Contents

I last reviewed Blackstone (BX) in this October 22, 2023 post at which time it had just released its Q3 and YTD2023 results. Now that BX has released its Q4 and FY2023 results on January 25, I take this opportunity to revisit this existing holding.

Business Overview

I encourage you to review the company's website and Part 1 of the FY2022 Form 10-K (the FY2023 Form 10-K has yet to be released as I compose this post).

The 'Our Businesses' section of BX's website has a menu of the areas in which BX invests. Over the years, it has established an unparalleled global platform of leading business lines, offering over 70 distinct investment strategies.

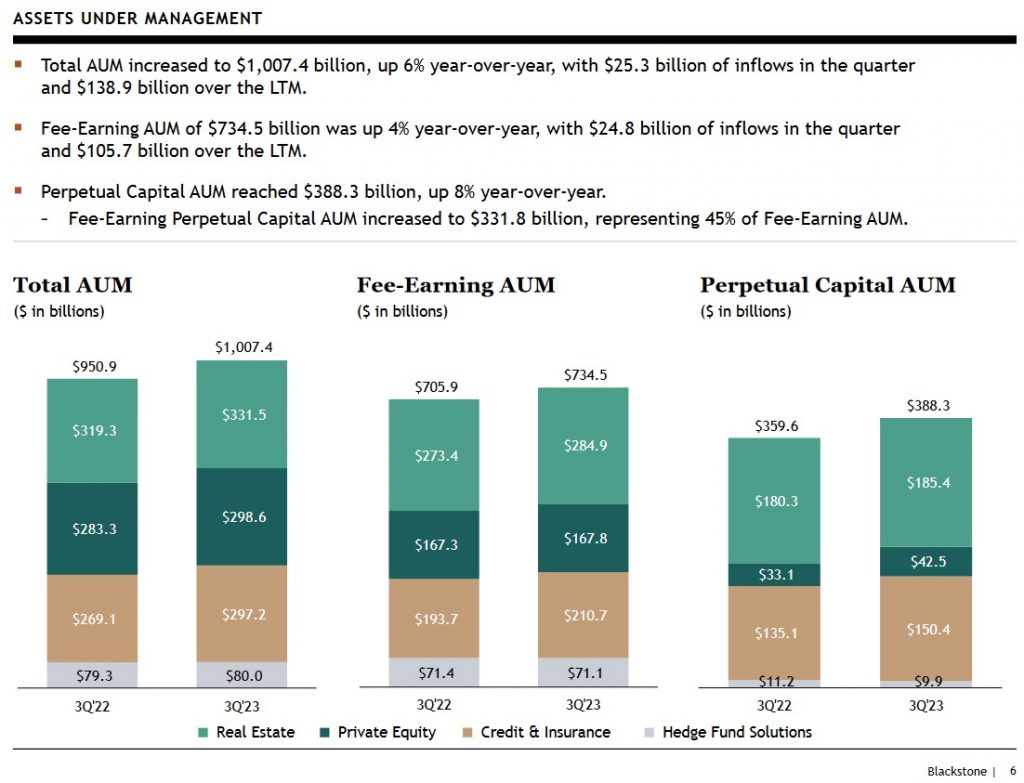

BX has surpassed the $1T level in total Assets Under Management (AUM) and reached this level more than 3 years ahead of the aspirational road map presented at the 2018 Investor Day (see presentation).

Financials

Q4 and FY2023 Results

The most recent results are accessible here and in the accompanying Q4 2023 Supplemental Financial Data. In particular, refer to pages 18 and 19 which reflect a high-level overview of the various funds BX manages.

I am unable to ascertain what are the underlying assets in each fund. When researching companies, however, I am often surprised to learn that BX has a stake.

Recently, a follower of this blog asked me for my opinion about Rover Group, Inc. (ROVR). I told him to stop wasting his time as the company had agreed to be acquired by BX!

