This Moody’s Corporation (MCO) stock analysis is the 8th in my series of analyses of Financial Data & Stock Exchanges industry participants. Previous posts within this series are accessible here.

I view the Financial Data & Stock Exchanges industry as an attractive industry in which to invest for the long term and currently have exposure to the following in retirement accounts, for which I do not disclose details, and/or in the FFJ Portfolio:

- S&P Global (SPGI) – guest post at Dividend Power

- Moody’s (MCO)

- CME Group (CME) – guest post at Dividend Power

- Intercontinental Exchange (ICE)

These industry participants will release earnings on the following dates and I intend to review each company shortly following their respective earnings release.

- FactSet Research Systems Inc. (FDS) – released September 28

- Nasdaq, Inc. (NDAQ) – released October 20

- S&P Global Inc. (SPGI) – released October 26

- MSCI Inc. (MSCI) – released October 26

- CME Group Inc. (CME) – released October 27

- Morningstar, Inc. (MORN) – released October 27

- Intercontinental Exchange, Inc. (ICE) – October 28

- Moody’s Corporation (MCO) – October 28

- CBOE Global Markets, Inc. (CBOE) – October 29

- TMX Group Limited (X.to) – November 8

Value Line, Inc. (VALU) released its Q1 2022 results for the quarter ending July 31 on September 13, 2021. This is a small-cap company ($0.31B market cap). I do not invest in small-cap companies, and therefore, do not intend to review it. I have reviewed MCO on various occasions, most recently in a September 9th post for which a link is provided above.

Business Overview

MCO and SPGI are market leaders in providing credit ratings on fixed-income securities. The embedded nature of credit ratings among capital markets participants, regulators,

and index providers enable both companies to generate a strong operating margin.

Regarding acquisitions, The rating segment is mature globally, and therefore, I only expect small investments and acquisitions in this area.

The following are two examples of small investments:

- MCO acquired a minority stake in Malaysian Rating Corporation Berhad (MARC). This is a credit rating agency serving the Malaysian domestic bond and sukuk markets. The investment strengthened Moody’s presence in Southeast Asia and across domestic bond markets globally, further advancing MCO’s position as a leader in Islamic Finance. In October 2021, MCO announced that it had won Best Rating Agency in Islamic Finance in the Islamic Finance News Service Providers Poll 2021.

- In 2016, MCO acquired full ownership of Korea Investors Service (KIS), a leading provider of domestic credit ratings in Korea. KIS was founded in 1985. It serves the domestic capital markets in Korea with credit ratings, research and other services. KIS has been a majority-owned affiliate of Moody’s Investors Service since 2001.

I anticipate acquisition activity to be concentrated in MCO’s Analytics segment for the foreseeable future.

A good overview of MCO’s business and the risk factors can be found in Part 1 of the FY2020 10-K.

Acquisition of RMS

In my September 9 post, I mentioned that on August 5, 2021, MCO and Risk Management Solutions, inc. (RMS) announced that they entered into a definitive agreement for MCO to acquire RMS for ~$2B from Daily Mail and General Trust plc; RMS is a leading global provider of climate and natural disaster risk modelling and analytics.

The acquisition will immediately increase MCO’s insurance data and analytics business to ~$0.5B in revenue and will accelerate the development of MCO’s global integrated risk capabilities to address the next generation of risk assessment. On September 15, 2021, MCO confirmed the completion of the acquisition of RMS.

Moody’s Corporation – Stock Analysis – Financials

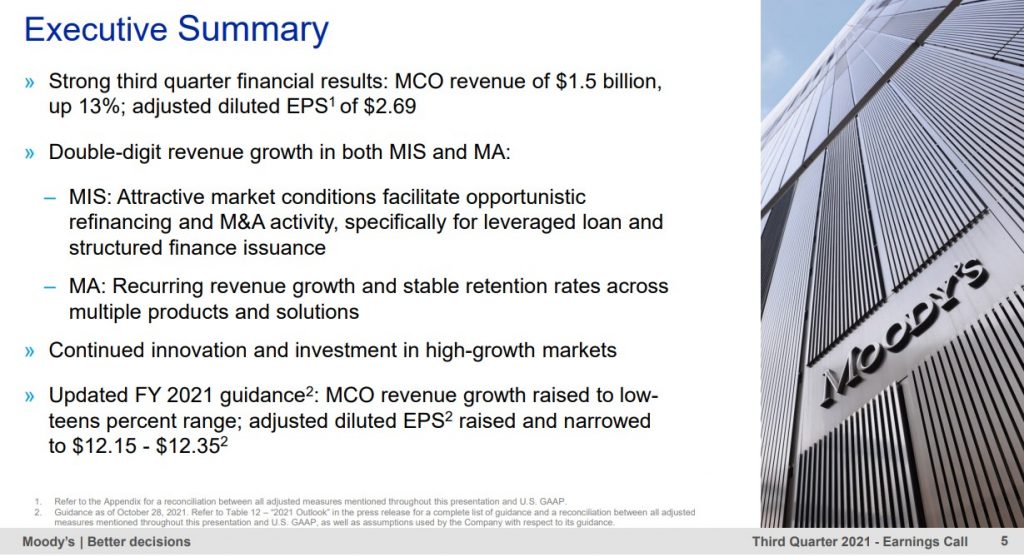

On October 28, 2021, MCO released Q3 and YTD2021 results (Form 8-K and Earnings Presentation).

