Lockheed Martin Corporation’s (LMT) share price has appreciated substantially after my Lockheed Martin Corporation – A Low Risk, Reasonably Valued High-Quality Defense Prime Contractor article and December – February follow-up articles. Looking at LMT’s share price in isolation, however, does not enable investors to properly assess the company’s current valuation. In this article, I look at Q1 results and revised guidance and provide my thoughts on why Lockheed Martin is still a compelling value investment opportunity.

In addition to reviewing Q1 2020 results and reading the transcript of the earnings call with analysts, I listened to the May 13th Goldman Sachs Industrials & Materials Conference in which LMT’s CFO discusses the:

- ‘culture of cash’;

- US’s national defense budget;

- impending changes to the treatment of R&D from a tax perspective;

- potential increase in corporate tax rates and the negative impact of potential changes to the treatment of Foreign Derived Imputed Income (FDII);

- changes in the Pension Relief Act and their impact on LMT’s results until 2025;

- status of the Aerojet Rocketdyne acquisition; and

- 2021 – 2023 outlook.

Business Overview

LMT is a global security and aerospace company principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. It also provides a broad range of management, engineering, technical, scientific, logistics, system integration and cybersecurity services.

Through its four business segments:

- Aeronautics;

- Missiles and Fire Control (MFC);

- Rotary and Mission Systems (RMS); and

- Space.

LMT serves its U.S. and international customers with products and services that have defense, civil and commercial applications. Its main areas of focus are in defense, space, intelligence, homeland security and information technology, including cybersecurity.

Its principal customers are agencies of the US Government. In FY2020, 74% of LMT’s $65.4B in net sales were from the US Government, either as a prime contractor or as a subcontractor (including 64% from the Department of Defense). The remainder was 25% from international customers (including foreign military sales contracted through the US Government) and 1% from US commercial and other customers.

A comprehensive overview of LMT is found in the ‘Who We Are’ and ‘What We Do’ sections on the company’s website and in Part 1 of the 2020 Annual Report. Immediately following the Business Overview section of the Annual Report is the Risk Factors section. Here, LMT presents the risks it seeks to identify, manage and mitigate.

Culture of Cash

On the May 13th call, LMT’s CFO stressed that throughout the organization, employees are committed to driving cash flow.

LMT intends to increase its strong cash flow through:

- delivering products and services on time;

- the acceleration of deliveries; and

- working on improving milestone payments with customers.

LMT intends to improve cash flow by working hard to lower the value of Contract assets (~$10.9B on page 5 of 31 in the Q1 2021 10-Q). These current assets include unbilled amounts typically resulting from sales under contracts when the percentage-of-completion cost-to-cost method of revenue recognition is utilized and revenue recognized exceeds the amount billed to the customer.

US National Defense Budget

The FY2021 budget cycle marks the final year of the Budget Control Act enacted in 2011. As part of the FY2021 omnibus funding bill, there is a fully funded national defense budget of ~$740B.

The White House recently released its preliminary budget proposal for FY2022, targeting a ~$11B top-line increase for the Department of Defense. This is an indication of the desire for continued stability in national security funding.

President Bidden has also issued an interim national security strategic guidance document that incorporates the following key elements:

- diplomacy;

- economic development;

- innovation; and

- modernizing military capabilities.

This document places emphasis on deterrence, investments in emerging technologies such as artificial intelligence, and secure next-gen 5G infrastructure as well as the need for strong defense and intelligence capabilities.

This vision aligns well with LMT’s 21st-century warfare strategy and plays to the strength of the company’s broad portfolio and culture of innovation.

Impending Changes In The Treatment of R&D From A Tax Perspective

The 2017 tax law changes reduced corporate taxes from 35% to 21%. However, the tax law changes require publicly held corporations to amortize R&D expenses over 5 years; they will no longer be able to expense them commencing in 2022. LMT’s CFO indicates the effect of this change will negatively impact LMT by $2.1B in 2022, $1.6B in 2023 with this amount reducing over the next 5 years.

LMT has been in discussions with key constituents in government because the company is very focused on internal investments and the proposed changes could:

- impede the investments LMT makes;

- negatively impact cash available for share repurchases and dividends.

