I last reviewed Merck & Co., Inc. (MRK) in this January 13, 2022 guest post at Dividend Power. At the time of that post, MRK’s Q3 2021 results were the most recent.

With the release of Q3 and YTD2022 results and a revised FY2022 outlook on October 27, 2022, I take this opportunity to revisit MRK. Based on my analysis below, I suggest you pass on MRK and invest in other great companies that have temporarily fallen out of favour.

Business Overview

MRK has transformed over the last couple of years. You may find it beneficial to review the company’s website, the FY2021 10-K, the Q2 2022 Form 10-Q (the Q3 2022 Form 10-Q is currently unavailable as I compose this post), and the recently released Q3 2022 results for which links are provided below.

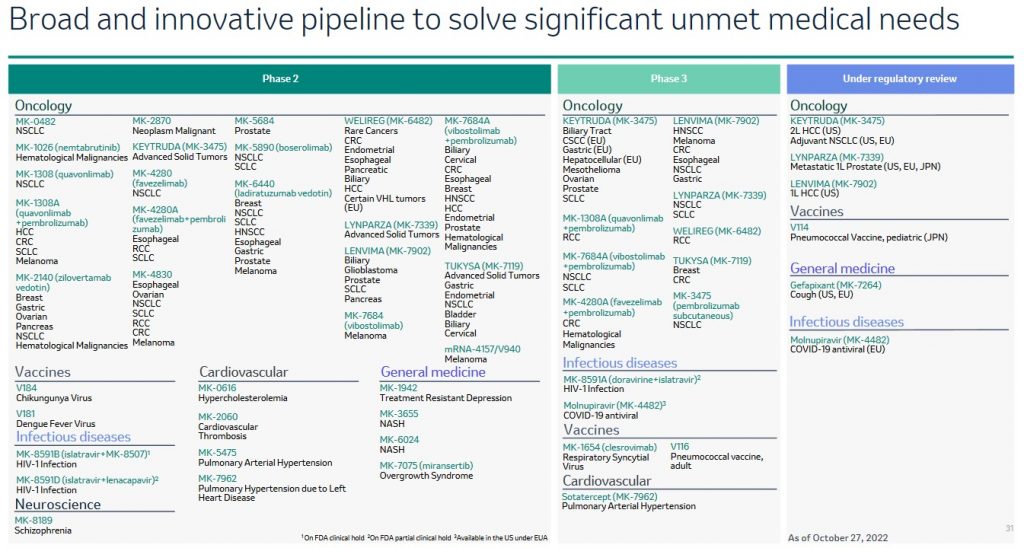

Pipeline

A key factor in determining whether to invest in a pharmaceutical company is the robustness of a company’s pipeline.

MRK’s current pipeline includes 83 programs in Phase 2. Most programs will likely not make it beyond Phases 2 or 3.

MRK, for example, has just announced that it is discontinuing further investment in the investigational Oncolytic Immunotherapy acquired from its 2018 purchase of Viralytics. This asset was under development to treat melanoma, breast cancer, cutaneous squamous cell carcinoma, head and neck squamous cell carcinomas and other solid tumours.

The recent discontinuation announcement comes within weeks after MRK disclosed that it recently exercised its option to jointly develop a personalized cancer vaccine as part of its ongoing collaboration with Moderna.

On the Q3 2022 Earnings Call, one of the analysts asked the following of MRK’s CEO:

‘You have been CEO for 16 months and now you are going to be Chairman. What do you view as your greatest accomplishments during this time? And what have been the greatest disappointments? I think given the comments you made when you took over, we might have expected more to be done more quickly to build the pipeline, especially since Merck’s pipeline is the second smallest in global pharma. Do you think this is a fair assertion? And if so, why haven’t things changed more quickly?‘

In response to the inquiry, MRK’s CEO stated:

‘A year ago, no one gave us credit for having a cardiovascular pipeline. By the 2024-2028 timeframe we could have as many as 8 new approvals driving revenue that could be in excess of $10B by the mid-2030s.’

