When I last reviewed Agilent (A) in this November 22, 2023 post, it had just released its Q4 and FY2023 results and Q1 and FY2024 guidance. At the time, management had forecast strong FY2024 cashflow while navigating challenging business conditions.

With the release of Q3 and YTD2024 results and FY2024 guidance on August 21, 2024, it is an opportune time for me to revisit this existing holding.

Business Overview

A operates in the life sciences, diagnostics and applied chemical markets. It provides application focused solutions that include instruments, software, services and consumables for the entire

laboratory workflow.

In Q1 2024, it changed its operating segments by moving its cell analysis business from the life sciences and applied markets segment to the diagnostics and genomics operating segment. The purpose of this transition was to further strengthen growth opportunities for both organizations.

Following this reorganization, A continues to have 3 reportable business segments:

- life sciences and applied markets;

- diagnostics and genomics; and

- Agilent CrossLab.

The Q3 2024 Form 10-Q is unavailable as I compose this post. Part 1, Item 1 in the Q2 2024 Form 10-Q (see SEC Filings), however, provides a comprehensive overview of the business, competition, and risks.

Acquisitions

A’s two recent acquisitions focus on biopharma and increasing recurring revenue.

North American CDMO BIOVECTRA Acquisition

On July 22, A announced the signing of a definitive agreement to acquire BIOVECTRA, a leading specialized contract development and manufacturing organization based in Prince Edward Island, for $0.925B.

BIOVECTRA builds on A’s capabilities in oligonucleotides and CRISPR therapeutics by expanding its portfolio of services.

BIOVECTRA delivered more than $0.11B in revenue during the 2023 calendar year and double-digit revenue growth is expected in 2024.

The transaction is subject to customary closing conditions and is expected to close before 2025. Upon close, BIOVECTRA will become part of the Agilent Diagnostics and Genomics Group.

Sigsense Technologies Acquisition

On July 29, A announced it the acquisition of Sigsense Technologies, a San Francisco, California-based startup that uses artificial intelligence and power monitoring to help optimize lab operations. Sigsense Technology already is available to A’s customers through CrossLab Connect, a suite of digital applications that improve lab performance.

Financial terms of the acquisition were not disclosed.

Financials

Q3 and YTD2024 Results

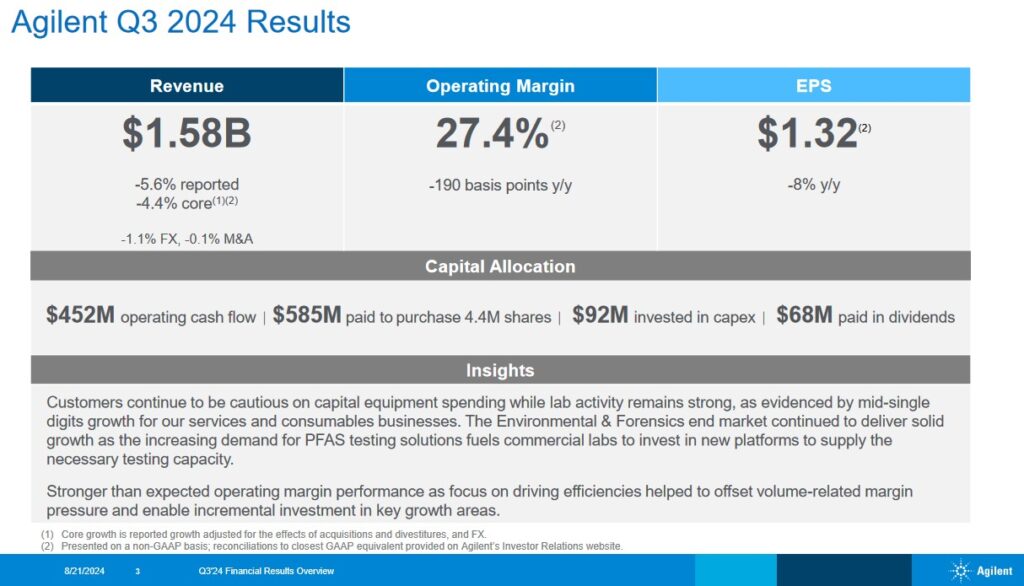

Material related to the Q3 2024 earnings release is accessible here. The following reflects A’s Q3 2024 results for the company as a whole. The earnings presentation reflects Q3 revenue by geography, product type, end market, and segment.

