Contents

Despite Visa (V) being my largest holding, I last reviewed it in my December 15, 2022 guest post at Dividend Power.

With the release of Q4 and FY2023 results and FY2024 outlook following the October 24 market close, I revisit this existing holding.

Potential Exchange Offer Program for Class B Common Stock

V was a bank-owned cooperative before going public in 2008. It adopted an unconventional share-class structure when it went public by issuing 3 classes of stock:

- the public owns Class A shares;

- US banks own Class B shares; and

- Foreign banks own Class C shares.

The reasoning for this share class structure at the time of the initial public offering (IPO) is that V faced litigation from merchants and sought to insulate future shareholders from loss claims related to merchant suits that dated back to when V was owned by the banks. The Class B shares made it so V's former bank owners would be responsible for litigation claims. Once all litigation was complete, the plan was for US banks to have the ability to sell their Class B shares.

V is not yet done resolving claims related to the 2005 merchant suit. It has, however, settled claims corresponding to about 90% of the associated payment volume at the time.

Now, V is exploring a potential exchange offer program that would have the effect of releasing portions of its Class B common stock. Given the complexity of the topic, V provides a simple overview of the proposal.

If the plan goes forward, V would let all shareholders vote on whether to let the banks unload some of their Class B shares before the resolution of all litigation. Through the potential exchange offer, banks would be able to swap half of their current Class B shares for Class C shares. In accordance with a staggered lock-up window, these banks would then be able to sell Class C shares while continuing to own Class B stock; the Class B shares would be renamed Class B-2 stock for participants in the offer and existing Class B stock would be dubbed B-1 shares.

Banks which exchange some Class B stock for Class C stock would be able to sell up to a third within the first 45 days, up to two-thirds within the first 90 days, and up to the full amount after that.

Under the terms and conditions of the proposal, there would be a requirement that all banks participating in the exchange offer sign an agreement stipulating that they would cover any additional loss litigation in the event the remaining Class B shares were insufficient to satisfy future claims.

The amendment would also allow for the possibility of three additional exchange offers down the line. These each could occur more than 12 months after the prior one and after a further 50% reduction of the interchange at issue in the longstanding merchant claims

Comprehensive information regarding the potential Exchange Offer Program for Class B Common Stock is accessible here.

Financial Results

A comprehensive overview of V is found within its FY2022 Form 10-K.

Q4 and YTD2023 Results

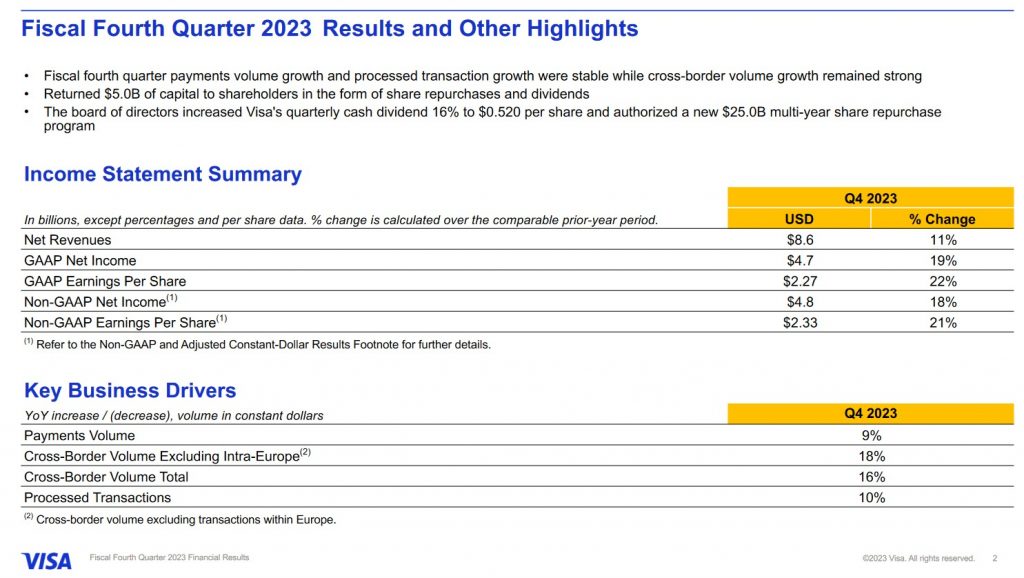

Please refer to the Q4 2023 material.

