietary Products

- Contract-Manufactured Products

It manufactures over 45 billion components annually from 28 manufacturing facilities around the world; WST’s property locations are reflected on pages 23 and 24 of 100 in the FY2021 Form 10-K.

A good overview of each segment is found in the Products and Services sections of the company’s website.

Intellectual property, including patents, trademarks, copyrights, and trade secrets, is important to WST. It owns or licenses intellectual property rights, including know-how and issued patents and pending patent applications in the US and other countries, that relate to various aspects of WST’s products. In 2021, more than 200 patents were issued to WST across the globe. Some key value-added and proprietary products and processes are exclusively licensed from Daikyo. Some of these products and processes include but are not limited to, Crystal Zenith, FluroTec and B2-coating technologies.

These intellectual property rights help protect WST’s products and are critical to the company’s growth.

WST’s rights to these products and processes are licensed under agreements that expire in 2027. If the agreements are terminated early or not renewed, WST’s business could be adversely impacted. However, in Q4 2019, WST increased its ownership interest in Daikyo from 25% to 49%. This sizable stake in Daikyo somewhat reduces the risk of early termination or non-renewal of WST’s agreement with Daikyo.

When I last reviewed WST in April 2018, its 10 largest customers accounted for 37.5% of FY2017 consolidated net sales. No single customer accounted for greater than 10% of consolidated net sales. In FY2021, the 10 ten largest customers accounted for 41.4% of consolidated net sales. Once again, no single customer accounted for more than 10% of consolidated net sales.

Minority Investment in Dublin-Based Latch Medical

On August 11, 2022, WST announced that has taken a strategic minority stake in Latch Medical. Latch is a Dublin-based leader in next-generation vaccine and biologics delivery technology that is pioneering a new approach to intradermal delivery. Latch Medical is a developer of a two drug delivery device platforms based on technology designed to securely anchor microneedle patches to the skin.

One platform, Pharma Latch Hollow, features hollow microneedles that allow liquid formulations to pass through them for direct intradermal administration. Latch claims the device offers a more consistent dosing and higher payload capacity than rival technologies.

The second delivery platform, Pharma Latch Coated, features solid microneedle arrays with dry-form compound coatings on them. Once exposed to the moisture of the skin, the arrays dissolve and release their payloads. While other companies have developed similar technologies, Latch claims its platform overcomes problems such as poor needle penetration, which makes dosing inconsistent, and costly.

Plant Expansion in Jersey Shore, Pennsylvania

In late August 2022, WST announced that it will spend $65 million to expand its Jersey Shore, Pennsylvania, manufacturing facility in a project that will create 225 new jobs across the state.

It has earmarked $60 million of its own money toward the expansion of the site that produces components and delivery systems for injectable drugs. The state of Pennsylvania will contribute $5 million.

Financials

Q3 and YTD2022 Results

Please refer to WST’s Q3 Earnings Release, Form 10-Q, and Earnings Presentation.

FY2022 and Preliminary FY2023 Guidance

On February 17, 2022, WST released its Q4 and FY2021 results. FY2022 guidance was for:

- net sales of $3.05B – $3.07B;

- adjusted diluted EPS of $9.20 – $9.35; and

- CAPEX of $0.380B.

Expectations were for ~10% organic sales growth comprised of a mid-teen growth in WST’s proprietary business with mid-teen growth in the base business and mid-teen growth in net COVID-related revenues.

For contract manufacturing, the forecast was for low-to-mid single-digit negative growth in FY2022 with a return to growth forecast in 2023.

With the release of Q1 2022 results, guidance was for FY2022 net sales and adjusted diluted EPS in the ranges of $3.05B – $3.075B and $9.30 – $9.45.

With the release of Q2 2022 results, guidance was for FY2022 net sales and adjusted diluted EPS in the ranges of $2.95B – $2.975B and $9.00 – $9.15.

Now, FY2022 net sales and adjusted diluted EPS guidance are $2.83B – $2.84B and $8.15 – $8.20; the lowered net sales projections include a ~$60 million Q4 headwind based on current foreign exchange rates.

