Contents

Zoetis Inc. (ZTS) is expanding its broad product portfolio through the internal development of new products and also by way of acquisition.

It released its Q2 and YTD2019 results and updated FY2019 guidance on August 6, 2019.

Summary

- ZTS' global infrastructure gives it a cost advantage over its peers.

- ZTS is expanding its broad product portfolio through the internal development of new products and also by way of acquisition (Abaxis in 2018 and impending acquisition of Platinum Performance).

- A great company does not necessarily translate into a good investment if the valuation is unreasonable.

Introduction

When I wrote my previous Zoetis Inc. (ZTS) article on August 3, 2018 I did not disclose the name of the company other than to subscribers of this site. Based on my analysis at the time, I came away with the opinion that ZTS shares were richly valued and that I would pass on initiating a position. In the ‘Final Thoughts section of that article I stated that while ZTS is an impressive company, an impressive company and a reasonable valuation are separate and distinct.

Subsequent to writing that article, ZTS’ share price did pull back and briefly touched the high $70s/low $80s in mid December 2018; I did not initiate a position in ZTS when shares pulled back as I deployed money toward the purchase of shares in other companies.

Subsequent to mid December, ZTS’ share price has experienced a significant run-up and shares are trading at $125.07 as I compose this article.

The following have recently occurred which have prompted me to revisit ZTS.

- We recently had to purchase animal medication of which some was manufactured by ZTS. Wow, animal medication is expensive!

- On July 22nd, ZTS announced that it had entered into an agreement to acquire Platinum Performance, a privately held, nutrition-focused animal health company. Our daughter is an avid barrel racer and Platinum Performance products have a good reputation within the equine community.

- On August 6th, ZTS released Q2 and YTD2019 results and updated FY2019 guidance.

Business Overview

While I provided an overview of ZTS in my August 3, 2018 article I now provide the following additional high level information.

Although ZTS is the largest within its industry based on revenue in the animal health medicines, vaccines and diagnostics industry, it has primary competitors which produce animal health medicines, vaccines and diagnostic companies. Some of these competitors are divisions of global pharmaceutical companies.

- Boehringer Ingelheim Animal Health Inc., the animal health division of Boehringer Ingelheim GmbH;

- Merck Animal Health, the animal health division of Merck & Co., Inc.;

- Elanco Animal Health, an independent animal health company as of September 2018 and formerly the animal health division of Eli Lilly and Company;

- Bayer Animal Health, the animal health division of Bayer AG;

- IDEXX Laboratories.

Principal drivers of competition vary depending on the particular region, species, product category and individual product, and include new product development, quality, price, service and promotion to veterinary professionals, pet owners and livestock producers.

Competition also includes several new start-up companies working in the animal health area and numerous producers of animal health products on a global basis.

There is also competition from generic products which varies from market to market. The level of generic competition, for example, is higher in Europe and certain emerging markets than in the United States.

Unlike the human health market, there is no large, well-capitalized global company focused on generic animal health products that exists as a global competitor. Reasons for this include:

- the relatively smaller average market size of each product opportunity;

- the importance of direct distribution and education to veterinarians and livestock producers;

- the primarily self-pay nature of the business.

ZTS has also indicated that companion animal health products are often directly prescribed and dispensed by veterinarians. The importance of quality and safety concerns to pet owners, veterinarians and livestock producers also contributes to animal health brand loyalty. On this basis, ZTS believes that significant brand loyalty to products often continues after the loss of patent-based and regulatory exclusivity.

Platinum Performance Acquisition

ZTS continue to support future growth through business developmental activities with the impending acquisition of Platinum Performance being the most recent example.

Platinum Performance features premium nutritional product formulas and a unique approach to the field of scientific wellness for horses as well as dogs and cats. ZTS’ expansion in nutrition will further strengthen its portfolio in the equine and pet care markets and will contribute toward ZTS’ increasing focus on health and wellness.