In addition, he responded that the $11.5B acquisition of Acceleron is one of his first accomplishments as CEO; this deal brought a heart drug (Sotatercept). On October 10, 2022, MRK announced positive top-line results from a pivotal Phase 3 trial in the evaluation of Sotatercept for the treatment of adults with Pulmonary Arterial Hypertension (PAH).

Furthermore, in response to the analyst’s inquiry, he mentioned pneumococcal vaccine Vaxneuvance as ‘underappreciated’ and a ‘game-changer’ with its differentiated approach geared toward defending adults and children against the virus.

MRK’s senior management is keenly aware that it needs to build a more robust pipeline.

Financials

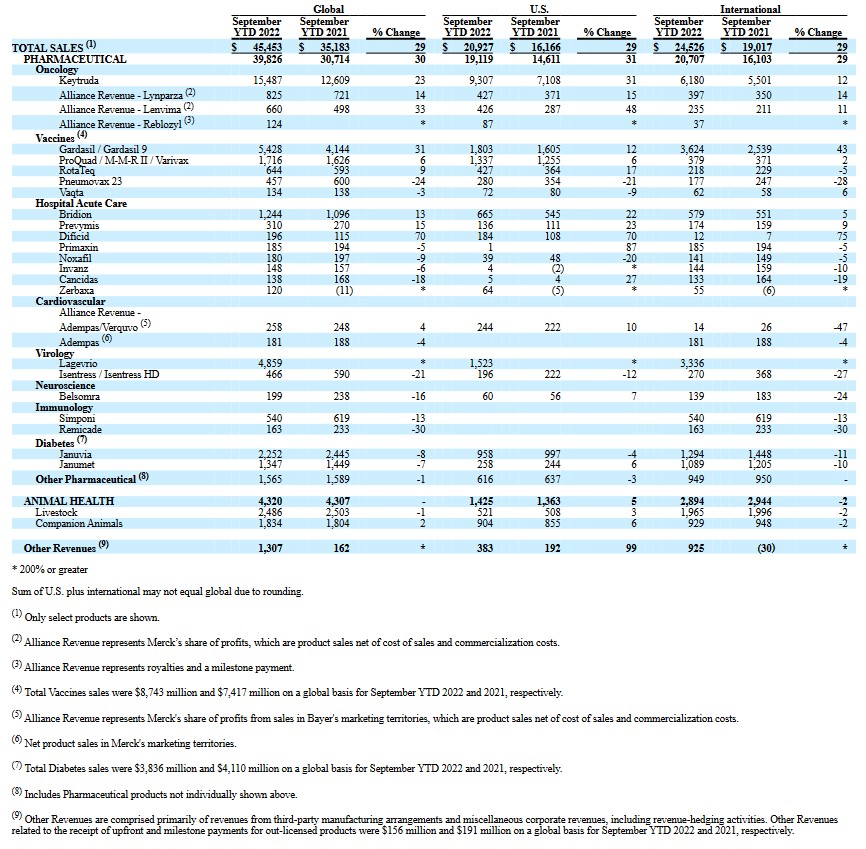

Q3 and YTD2022 Results

Details of MRK’s Q3 and YTD2022 results are reflected in the Form 8-K and Earnings Presentation.

