In this November 20 2020 post, I disclose that I initiated a position in Lockheed Martin (LMT) to increase my exposure to the aerospace and defense industry. Within the FFJ Archives are posts in December 2020 and January 2021 in which I disclose the purchase of additional LMT shares when the share price came under pressure.

On July 14, 2021, I added another 50 shares to my existing LMT exposure in one of the Core accounts within the FFJ Portfolio. My current LMT exposure is 373 shares.

Lockheed Martin – Stock Analysis – Business Overview

I encourage you to review all of LMT’s capabilities which fall under LMT’s core business areas if you are unfamiliar with the company. In addition, details on LMT’s advanced technologies and capabilities can be accessed here.

The company’s history dates back more than 100 years. A high-level overview of the remarkable people and the little-known histories behind the achievements that shaped LMT is accessible here.

A comprehensive overview of LMT can be found in Part 1 of the 2020 Annual Report.

Lockheed Martin – Stock Analysis – Financials

LMT released its Q1 2021 results on April 20, 2021. It is to release Q2 and YTD results on June 26th which is just a few business days from now. I, therefore, see no purpose in reviewing Q1 results.

What is worth noting is that during FY2010 – FY2020, LMT generated free cash flow (FCF) of (expressed in billions) $2.727, $3.266, $0.619, $3.710, $3.021, $4.162, $4.126, $5.299, $1.860, $5.827, and $6.417. In Q1 2021 it generated $1.467B in FCF.

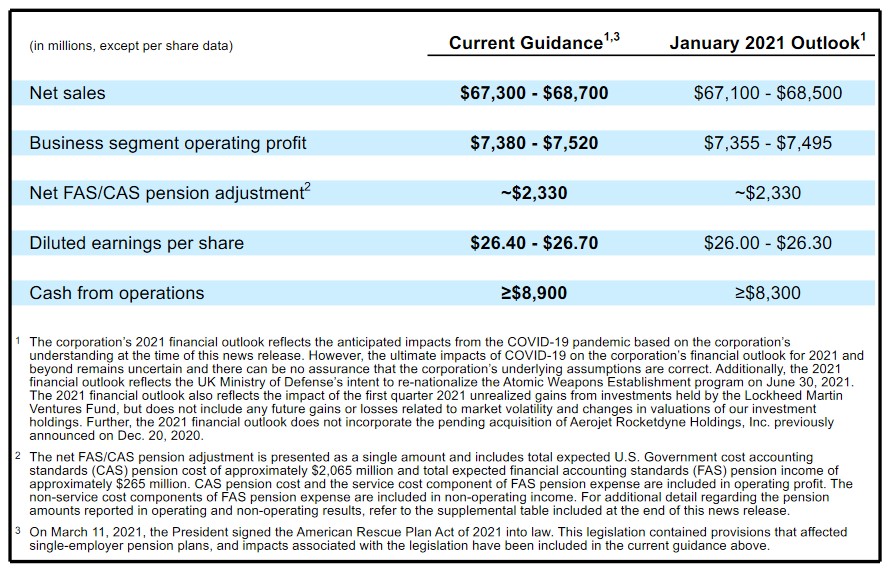

Furthermore, LMT raised FY2021 guidance when it released its Q1 2021 results. Given that guidance was just recently raised I do not expect guidance to be lowered when Q2 2021 results are released.

Of further importance is that on December 20, 2020, LMT entered into an agreement to acquire Aerojet Rocketdyne Holdings, Inc. for a transaction value of ~$4.4B after the assumption of Aerojet Rocketdyne’s projected net cash.

The transaction was approved by Aerojet Rocketdyne’s stockholders on March 9, 2021 and closing is expected in the latter part of 2021; LMT’s financial results will not include Aerojet Rocketdyne’s results until the acquisition closes.

Management expects to finance the acquisition through a combination of cash on hand and new debt issuances.

Lockheed Martin – Stock Analysis – Credit Ratings

I am not prepared to assume unnecessary risk with my investments at this stage of my life. Furthermore, I am cognizant that as an equity investor I assume a greater level of risk than debt holders. I, therefore, pay attention to a company’s credit risk and shy away from companies where the unsecured debt is non-investment grade.

LMT’s senior unsecured domestic currency debt ratings from the 3 major rating agencies are at the lowest tier of the upper-medium investment-grade level.

- Moody’s: A3

- S&P Global: A-

- Fitch: A-

These ratings define LMT as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Lockheed Martin –

Dividend and Dividend Yield

We see from LMT’s dividend history that its 4th quarterly $2.60 dividend with be distributed on September 24th. Based on the current ~$375.60 share price this yields ~2.8%.

I think LMT will announce an increase in its quarterly dividend to ~$2.70 – ~$2.80 in the last week of September if the most recent dividend increases are indicative of what investors can expect; LMT generates ample Operating Cash Flow to support its dividend.

LMT continues to reduce its share count with the diluted weighted average shares outstanding in FY2011 – FY2020 (in millions) of 340, 328, 327, 322, 315, 303, 291, 287, 284, and 281. This was further reduced in Q1 2021 to 280.

Details of LMT’s share repurchases are found in Note 10 (page 19 of 131) in the Q1 10-Q.

Lockheed Martin – Stock Analysis – Valuation

At the time of my November 20, 2020 post, management had provided FY2020 diluted EPS from continuing operations guidance of ~$24.45. Using the ~$369/share price at which I acquired 200 shares, the forward adjusted diluted PE was ~15.1 versus diluted PE levels of 16.02, 19.47, 19.27, 18.81, 26.04, 24.80, and 18.51 recorded in FY2013 – 2019. When FY2020 results were released, LMT’s diluted PE was 15.16.

I subsequently added to my LMT exposure in December and January at even more favourable valuations.

Fast forward to the present where LMT is trading at ~$375.60. Using the $26.55 mid-point of management’s FY2021 guidance we get a ~14.2 forward adjusted diluted PE.

In addition, FY2021 and FY2022 guidance from 24 brokers is currently:

- FY2021 – mean of $26.68 and low/high of $26.46 – $27.25. Using the current share price and the mean, the forward adjusted diluted PE is ~14.1.

- FY2022 – mean of $27.89 and low/high of $26 – $29.77. Using the current share price and the mean, the forward adjusted diluted PE is ~13.5.

I view these estimated levels as attractive.

Lockheed Martin – Stock Analysis – Final Thoughts

LMT is attractively valued and its outlook is promising. I have thus added another 50 shares on July 14th to my current exposure in one of the ‘Core’ accounts within the FFJ Portfolio.

When I analyzed all my holdings in April 2021, our top 20 and top 30 holdings constituted 63.05% and 77.21% of all our holdings and LMT was my 18th largest holding. This is quite a jump from having had no exposure to the company before November 20, 2020.

As much as I want diversification, I do not want to ‘throw mud at the wall’. I like the companies in which I have invested and think increasing my exposure to them is appropriate. As a result, although I expressed an intent to initiate a position in Northrop Grumman (NOC) in my June 21st post if shares retraced to $350 or lower, I am adding to my LMT exposure and will refrain from investing in NOC; I also have exposure to the aerospace and defense industry through holdings in Raytheon (RTX) and Heico (HEI-a).

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I do not know your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long LMT, RTX, and HEI-a.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.