Potential Increase In Corporate Tax Rates

The Biden administration is talking about increasing the 21% corporate statutory tax rate to 25% – 28%.

LMT also benefits from the Foreign Derived Imputed Income (FDII). This relates to products being built in the US for export to foreign customers. There are discussions about eliminating this benefit.

LMT’s CFO thinks that internal and external investments will be stifled if all these proposed changes are enacted.

Pension Relief Act

The American Rescue Plan Act of 2021 stimulus package has recently been enacted into legislation. It provides funding relief for single-employer pension plans in the form of interest rate stabilization and extending the period for amortizing funding shortfalls.

In addition, it extends the CARES Act Section 3610 provision until September 30, 2021 and enables federal agencies to continue to reimburse contractors for the cost of keeping employees and subcontractors in a ready state as a result of the global pandemic.

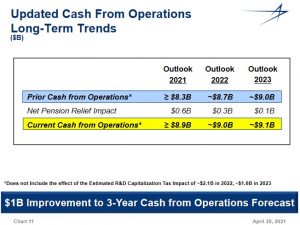

The passage of the American Rescue Plan Act means LMT is no longer planning to make a $1B discretionary pension contribution in 2021. This benefit is partially offset by a reduction in pension tax deductions with the net increase to cash of ~$0.6B. The net impact also improves LMT’s anticipated cash flow in 2022 and 2023.

This change allows LMT to recover the entire $8.3B of existing CARES prefunding credits by 2026. Based on the changes in law and LMT’s current estimates and assumptions for future pension asset performance, it does not believe there will be a required pension cash contribution before 2026. In addition, LMT expects minimal contributions thereafter.

In total, this change in legislation increases LMT’s 3-year cash flow estimate by $1B. Combined with reduced future CARES expenses, LMT believes there will be an improvement in its cost competitiveness and affordability to customers.

Aerojet Rocketdyne Acquisition

On December 20, 2020, LMT agreed to acquire Aerojet Rocketdyne Holdings, Inc. for a transaction value of ~$4.4B after the assumption of Aerojet’s projected net cash; the transaction was approved by Aerojet’s stockholders on March 9, 2021.

Just recently, LMT and Aerojet received a request for additional information from the Federal Trade Commission (FTC) as part of the regulatory review process. This second request extends the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. Both companies continue to work cooperatively with the FTC with a resolution of the regulatory review process likely to occur in the 2nd half of 2021.

According to LMT’s CFO, funding of this acquisition will come from a combination of cash on hand and potentially from the issuance of debt. He states LMT is underleveraged and with the current low-interest-rate environment and LMT’s investment-grade credit ratings, the use of low-cost debt to enhance shareholder value is a realistic means by which to finance the Aerojet acquisition.

Q1 2021 Results and FY2021 Guidance

On April 20, 2021, LMT released its Q1 results and accompanying Earnings Presentation.

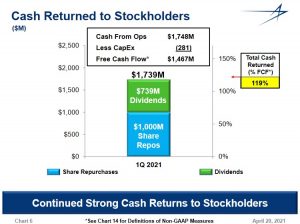

Cash generation remains strong with over $1.7B of cash generated from operations in Q1. This includes ~$1.4B of accelerating payments to suppliers that include thousands of small and vulnerable companies that are stressed due to COVID-19 impacts.

LMT consistently generates strong FCF thus providing it with flexibility when it comes to:

- reinvesting in the business;

- debt repayment;

- share buybacks; and

- dividend increases.

In fact, LMT returned more than $1.7B to shareholders in Q1.

By comparison, in FY2010 – FY2020, LMT generated free cash flow (FCF) of (expressed in billions) $2.727, $3.266, $0.619, $3.710, $3.021, $4.162, $4.126, $5.299, $1.860, $5.827 and $6.417.

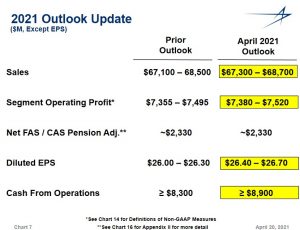

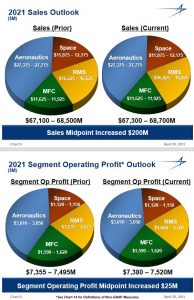

With a strong Q1, a robust backlog of orders, and key programs that continue to deliver growth and sustained performance, LMT has increased its FY2021 sales, operating profit, EPS and cash from operations outlook.