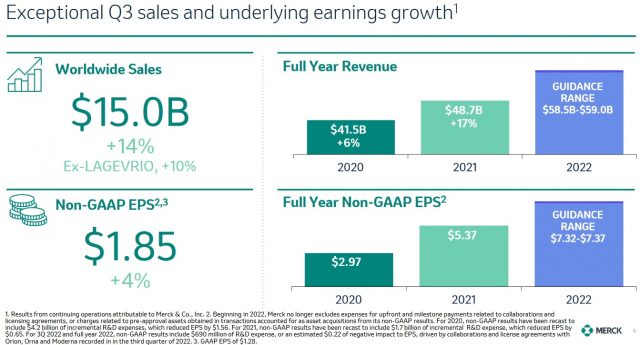

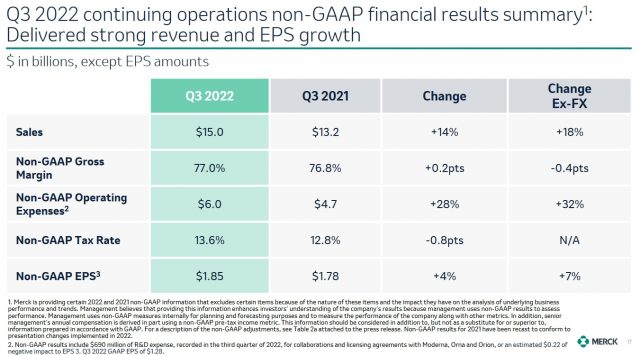

Source: MRK – Q3 2022 Earnings Presentation – October 27, 2022

Source: MRK – Q3 2022 Earnings Presentation – October 27, 2022

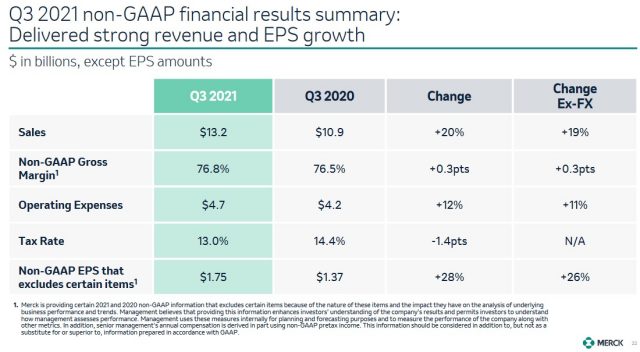

The following are provided from MRK’s Q3 2021 Earnings Presentation for comparison purposes.

Source: MRK – Q3 2021 Earnings Presentation – October 28, 2021

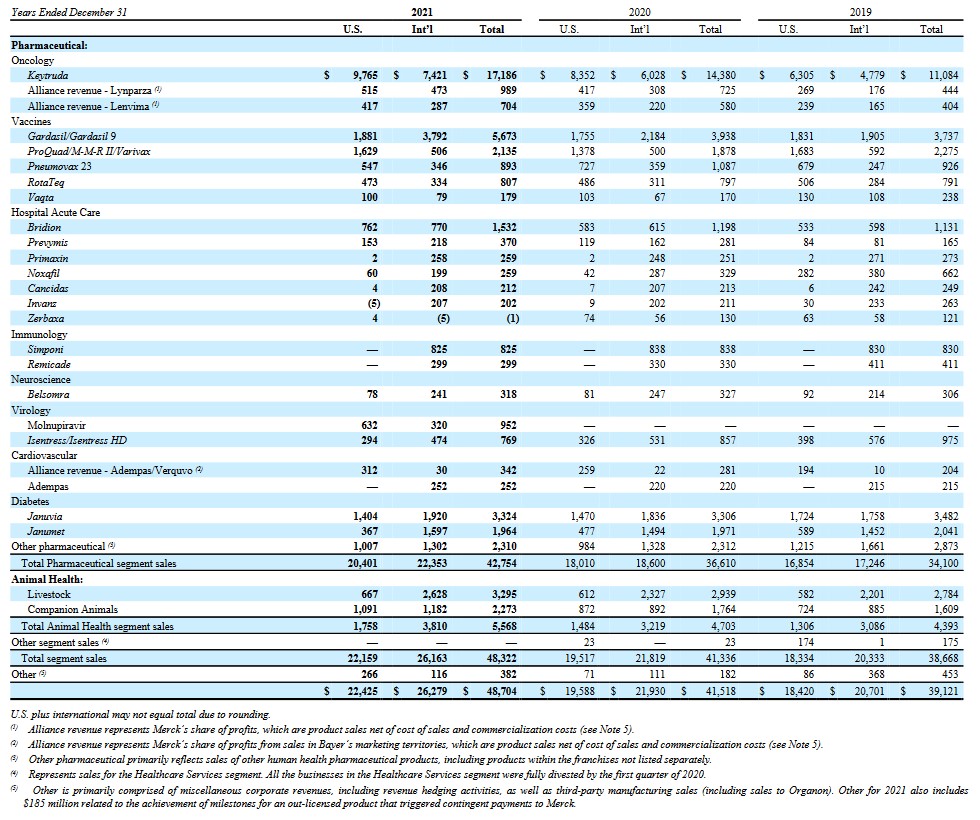

The following reflect the sales of MRK’s products in FY2019 – FY2021 and the first 3 quarters of FY2022.

