Summary

Summary

- This company recently released its Q4 and FY2018 results and Mr. Market responded with a +11% increase in the company’s stock price.

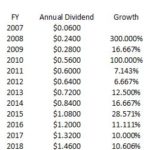

- The Board approved a 33% increase in the annual dividend and the dividend’s compound annual growth rate since going public in 2007 is ~33.6%.

- Diluted EPS growth of 12% – 16% is projected for FY2019.

- FY18 Free Cash Flow of ~$0.6B included $41 million from excess tax benefits from stock-based compensation. FY2019 FCF is projected to be $0.565B – $0.615B.

- Long-term shareholders have generated significant returns but I view this stock’s current valuation to be somewhat stretched.

Introduction

Over the course of the past year I have written several articles about this company (February 9, 2017, May 13, 2017, August 11, 2017, February 9, 2018, and July 16, 2018). In the first 4 articles I highly recommended this company as an attractive investment for investors with a long-term outlook.

In June 2018 this company was added as a member of the S&P 500. In my July 16, 2018 article I expressed caution that by becoming a component of this index, it was likely going to receive much more investor attention and this somewhat of a hidden gem would no longer be hidden. As it was, I felt that this company had become somewhat overvalued and investors should become cautious if they were thinking of initiating / adding shares in this company.

I also indicated that I expected this company to announce at least a ~10% increase in its annual dividend when it released its FY2018 results.

Well….Q4 and FY2018 results have been released and guess what happened? The stock jumped over 10% and the dividend….it was increased 33%!

This is insane!

The company was spun off from Automatic Data Processing (NASDAQ: ADP) in March 2007 at which time I received a few hundred shares. With the subsequent purchase of additional shares my average cost is USD ~$34 and shares are now trading just shy of $128. While that’s all well and good, a company has no control over its stock price as the stock price is based on the law of supply and demand. What really impresses me is that shortly after this company’s IPO in 2007, its initial dividend was $0.06/quarter. Now? $0.485/quarter. That is a ~33.6% compound annual growth rate. I NEVER received a pay raise of this magnitude over this timeframe in my entire career!

And investors make speculative investments in the hopes of striking it rich!

Are you kidding me? Why speculate when you can invest in great companies that have a proven business model and which generate considerable Free Cash Flow (FCF) so they can reward investors which generous dividend increases? I would much prefer to sit back and do nothing versus continually monitoring my investments hoping that they increase in value. Who needs more stress in their life?

I am certainly not telling you what to do with your money. Your money is your money so do as you see fit. If you want to shorten your journey to financial freedom, however, you may want to put this company on your radar.

The stock might be somewhat richly valued at this stage (in my opinion) but if we get a long overdue market correction, this company’s stock price will likely retrace to a more reasonable valuation at which time I would ‘back up the truck’.

Business Overview

An overview of Broadridge Financial Solutions, Inc. (NYSE: BR) can be found in my February 9, 2017, May 13, 2017, August 11, 2017, February 9, 2018, and July 16, 2018 articles. Further details regarding BR’s evolution and the solutions and products it provides to various industries can be found here.

BR is a global fintech leader providing investor communications and technology-driven solutions to banks, broker-dealers, mutual funds and corporate issuers. A comprehensive overview of its business and risk factors can be found in its FY2018 10-K.

BR’s Performance vs S&P500 since March 30, 2007 IPO

The following chart reflects BR’s performance relative to the S&P500. Please note that the website from which I obtained this graph has not yet been updated as at the time this article is being composed to account for the August 7, 2018 surge in the company’s stock price.

Clearly, BR shareholders have been well rewarded.

Source: TickerTech

Q4 and FY2018 Results

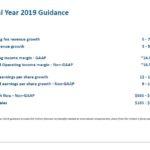

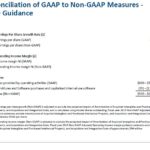

On August 7, 2018, BR released its Q4 and FY2018 results. The following images are key takeaways from today’s Earnings Release.

Source: BR – Q4 and FY2018 Earnings Release – August 7, 2018

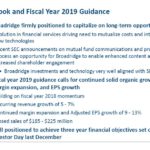

FY2018 Guidance and 2017 – 2020 Growth Objectives

BR is on track for another steady year of growth as evidenced from the following images from the Q4 and FY2018 Earnings presentation.

