Contents

Summary

Summary

- Broadridge released its Q2 and 1st half of FY2018 results February 8, 2018.

- Projections have been revised upwards for the remainder of 2018.

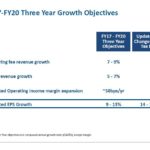

- Changes in the US Tax Law have resulted in BR revising its FY2017 – 2020 Growth Objectives in Adjusted EPS from the 9% - 13% range to the 14% - 18% range.

- BR’s capital allocation policy includes a 45% dividend payout ratio. With the upwards revision in Adjusted EPS I expect another double digit percentage increase in BR’s dividend to be declared in August 2018.

Introduction

This is a follow up to my February 9, 2017, May 13, 2017, and August 11, 2017 Broadridge Financial (NYSE: BR) articles.

BR is a global fintech leader which provides investor communications and technology-driven solutions to banks, broker-dealers, mutual funds and corporate issuers. Services include investor and customer communications, securities processing, and data and analytics solutions.

BR operates in two reportable segments: Investor Communication Solutions and Global Technology and Operations. Details can be found in my February 9, 2017 article (see link above).

Further details can also be found on BR's website.

Recent Events

FORTUNE® magazine recently named BR to its 2018 list of the World's Most Admired Companies in the category of financial data services for the 5th time. The FORTUNE® list is considered one of the leading measures of corporate reputation among the world's largest companies. It rates companies on a range of criteria, from investment value to global competitiveness and innovation.

In January 2018, BR completed its acquisition of Morningstar, Inc.'s 15(c) board consulting services business. This strengthens BR’s ability to offer the most complete source for independent, verifiable data on which mutual fund boards of directors rely to fulfill their governance responsibilities.

This new acquisition will be integrated with BR’s existing 15(c) compliance solutions which it has offered since the 2015 acquisition of Thomson Reuters' Fund Information Services business

In late January 2018, BR announced the launch of its new Repo Order Quote (ROQ) solution. This is a multi‐market aggregation and execution tool for repo markets. BR’s solution is currently in use with a major European bank and it allows repo traders to view liquidity and pricing across multiple electronic marketplaces. The system enables traders to see demand and availability for each term, security, or basket of general collateral securities and also provides the ability to quote and execute on an aggregate basis.

Q2 and 6 month FY2018 Results

On February 8, 2018, BR released its Q2 and 6 month FY2018 results.

Growth in event-driven revenues contributed to adjusted operating income to $0.137B.

In Q2, BR benefited from a proxy vote at one of the largest global mutual firms and also activist campaigns at two large equity companies. In all cases, the corporate issuer and the mutual funds relied on BR’s technology which enabled them to communicate with millions of investors and to accurately count tens of millions of books.

This event driven activity is unpredictable but the underlying activity behind these events serves BR well as mutual fund firms conduct a proxy vote every ~5 years. The infrastructure BR has built and maintained for event driven activities enables these firms to effectively communicate with fund holders to get the approvals related to governance matters.

Activist investors who want to make sure their voice is heard at the board level can also tap into an on-demand infrastructure thus enabling them to communicate directly with shareholders. When Bill Ackman initiated a proxy battle for Automatic Data Processing (NYSE: ADP) I received multiple mailings from BR on behalf of ADP and Ackman in which each party presented their case seeking my vote.

As I indicated in a previous article, I like the recurring revenue aspect of the business. My reasoning is twofold. It:

- means clients are pleased with BR’s services and service levels;

- is much less costly to upsell and to service existing clients than it is to acquire new clients.

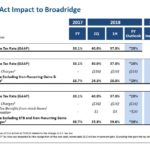

Source: BR Earnings Webcast & Conference Call Second Quarter and First Six Months of Fiscal Year 2018 - February 8, 2018

Source: BR Earnings Webcast & Conference Call Second Quarter and First Six Months of Fiscal Year 2018 - February 8, 2018

FY2018 Guidance and 2017 – 2020 Growth Objectives

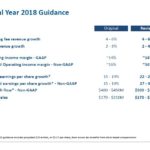

BR is projecting another steady year of growth in FY2018 and has revised upwards it growth objectives for the 2017 - 2020 period.

Source: BR Earnings Webcast & Conference Call Second Quarter and First Six Months of Fiscal Year 2018 - February 8, 2018

Source: BR Earnings Webcast & Conference Call Second Quarter and First Six Months of Fiscal Year 2018 - February 8, 2018

BR’s previous event driven revenue record year was in 2010. In that year it recorded $0.256B of event driven revenue as a result of above normal reincorporation and merger activity and because ~50% of all mutual funds went out for proxy vote.