Source: MRK – FY2021 Form 10-K

MRK generates a significant percentage (34% of YTD Total Sales) from Keytruda. This cancer drug loses exclusivity in 2028 but new cancer drugs are being coformulated with Keytruda and pivotal data is likely in 2024-26.

Gardasil / Gardasil 9 generates the second-largest amount of MRK’s revenue; this drug loses exclusivity in 2028. These vaccines are HPV vaccines that protect against infection with human papillomaviruses (HPV). HPV is a group of more than 200 related viruses, of which more than 40 are spread through direct sexual contact. Gardasil 9 has, since 2016, been the only HPV vaccine used in the United States.

While 2028 might seem like well into the future, it can take years from the time a drug enters Phase 1 to the time it receives regulatory approval. MRK really does not have that much time to bolster its pipeline.

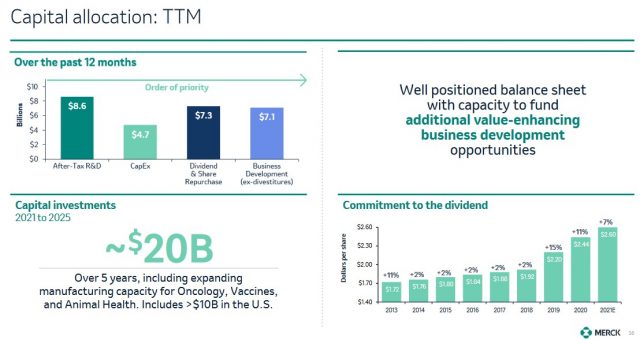

Capital Allocation

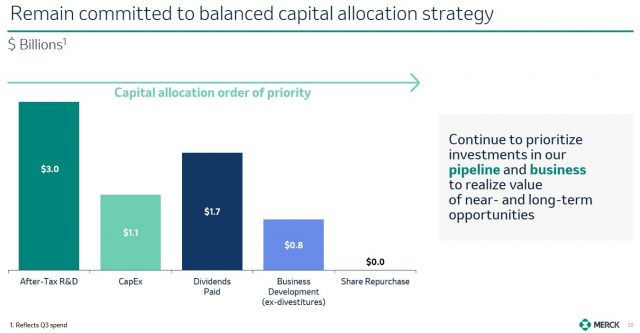

The following reflect MRK’s current balanced capital allocation strategy and the capital allocation over the past 12 months.

Source: MRK – Q3 2022 Earnings Presentation – October 27, 2022

Source: MRK – Q3 2022 Earnings Presentation – October 27, 2022

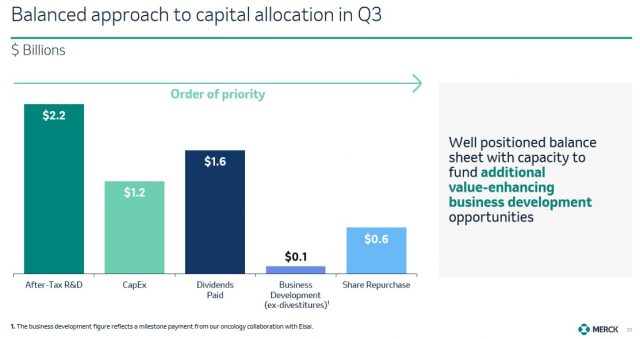

MRK’s capital allocation when Q3 2021 results were presented is provided for comparison purposes.

