When I last reviewed Visa (V) in my October 25, 2023 post, it had just released its Q4 and FY2023 results and FY2024 outlook. With the release of Q1 2024 results and revised FY2024 outlook following the January 25 market close, I provide this brief update.

I have been a V shareholder almost from the day it went public on March 18, 2008. In addition, I have added to my exposure over the years.

Although I only disclose 225 V shares held in a ‘Core’ account in the FFJ Portfolio, most of my V shares are in a retirement account for which I do not disclose details; V continues to be my largest holding (see my 2023 Year End FFJ Portfolio Review).

Financial Results

A comprehensive overview of V is found within its FY2023 Form 10-K.

Q1 2024 Results

V’s Q1 2024 related material is accessible here.

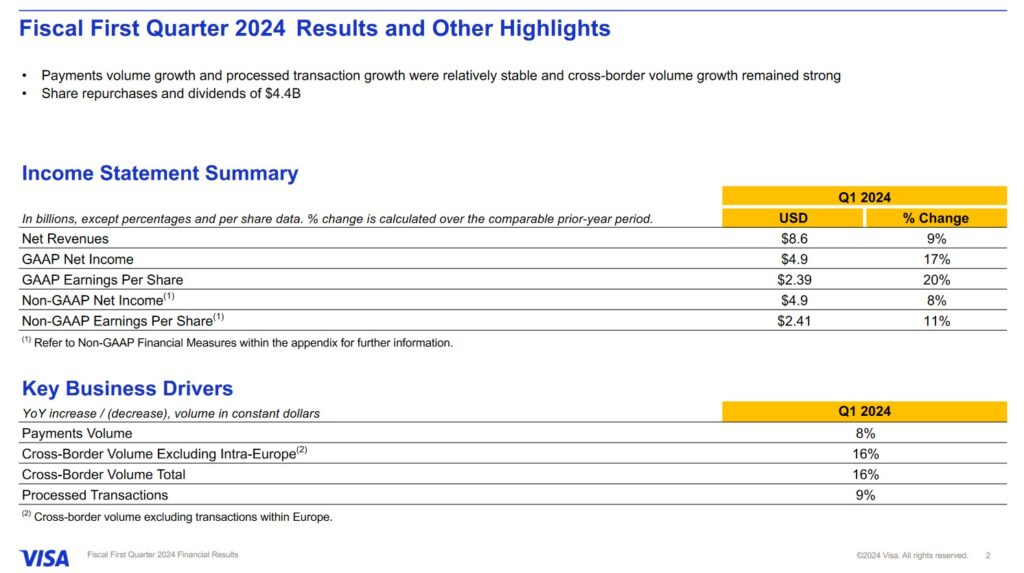

The Q1 results reflect relative stable growth in overall payments volume and process transactions and strong growth in cross-border volume.

GAAP operating expenses declined 6% driven by a decrease in the litigation provision. This, however, was somewhat offset by an increase in personnel expenses.

Non-GAAP operating expenses grew 7%, primarily due to an increase in personnel expenses.

Free Cash Flow (FCF)

The return to shareholders in Q1 2024 exceeds Q1 FCF, however, this is no cause for alarm. V rigorously prioritizes its capital allocation and is not about to jeopardize the company’s financial position. Investors should not look at one quarter in isolation but rather over a period of several years.

V’s FY2014 – FY2023 annual FCF (in billions of $) is 6.65, 6.17, 5.05, 8.61, 12.22, 12.03, 9.70, 14.52, 17.88, and 19.70.