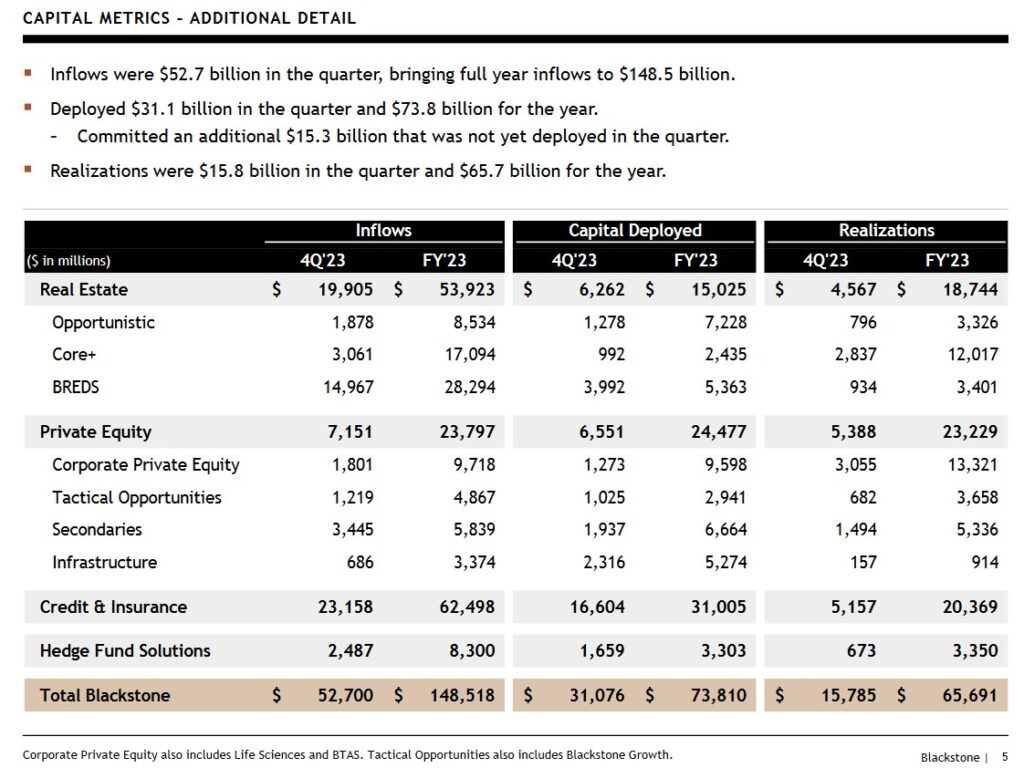

BX has a diverse range of growth engines that enable it to continually generate inflows, deploy capital, and generate realizations.