Source: MRK – Q3 2021 Earnings Presentation – October 28, 2021

Source: MRK – Q3 2021 Earnings Presentation – October 28, 2021

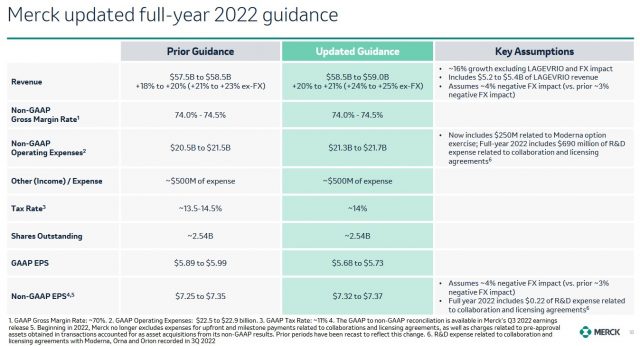

FY2022 Guidance

MRK is raising its top-line guidance and is increasing and narrowing its operating expense projection to $21.3B – $21.7B. This revision in expense projections is principally driven by a $0.25B payment related to the recent exercise of MRK’s option to jointly develop a personalized cancer vaccine as part of its ongoing collaboration with Moderna.

Management’s guidance does not assume additional significant potential business development transactions.

The expected adjusted diluted EPS range is now $7.32 – $7.37, an increase of $0.05 at the midpoint. The operational momentum in the business would have led to a ~$0.20 increase in guidance. However, it is being partially offset by the Moderna-related option payments and an incremental headwind from foreign exchange of nearly 1% using mid-October rates.

Expectations are for the continued durable underlying demand across key pillars, including Keytruda, Gardasil, and Animal Health.

On the earnings call, management indicates that while it actively manages foreign exchange through its revenue hedging program, foreign exchange continues to be a headwind to growth. This is particularly apparent across products with a larger portion of international revenues, such as in the Animal Health business.

Source: MRK – Q3 2022 Earnings Presentation – October 27, 2022

Credit Ratings

All 3 major rating agencies rate MRK’s unsecured long-term debt as investment grade.

- Moody’s: A1

- S&P Global: A+

- Fitch: A+

All ratings are the top tier within the upper-medium grade category. These ratings define MRK as having a STRONG capacity to meet its financial commitments. The company, however, is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Dividend and Dividend Yield

MRK’s dividend history can be found here.

When I wrote my November 4, 2021 post, MRK shares were trading at ~$90 and it had recently distributed its 4th consecutive $0.65 quarterly dividend for a ~3% dividend yield.

At the time of my January 13, 2022 guest post at Dividend Power, MRK had recently distributed its first quarterly $0.69 dividend. With shares trading at ~$79, the dividend yield was ~3.5%.

Shares now trade at ~$100 and MRK has just distributed its 4th consecutive $0.69 quarterly dividend on October 7, 2022.

Dividends are MRK’s 3rd priority when it comes to capital allocation and I anticipate a ~$0.03 – $0.05/share increase in the quarterly dividend in mid-December.

MRK has historically generated ample Cash Flow from Operations and Free Cash Flow thus enabling it to easily service its declared dividends.

In FY2011 – FY2021, MRK’s average shares outstanding (in millions) were 3,094, 3,076, 2,996, 2,928, 2,841, 2,787, 2,748, 2,679, 2,580, 2,541, and 2,538. The total was 2,542 for the 9 months ending September 30, 2022.

Management seeks to provide a competitive return to shareholders through a growing dividend and share repurchases. This is balanced with the need to invest in the business to drive growth and business development. The desire is to not create excess cash on the balance sheet. MRK, therefore, looks opportunistically at share buybacks based on the assessment of the business development pipeline.

In October 2018, MRK’s Board authorized purchases of up to $10B of MRK’s common stock for its treasury. The treasury stock purchase authorization has no time limit.

In May 2021, MRK restarted its share repurchase program, which the Company had temporarily suspended in March 2020. The number of outstanding shares has been relatively stagnant for the last couple of years and management’s FY2022 assumptions are based on 2.54B shares outstanding.