Source: V – Q1 2024 Earnings Presentation – January 25, 2024

FY2024 Outlook

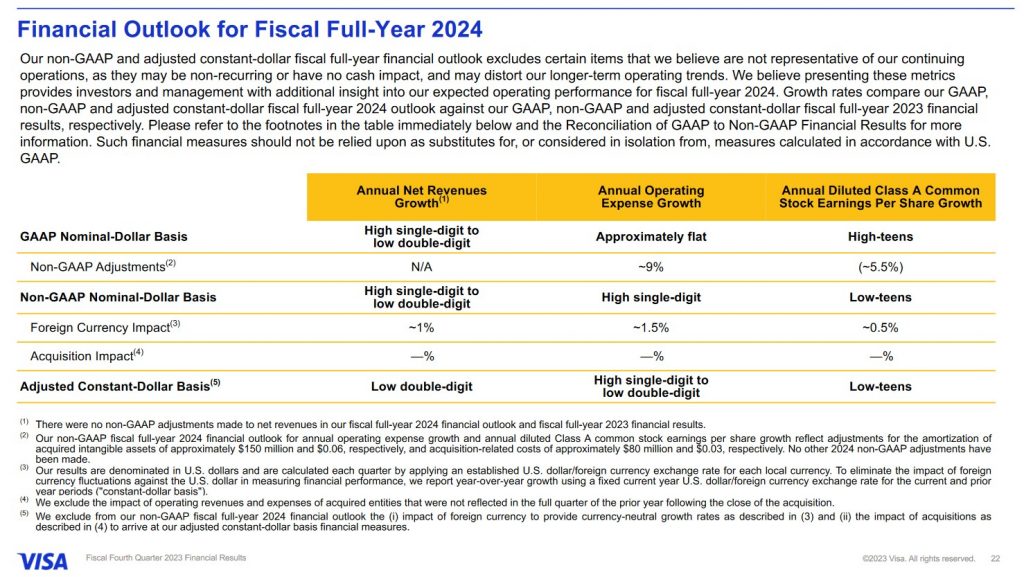

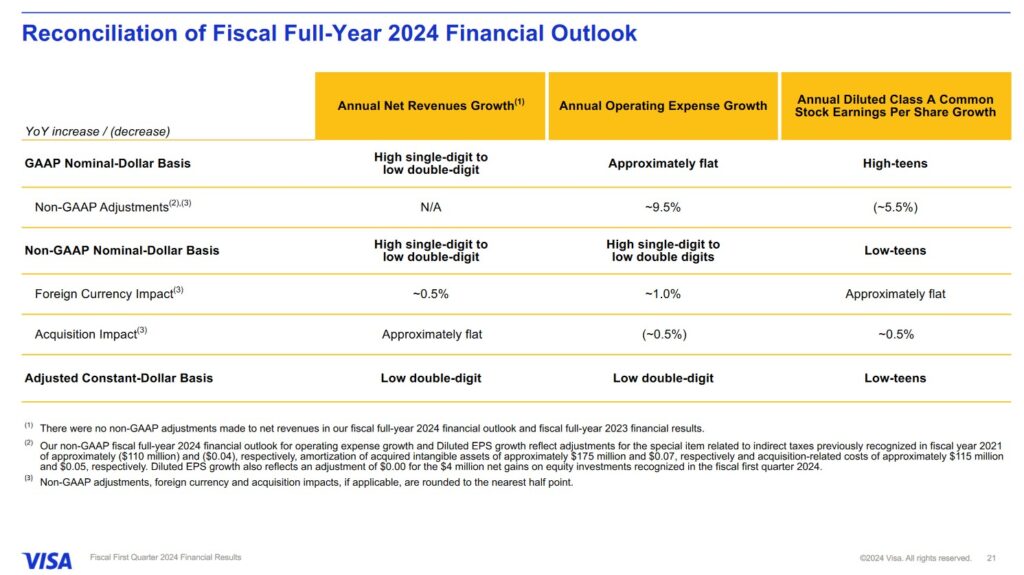

The following reflect V’s current and prior FY2024 financial outlook; there is no material changes to the prior outlook for adjusted net revenues or EPS growth.

Assumptions used to generate the FY2024 outlook include:

- no recession; and

- no further increase in Reg II impacts. Regulation II (Debit Card Interchange Fees and Routing) establishes standards for assessing whether a debit card interchange fee received by a debit card issuer for an electronic debit transaction is reasonable and proportional to the costs incurred by the issuer with respect to the transaction.

Source: V – Q1 2024 Earnings Presentation – January 25, 2024

Credit Ratings

I pay particularly close attention to the risk aspect of my investments. This includes an assessment of the maturity schedule of a company’s credit facilities and credit ratings.