Operating Cash Flow (OCF), Free Cash Flow (FCF), and CAPEX

In FY2014 – FY2023,

- OCF was (in B$) 0.731, 0.512, 0.793, 0.889, 1.087, 1.021, 0.921, 1.485, 1.312, and 1.772. OCF in the first 3 quarters of FY2024 is 1.270B.

- CAPEX was (in B$) 0.205, 0.098, 0.139, 0.176, 0.177, 0.155, 0.119, 0.188, 0.291, and 0.298. CAPEX in the first 3 quarters of FY2024 is 0.285B.

- FCF was (in B$) 0.526, 0.414, 0.654, 0.713, 0.910, 0.866, 0.802, 1.297, 1.021, and 1.474. FCF in the first 3 quarters of FY2024 is 0.985B.

Return On Invested Capital (ROIC)

High quality companies often generate a high ROIC. If a company generates a high ROIC, it needs to invest less to achieve a certain growth rate thus reducing the need for external capital.

When a company consistently generates a high ROIC over the long term and it is growing its revenue, it can reinvest a portion of its profits under favorable conditions thereby leading to a compounding effect. I would much rather invest in a growing company that can reinvest to create greater shareholder value than to invest in a company that has limited growth opportunities and thus chooses to distribute a growing dividend.

A company that generates $0.15/profit for every $1 invested, for example, achieves a ROIC of 15%. I consider a ~15%+ ROIC to be a reasonable minimum threshold because most of the time, a company’s cost of capital will be lower than this level.

A’s ROIC in FY2014 – FY2023 (%) is 7.29, 6.55, 8.58, 11.09, 5.28, 15.54, 10.83, 16.76, 16.23, and 15.4.

Capital Allocation

A’s capital allocation priority is to reinvest in the business. Share repurchases and dividend distributions are also a component of A’s capital allocation.

