Contents

Nasdaq (NDAQ) is targeting higher annual recurring revenue from high-growth areas of business to reduce earnings volatility.

I last reviewed Nasdaq (NDAQ) in my September 14 guest post at Dividend Power. At the time of that post, the most currently available financial information was for Q2 2023.

On October 18, NDAQ released its Q3 and YTD2023 results. The purpose of this brief post is to determine if NDAQ remains attractively valued.

Business Overview

In September 2022, NDAQ announced a new organizational structure to align its businesses more closely with the shifts driving the evolution of the global financial system.

NDAQ previously operated with 4 business segments:

- Market Technology;

- Investment Intelligence;

- Corporate Platforms; and

- Market Services.

Its new corporate structure consists of 3 business segments:

- Capital Access Platforms;

- Market Platforms, and

- Anti-Financial Crime.

An explanation of each business segment is included in NDAQ's most recent Form 10-Q; the Q2 Form 10-Q is the most current as I compose this post.

Adenza Acquisition

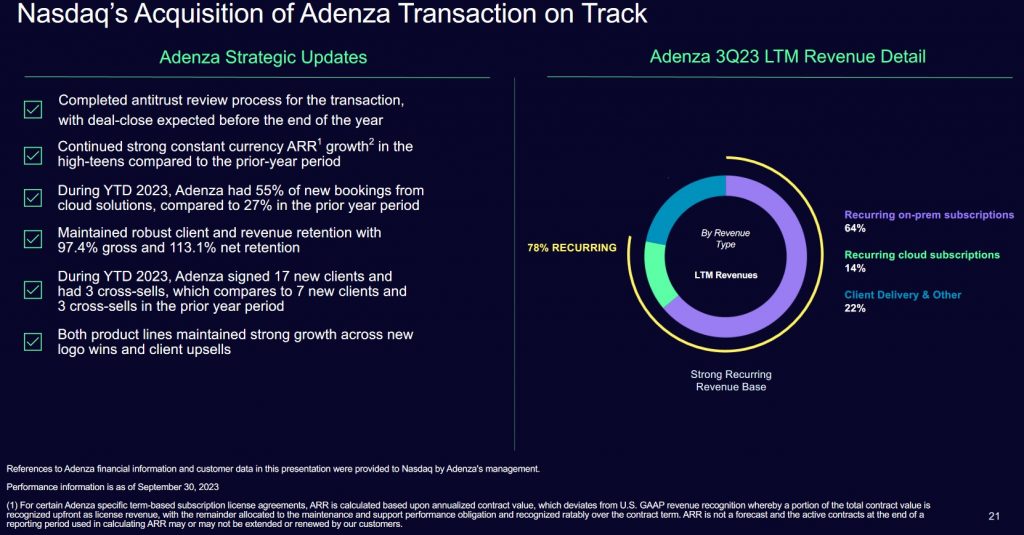

In previous posts, I touched upon the rationale for NDAQ's proposed Adenza acquisition; NDAQ provided an Adenza-related presentation on June 12 when it announced its intent to acquire the company.

The antitrust review has now been completed and Thoma Bravo (the seller) is on track to obtain the remaining approvals from the Nordic and Baltic financial regulators to become a major shareholder in NDAQ. Expectations are for the transaction to close in Q4 2023.