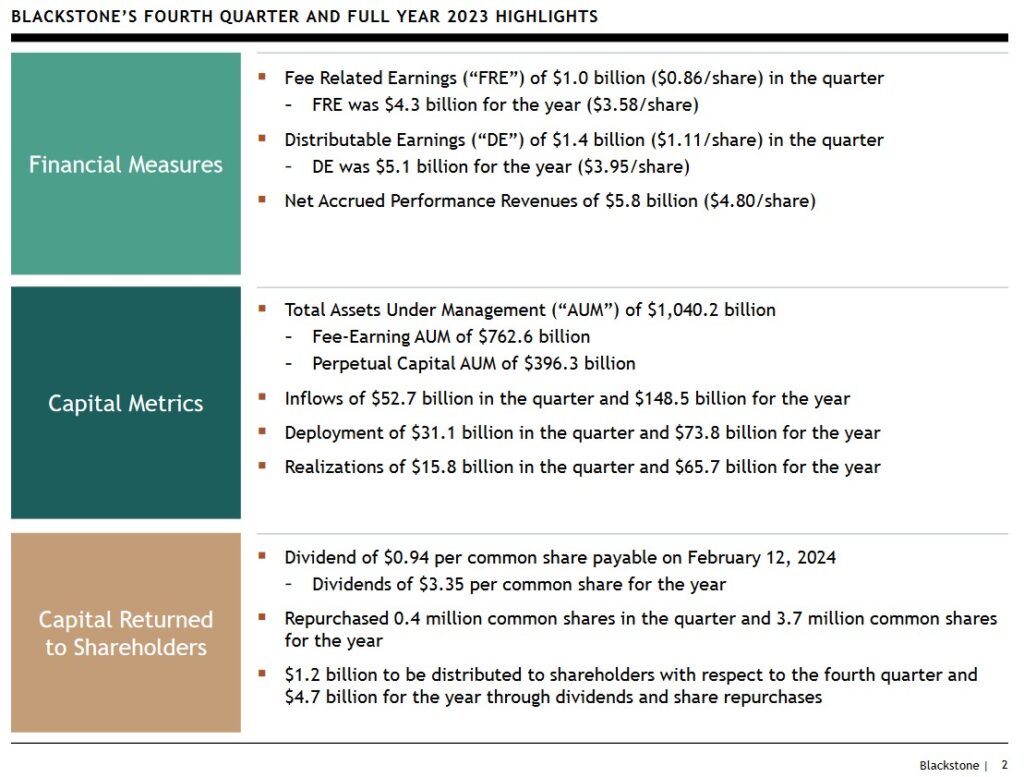

Source: BX - Q4 and FY2023 Earnings Presentation - January 25, 2024

FY2024 Outlook

In July 2023, PwC released the findings of its '2023 Global Asset and Wealth Management Survey' in which it is estimated that 1 in 6 asset and wealth management companies globally are likely to disappear or be acquired by 2027. This is twice the normal turnover rate and BX, arguably the industry leader, stands to benefit if there is industry consolidation.

In the last several months, private equity firms slammed the brakes on deals after an era of easy money and cheap financing as the Federal Reserve’s interest-rate hikes drove up borrowing costs. BX, however, has made several investments yet it still has ~$200B of 'dry powder' to deploy and it continues to generate significant inflows.

In a January 25, 2024 interview on Bloomberg Television, Jon Gray (President and Chief Operating Officer) discusses how the firm is poised to take advantage of the 'virtuous cycle'. In this interview he states:

There’s this movement from higher cost of capital in the last two years to what appears to be a lower cost of capital as inflation has come down. There is a virtuous cycle that happens when you get this regime shift.

Not only are buyout firms starting to signal a readiness to deal again, they are also under mounting pressure from investors to return cash to investors.