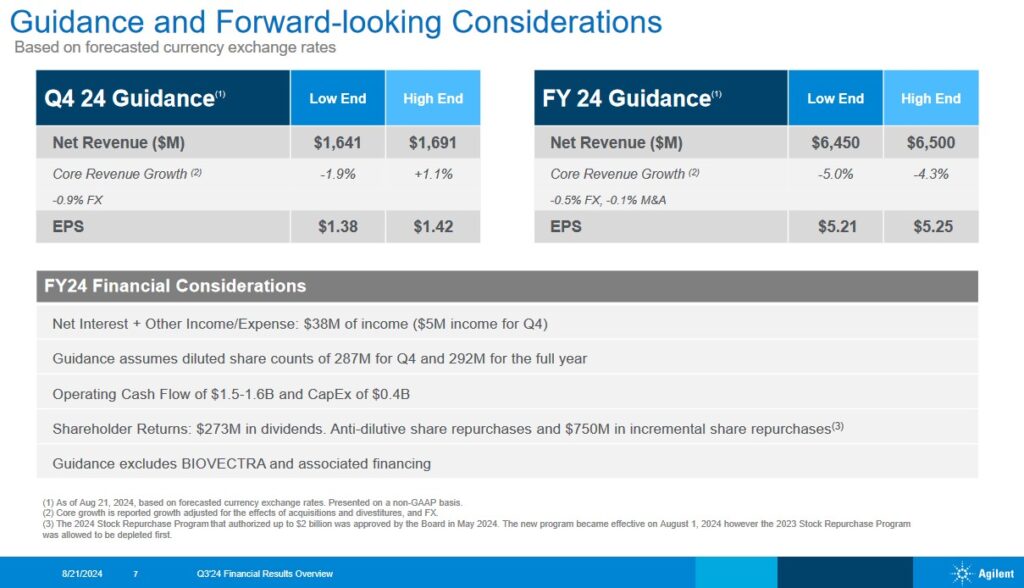

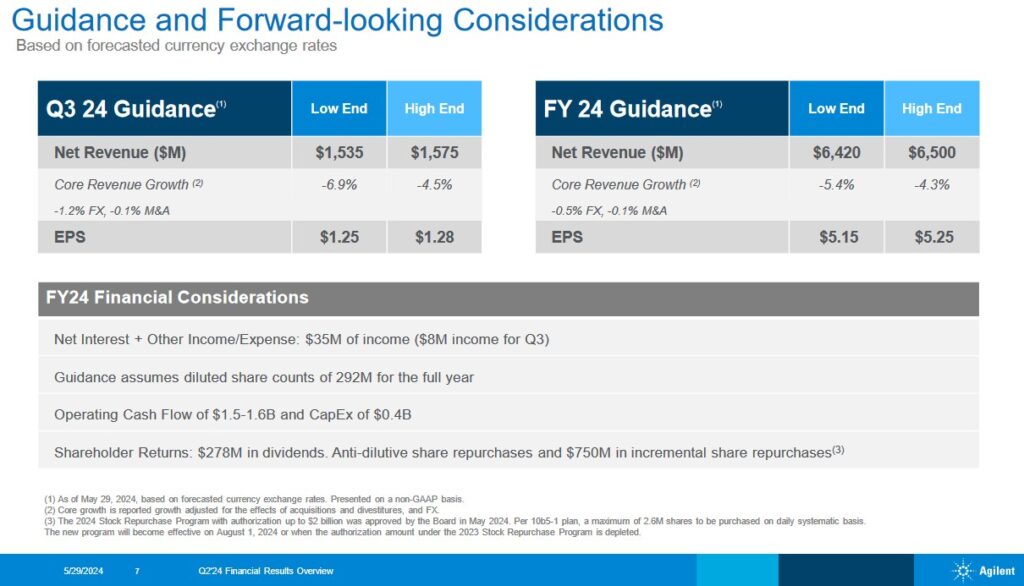

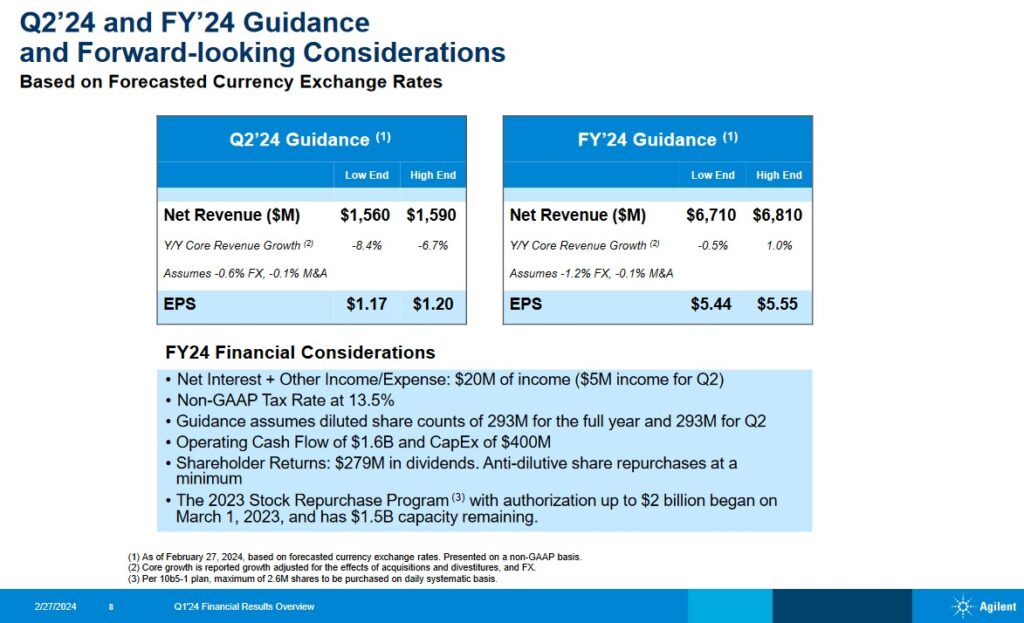

Q4 and FY2024 and Prior Guidance

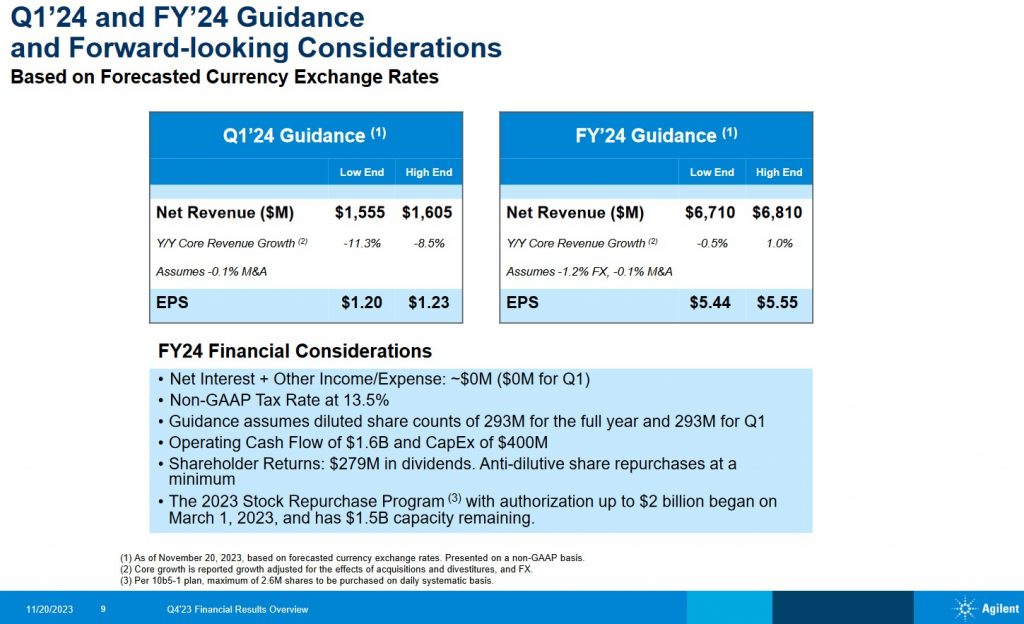

The following quarterly guidance and forward-looking considerations have