Contents

Summary

- The company’s total investment return since going public in 1992 grossly exceeds that of the S&P 500.

- Consistently increases its dividend but is more of a growth stock than an income stock.

- Unique business strategy enables it to generate free cash flow that is fairly similar to operating cash flow.

- Business model now allows it to use working capital as a source of cash instead of a use of cash.

Introduction

Investors interested in looking for a higher growth company which consistently increases its dividend annually may be interested in the company analyzed in today’s article.

Many readers will be unfamiliar with this company. It is, however, a very interesting company with a business formula that enables it to turn most of its operating cash flow into free cash flow.

This company generated just over $4.6B in Net Revenues for the fiscal year ending December 31, 2017 and Net Revenues and Net Earnings have grown ~42% and ~80% respectively from fiscal 2013 to fiscal 2017. If we exclude a one-time net income tax benefit from The Tax Cuts and Jobs Act of 2017, Net Earnings growth was ~40% versus ~80%.

Business operations are reported in the following 4 segments based upon common customers, markets, sales channels, technologies and common cost opportunities.

- RF Technology - provides radio frequency identification (“RFID”) communication technology and software solutions. FY2017 net revenues of $1.86B: 40.4% of total net revenues.

- Medical & Scientific Imaging - offers products and software in medical applications, and high performance digital imaging products. FY2017 net revenues of $1.41B: 30.6% of total net revenues.

- Industrial Technology - produces primarily water meter and meter reading technology, fluid handling pumps, and materials analysis solutions. FY2017 net revenues of $0.784B: 17.0% of total net revenues.

- Energy Systems & Controls - principally produces control systems, testing equipment, valves and sensors. FY2017 net revenues of $0.551B: 12.0% of total net revenues.

This company has been one of the best performing Dividend Aristocrats (a company with a track record of increasing dividends for at least 25 consecutive years) but differs from your typical dividend growth stock and is more of a growth stock.

Business Overview

Roper Technologies, Inc.’s (NYSE: ROP) 4 business segments generate excess free cash flow which is then deployed to acquire more high-performing businesses.

Source: ROP - EPG Annual Spring Conference May 21, 2018 Presentation

ROP has also indicated it intends to deploy $7B+ over the next 4 years.

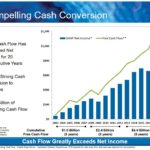

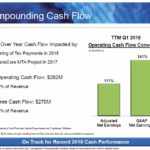

This combination of outstanding business performance and value-creating capital deployment has generated a ‘compounding effect’ on cash flow which has driven superior long-term value creation as evidenced by the total shareholder return dating back to its February 21, 1992 IPO.

Source: ROP - EPG Annual Spring Conference May 21, 2018 Presentation

Source: Tickertech

The strategic focus is on asset-light, diversified technology businesses which have the ability to generate and compound cash flow. The high-margin, high cash-generating, asset-light businesses across a variety of niche end markets are well positioned at this stage of the economic cycle where there is a key focus on productivity enhancement.

Source: ROP - EPG Annual Spring Conference May 21, 2018 Presentation

By focusing on asset-light businesses ROP’s free cash flow and operating cash flow are fairly similar. In FY2017, operating cash flow grew 23% to $1.23B and free cash flow grew 22% to $1.17B; operating cash flow was 26% of revenue and free cash flow was 25% of revenue.

Source: ROP - EPG Annual Spring Conference May 21, 2018 Presentation

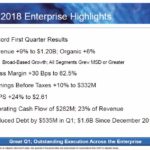

As further evidence of the success of ROP’s strategic focus, in FY2017 ROP grew revenue, net earnings, EBITDA, and cash flow by greater than 20% in each metric.

Its large 2016 Deltek and ConstructConnect acquisitions exceeded revenue and cash flow expectations, and the core businesses delivered >5% organic revenue growth. Furthermore, gross margin expanded 90 basis points.

**For readers unfamiliar with the terminology, free cash flow is net income plus amortization and depreciation minus change in working capital minus capital expenditures. Operating cash flow is calculated in the same way, omitting capital expenditures. **

Readers who look at ROP’s working capital may be alarmed that the company ended FY2017 with negative net working capital for the first time in its history. In fact, net working capital as a percentage of revenue was -3% at the end of 2017, compared to +3% in FY2016, +7% in FY2012, and +13% in FY2007. ROP’s business model, however, now allows it to use working capital as a source of cash instead of a use of cash; the software and network businesses, which represent approximately 50% of ROP’s earnings before interest, taxes, depreciation and amortization (EBITDA), are an important driver of the transformation to the use of working capital as a source of cash.