Valuation

When I reviewed MRK in my November 4, 2021 post, management’s FY2021 diluted EPS guidance was $4.71 – $4.76. With shares trading at ~$90, the forward diluted PE was ~19.

Management’s FY2021 adjusted diluted EPS guidance was $5.65 – $5.70. With shares trading at ~$90, the forward adjusted diluted PE was ~16.

Using the adjusted diluted EPS estimates from the brokers who cover MRK, the forward adjusted diluted PE levels were:

- FY2021: mean of $5.86 and a low/high range of $5.64 – $6.78 from 11 brokers. The forward adjusted diluted PE using the mean estimate is ~15 and ~13 if I use $6.78.

- FY2022: mean of $7.34 and a low/high range of $6.35 – $8.60 from 13 brokers. The forward adjusted diluted PE using the mean estimate is ~12 and ~10 if I use $8.60.

- FY2023: mean of $7.26 and a low/high range of $6.59 – $7.95 from 9 brokers. The forward adjusted diluted PE using the mean estimate is ~12 and ~11 if I use $7.95.

When I wrote my January 13, 2022 guest post, MRK’s shares were trading at ~$79.50. Based on the forward-adjusted diluted earnings estimates available at the time, MRK’s forward-adjusted diluted PE valuations were:

- FY2021: mean of $5.78 and a low/high range of $5.60 – $6.40 from 19 brokers. The forward adjusted diluted PE using the mean estimate is ~13.8 and ~12.4 if I use $6.40.

- FY2022: mean of $7.23 and a low/high range of $6.35 – $8.19 from 23 brokers. The forward adjusted diluted PE using the mean estimate is ~11 and ~10 if I use $8.19.

- FY2023: mean of $7.22 and a low/high range of $6.35 – $7.88 from 19 brokers. The forward adjusted diluted PE using the mean estimate is ~11 and ~10 if I use $7.88.

Shares are now trading at ~$100. Management’s updated FY2022 GAAP EPS guidance is $5.68 – $5.73 thus giving us a forward diluted PE range of ~17.6 – ~17.5.

Furthermore, management’s FY2022 adjusted diluted EPS guidance is now $7.32 – $7.37 thus giving us a forward adjusted diluted PE range of ~13.6 – ~13.7.

Based on the current forward-adjusted diluted earnings estimates available from the brokers which cover MRK, MRK’s forward-adjusted diluted PE valuations are:

- FY2022: mean of $7.37 and a low/high range of $7.28 – $7.59 from 22 brokers. The forward adjusted diluted PE using the mean estimate is ~13.6 and ~13.2 if I use $7.59.

- FY2023: mean of $7.47 and a low/high range of $6.71 – $8.11 from 22 brokers. The forward adjusted diluted PE using the mean estimate is ~13.4 and ~12.3 if I use $8.11.

- FY2024: mean of $8.59 and a low/high range of $7.76 – $9.47 from 18 brokers. The forward adjusted diluted PE using the mean estimate is ~11.6 and ~11.6 if I use $9.47.

Since MRK has just released its results and guidance within the past 24 hours, I think these estimates are likely to be revised slightly upwards over the coming days.

Final Thoughts

As with any pharmaceutical company, the extent to which a company is successful in moving its drugs through the pipeline so as to reach FDA approval is of utmost importance when assessing a potential investment. MRK’s phase 2 pipeline holds significant potential, but as noted earlier, pharmaceutical companies can invest a considerable amount in R&D only to have most drugs under development failing to receive FDA approval. In this regard, I expect MRK is likely to increase its acquisitions and partnerships to augment internal research and development efforts. I am, therefore, very reluctant to rely on earnings estimates beyond FY2023 since much can change within a year.

Given this reluctance, I am not increasing my 408 MRK share exposure other than through automatic dividend reinvestment; these shares are held in one of the ‘Core’ accounts in the FFJ Portfolio.

When I completed my Mid 2022 Investment Holdings Review, MRK was not a top 30 holding.

MRK’s share price has experienced a recent run-up. Despite an attractive valuation I suggest investing in other great companies that have temporarily fallen out of favour.

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long MRK.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.