been extracted from recent quarterly earnings presentation. We see that Net Revenue and EPS guidance is lower than what was communicated at the outset of the fiscal year.

Risk Assessment

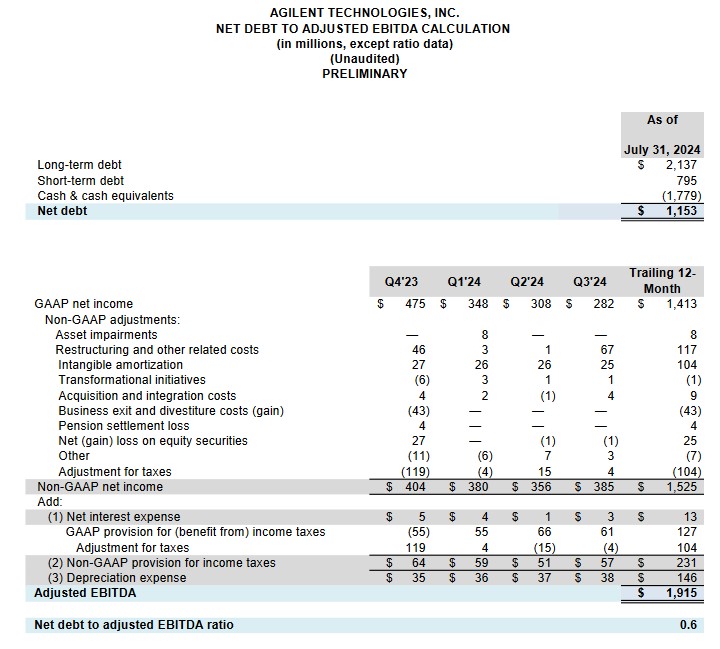

A’s net debt to adjusted EBITDA ratio is 0.6.

