Summary

- Brown-Forman (BF) is a high quality company which has richly rewarded shareholders over the years.

- BF is a classic example of why exclusive reliance on stock screeners to identify investment opportunities is short-sighted.

- The company faces uncertainty as a result of foreign countries imposing retaliatory tariffs in response to ill-advised tariffs announced by the US government.

- BF started taking measures months ago to reduce the impact of anticipated tariffs but management has indicated it is difficult at this juncture to provide a precise full-year outlook.

- BF generally trades at a premium to the overall S&P500 but its current valuation appears to be somewhat elevated from historical norm.

Introduction

Over the span of almost 150 years, Brown-Forman Corporation (NYSE: BF-a and BF-b) has built a portfolio of more than 40 spirit, ready-to-drink cocktail, and wine brands that includes some of the best-known and most-loved trademarks in the industry; BF will be celebrating its 150th year in business in 2020.

BF’s most important brand in its portfolio is Jack Daniel’s Tennessee Whiskey. According to Impact Databank’s ‘Top 100 Premium Spirits Brands Worldwide’ list it is the 4th largest spirits brand of any kind and the largest American whiskey brand in the world. Jack Daniel’s Tennessee Whiskey was the only premium spirits brand among the top 5 to grow volume in each of the past five years.

In its 5th year on Impact Databank’s list, Jack Daniel’s Tennessee Honey was recognized as a top 15 growth brand and remains the second-largest-selling flavored whiskey.

Other leading BF global brands on the Worldwide Impact list are:

- Finlandia (the 10th largest selling vodka);

- Canadian Mist (the 4th largest selling Canadian whisky);

- el Jimador (the 5th largest selling tequila which is designated as an Impact “Hot Brand”);

- Woodford Reserve (once again selected as an Impact “Hot Brand”)

BF is a “controlled company” under New York Stock Exchange rules because the Brown family owns more than 50% of the company’s voting stock. In addition, when ownership of shares of BF’s non-voting stock is taken into account, the Brown family controls more than 50% of the economic ownership in Brown-Forman.

Typically, the purpose of a dual class share structure is to keep ownership control in the hands of a select few who want to maintain control over a company. While some may have a negative view of a dual class share structure, I have no objection to same.

First and foremost, when I invest in a company with such a structure I am fully aware one exists. If one objects to this structure then the solution is simple…do not invest in the company. Secondly, this structure was likely created by the founding family/families because they felt they and their descendants would have more of a long-term orientation than some random investor who subsequently acquired a large block of stock.

The non-voting shares (BF-b) have an identical interest in the company; the only exception is the inability to vote. One would think that the voting shares (BF-a) would trade at a slight premium to the non-voting shares but the reverse is typically the case. In my opinion, the reasoning for BF-b generally being priced at a slight premium has to do with liquidity.

The average daily trading volume for BF-b non-voting shares is in excess of 1 million shares. On the other hand, BF-a’s average daily trading volume is under 50,000 shares.

I recognize some readers may be inclined to purchase the BF-a voting shares because they wish to have a say in how the company is managed. Regardless of how many voting shares are purchased, your votes will be meaningless because the Brown Family collectively own in excess of 65% the company.

Since the Class B non-voting shares are the most heavily traded and the variance in the market price between the two classes of shares is negligible (~$0.16), this article is written from the viewpoint of owning / acquiring the Class B shares.

Business Overview

BF, the largest American-owned spirits and wine company with global reach, was founded as a partnership in 1870 but was incorporated in 1901. It primarily manufactures, bottles, imports, exports, markets, and sells a wide variety of alcoholic beverages under recognized brands.

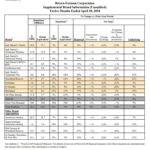

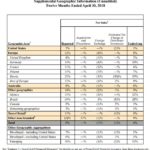

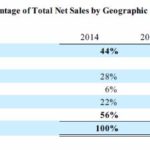

It sells its products in over 170 countries with the US accounting for 47% of net sales in FY2018. BF’s largest international markets include the United Kingdom, Australia, Mexico, Germany, France, Poland, Russia, Brazil, and Canada.