Source: BR – Q4 and FY2018 Earnings Release – August 7, 2018

Credit Ratings

There has been no change to BR’s credit ratings from Moody’s and S&P Global subsequent to my last article and there is no indication the credit ratings are under review.

Moody’s continues to rate BR’s long-term debt as Baa1 which is classified as lower medium grade. Standard & Poor’s continues to rate the debt BBB+ which is also lower medium grade.

These ratings are satisfactory for my purposes.

Free Cash Flow (FCF) Conversion

BR’s FCF levels in 2012 – 2018 were $0.244B, $0.22B, $0.334B, $0.365B, $0.362B, $0.402B, and $0.596B.

This favorable trend in FCF is what enables BR to pursue acquisition opportunities, to repurchase shares, and to increase dividends.

Dividend, Dividend Yield, and Dividend Payout Ratio

In my July 16th article I indicated I expected a dividend increase of at least 10%. This would have been in keeping with historical dividend increases. I couldn’t have been further off the mark!

On August 6, 2018, BR’s Board of Directors declared a quarterly dividend of $0.485 per share payable on October 3, 2018 to shareholders of record on September 18, 2018. This is a 33% increase ($1.46 increased to $1.94)! This marks the 11th consecutive year in which BR has increased its annual dividend since becoming a company in 2007.

As you can see from the following compound annual growth rate calculations below, BR’s dividend has far outpaced the rate of inflation. I do not foresee this growth rate going on in perpetuity but there is ample leeway for BR’s dividend growth rate to be reduced while still outpacing the rate of inflation.

Despite the dividend’s impressive growth rate, BR’s stock price has also experienced an impressive growth rate. As a result, the new $1.94 annual dividend is a yield of only ~1.5% based on BR’s current ~$129 stock price. This low dividend yield will undoubtedly result in many investors excluding BR as a potential investment.

BR reported FY2018 Diluted EPS (GAAP) of $3.56 and Adjusted Diluted EPS (Non GAAP) of ~$4.19. BR is projecting Diluted EPS (GAAP) growth of 12% – 16% ($3.99 – $4.13) and projected Adjusted Diluted EPS (Non GAAP) of 9% – 13% ($3.88 – $4.02). If we use the mid-point of these estimates ($4.06 and $3.95), the new $1.94 annual dividend is a dividend payout ratio of ~47.8% and ~49.1%. These dividend payout ratios give me comfort that BR should be able to service its dividend commitment.

Share Repurchases

BR continues to reduce its weighted average shares outstanding. In FY 2011, the weighted average number of shares outstanding amounted to 124.8 million shares and the diluted weighted average shares outstanding amounted to 128.3 million. As at the end of FY2018 these figures have been reduced to 116.8 million and 120.4 million.

Valuation

FY2019 guidance for Diluted EPS (GAAP) growth is 12% – 16% and growth of 9% – 13% in adjusted Diluted EPS (Non GAAP).

On the basis of FY2018 Diluted EPS (GAAP) and adjusted Diluted EPS (Non GAAP) of $3.56 and $4.19, investors can expect Diluted EPS (GAAP) of ~$3.99 – ~$4.13 and adjusted Diluted EPS (Non GAAP) of ~$4.57 – ~$4.73.

Using the August 7, 2018 $129.17 closing stock price we get a forward diluted PE range of ~30.8 – ~36.3 and a forward adjusted diluted PE of ~27.3 – ~28.3.

As much as think BR is a great company, its valuation is far too lofty for me and I will refrain from acquiring additional shares until such time as BR’s valuation retraces to the low – mid 20s (based on Diluted EPS (GAAP) results).

Final Thoughts

BR has certainly rewarded me well and I continue to view it as a company with a very promising future. Having said this, I think Mr. Market has bid up the price to a level where perfection is expected. At some stage, I envision BR will retrace to a more reasonable valuation; I do not expect BR to retrace to a PE in the teens but somewhere between the low – mid 20s seems more reasonable.

As much as I like the company I just can’t bring myself to acquire more shares at this stage.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long BR.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.