A does not have debt maturities until April 15, 2025 at which time a $0.6B Term loan matures.

As noted earlier, A’s Q3 2024 Form 10-Q is unavailable as I compose this post. Details of A’s short- and long-term reflected in the Q2 2024 Form 10-Q, however, provide a good overview of the existing credit arrangements.

The total of A’s Senior Notes (long-term debt) at FYE2023 was $2.735B and $2.137B at the end of Q3 2024 for a variance of $0.598B. The short-term debt at FYE2023, however, was $0 but $0.795B at the end of Q3. The combined variance is $0.197B ($0.795B – $0.598B).

While A has generated $1.270B YTD net cash provided by operating activities, it has incurred YTD CAPEX of $0.285B, repurchased $0.815B of its shares, and has distributed $0.206B in dividends. These 3 items alone total $1.306B.

A’s balance sheet and leverage ratios will still be in a strong position even after the upcoming BIOVECTRA acquisition.

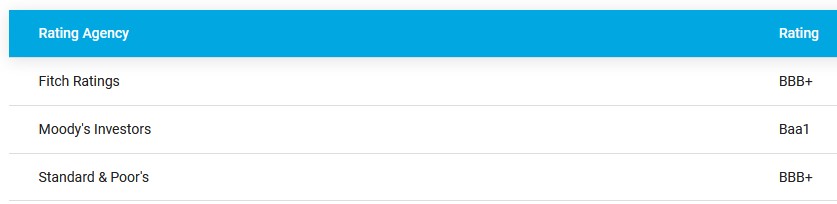

A’s website reflects the following credit ratings.

- Moody’s completed its most recent review on May 3, 2023 at which time A’s rating was upgrade from Baa2 to Baa1.

- S&P Global completed its most recent review on April 16, 2024 and affirmed A’s BBB+ rating with a Positive outlook.

- Fitch completed its most recent review on May 20, 2024 and affirmed A’s BBB+ rating with a Stable outlook.

All three rating agencies define A as having an adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of A to meet its financial commitments.

Dividend and Dividend Yield

A distributed $0.068B in dividends in Q3 bringing the YTD dividend distribution to ~$0.206B.

A’s dividend history reflects the distribution of three $0.236 quarterly dividends with the most recent having been distributed on July 24. The 4th quarterly dividend at this level is to be declared in September for distribution in October.

I anticipate a nominal increase in the quarterly dividend will be announced in November. Despite this increase, the dividend yield should remain below 1%.

The bulk of A’s future total investment return is likely to continue to be predominantly capital appreciation.

A’s weighted average shares outstanding in FY2013 – FY2023 are (in millions of shares) 345, 338, 335, 329, 326, 325, 318, 312, 307, 300, and 296. This had been reduced to 291 in Q3 2024.

In the first half of FY2024, A repurchased $0.23B of its shares. On the Q2 earnings call, management disclosed plans to leverage the company’s strong balance sheet and to repurchase $0.75B of common stock in Q3 and Q4, over and above the normal anti-dilutive repurchases.

In Q3 and YTD2024, A repurchased $0.585B and $0.815B of its shares; this includes $0.5B of the opportunistic repurchase management disclosed on the Q2 earnings call. The remaining $0.250B opportunistic repurchase is to be made in Q4.

Valuation

A’s valuation at the time of prior reviews is found in my August 16 post and September 12 post.

Using my $113.82 purchase price on September 11 and the $5.415 current mid-point of management’s FY2023 adjusted diluted EPS guidance, the forward adjusted diluted PE was ~21.

The forward-adjusted diluted PE using current broker estimates was:

- FY2023 – 17 brokers – ~21 using a mean of $5.42 and low/high of $5.40 – $5.46.

- FY2024 – 17 brokers – ~20 using a mean of $5.70 and low/high of $5.58 – $5.82.