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

Financials

Q3 and YTD 2023 Results

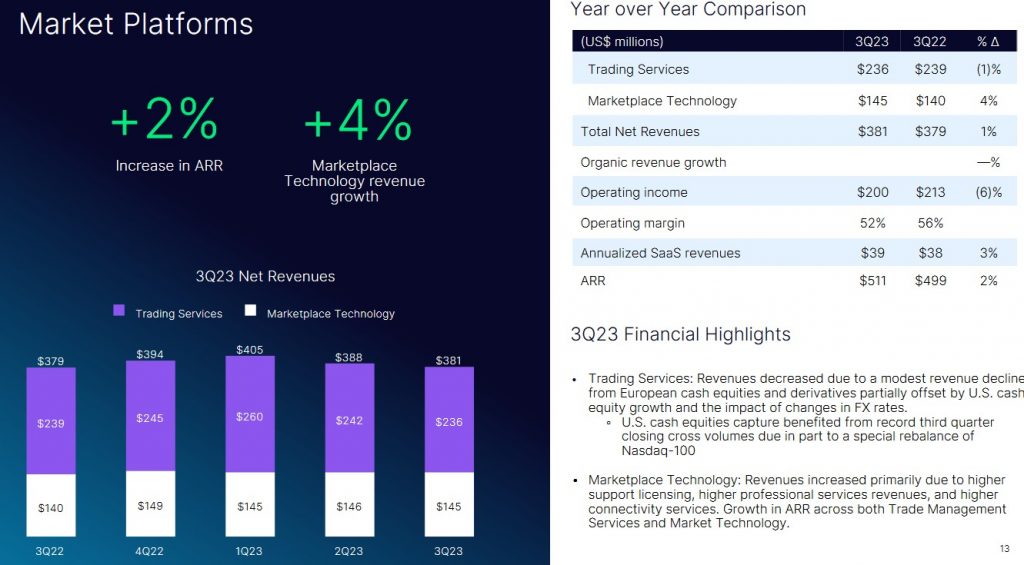

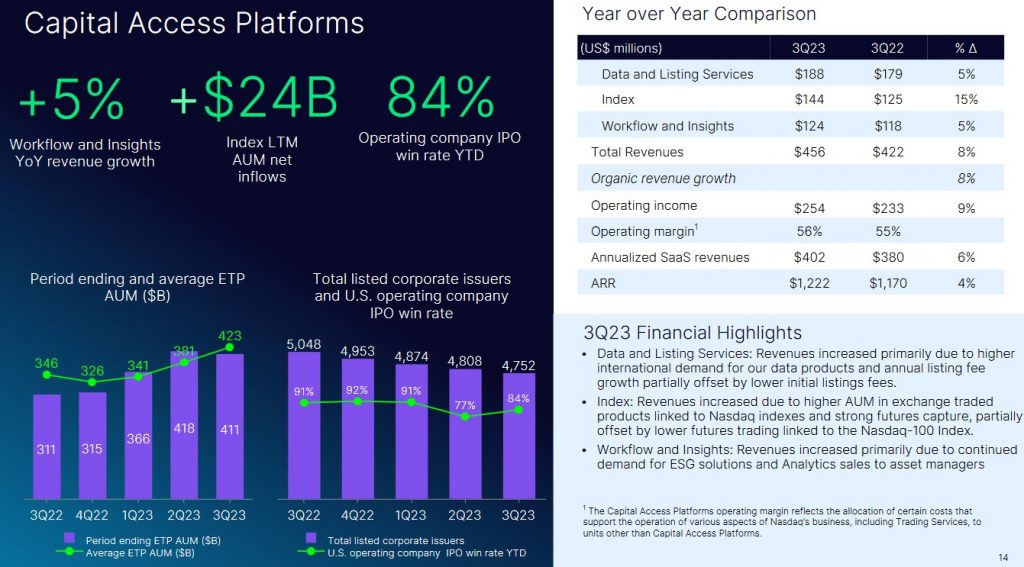

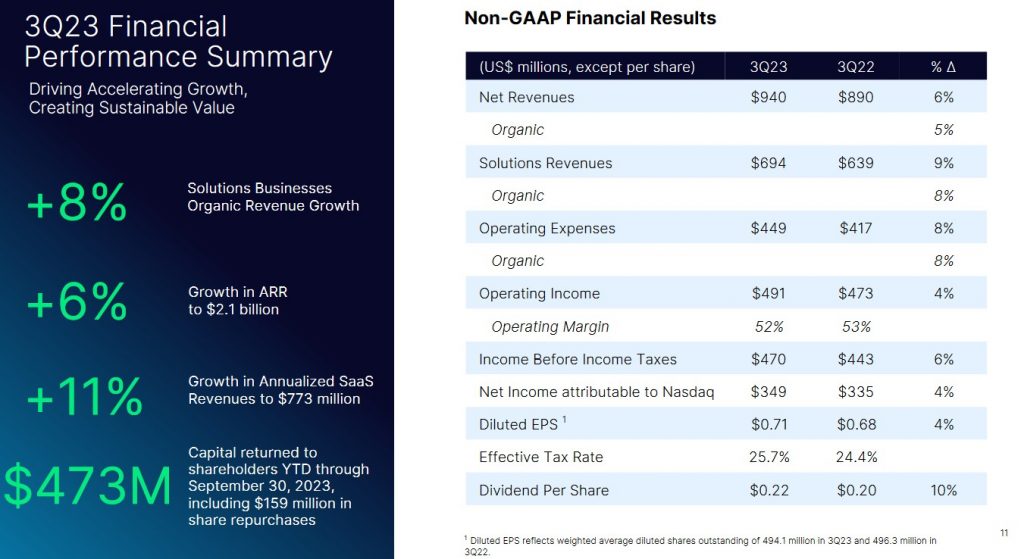

NDAQ has historically generated most of its revenue (93.3% in Q3 2023) from its Market Platforms and Capital Access Platforms. In the first 3 quarters of FY2023, for example, the Market Platforms and Capital Access Platforms generated 63.7% and 29.6% of NDAQ's YTD2023 $4.417B Revenues (before transaction-based expenses).