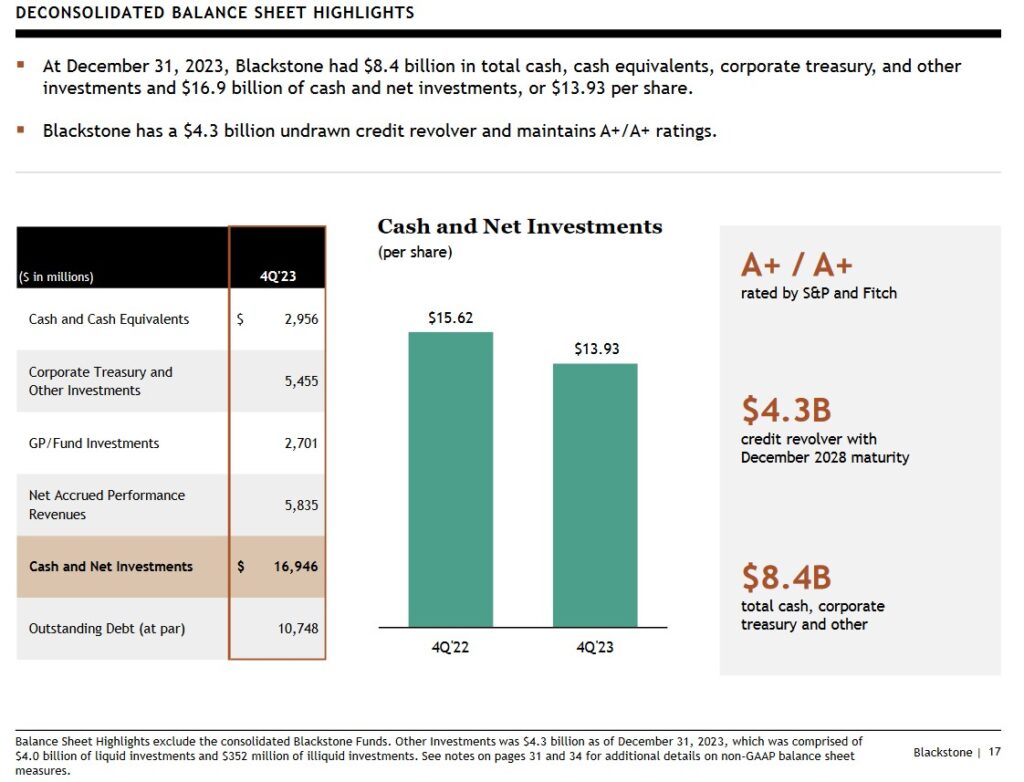

Credit Ratings

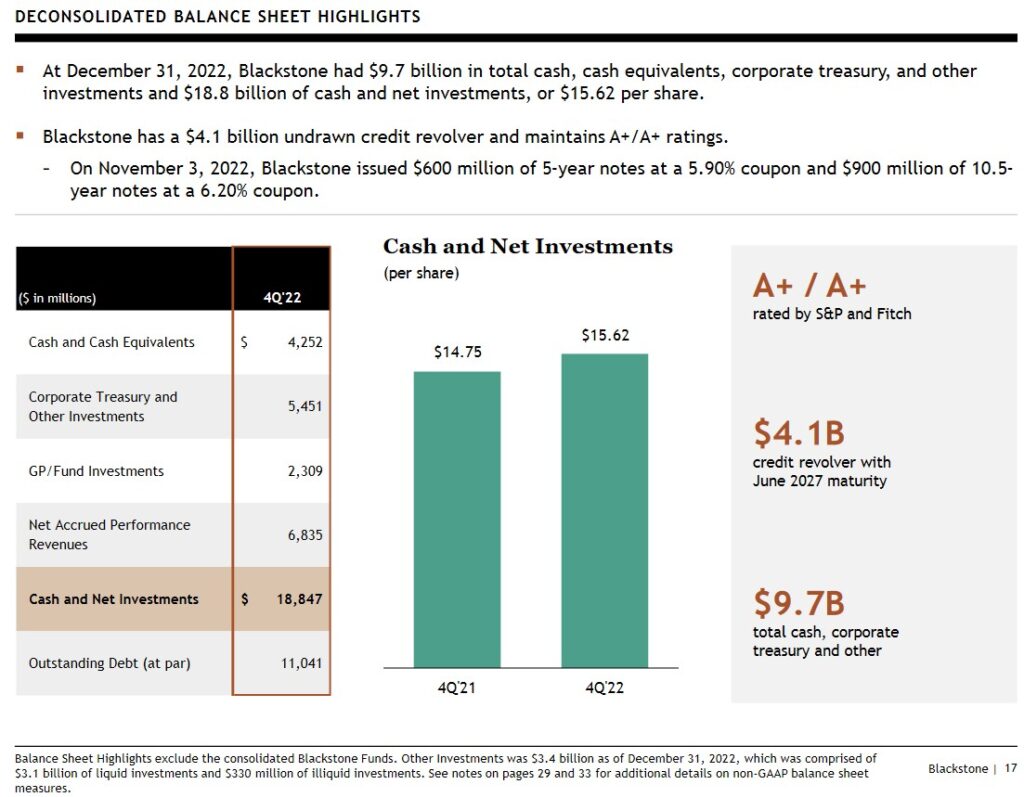

BX's senior unsecured domestic long-term debt ratings are at the top of the upper-medium-grade investment-grade tier. There is no change from prior reviews.

- S&P Global assigns an A+ long-term unsecured debt credit rating with a stable outlook; and

- Fitch assigns an A+ long-term unsecured debt credit rating with a stable outlook;

These ratings define BX as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

These are BX's deconsolidated Balance Sheet highlights for Q4 2023.

Source: BX - Q4 and FY2023 Earnings Presentation - January 25, 2024

For comparison purposes, these are BX's deconsolidated Balance Sheet highlights for Q4 2022.