In FY2018, BF generated 53% of net sales outside the United States versus 56% in FY2014. The US proportion of net sales grew from FY2014 to FY2016 and stayed constant in FY2017 primarily due to the negative effect of foreign exchange on its international business.

Holiday buying makes the 4th calendar quarter (generally, BF’s 3rd fiscal quarter) the peak season. Approximately 31%, 30%, and 31% of net sales for FY2016, FY2017, and FY2018 were in the 4th calendar quarter.

Trade information indicates BF is one of the largest global suppliers of premium spirits. According to International Wine & Spirit Research (IWSR), the 10 largest global spirits companies controlled less than 20% of the total global market for spirits (on a volume basis) in 2017.

The industry is highly competitive. Competition includes many global, regional, and local brands in a variety of categories of beverage alcohol. BF’s brands, however, compete primarily in the industry’s premium-and-higher price categories. Competitors include major global spirits and wine companies, such as Bacardi Limited, Becle S.A.B. de C.V., Beam Suntory Inc., Davide Campari-Milano S.p.A., Diageo PLC, LVMH Moët Hennessy Louis Vuitton SE, Pernod Ricard SA, and Rémy Cointreau.

In addition, and particularly in the US, BF is increasingly competing with national companies and craft spirit brands with many being recent entrants to the industry.

The following innovation and acquisition and divestiture developments in BF’s business occurred in FY2016, FY2017, and FY2018.

- Significant innovation within the Jack Daniel’s family of brands which has driven growth;

- The continued capitalization on consumers’ interest in super- and ultra-premium whiskey with BF’s range of brands, including Woodford Reserve and Old Forester;

- Significant growth for BF’s tequila brands in FY2018, as Herradura, el Jimador, and New Mix contributed significantly to overall net sales growth in the fast-growing market for ultra-premium “cristalino” tequilas in Mexico;

- The purchase of all of Slane Castle Irish Whiskey Limited in June 2015 followed by the unveiling of the first product from BF’s Slane Irish Whiskey brand in Travel Retail in Ireland in April 2017. The brand was also introduced selectively in the United States, the United Kingdom, and Australia in the summer of 2017. Plans are to expand Slane nationally in the United States in the summer of 2019;

- The sale of Southern Comfort and Tuaca brands in March 2016 and related assets to Sazerac Company with all activities related to this transition of ownership completed in FY2017;

- The June 1, 2016 acquisition of The BenRiach Distillery Company Limited for $0.407B. This consisted of a purchase price of $0.341B and $0.066B in assumed debt and transaction-related obligations which have since been paid. This acquisition brought three single malt Scotch whisky brands into BF’s portfolio. Management is of the opinion these super-premium brands will provide BF with an opportunity to participate in the growing single malt Scotch category and to strengthen its portfolio’s long-term growth prospects in the United States, the United Kingdom, Taiwan, Germany, and Travel Retail.

Trade Disputes (War!)

Readers are likely well aware of the recently imposed tariffs and the impending tariffs introduced by the US federal government. BF was aware of impending trouble from tariffs being slapped on U.S. bourbon, and therefore, has been working in recent months to mitigate the potential impact by shipping more liquor overseas.

BF was thrust into the spotlight in recent weeks when Mexico placed a 25% tariff on bourbon imports in response to Trump’s imposition of import duties on metals. In addition, the European Union has indicated it will also respond with levies. Given these circumstances, BF has indicated it is difficult to provide a precise full-year outlook. It has, however, gained more flexibility in managing trade risks by moving shipments to markets where it has its own distribution, rather than depending on third-party distributors.

Q4 and FY2018 Results and FY2019 Guidance

On June 6, 2018, BF released its FY2018 results.

Included in the results is the establishment of a charitable foundation with $70 million. The purpose of this charitable foundation is to supplement and stabilize the amounts the company provides annually to non-profit groups. The goal is to provide a stable source of funding for charitable giving that is not tied to the company’s performance. The intent is to generate $3 – $5 million a year, depending on how the investments fare.

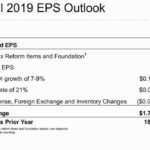

FY2019 guidance is as follows.