FY2022 CAPEX guidance is now $0.3B – $0.32B versus the prior $0.38B.

On the Q3 earnings call, management explained that it is encountering FX headwinds. It also had declining sales in contract manufacturing and a decline in COVID-19-related sales of about $20 million relative to 2021. Excluding the COVID headwinds, proprietary organic sales grew over 11%.

While management has had to once again lower FY2022 guidance, they stressed on the earnings call that all the issues are supply-related and not demand-related.

Its customers have reiterated that they are looking to WST to deliver the critical components and devices to address the growing injectable drug demand. Several customers, for example, have notified WST of potential upside demand, especially for NovaPure plungers beyond WST’s current order book.

Management is confident the resolution of its capacity issues will occur in early 2023. Preliminary FY2023 projections, therefore, assume that COVID-19 sales will decline to full-year sales of ~$90 million or a 75% decline from FY2022. This is based on current customer forecasts.

The non-COVID-19 overall base business, however, is expected to grow in the double digits. Base proprietary products are expected to grow in the low teens led by biologics, and Contract-Manufactured Products sales are forecast to grow in FY2023.

More detailed guidance is to be provided on the Q4 2022 call in February 2023.

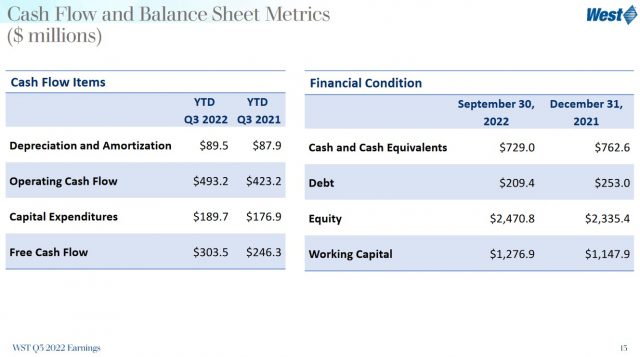

Free Cash Flow (FCF)

In FY2011 – FY2021, WST generated FCF of (in millions of $): 55, 65, 71, 81, 49, 133, 184, 241, 298, and 331. In the first 3 quarters of FY2022, it has generated ~$303.5.

Credit Ratings

While no rating agency rates WST’s debt, we see from the following cash flow and Balance Sheet metrics that WST’s credit risk is very low.

Note 8 – Debt in WST’s Q3 2022 Form 10-Q (page 12 of 46) provides details of the company’s various credit facilities.

Looking at page 5 of 46 in the Q3 2022 Form 10-Q, we see that WST has $0.846B of TOTAL debt. This includes ~$0.207B in long-term debt of which ~$0.137B matures in 2024 and ~$0.073B matures in 2027. WST, however, had ~$0.729B in cash and cash equivalents at the end of Q3. If WST were to use all its cash and cash equivalents to eliminate its debt, it would have ~$0.117B in debt remaining against just under $0.9B in accounts receivable and inventories. In addition, WST has ~$1B in the net value of property, plant and equipment.

Although no rating agency rates WST, it is readily apparent the company’s credit risk is very low.

Dividends, Share Repurchases, and Stock Splits

Dividend and Dividend Yield

WST’s dividend history reflects $0.01/share dividend increases over the past several years. WST’s dividend history on its website is currently outdated with the last dividend reflected being a $0.17 dividend payable August 4, 2021.

Distribution of the next $0.19/share quarterly dividend is to occur in early February. With shares currently trading at ~$225, the dividend yield is ~0.34%.

This low dividend yield is likely to dissuade some investors from investing in the company. Investors, however, should focus on an investment’s total potential long-term investment return. The bulk of WST’s future total investment return is likely to continue to be predominantly in the form of capital appreciation.

In the first 9 months of FY2022, WST distributed ~$40 million in dividends. WST generates ample OCF and FCF to service its dividend.