Cash Return on Investment (‘CRI’) is a key operating metric used to measure the performance and value of ROP’s operating businesses and potential acquisitions. By applying CRI principles throughout the organization, ROP can focus investment on areas that will increase shareholder value, drive cash flow growth, and minimize physical assets.

Through a combination of internal improvements and disciplined capital deployment, ROP has increased its CRI from ~30% in 2003 to ~300% in 2017. In the past 10 years alone, ROP’s transformation into a diversified technology company has resulted in a gross margin expansion of 12.20%, EBITDA margin expansion of 9.2%, and working capital becoming a -3.3% of annualized revenue.

Source: ROP – 2017 Annual Report

ROP’s strategy has clearly worked out well for long-term shareholders.

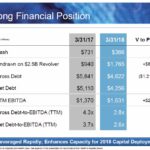

Q1 2018 Results

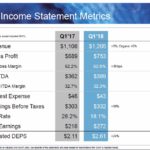

ROP’s Q1 2018 financial results can be found here. Additional information is also provided in the following slides from the Q1 2018 April 20, 2018 presentation; Q2 2018 results are to be released July 26, 2018, and therefore, I will not delve into Q1 results.

Source: ROP – Q1 2018 Earnings Presentation

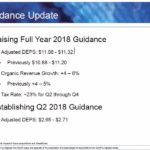

2018 Guidance

At the beginning of FY2018, full year adjusted diluted EPS guidance was $10.88 - $11.20. This range was subsequently revised to $ 11.08 - $11.32 when Q1 2018 results were released April 20, 2018.

Source: ROP – Q1 2018 Earnings Presentation

Credit Ratings

Moody’s and S&P Global rate ROP’s long-term debt Baa3 and BBB+, respectively. Moody’s rating is the lowest tier within the lower medium grade and is the lowest investment grade credit rating. S&P’s rating the highest tier within the lower medium grade and is third lowest investment grade credit rating.

Valuation

ROP closed at $281.93 on July 12, 2018. If the use $11.20 mid-point of the adjusted diluted EPS guidance provided on April 20, 2018, ROP’s projected PE is ~25.2; the forward PE for the S&P 500 is ~17.1.

When we compare ROP’s historical results for the PE and Price/Cash Flow metrics, we see that ROP’s recent full year PE is well above the historical norm. Its Price/Cash Flow is also above the historical norm although not to the same extent as its PE.

ROP’s PE for 2008 – 2017 is: 14.2, 20.3, 22.9, 20.6, 22.9, 26.8, 25.2, 28.6, 27.3, and 37.6.

ROP’s Price/Cash Flow for 2008 – 2017 is: 9.4, 13.2, 14.8, 15.1, 16.4, 17.8, 19.3, 20.9, 19.5, and 23.5

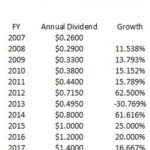

Dividend, Dividend Yield and Dividend Payout Ratio

ROP’s dividend and stock split history can be found here. The upcoming July 23rd dividend will mark the 3rd dividend at the $0.4125/share level; a similar dividend is expected to be distributed in October 2018.

In the Introduction of this article I indicated ROP differs from your typical dividend growth stock and is more of a growth stock. While the company has rewarded shareholders with an impressive dividend compound annual growth rate (CAGR), the dividend yield is typically under 1% which many investors will view as an automatic reason to exclude ROP as a potential investment.

Based on ROP’s FY2017 diluted EPS of $9.39, the $1.65 dividend represents a ~17.6% dividend payout ratio. Using the $11.20 the mid-point of the adjusted diluted EPS guidance provided on April 20, 2018, the dividend payout ratio is ~14.7%. This low dividend payout ratio provides investors with a degree of confidence that the risk of a dividend cut is remote.

Final Thoughts

When the market is behaving rationally you will generally find that long-term performance will predominantly be based on how well /poorly a company is performing on an operating basis. In addition, there will generally be a correlation between a company’s dividend and operating results.

In my view, the market is behaving somewhat irrationally. As a result, I think many investors have become complacent and are not looking at stock values relative to the underlying fundamentals of many businesses. This is why we are seeing companies, such as ROP, which are overvalued.

While I do not dispute ROP is a well-run company there is a level at which I am not prepared to ‘pay up’. I will continue to monitor ROP with the hopes of its stock price retracing to a more reasonable valuation and intend to perform a very brief review when Q2 2018 results are released later in July.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected]

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently hold a position in ROP and do not intend to initiate a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.