Credit Ratings

Moody’s continues to rate LMT’s senior unsecured domestic currency debt A3. Fitch and S&P Global continue to rate this debt A-. All 3 ratings are investment grade and are the lowest tier in the upper-medium grade category.

These ratings define LMT as having a STRONG capacity to meet its financial commitments. The company, however, is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

I view LMT’s risk as acceptable.

Dividend, Dividend Yield, and Share Repurchases

LMT’s dividend history can be accessed here and its stock split history can be accessed here.

When I initiated my LMT position in November, the dividend yield was ~2.8% (($2.60 x4)/$369) based on my ~$369 purchase price; my follow-up purchases were at lower share prices thus resulting in a superior dividend yield. With shares now trading at ~$391, the dividend yield is ~2.66%.

The dividend yield is a metric upon which many investors heavily base their investment decision. However, it is only one component of an investment’s potential return. Even if the dividend yield is attractive, acquiring grossly overvalued shares often leads to sub-standard investment returns. This occurs if a company falls out of favour or when there is a shock to the system as witnessed when the .com bubble burst, the Financial Crisis hit, and the economic shutdown in 2020 due to COVID-19.

LMT generates ample Free Cash Flow which provides it with the flexibility to reduce share count. In 2011 – 2020, LMT’s weighted average number of outstanding diluted shares was 340, 328, 327, 322, 315, 303, 291, 286.8, 283.8, and 281.2 (in millions). At the end of Q1 2021, this figure stands at 280 million shares.

Valuation

Rather than focus on dividend yield or the company’s share price in isolation, investors should consider an investment’s overall potential return. This is why it is of utmost importance to pay attention to a company’s valuation.

When I wrote my November 20, 2020 article, LMT had reported $17.92 in YTD diluted EPS. In Q3, however, it incurred a $55 million ($0.20 per share) non-cash charge resulting from the resolution of certain tax matters related to the former IS&GS business divested in 2016. By adding this non-cash charge we arrived at a YTD diluted EPS of $18.12. Management had also provided FY2020 diluted EPS from continuing operations guidance of ~$24.45. We now know that LMT reported $24.50 in GAAP diluted EPS for FY2020.

Using the ~$369/share price at which I acquired 200 shares and the FY2020 GAAP diluted EPS of $24.50, the diluted PE is ~15.1. This compares favourably with the 16.02, 19.47, 19.27, 18.81, 26.04, 24.80, and 18.51 PE levels recorded in FY2013 – 2019.

In early 2021, LMT provided FY2021 adjusted diluted EPS guidance of $26.00 – $26.30. However, guidance is now $26.40 – $26.70. With shares trading at ~$391 we get a forward adjusted diluted PE range of ~14.64 – ~14.81.

FY202021 adjusted diluted EPS guidance from 23 brokers is a mean of $26.68 and a range of $26.46 – $27.25. This gives us a forward adjusted diluted PE range of ~14.35 – ~14.78.

In my opinion, LMT is still a compelling value investment opportunity.

Lockheed Martin – Still A Compelling Value Investment Opportunity – Final Thoughts

On November 20, 2020, I initiated a position in Lockheed Martin Corporation (LMT) in one of the ‘Core’ accounts within the FFJ Portfolio. After this purchase I acquired additional shares on 4 separate occasions during December – February; I disclose these purchases in follow-up LMT articles.

Although LMT’s share price has appreciated somewhat from the time of my purchases, LMT has increased its FY2021 guidance. As a result, LMT’s valuation is somewhat similar to when I initiated my position in November 2020.

I recognize some of the headwinds mentioned by LMT’s CFO on the May 13th call might concern some investors. However, LMT is not the only company that would experience serious negative repercussions with the enactment of all the proposed changes. I expect extensive negotiations with the Bidden administration to be held over the next several months. This should lead to some concessions.

I think Lockheed Martin is still a compelling value investment opportunity despite the recent share price appreciation.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long LMT.

Disclaimer: I do not know your individual circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.