Share Repurchases

WST’s weighted average shares outstanding in FY2012 -FY2021 and the first 9 months of FY2022 are (in millions of shares) 71.8, 71.4, 72.8, 73.8, 75, 75.8, 75.4, 75.4, 75.8, 76.3, and 75.7.

In December 2021, WST announced a share repurchase program for 2022 authorizing the repurchase of up to 650,000 shares of common stock from time to time on the open market or in privately-negotiated transactions as permitted under Exchange Act Rule 10b-18. The number of shares to be repurchased and the timing of such transactions depend on a variety of factors, including market conditions. This share repurchase program is expected to be completed by December 31, 2022.

In Q3, WST purchased 86,667 shares of common stock under the program afor$27.2 million, or an average price of $313.22/share. During the 9 months that ended September 30, 2022, WST purchased 563,334 shares of common stock under the program afor$202.9 million, or an average price of $360.03/share.

Stock Splits

WST initiated a 2-for-1 stock split in September 2013. This explains why it appears the company cut its dividend in half in 2013.

Valuation

WST’s FY2012 – FY2021 diluted PE levels are 23.80, 31.65, 32.46, 47.05, 45.85, 39.47, 47.82, 49.29, 68.60, and 58.12.

In FY2020, WST generated $4.57 and $4.76 in diluted EPS and adjusted diluted EPS. The 52-week intra-day low/high was $124.53 in March 2020 and $305 in November 2020. Using this data, WST’s diluted PE range was ~27 – ~66.7 and the adjusted diluted PE range was ~26.2 – ~64.

In FY2021, WST generated $8.67 and $8.58 in diluted EPS and adjusted diluted EPS. The 52-week intra-day low/high was $253.86 in March 2021 and $475.35 in September 2021. Using this data, WST’s diluted PE range was ~29.3 – ~54.8 and the adjusted diluted PE range was ~29.6 – ~55.4.

YTD2022 diluted EPS and adjusted diluted EPS are $6.36 and $6.80. Management’s FY2022 adjusted diluted EPS guidance is now $8.15 – $8.20. If we use the $8.175 mid-point and the current ~$225 share price, the forward adjusted diluted PE is ~27.5. Should WST generate $1.30 in diluted EPS in Q4, then FY2022 diluted EPS is ~$7.66. Using this and the current share price, the forward diluted PE is ~29.4.

Very few brokers cover WST. However, using the few adjusted earnings estimates currently available, we get the following forward-adjusted diluted PE levels:

- FY2022 – 6 brokers – mean of $8.17 and low/high of $8.15 – $8.20. Using the mean estimate, the forward-adjusted diluted PE is ~27.5.

- FY2023 – 6 brokers – mean of $7.35 and low/high of $6.54 – $8.05. Using the mean estimate, the forward-adjusted diluted PE is ~30.6.

- FY2024 – 3 brokers – mean of $8.72 and low/high of $8.11 – $9.20. Using the mean estimate, the forward-adjusted diluted PE is ~25.8.

WST’s current valuation based on the most recent guidance is roughly similar to that when shares were trading at a 52-week low in 2020 and 2021.

Final Thoughts

Despite WST’s current challenges, it is a company that generates strong FCF and it is virtually debt free.

A common theme in all the earnings call transcripts I read is the expression of concern by senior executives about a challenging economic environment and a potentially difficult 2023. Investors would be wise to steer clear of highly leveraged companies with a spotty FCF and profitability track record. Companies with minimal debt are more likely to be able to withstand headwinds than those which employ significant use of debt.

In analyzing WST, it appears its headwinds are supply rather than demand-related. Steps are being taken to address this but we likely will not see an improvement in results until 2023.

In my opinion, the time to acquire shares in high-quality companies is when they fall out of favour with the investment community. Despite expectations for a challenging 2023, I think WST’s performance will improve by mid-2023. Should this happen, I think WST will come back into favour with investors and its share price will be bid up. This will likely lead to a valuation that is less favourable than the current level.

On the morning of November 25, I decided to buy out of favour West Pharmaceutical and initiated a 100-share position @ ~$225/share in one of the ‘Core’ accounts within the FFJ Portfolio.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long WST.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.