MCO’s profitability largely revolves around its credit ratings business in that just under 80% of adjusted operating income is derived from this line of business.

Record collateralized loan obligation (CLO) volumes in the US and Europe have featured significant refinancing and reset activity. This tailwind has benefited MCO but it now faces difficult comps and FY2022 may experience a slight decline.

FY2021 Guidance

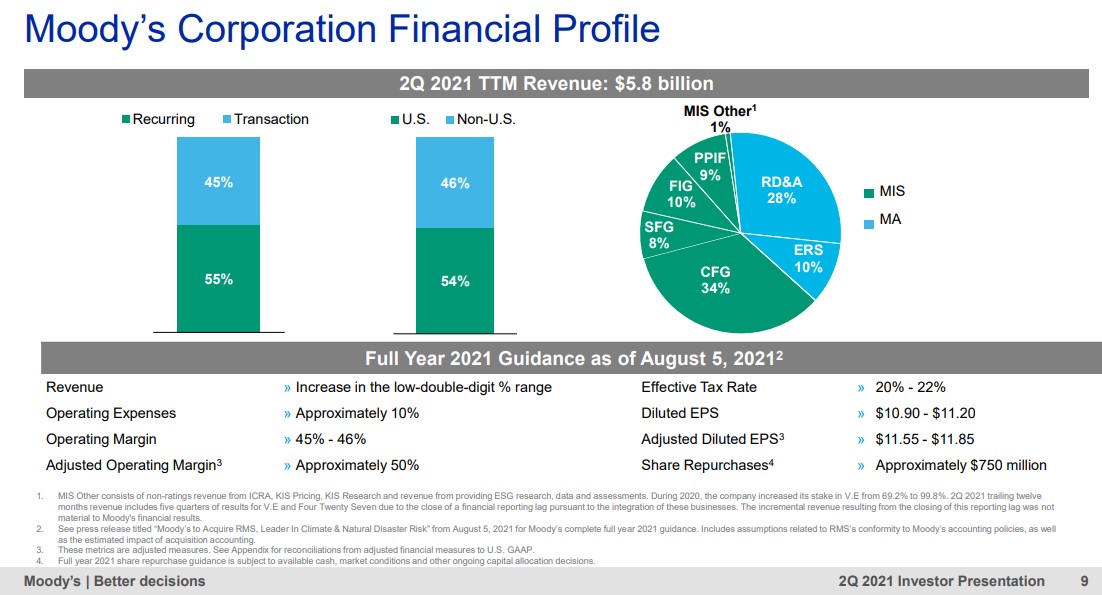

On August 10, 2021, MCO provided the following FY2021 guidance. Free Cash Flow guidance, while not reflected on the following image, was $2.2B – $2.3B.

Source: MCO – Q2 2021 Earnings Presentation – August 10, 2021

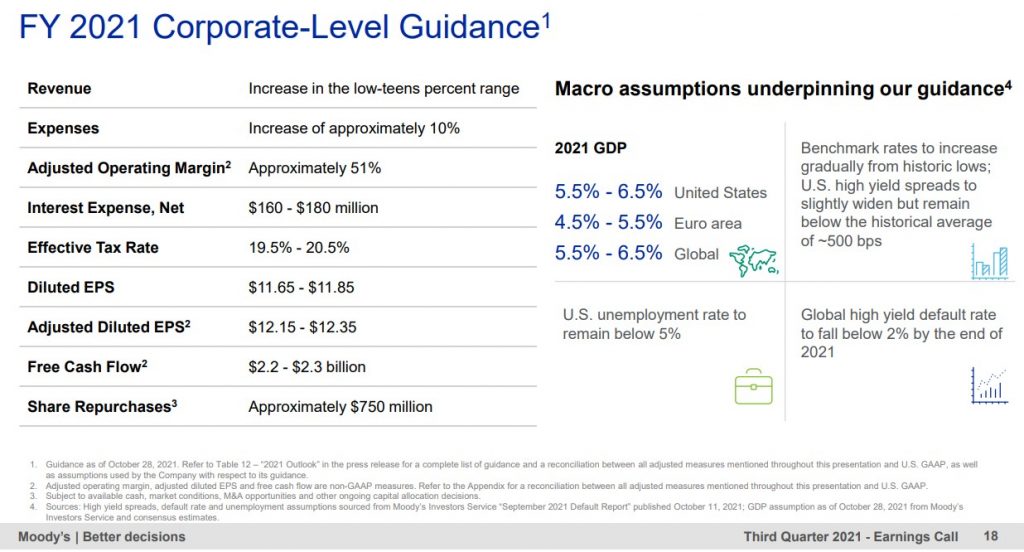

Guidance has now been revised as follows:

Source: MCO – Q3 2021 Earnings Presentation – October 28, 2021

Moody’s Corporation – Stock Analysis – Credit Ratings

The senior unsecured domestic long-term debt ratings assigned by S&P Global and Fitch are:

- S&P Global – BBB+ long-term unsecured debt credit rating with a stable outlook; and

- Fitch – BBB+ long-term unsecured debt credit rating with a stable outlook;

Both ratings are the top tier of the lower medium-grade investment-grade tier. These ratings define MCO as having an ADEQUATE capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to MCO having a weakened capacity to meet its financial commitments.

The Summary of Outstanding Debt and Debt Maturity Profile as of September 30, 2021, reflects a well-balanced maturity schedule.

I view MCO’s credit risk to be acceptable.

Moody’s Corporation –

Dividend and Dividend Yield

MCO’s dividend history reflects annual dividend increases starting 2011 following a dividend freeze that was precipitated by challenging business conditions during The Financial Crisis.

On October 26, 2021, MCO’s Board declared a regular quarterly dividend of $0.62/share payable on December 14, 2021 to stockholders of record at the close of business on November 23, 2021.

Moody’s returned $0.115B to its stockholders via dividend payments during Q3 2021 and $0.347B during the first 9 months of FY2021. At the time of my September 9, 2021 post, MCO was trading at ~$382.

With a $0.62 quarterly dividend, the yield is ~0.65%. Shares are now trading at ~$404 so the dividend yield is ~0.61%.

On December 16, 2019, MCO’s Board authorized $1B in share repurchase authority. On February 9, 2021, the Board approved an additional $1B in share repurchase authority. As of September 30, 2021, MCO had ~$1.2B of share repurchase authority remaining with no established expiration date for the remaining authorization.

In Q3 2021, MCO repurchased ~333 thousand shares at a total cost of $0.125B at an average cost of $374.70/share. It also issued net 54 thousand shares as part of its employee stock-based compensation programs. The net amount includes shares withheld for employee payroll taxes. YTD, MCO has repurchased 1.9 million shares at a total cost of $0.628 at an average cost of $327.88/share. It has also issued net 700,000 shares as part of its employee stock-based compensation program.

In Q4 2020, Q1 2021 and Q2 2021, Moody’s issued a net 0.2 million shares, 0.6 million shares, 0.2 million shares under employee stock-based compensation plans. Despite the issuance of these shares, MCO’s Diluted Weighted-Average Shares of Common Stock Outstanding has steadily declined as evidenced from the FY2011 – FY2020 figures of 229, 227, 224, 215, 203, 195, 194, 194, 192, and 189 (millions of shares). Outstanding shares as of September 30, 2021 totalled 185.9 million.

Moody’s Corporation – Stock Analysis – Valuation

When I reviewed MCO on September 9, 2021, management’s adjusted diluted EPS guidance was $11.55 – $11.85. Using a ~$382 share price and the $11.70 mid-point of guidance the forward adjusted diluted PE was ~32.7. In addition, the following were the FY2021 – FY2023 adjusted diluted EPS analyst estimates:

- FY2021 – 16 brokers – mean of $11.87 and low/high of $11.69 – $12.52. Using the mean estimate, the forward adjusted diluted PE is ~32.2.

- FY2022 – 17 brokers – mean of $12.40 and low/high of $11.54 – $13.50. Using the mean estimate, the forward adjusted diluted PE is ~30.8.

- FY2023 – 12 brokers – mean of $14.01 and low/high of $13.05 – $15.25. Using the mean estimate, the forward adjusted diluted PE is ~27.3.

FY2021 adjusted diluted EPS guidance has now been raised to $12.15 – $12.35. With shares trading at ~$404, the forward adjusted diluted PE range is ~33. I anticipate broker guidance will be adjusted over the next several days but at the moment estimates are as follows:

- FY2021 – 17 brokers – mean of $12.04 and low/high of $11.70 – $12.67. Using the mean estimate, the forward adjusted diluted PE is ~33.6.

- FY2022 – 17 brokers – mean of $12.46 and low/high of $11.62 – $13.61. Using the mean estimate, the forward adjusted diluted PE is ~32.4.

- FY2023 – 14 brokers – mean of $14.03 and low/high of $13.04 – $15.72. Using the mean estimate, the forward adjusted diluted PE is ~29.

Moody’s Corporation – Stock Analysis – Final Thoughts

I like MCO as a long-term investment. Its current valuation, however, is too rich for me and I do not intend to add to my existing position at this time.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long SPGI, MCO, CME and ICE.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.