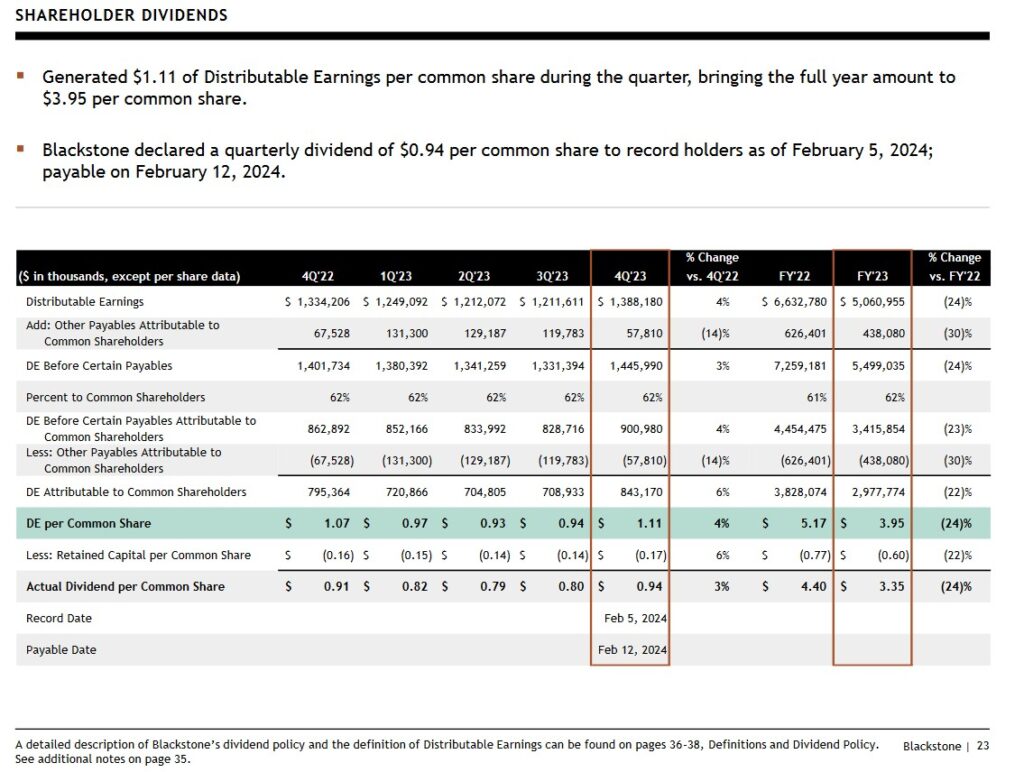

Dividend and Dividend Yield

BX distributes a quarterly dividend. Its distributions are, however, unconventional and fluctuate depending on Distributable Earnings (DE). BX's distribution policy states:

'We intend to pay to holders of common stock a quarterly dividend representing approximately 85% of The Blackstone Group Inc.’s share of Distributable Earnings, subject to adjustment by amounts determined by our board of directors to be necessary or appropriate to provide for the conduct of our business, to make appropriate investments in our business and funds, to comply with applicable law, any of our debt instruments or other agreements, or to provide for future cash requirements such as tax-related payments, clawback obligations and dividends to shareholders for any ensuing quarter. The dividend amount could also be adjusted upward in any one quarter.'

Because BX's quarterly dividend fluctuates, I do not calculate BX's forward dividend yield.

Source: BX - Q4 and FY2023 Earnings Presentation - January 25, 2024

I look at an investment's total potential long-term return perspective (capital gains and dividend income). Inconsistency in BX's quarterly dividend, therefore, is irrelevant for my purposes.

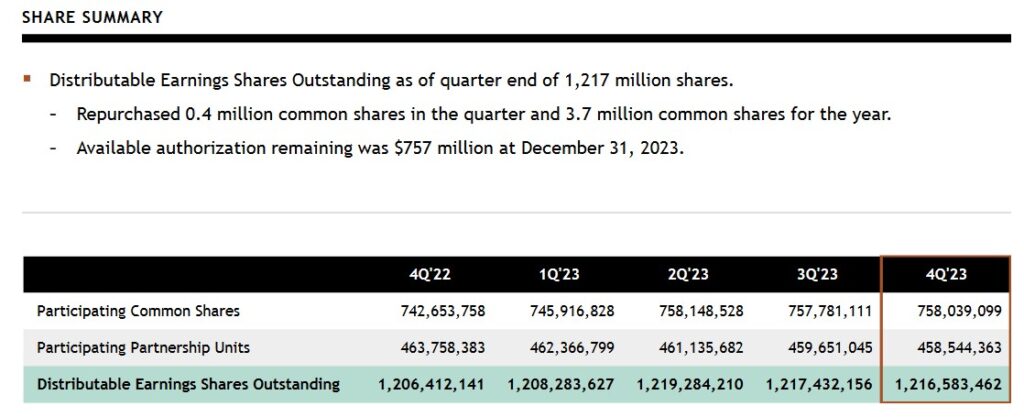

BX is hyper-focused on capital allocation. The extent to which it repurchases shares depends on whether there is a meaningful deterioration in BX's share price relative to the true underlying value.