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

Revenue generated within these 2 business segments is largely transactional. For example, there is a direct link between the market and the market segment's results as fee income is based on the amount of assets linked to its indexes. Due to the success of the Nasdaq 100 index, this segment is particularly sensitive to the volatile technology sector. While the market segment has delivered several quarters of double-digit quarter-over-quarter growth, this was largely driven by market forces, and sequential growth of this magnitude may well decelerate going forward.

When NDAQ announced its proposed acquisition of Adenza, it stated that 56% of its annual revenue was recurring. With the acquisition of Adenza, management forecasts that annual recurring revenue (ARR) will increase to 60%; 80% of Adenza's revenue is ARR with a high degree of revenue visibility (3 - 5 year client contracts with gross retention of 98%).

The Q3 and YTD2023 results are accessible here.

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

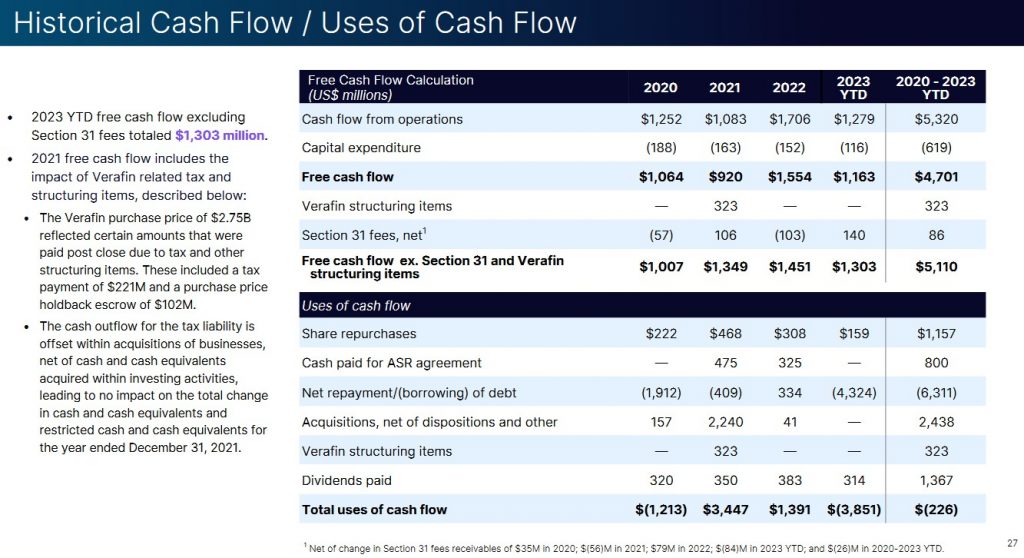

Free Cash Flow (FCF)

Various investor platforms reflect NDAQ's FY2013 - FY2022 FCF as being (in millions of $) 459, 492, 594, 642, 765, 917, 836, 1,064, 920, and 1,554. In the first half of FY2023, NDAQ generated 900 of FCF and by the end of Q3, this had increased to 1,663. NDAQ, however, also calculates its FCF by taking into consideration a couple of additional items (see below).

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

Expectations are for Adenza to generate ~$0.3B in unlevered pre-tax cash flow in the first year following the acquisition. The debt financing for the Adenza acquisition, however, is likely to result in an annual interest payment of ~$0.325B which is more than Adenza’s current free-cash flow. However, as Adenza grows and debt is reduced, NDAQ expects incremental FCF from the addition of Adenza to fund incremental debt repayment and share buybacks; management expects ~$0.7B in excess annual FCF beyond the dividends and employee-related buybacks. This amount is expected to grow commensurately with earnings growth over the next few years.