- FY2025 – 14 brokers – ~17.8 using a mean of $6.40 and low/high of $6.21 – $6.76.

Looking at A’s valuation from a FCF perspective, management’s revised FY2023 FCF guidance was ~$1.2B. The diluted weighted average shares outstanding for the quarter ended July 31 was ~295 million. Dividing the guidance by the shares outstanding resulted in ~$4.07 FCF/share. Using my $113.82 purchase price divided by ~$4.07 FCF/share resulted in a forward P/FCF value of ~28.

A’s share price closed at ~$124 on November 21 and management’s FY2024 adjusted diluted EPS guidance was $5.44 – $5.55 giving us a forward adjusted diluted PE range of ~22.3 – ~22.8.

The forward-adjusted diluted PE using current broker estimates was:

- FY2024 – 19 brokers – ~22.5 using a mean of $5.50 and low/high of $5.30 – $5.82.

- FY2025 – 19 brokers – ~20.4 using a mean of $6.09 and low/high of $5.60 – $6.50.

- FY2026 – 12 brokers – ~18.6 using a mean of $6.67 and low/high of $6.28 – $7.10.

Looking at A’s valuation from an FCF perspective, management’s FY2024 FCF guidance was ~$1.2B. Guidance assumed ~293 million shares outstanding in FY2024. Dividing the FCF guidance by the shares outstanding guidance gave me ~$4.10 of FCF/share. Dividing the current ~$124 share price by ~$4.10 FCF/share and the forward P/FCF was ~30.2.

Management’s FY2024 adjusted diluted EPS guidance is now $5.21 – $5.25. With shares trading at ~$140, the forward adjusted diluted PE is ~26.7 – ~26.9.

The forward-adjusted diluted PE using current broker estimates is:

- FY2024 – 19 brokers – ~26.7 using a mean of $5.24 and low/high of $5.20 – $5.25.

- FY2025 – 19 brokers – ~24.7 using a mean of $5.67 and low/high of $5.46 – $6.05.

- FY2026 – 13 brokers – ~22.4 using a mean of $6.25 and low/high of $5.98 – $6.44.

The FY2024 OCF outlook is ~$1.5B – ~$1.6B and the CAPEX outlook is $0.4B thus giving us a FCF range of ~$1.46B – ~$1.56B. The weighted average diluted shares outstanding in Q3 was 291 million. A intends to repurchase at least $0.25B of its shares in Q4. Let’s use an average share price of $145 meaning ~1.7 million shares will be repurchased in Q4. Based on this, let’s be conservative and use 290 million shares outstanding at FYE2024. There were ~296 million shares outstanding at the beginning of the year so I will use an average of 293 million shares outstanding in FY2024.

Divide ~$1.46B – ~$1.56B by 293 million shares and we get a FCF/share range of ~$4.98 – ~$5.32. Divide $140 by ~$5.32 and we get a P/FCF of ~26.3 and ~28.1 using ~$4.98.

Clearly, this is not an exact science. Nobody knows at what price and how many shares A will repurchase in Q4. In addition, A’s FY2024 FCF outlook has a $1B range.

Final Thoughts

A first came to my attention when, through work, we helped it establish new banking facilities in Canada; it was spun off from Hewlett-Packard in 1999.

Almost a quarter of a century later, I initiated a 200 share position. Through May – September 2023, I added to my exposure and now have 500 shares at an average cost of ~$120.66 in a ‘Core’ account within the FFJ Portfolio; A was not a top 30 holding when I completed my 2024 Mid Year FFJ Portfolio Review.

In several posts, I state my desire to acquire shares in high-quality companies experiencing temporary headwinds and whose shares have fallen out of favor. A, however, has done a commendable job in navigating challenging business conditions and shares are no longer as undervalued as at the time of my purchases.

I consider A’s valuation to be insufficiently attractive to add to my exposure. With a little luck, we will experience a substantial broad market correction that may lead to A becoming somewhat more undervalued. At such time, I will revisit whether I should add to my exposure.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long A.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.