Source: BX - Q4 and FY2023 Earnings Presentation - January 25, 2024

Valuation

I typically look at:

- diluted EPS;

- adjusted diluted EPS; and

- Free Cash Flow (FCF)

metrics to gauge the valuation of most companies I analyze. These metrics, however, are of little relevance when trying to assess BX's performance and outlook.

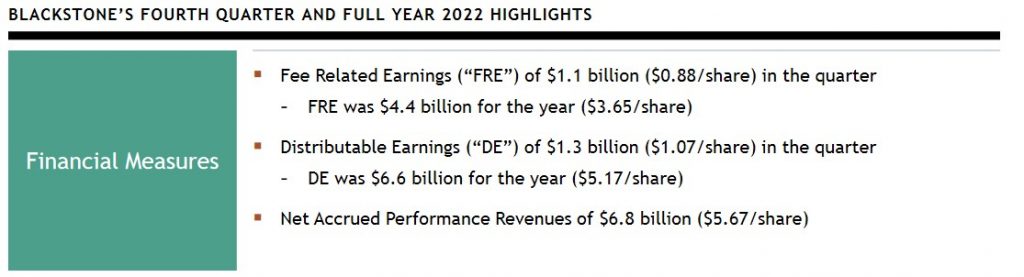

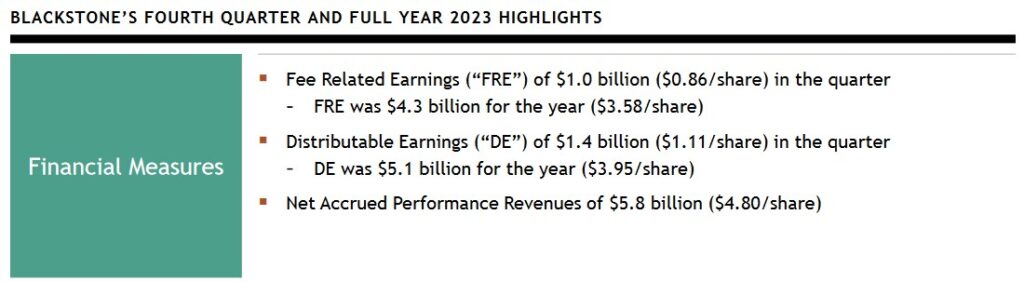

BX uses Distributable Earnings (DE) and Fee Related Earnings (FRE) to more accurately measure its performance; these, and other terms, are defined within the FY2022 Form 10-K.

The very manner in which BX operates makes it virtually impossible to forecast them which explains why BX does not provide guidance.

BX is not easy to value because it raises large pools of capital from clients for deployment thus resulting in multiple multi-billion-dollar acquisitions annually. Because it continually makes sizable acquisitions or divestitures, earnings estimates can quickly become outdated.

Some of the assets are meant to be perpetual holdings. In other cases, BX uses its expertise to improve the performance of the companies in which it invests with the intent of monetizing these assets as part of its capital recycling programs. It is not, therefore, unusual to see wide swings in YoY GAAP results.