Source: BF Q4 and FY2018 Earnings Presentation – June 6 2018

Credit Ratings

Moody’s rates BF’s long-term debt as A1 (stable) and S&P Global rates it A- (stable). Moody’s rating is the top tier of the upper medium grade category while S&P Global’s rating is the bottom tier of the upper medium grade category. These ratings are acceptable from my perspective.

Valuation

In FY2018, BF generated $1.48 in diluted EPS from continuing operations and $1.67 in adjusted diluted EPS. With BF trading at $49.81 as at the close of business on June 22, 2018, BF’s PE is ~33.66 using the $1.48 in diluted EPS.

Management has forecast 18% – 25% EPS growth ($1.75 – $1.85) for FY2019 thus giving us a forward PE range of ~26.92 – ~28.46.

The 5 year average PE is ~26.8. That for the S&P500 is ~20.5 and for the industry it is ~22.4. BF is a leader within the industry so I am inclined to assign a bit of a premium but a forward PE range of ~26.92 – ~28.46 strikes me as a bit expensive.

Dividend, Dividend Yield, Stock Splits, Share Repurchases, and Dividend Payout Ratio

BF’s dividend and stock split history can be found here. It has paid regular quarterly cash dividends for 72 consecutive years and has increased the dividend for 34 consecutive years.

BF returned $3.0B to its shareholders through FY2016 – FY2018 via $0.8B in regular quarterly dividends, $0.5B in special dividends, and $1.7B in share repurchases. Same was made from cash on hand and proceeds from the issuance of long-term debt totaling $1.8B (net). Of the $3B, $0.773B was returned to shareholders in FY2018; this included a $1/share special dividend.

Had you owned BF shares prior to November 2003 you would have benefited from 5 stock splits; 500 shares would now be ~4688 shares. You would have well in excess of this number of shares if you had been automatically reinvesting your quarterly and ‘special’ dividends.

While BF’s dividend yield is typically less than 1.50%, the dividend yield reported on various websites exclude the ‘special’ dividends since the distribution of same is inconsistent.

BF’s dividend yield is reported as being ~0.63% when I look at various stock screeners. Were we to include the $1.00 ‘special’ dividend which was distributed April 23, 2018, the $0.158 quarterly dividend and the $1.00 ‘special’ dividend would result in a dividend yield of ~3.28% ($1.632 / $49.81 stock price) for shareholders who owned BF prior to April.

This is a prime example of why exclusive reliance on stock screeners can result in missed investment opportunities.

In addition, misleading information is found on websites which provide charts comparing a stock’s performance relative to a benchmark when companies pay ‘special’ dividends. Look at BF’s 10 year performance relative to the S&P500.

Source: Tickertech.com

Source: Tickertech.com

The dividends reinvested per share over the 10 year timeframe, for example, are incorrectly reported as being $5.68. If you look at the company’s dividend and stock split history (link provided above) we see that BF paid ‘special’ dividends of $6 during the most recent 10 years ($1 in 2018, $4 in 2012, and $1 in 2010).

BF’s $0.632 annual dividend amounted to ~42.7% of FY2018’s diluted EPS or ~110.27% if we include the $1 ‘special’ dividend. Clearly, BF’s Board is not about to approve ‘special’ dividends on an ongoing basis if the dividend payout ratio will exceed diluted EPS. On this basis I will rely on the dividend payout ratio where the ‘special’ dividend is excluded. I am satisfied that BF’s dividend payout ratio is sufficiently conservative.

Final Thoughts

Diageo plc (NYSE: DEO) is currently my sole exposure to the Wineries and Distillers industry. I would like to expand my exposure to this industry by initiating a position in BF but view BF’s valuation as lofty.

I am not concerned about the long-term impact on BF from the implementation of ill-advised tariffs and have the utmost confidence BF’s management will navigate the business prudently during this challenging environment.

I think the tariffs will be of a short term nature. In my opinion, the new US President at the end of Trump’s term (I do not envision him being re-elected) will most likely takes steps to reverse the harmful measures which have been introduced / which will likely be introduced.

At this juncture I am prepared to patiently wait for a better entry point. Based on the information at hand I would be prepared to initiate a position if BF were to retrace to $45 or less.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently own shares in BF-a or BF-b nor do I intend to purchase shares within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.