V's Q4 results reflect a continuation of recent trends. Consumer spending appears to be resilient and V is benefitting from a recovery in cross-border spending.

Although growth rates have been healthy, a growing number of consumers are experiencing financial stress. We are now beginning to uncover who was 'soaring with the eagles while the pigeons were s**tting on their head.

Generally, cardholders facing financial stress will try to tread water by servicing debt deemed to be a higher priority (eg. mortgage on a principal residence, automotive debt, etc.). Once a cardholder fails to meet their credit card obligations, their financial situation is generally pretty dire.

Fortunately, V does not absorb credit risk, unlike American Express which has direct exposure to cardholder delinquencies. The financial institutions which issue V-branded cards carry the risk unless they offload this risk to another party. V may not have the same type of credit risk exposure as American Express but its results could be negatively impacted if cardholders curtail their debit and credit card purchases.

On the bright side, V's revenue structure means it benefits from higher card spend. If, for example, a $100 item purchased with a V-branded credit card in 2022 is purchased for $125 in 2023, V receives a sliver more in revenue without a corresponding increase in the cost of processing the transaction.

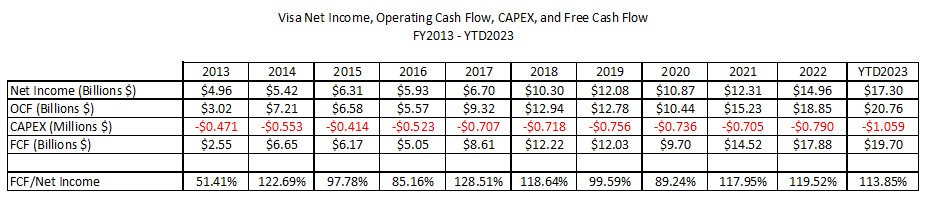

Free Cash Flow (FCF)

V continues to rigorously prioritize investment plans and manage expense growth in line with revenue growth expectations.

This is a long-cycle business. Investments made today typically have revenue growth 2 – 3 years in the future. As a result, V must continue to fund key growth initiatives across consumer payments, new flows and value-added services.

The following reflects the extent to which V generates FCF.

Source: V - Q4 2023 Earnings Presentation - October 24, 2023

FY2024 Outlook

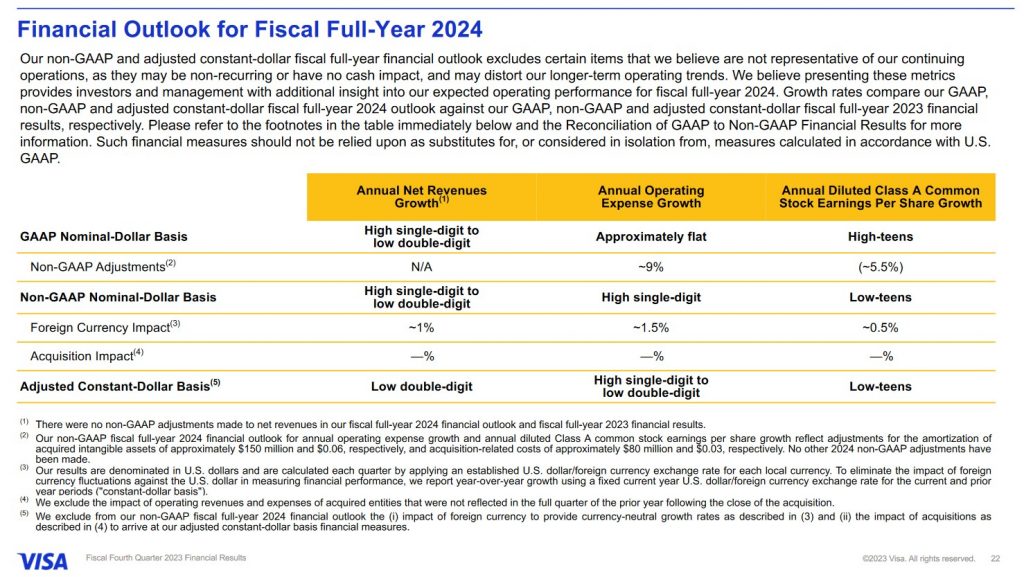

V expects low double-digit adjusted net revenue growth with the assumption that currency volatility will moderate slightly from Q4 levels.