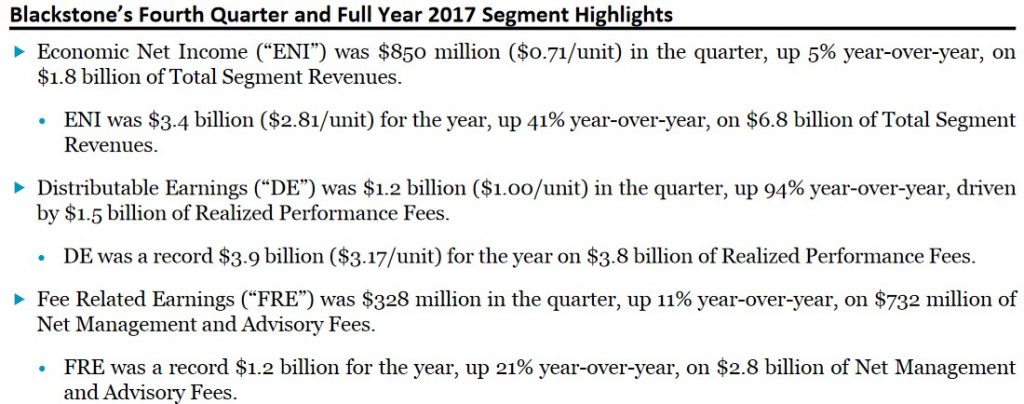

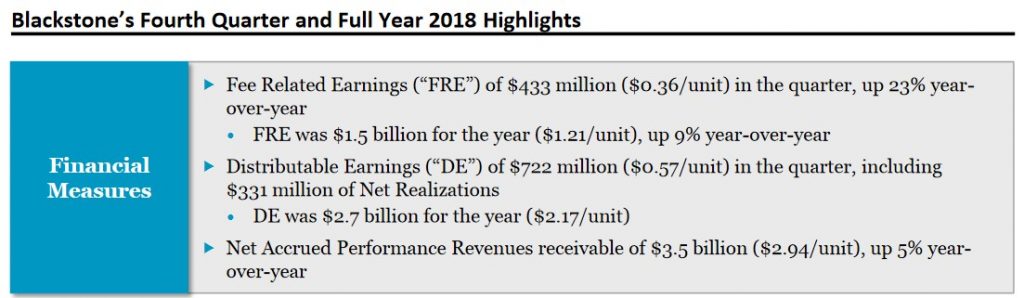

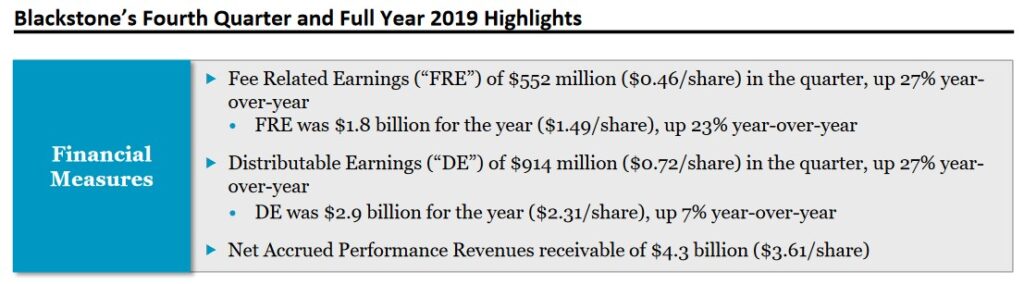

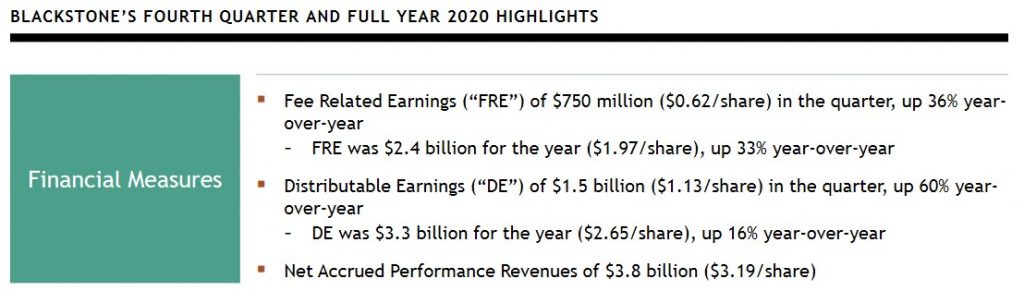

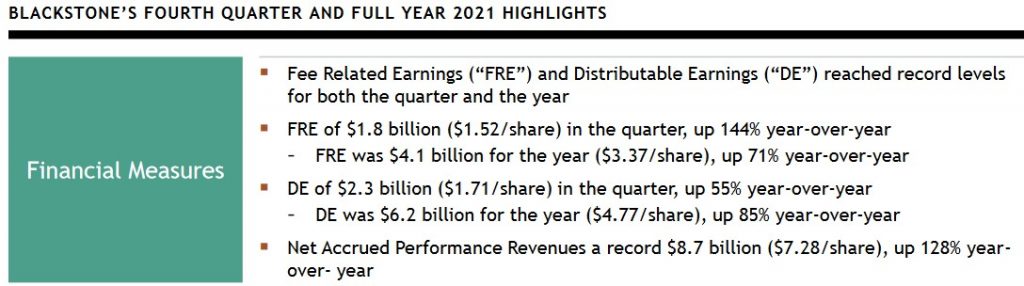

Fluctuations in quarterly FRE and DE are to be expected so they do not factor into my investment decision making process. I am more interested in the long-term trend of these two metrics. I, therefore, like to compare annual FRE and DE over several years.