This acquisition is expected to be completed in Q3 and the plan is to expand the Platinum Performance equine business through ZTS’ U.S. field force, accelerate the growth in Platinum Performance’s pet care formulas with veterinarians and pet owners through digital marketing capabilities, and evaluate international expansion opportunities over the long-term.

Q2 2019 Financial Results

On August 6th, ZTS released its Q2 2019 results and updated its FY2019 guidance. ZTS’ Q2 2019 Earnings Presentation can be accessed here.

Prior to the release of its Q2 2018 results, ZTS announced that it had closed the acquisition Abaxis, a leader in the development, manufacture and marketing of diagnostic instruments for veterinary point-of-care services for ~$2.0B. At the time the acquisition was announced, Abaxis had recently reported revenue of $0.244B for FY2018 which had ended March 31, 2018; this was an 8% increase from FY2017.

In Q2 2019, ZTS increased operational revenue by 14% with diagnostic sales from the Abaxis acquisition accounting for 5% of that overall growth. ZTS’ companion animal portfolio is continuing its positive momentum with 22% of operational revenue growth based on diagnostic sales from the Abaxis acquisition, strong sales of key dermatology drugs, and parasiticides.

Livestock product sales returned to growth in Q2 with 3% operational growth and with increases across all species. Poultry products experienced the highest level of operational growth at 15%. This was, however, partially offset by more modest growth in the fish, cattle and swine lines which were negatively impacted by African Swine Fever in China.

African Swine Fever remains a major factor for the overall industry growth in 2019 and an industry forecast expects the animal health industry to grow ~4% compared to 5.6% in 2018. Management is of the opinion ZTS’ diverse portfolio across species, geographies and therapeutic areas will help it grow revenues faster than the market in 2019.

Adjusted net income grew by 17% in Q2 and was ZTS’ highest gross margin ever recorded.

FY2019 Guidance

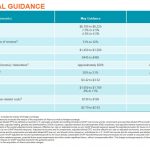

The following FY2019 guidance was provided when ZTS released its FY2018 results on February 14, 2019.

Source: ZTS – Q4 2018 and FY2018 Earnings Presentation - February 14 2019

As we can see from the following image, ZTS modified its guidance when Q1 2019 results were released May 2, 2019.

Guidance has once again been modified to reflect an increase and a narrowing of revenue and adjusted diluted EPS guidance for the year. This has been done on the basis of positive performance in the first half of 2019.

Source: ZTS - Q2 2019 Earnings Presentation- August 6 2019

Despite increased Operational Revenue Growth guidance, management expects Q3 operational revenue growth to be lower than in the first half of the year. This is due to Abaxis having less of an impact on growth as the purchase of this entity closed July 31 2018. In addition, ZTS expects to continue to see market challenges due to African Swine Fever and the weakness in the U.S. dairy and beef sectors. Growth will also be impacted by moderated price increases in the U.S. as well as the recovery of the Brazil truck driver strike and increased revenue in Q3 2018.

Q3 will also reflect higher operating expenses with ZTS expecting ~$0.1B in incremental capital expenditures related to information technology and manufacturing to support the Abaxis acquisition, improvement in cost efficiencies, and increased capacity. ZTS anticipates operating expenses will continue at this elevated level for the next three years as further investment will be made in manufacturing and infrastructure to support future growth and product launches.

Credit Ratings

Looking at the following schedule of long-term debt extracted from ZTS’ Q2 2019 10-Q we see that the interest rates associated with ZTS’ long-term debt are reasonably attractive. We also see that the maturity dates of its obligations are well diversified; I am of the opinion ZTS should be able to service its obligations, at least within the next few years, without any difficulty.

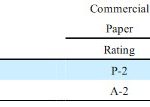

The following table provides the current ratings assigned by Moody’s and S&P Global to ZTS’ commercial paper and senior unsecured non-credit-enhanced long-term debt.