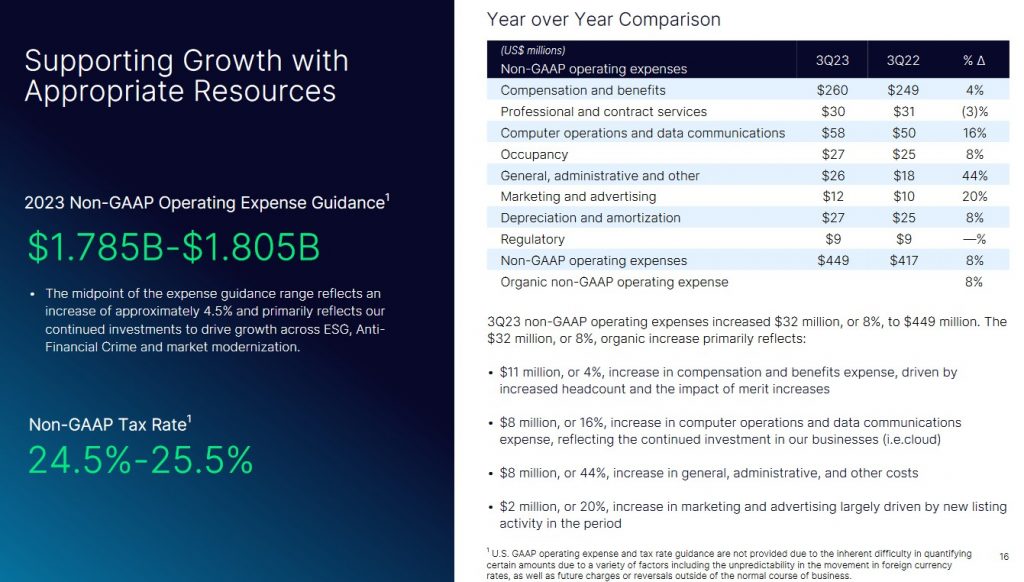

FY2023 Guidance

NDAQ has narrowed its 2023 non-GAAP operating expense guidance to $1.785B - $1.805B from the prior $1.785B - $1.815B range.

The FY2023 non-GAAP tax rate has been adjusted to 24.5% - 25.5% from the prior guidance of 24% - 26%.

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

Credit Ratings

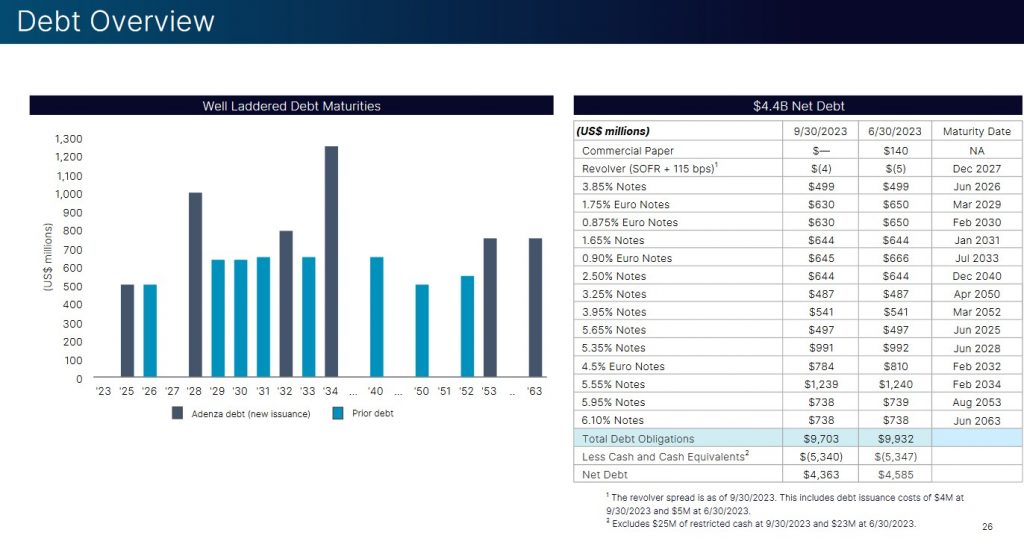

The following reflects NDAQ's current net debt position.

Source: NDAQ - Q3 2023 Earnings Presentation - October 18, 2023

When looking at NDAQ's Balance Sheet (page 10 of 15) at the end of Q3, we see $5.34B of cash and cash equivalents. In my July 20 post, however, I touch upon why this level is so high and what will happen when the Adenza transaction closes.

Immediately upon announcing the Adenza acquisition, NDAQ's domestic unsecured long-term debt was downgraded from Baa1 to Baa2 by Moody's and from BBB+ to BBB by S&P Global. These new ratings are the middle tier of the lower medium grade investment grade category. They define NDAQ as having an adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity for NDAQ to meet its financial commitments.