The current plans are to grow adjusted operating expenses in the high single digit to low double digits. Nonoperating income is expected to be $0.25B - $0.3B.

An 18.5% - 19% tax rate is forecast for FY2024.

Adjusted net revenue growth is expected to be lower in the first half than in the second half of FY2024.

Since the Olympics are being held in 2024, V expects Q2 and Q3 expenses to have the largest percentage increases; V is a significant Olympic sponsor.

Source: V - Q4 2023 Earnings Presentation - October 24, 2023

Credit Ratings

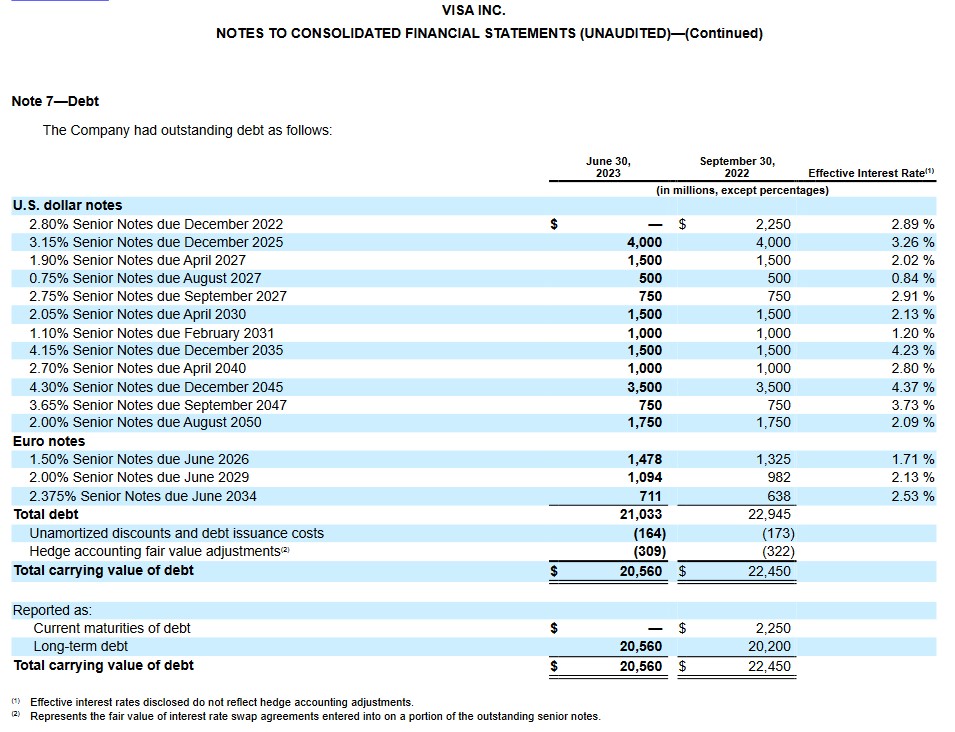

As a relatively risk-averse investor, I pay particularly close attention to a company’s liabilities. This includes an assessment of the maturity schedule of a company’s credit facilities and credit ratings.

V's FY2023 Form 10-K is currently unavailable as I compose this post, and therefore, I provide a schedule of its outstanding debt at the end of Q3 2023. The total carrying value of the debt on June 30, 2023 is very similar to the $20,463 reflected on the FYE2023 Balance Sheet (see page 8 of 14 in the October 24 earnings release).

Source: V - Q3 2023 Form 10-Q

V's current unsecured domestic long-term debt credit ratings and outlook are:

- Moody's: Aa3 (stable)

- S&P Global: AA- (stable)

These ratings are the lowest tier of the high-grade investment-grade category and define V as having a VERY STRONG capacity to meet its financial commitments. The ratings differ from the highest-rated obligors only to a small degree.