Source: ZTS 2018 – 10-K (page 61 of 146)

Moody’s initiated coverage in January 2013 at which time it rated ZTS’ senior unsecured debt Baa2 which is the middle tier of the ‘lower medium grade’ rating; this is 2 notches above non-investment grade. In August 2017, Moody’s upgraded the debt to Baa1 and this is the current rating. This is upper tier within the lower medium grade category.

S&P Global rates ZTS’ senior unsecured long-term debt BBB which is the middle tier of the ‘lower medium grade’ rating; this is 2 notches above non-investment grade and is one notch lower than Moody’s assigned rating.

Neither agency has ZTS’ credit ratings under review.

These ratings are satisfactory for my purposes.

Valuation

At the time of my August 3, 2018 article, ZTS’ stock price had just jumped $5.41 or 6.29% to close at $91.43 on August 2nd.

In its Q2 2018 Earnings Release, ZTS’ guidance for FY2018 was reported diluted EPS of $2.72 - $2.89 giving us a forward diluted PE of ~31.6 - ~33.6. On an adjusted basis, FY2018 adjusted diluted EPS guidance was $3.00 - $3.10 giving us a forward adjusted PE range of ~29.5 - ~30.48.

On February 14, 2019 when ZTS released FY2018 results, shares were trading at $93.26 and ZTS had just reported FY2018 diluted EPS of $2.93 and adjusted diluted EPS of $3.13 giving us a diluted PE of ~31.83 and an adjusted diluted PE of ~29.80.

Guidance now calls for reported diluted EPS of $2.93 - $3.04 and adjusted diluted EPS of $3.53 - $3.60. With shares having closed at $125.07 on August 9th we get a forward diluted PE range of ~41.14 - ~42.69 and a forward adjusted diluted PE range of ~34.74 - ~35.43.

While I am of the opinion that ZTS has a promising future I just can’t justify paying almost $42 to receive a $1 in return.

Dividend, Dividend Yield and Dividend Payout Ratio

I am unable to locate ZTS’ brief dividend history on its website and recommend you look at its history found here….https://www.nasdaq.com/symbol/zts/dividend-history; I expect ZTS will be declaring its 4th $0.164/share quarterly dividend within the next 2 weeks.

With a current dividend yield of ~0.52% I fully expect that investors who rely heavily on stock screeners to seek investments with attractive dividend yields will completely overlook ZTS as a potential investment.

On the basis of reported diluted EPS guidance of $2.93 - $3.04, the $0.656 annual dividend is a payout of ~21.6% - ~22.4%. I consider this to be an attractive margin of safety.

In the first half of FY2019, ZTS repurchased ~$0.3B of its shares; the diluted weighted average shares outstanding as at FYE2018 was 486,898 and 482,700 for the 6 month period ending June 30, 2019 (shares outstanding are expressed in thousands); this figure was 502,025 in FY2014.

There is ~$2B remaining under the multi-year share repurchase plan that was approved in 2018 and management remains committed to its capital allocation priorities of internal investments, M&A and the return of excess cash to shareholders.

Final Thoughts

I like ZTS because its global infrastructure gives it a cost advantage over its peers. I am also impressed with its broad product portfolio. I just can’t, however, justify the current valuation.

In my opinion, if you were to initiate a ZTS position when the forward diluted PE is in the ~41 – 42 range you would need to be confident that there will be no ‘bumps in the road’. Essentially, there is no margin for error and investing at such a high valuation when trade tensions are having an impact globally does not seem to be prudent from my perspective.

ZTS’ volatility is lower than that of the broad market so a pullback to December 2018 levels in the low $80s might be a stretch. A pull back to the low $90s would mean a pullback of ~28% from the current $125.07 share price; this does not seem totally unreasonable from my perspective.

Should ZTS retrace to the low $90s I would very seriously consider initiating a position but naturally would need to weigh an investment in ZTS relative to other investment opportunities.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently hold a position in ZTS and do not intend to initiate a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.