Management now expects to record an even stronger event driven revenue year in FY2018 even though only 28% of fund positions are going to proxy. The reason for this is that a much smaller percentage of the market is driving a greater level of revenue and the total number of mutual fund and exchange traded fund investors has increased in line with the 8% average annual growth in mutual fund relative to 2010 levels.

BR also expects a positive impact on the tax front. Approximately 80% of BR’s business is in the United States so the recent corporate tax cuts will have a positive impact on BR’s earnings and cash flow; in the February 8th conference call, BR’s CEO indicated shareholders will benefit from the recent tax cuts.

BR has now raised its 3 year adjusted EPS growth objective to 14% - 18% from the 9% - 13% range. One of the benefits from this increase is that BR has a capital allocation policy which includes a 45% dividend payout ratio. Given this, I strongly suspect BR will announce in May 2018 another double digit percentage increase in its dividend payable August 2018.

Credit Ratings

Moody’s currently rates BR’s long-term debt as Baa1 which is classified as lower medium grade. Standard & Poors rates the debt BBB+ which is also lower medium grade. Neither agency has BR’s debt under review.

Free Cash Flow Conversion

FCF levels in 2012 – 2017 were $0.244B, $0.22B, $0.334B, $0.365B, $0.362B and $0.312B.

As noted in the FY2018 Guidance and 2017 – 2020 Growth Objectives section of this post, BR has upped its FY2018 FCF guidance from $0.4B - $0.45B to $0.5B - $0.55B.

Dividend, Dividend Yield, and Dividend Payout Ratio

BR’s dividend history can be found here.

On February 6, 2018, BR announced that its Board of Directors had declared a quarterly cash dividend of $0.365/share ($1.46/share/year); this is the 3rd consecutive quarterly dividend at this level. The dividend is payable April 3, 2018 to stockholders of record at the close of business on March 15, 2018.

Investors would be wise not to dismiss BR solely on the basis of its thin ~1.6% dividend yield (based on the February 8, 2017 closing stock price of current $90.74). BR has raised its dividend every year since becoming a public company in 2007 and FY2018 marks the 6th consecutive year of a double digit percentage increase and the 10th consecutive increase in the annual dividend.

Using the $1.46/year dividend, projected Diluted EPS (GAAP) of $3.35 and projected Adjusted Diluted EPS (Non GAAP) of $4.04, the dividend payout ratio is ~43.5% and ~36%. These ratios are conservative and the ability for BR to service its dividend commitment appears solid.

The basic and diluted weighted‐average shares outstanding for the 6 months ending December 31, 2017 were 116.5 million and 120.1 million. This compares favorably with 121.9 million and 125.4 million as at BR’s June 30, 2013 fiscal year end.

Valuation

Management has recently amended its guidance for FY2018 as reflected in the FY2018 Guidance and 2017 – 2020 Growth Objectives section of this article.

FY2017 Diluted EPS (GAAP) and adjusted Diluted EPS (Non GAAP) amounted to $2.70 and $3.13 respectively. Management had previously called for 15% - 19% growth in Diluted EPS (GAAP) and adjusted Diluted EPS (Non GAAP) for FY2018. Diluted EPS (GAAP) growth of 22% - 26% is now expected while 27% - 31% growth in adjusted Diluted EPS (Non GAAP) is now expected.

Using the new guidance and projected EPS on a basic and a diluted basis and the current $90.74 stock price, we get the following projected results for FY2018.

The levels are somewhat elevated but that is to be expected given the recent market euphoria and BR’s growth opportunities.

The levels are somewhat elevated but that is to be expected given the recent market euphoria and BR’s growth opportunities.

Final Thoughts

I have owned BR shares outside the FFJ Portfolio from the time BR was spun-off from ADP in 2007. The recent pullback from BR’s late January 2018 high of ~$97 and the upward revisions in FY2018 earnings and free cash flow now makes a more compelling case to acquire additional shares.

There is considerable volatility in the market at the moment and I suspect further pressure will be placed on equity prices across the board. As a result, I will make periodic additional BR share purchases as opposed to making one significantly more meaningful purchase.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this post. As always, please leave any feedback and questions you may have in the “Contact Me Here” section to the right.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long BR.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.