These ratings are acceptable for my conservative investor profile and I see nothing suggesting V is at risk of being unable to satisfy the terms and conditions of its credit arrangements.

Dividend and Dividend Yield

V's dividend history is accessible here.

V's Board has authorized a 15.6% increase in the quarterly Class A common stock dividend ($0.45 increased to $0.52) payable on December 1, 2023, to all holders of record as of November 9, 2023. With shares trading at ~$235 at the August 24 market close, the dividend yield is ~0.9%.

The weighted average number of outstanding Class A shares in FY2013 - FY2022 (in millions of shares) is 2,624, 2,523, 2,457, 2,414, 2,395, 2,329, 2,272, 2,223, 2,188, and 2,136. In Q4 2023, this had been reduced to 2,065.

During the 3 months ending on September 30, 2023, V repurchased 17.0 million shares of class A common stock at an average cost of $241.03 per share for $4.1B. In the twelve months ended September 30, 2023, V repurchased a total of 55.4 million shares of class A common stock at an average cost of $222.98/share for $12.4B.

V has $4.7B of remaining authorized funds for share repurchase as of September 30, 2023. V's Board, however, has just authorized a $25B multiyear share repurchase program.

Valuation

At the time of my April 27, 2022 post, V Shares were trading at ~$214. The valuation based on current adjusted earnings estimates was:

- FY2022 – 32 brokers – mean of $7.12 and low/high of $6.94 – $7.33. Using the mean estimate, the forward adjusted diluted PE is ~30 and ~29.2 if I use $7.33.

- FY2023 – 34 brokers – mean of $8.38 and low/high of $7.67 – $8.67. Using the mean estimate, the forward adjusted diluted PE is ~25.5 and ~24.7 if I use $8.67.

- FY2024 – 18 brokers – mean of $9.79 and low/high of $9.41 – $10.07. Using the mean estimate, the forward adjusted diluted PE is ~21.9 and ~21.3 if I use $10.07.

Shares now trade at ~$207. The valuation based on current adjusted earnings estimates is:

- FY2023 – 31 brokers – mean of $8.28 and low/high of $8.00 – $8.50. Using the mean estimate, the forward adjusted diluted PE is ~25 and ~24.4 if I use $8.50.

- FY2024 – 28 brokers – mean of $9.64 and low/high of $8.83 – $10.10. Using the mean estimate, the forward adjusted diluted PE is ~21.5 and ~20.5 if I use $10.10.

- FY2025 – 11 brokers – mean of $11.13 and low/high of $10.50 – $11.68. Using the mean estimate, the forward adjusted diluted PE is ~18.6 and ~17.7 if I use $11.68.

Using current adjusted diluted earnings broker estimates and the ~$235 share price at the August 24 market close, V's forward adjusted diluted PE levels are:

- FY2024 – 34 brokers – 24 using the mean of $9.86 and low/high of $9.16 – $10.18.

- FY2025 – 26 brokers – 21 using the mean of $11.18 and low/high of $10.65 – $11.60.

Since V just released its results following the October 24 market close, I expect the estimates reflected above will change slightly over the coming days. The changes are unlikely to affect my overlook outlook on V.

Final Thoughts

As a Visa (V) shareholder almost from the day it went public on March 18, 2008, I have also increased my exposure over the years. I only disclose 225 V shares held in a 'Core' account in the FFJ Portfolio but V is my largest holding; most shares are in a retirement account for which I do not disclose details.

I like V as a long-term investment but shares are now fairly valued. My recommendation is to acquire shares in great companies that have temporarily fallen out of favour with investors such as:

- Danaher (DHR);

- Thermo Fisher (TMO)

- BlackRock (BLK)

- Agilent (A)

- Automatic Data Processing (ADP)

- Home Depot (HD)

- Goldman Sachs (GS)

- Genuine Parts (GPC)

- Canadian Pacific Kansas City Limited (CP.to)

- Nasdaq (NDAQ)

There is nothing fundamentally wrong with these companies and just like any other purchase, the time to buy is when things go on sale. It is critical, however, that any investment be made from a long-term hold perspective. In the short term, we have no control over share price behaviour. In the long term, however, a great company's share price is likely to represent its fair value.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long V and all other companies referenced in this post.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.