Despite the ratings downgrades, NDAQ has demonstrated its ability to reduce leverage within a reasonable timeframe following major acquisitions. Upon closing the Adenza acquisition, NDAQ's capital allocation priority over the next 3 years will be to reduce Gross Debt / Non-GAAP EBITDA to 4.0x in 18 months and to 3.3x in 36 months.

I am prepared to give management the benefit of the doubt that it can replicate what it did following the two most recent large transactions despite a higher cost of capital environment than in 2017 and 2021.

Dividend and Dividend Yield

NDAQ's dividend history is accessible here.

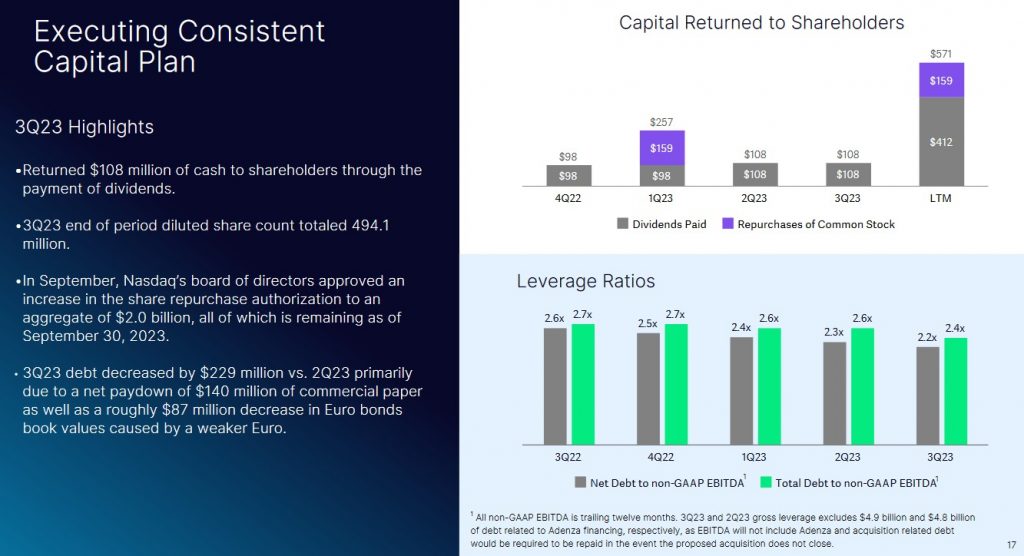

In Q3 2023, NDAQ returned ~$0.108B of cash to shareholders through the distribution of dividends. Using the current ~$51.92 share price, the dividend yield is ~1.7%.

On October 18, NDAQ declared its third consecutive $0.22/share quarterly dividend. This dividend is payable on December 22 to shareholders of record at the close of business on December 8.

Following the completion of the Adenza acquisition, debt repayment will be a top priority. I, therefore, anticipate NDAQ's $0.22/share dividend may only be increased to $0.24 when the end of June 2024 dividend is declared in mid-April. Using this estimate, NDAQ's next 4 dividend distributions will total $0.92 (($0.22 x2) + ($0.24 x 2)) and the forward dividend yield using a ~$51.92 share price is ~1.77%.

NDAQ plans to increase the dividend to achieve a 35% - 38% payout ratio over the next 3 or 4 years; this implies a ~10% CAGR in the dividend payout ratio over this timeframe. Calculation of this payout ratio annualizes the last paid quarterly dividend divided by the last 12 months of non-GAAP net income.

The weighted average number of shares outstanding in FY2013 - FY2022 (in millions of shares) is 514, 519, 514, 506, 509, 503, 501, 501, 505, and 498. For Q2 and Q3 2023, this was 493.6 and 494.1.

NDAQ's weighted average shares outstanding will surge once it issues 85.6 million common shares to Thoma Bravo. However, NDAQ expects to partially offset deal dilution with additional buybacks. In addition, it will continue to repurchase shares to offset employee stock compensation.

After NDAQ's leverage reaches target levels, the focus will be on using the vast majority of remaining FCF to execute share buybacks. Management states it does not anticipate making any significant acquisition-related capital allocation decisions that would deter the company from sizable stock buybacks over the coming years.

In September 2023, NDAQ's Board approved an increase in its share repurchase authorization to a total of $2B.

Stock Splits

NDAQ initiated a 3 for 1 stock split in 2022.