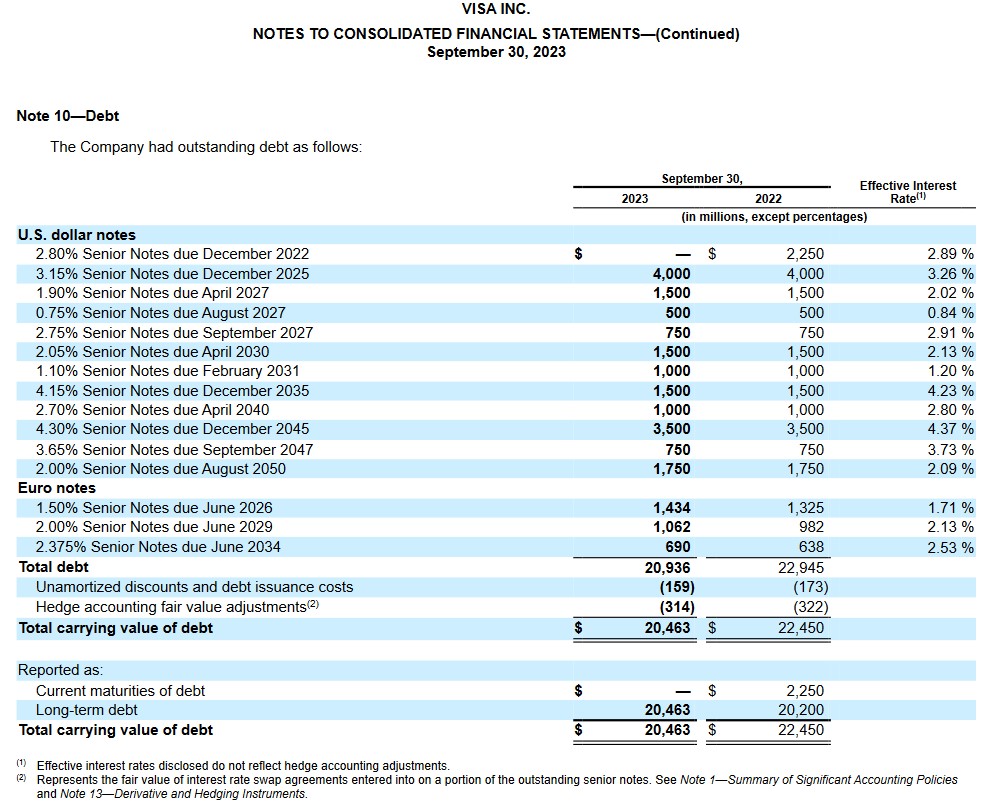

V’s Q1 2024 Form 10-Q has yet to be released as I compose this post, and therefore, I provide a schedule of its outstanding debt at FYE2023. The total carrying value of the debt on September 30, 2023 is very similar to the $20.703B reflected on the Q1 2024 Balance Sheet (page 6 of 11 in the January 25 Earnings Release).

V’s current unsecured domestic long-term debt credit ratings and outlook are:

- Moody’s: Aa3 (stable)

- S&P Global: AA- (stable)

These ratings are the lowest tier of the high-grade investment-grade category and define V as having a VERY STRONG capacity to meet its financial commitments. The ratings differ from the highest-rated obligors only to a small degree.

I see no reason why V should be unable to satisfy the terms and conditions of its credit arrangements.

Dividends and Share Repurchases

Dividend and Dividend Yield

V’s dividend history is accessible here.

On January 23, 2024, V’s Board declared its 2nd consecutive quarterly cash dividend of $0.52/share payable on March 1, 2024 to all holders of record as of February 9, 2024.

Including the upcoming $0.52/share dividend, I expect V to distribute 3 quarterly dividends of $0.52/share. I then envision at least a $0.07/share increase in the quarterly dividend to be declared in October. Should this materialize, the next 4 quarterly dividend payments should total $2.15 calculated as follows: ((3 x $0.52) + (1 x $0.59)).

With shares currently trading at ~$267, the forward dividend yield is less than 1% which is consistent with V’s historical dividend yield.

The majority of V’s total long-term investment return is likely to continue to be generated from capital appreciation.

Share Repurchases

The weighted average number of outstanding Class A shares in FY2013 – FY2023 (in millions of shares) is 2,624, 2,523, 2,457, 2,414, 2,395, 2,329, 2,272, 2,223, 2,188, 2,136, and 2,085. In Q1 2024, this had been reduced to 2,045.

During the 3 months ending on December 31, 2023, V repurchased 14.0 million shares of class A common stock at an average cost of $239.45/share for $3.4B. In addition, it had $26.4B of remaining authorized funds for share repurchases as of December 31, 2023.

Valuation

At the time of my October 25, 2023 post, V Shares were trading at ~$235. V’s forward adjusted diluted PE levels based on broker estimates were:

- FY2024 – 34 brokers – 24 using the mean of $9.86 and low/high of $9.16 – $10.18.

- FY2025 – 26 brokers – 21 using the mean of $11.18 and low/high of $10.65 – $11.60.

Shares now trade at ~$267. The valuation based on the current brokers’ forward earnings estimates are:

- FY2024 – 35 brokers – ~27 using the mean of $9.89 and low/high of $9.36 – $10.06.

- FY2025 – 35 brokers – ~24 using the mean of $11.15 and low/high of $9.72 – $11.59.

- FY2026 – 15 brokers – ~21 using the mean of $12.78 and low/high of $11.81 – $13.47.

As analysts updated their estimates over the coming days, I do not expect any meaningful change.

Final Thoughts

While V is currently fairly valued, I am not adding to my exposure because I want to acquire shares in undervalued high-quality companies.

As noted in several previous posts, I remain of the opinion that we are currently experiencing a period of irrational exuberance; a distinct possibility exists that we will experience a brief and unexpected broad market pullback within the next few months. If V’s share price gets caught in the downdraft, I intend to acquire additional shares at a slightly more favorable valuation.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long V.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.