When we compare BX's DE and FRE for FYE 2017 - FY2023, we see a noticeable increase in recent years relative to just a few years ago.

At December 31, 2016, for example, BX had $366.6B of AUM. At December 31, 2023 had $1,040.2B! As AUM grows, it stands to reason that DE and FRE should also grow over the very long-term.

Naturally, DE and FRE will fluctuate depending on market/economic conditions. If market/economic conditions are not conducive to the immediate the sale of certain assets, BX may elect to continue to manage the AUM until such time as market/economic conditions improve.

On the Q4 earnings call, Stephen Schwarzman (Chairman, CEO & Co-Founder) stated:

Performance revenues were down as expected in the context of limited realizations as we choose to sell less in unfavorable markets. We've designed the firm to provide resiliency in times of stress and capture the upside as markets recover.

Jon Gray also stated on the earnings call:

We're planting seeds for future realizations at a favorable moment. In closing, we're optimistic on the path ahead with multiple powerful dynamics unfolding in our business. Their recovery will not be a straight line, but as always, our brand and track record will continue to drive us forward and our shareholders stand to benefit from the firm's substantial embedded earnings power over time.

Source: BX - Q4 and FY2023 Earnings Presentation - January 25, 2024

Using the DE for FY2017 - FY2023 and the approximate share price on the date of the earnings release, we get the following P/DE valuations.

- FY2017: ~$37/$3.17 = ~11.7

- FY2018: ~$34/$2.17 = ~15.7

- FY2019: ~$61/$2.31 = ~26.4

- FY2020: ~$65/$2.65 = ~24.5

- FY2021: ~$119/$4.77 = ~25

- FY2022: ~$94/$5.17 = ~18.2

- FY2023: ~$124/$3.95 = ~31.4

Most of the companies in which I have exposure provide their guidance/outlook for the current fiscal year. BX does not do this because DE depends heavily on the sale (and timing) of asset sales.

Currently, BX shares appear to be expensive relative to recent prior years. We must, however, remember that BX is continually increasing AUM from which it earns fees. Given the manner in which BX generates DE, it stands to reason that there is a highly probability that it will generate more DE when it has over $1T in AUM than on, for example, the ~$400B in AUM at December 31, 2016.

BX is not about to suddenly discontinue its efforts to increase AUM. As a result, it is realistic to expect it to potential reach $1.5T - $2T in AUM by 2034. It is conceivable that BX could be consistently generating at least $4.25 of DE over each of the next 5 years, for example, and over $5.00 of DE over each of years 5 - 10. When viewed in this manner, we get a different perspective on the current ~31.4 P/DE.

Final Thoughts

Alternative asset exposure (eg. private equity, private debt, hedge funds, real estate, commodities, structured products, venture capital) can produce attractive long-term investment returns. Directly investing in alternative assets, however, is beyond my risk tolerance. This is why a portion of my alternative asset exposure is through BX.

A drawback with a BX investment is that it is impossible to know what investments are held within each fund. My BX investment, therefore, is partially made on the premise that BX is in the business of making money for highly sophisticated investors. Given that wealthy investors entrust billions with BX, I am inclined to 'follow the money'.

Furthermore, senior BX executives have significant share ownership and have considerable incentive to ensure BX's long-term success.

I currently hold 1481 BX shares in a 'Core' account in the FFJ Portfolio and it was my 12th largest holding when I completed my 2023 Year End FFJ Portfolio Review. Shares are held in a taxable account so as a Canadian resident I incur a 15% dividend withholding tax. Depending on BX's share price and the quarterly dividend, the automatic reinvestment of the dividend income typically adds 9 - 11 shares to my exposure every quarter.

I agree with BX's President and COO in that BX is well positioned to capitalize on the 'Virtuous Cycle' and fully intend to increase my exposure. Given current irrational market conditions, however, I am reluctant to deploy capital. I will acquire additional shares if/when we experience a sudden broad market pullback or if/when BX's share price come under pressure.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long BX.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.