Valuation

In FY2013 - FY2022, NDAQ generated diluted EPS of $0.75, $0.80, $0.83, $0.21, $1.43, $0.91, $1.54, $1.86, $2.35, $2.26. Its diluted PE levels were 20.52, 17.70, 27.31, 23.63, 49.57, 18.25, 33.89, 24.31, 30.57, and 26.91.

When I reviewed NDAQ in my July 13 post, the forward-adjusted diluted broker estimates and valuation using my ~$51 purchase price were:

- FY2023 - 14 brokers - mean of $2.72 and low/high of $2.60 - $2.84. Using the mean estimate, the forward-adjusted diluted PE is ~18.75.

- FY2024 - 15 brokers - mean of $2.89 and low/high of $2.66 - $3.11. Using the mean estimate, the forward-adjusted diluted PE is ~17.6.

- FY2025 - 8 brokers - mean of $3.06 and low/high of $3.00 - $3.15. Using the mean estimate, the forward-adjusted diluted PE is ~16.7.

Using my ~$50.75 purchase price on July 19 and the forward-adjusted diluted broker estimates, NDAQ’s valuation was:

- FY2023 – 16 brokers – mean of $2.76 and low/high of $2.60 – $2.84. Using the mean estimate, the forward-adjusted diluted PE is ~18.4.

- FY2024 – 17 brokers – mean of $2.87 and low/high of $2.29 – $3.10. Using the mean estimate, the forward-adjusted diluted PE is ~17.7.

- FY2025 – 11 brokers – mean of $3.14 and low/high of $2.97 – $3.33. Using the mean estimate, the forward-adjusted diluted PE is ~16.2.

When I wrote my September 14 guest post, NDAQ’s current share price was ~$51.50. The valuation using the current forward-adjusted diluted broker estimates was:

- FY2023 – 13 brokers – mean of $2.78 and low/high of $2.60 – $2.86. Using the mean estimate, the forward-adjusted diluted PE is ~18.5.

- FY2024 – 13 brokers – mean of $2.88 and low/high of $2.50 – $3.10. Using the mean estimate, the forward-adjusted diluted PE is ~17.9.

- FY2025 – 9 brokers – mean of $3.17 and low/high of $2.99 – $3.35. Using the mean estimate, the forward-adjusted diluted PE is ~16.25.

Shares now trade at $51.92 (October 18 market close). The valuation using the current forward-adjusted diluted broker estimates was:

- FY2023 – 15 brokers – mean of $2.78 and low/high of $2.65 – $2.83. Using the mean estimate, the forward-adjusted diluted PE is ~18.7.

- FY2024 – 15 brokers – mean of $2.89 and low/high of $2.48 – $3.10. Using the mean estimate, the forward-adjusted diluted PE is ~18.

- FY2025 – 13 brokers – mean of $3.17 and low/high of $2.96 – $3.34. Using the mean estimate, the forward-adjusted diluted PE is ~16.4.

Adenza is expected to become accretive to NDAQ’s earnings within 2 years. Until such time, NDAQ will be incurring acquisition and integration expenses that will likely exceed incremental earnings. Given this, if I lower NDAQ’s mean FY2024 forward-adjusted diluted estimate by $0.30 to $2.59, the forward-adjusted diluted PE ratio becomes ~18 based on the current ~$51.92 share price. Lowering the mean FY2025 forward-adjusted diluted estimate by $0.15 to $3.02, changes the forward-adjusted diluted PE to ~17.2.

I consider these levels to be acceptable given NDAQ’s growth potential.

Final Thoughts

In my June 13 post, I touched upon NDAQ's June 12 announcement regarding its definitive agreement to acquire Adenza from Thoma Bravo for $10.5B in cash and shares of common stock; Adenza provides mission-critical risk management and regulatory software to the financial services industry. The rationale for the acquisition is to accelerate NDAQ's strategic vision to become a leading technology provider to the global financial system.

In that post, I concluded that while Adenza is an expensive acquisition, I like NDAQ's long-term strategy. Using the weakness in NDAQ's valuation, I initiated a 500-share position in a 'Core' account within the FFJ Portfolio on June 12 at ~$51/share.

I revisited NDAQ in this July 20 post at which time I disclosed the purchase of an additional 100 shares @ ~$50.75; my NDAQ exposure is now 603 shares with the additional 3 shares being shares acquired through the automatic reinvestment of dividend income.

My final thoughts are the same as those in prior posts:

'An investment at the current valuation offers a realistic probability of attractive double-digit total investment returns over the next 5 - 10 years.'

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long NDAQ.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.