Contents

Summary

Summary

- Korn/Ferry released Q2 results and reported the best top line and bottom line results in the company’s history.

- Many investors will likely shy away from a KFY investment because of its sub 1% dividend yield and stagnant quarterly dividend.

- I view shares as being attractively valued and am currently employing a conservative covered Call option strategy to lower my cost base and to generate additional positive cash flow while I wait for KFY shares to appreciate in value.

Introduction

In September, subsequent to Korn/Ferry International (NYSE: KFY) releasing its Q1 2019 results and the stock price plunging from the high ~$60s to the high ~$40s, I decided to initiate a position.

In this article I wrote that KFY had just reported a diluted loss of $0.70/share versus diluted EPS of $0.51/share in Q1 FY2018 and adjusted diluted EPS of $0.78 in Q1 FY2019 versus adjusted diluted EPS of $0.55 in Q1 FY2018. I indicated:

‘The reason for this loss under GAAP is that on June 12, 2018 KFY’s Board of Directors approved a plan to go to market under a single, master brand architecture and to simplify the Company’s organizational structure by eliminating and/or consolidating certain legal entities and implementing a rebranding of the Company to offer the Company’s current products and services using the “Korn Ferry” name, branding and trademarks. In connection with that Plan, KFY indicated that the intent was to sunset all sub-brands (ie. Futurestep, Hay Group and Lominger).

The purpose of harmonizing under one brand was to help accelerate the firm’s positioning as the preeminent organizational consultancy and to bring more client awareness to its broad range of talent management solutions.

KFY indicated the rebranding would have no impact on the financial reporting for its various segments with the change in reporting to commence Q1 FY2019.’

Fast forward to December 6th and KFY has just released Q2 results in which it has just reported the best top line and bottom line results in the company’s history.

Despite strong results, Mr. Market has not been kind to KFY’s stock price and it has dropped to the current $44.51 level as I compose this article. I am not concerned about this further pullback and as indicated in this article, stock pullbacks should be looked upon from a positive perspective.

I strongly suspect anybody reading this article likes to acquire something when it is on sale. It is surprising, however, how the very same people who like to get a ‘deal’ get upset when the share price of a company in which they have invested drops in value. If a share price decline is not attributed to a permanent impairment of the company I don’t see the need to be concerned. In fact, acquiring more shares at a more favorable price (unless you hold a full position) is what comes to my mind.

In hindsight, when I initiated my KFY position in September 2018 and wrote covered calls, I didn’t wait long enough for the option values to fully catch up with the drop in the share price. I also went too far out on the calendar when I wrote my calls.

When I wrote calls with a March 15, 2019 expiry and a $55 strike price, shares were trading just below $50 and I only received $1.35/share. If my memory serves me correctly, a little patience on my part in writing these covered calls and I could have received closer to $2.50 - $3/share.

While the last price for these options is reflected as being $1.88/share, the Bid and Ask prices are $0.45 and $0.75 respectively as I compose this article. This means that if I were to buy my covered calls to close my position I would need to pay somewhere in this range.

I have no pressing reason to close out my position. Quite frankly, with the way Mr. Market is behaving I strongly suspect KFY’s share price will not come close to the $55 strike price by the March 15th expiry. If the share price stays below $55 then the options will just expire worthless and I will retain my shares and the option premium.

With KFY trading at $44.51 and 6 month results having just been reported, let’s look at whether KFY is currently an attractive investment.

Q2 FY2019 Results

KFY’s Q2 Earnings Release can be accessed here and its Q2 Earnings Presentation can be accessed here.

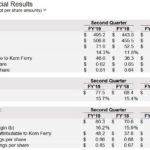

At the time of the Q1 Earnings Release KFY provided the following Q2 Earnings Outlook which I included in my September 20th article.

Source: KFY – Q1 Fiscal 2019 Earnings Release – September 6 2018

Looking at Q2 results we see that KFY’s actual results exceeded management’s outlook.

Source: KFY – Q2 Fiscal 2019 Earnings Release – December 6 2018

Three takeaways from the Q2 earnings release are that KFY reported record:

- revenue across each business line;

- profitability with earnings growth outpacing revenue growth;

- new business in executive search and advisory with very strong new business in recruitment process outsourcing (RPO) and professional search.

KFY achieved record highs in revenue earnings and profitability. Global fee revenue reached $0.495B, a 12% YoY increase at actual exchange rate and nearly 15% at constant currency. Q2 marked the fifth consecutive quarter in KFY achieved double-digit revenue growth.

Growth was once again broad based. Each operating segment benefited from synergies across KFY’s core and integrated solution offerings. At constant currency RPO and professional search grew 25%, Executive search grew 14% and revenue growth for advisory was ~12% (Q2 advisory revenue of $0.217B was an all time high).

From the comments made on the Q2 conference call with analysts, KFY was firing on all cylinders in Q2.

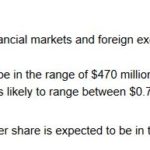

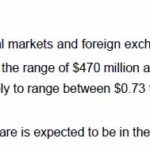

Q3 FY2019 Outlook

Management provides guidance solely for the upcoming quarter and the following was provided in the December 6, 2018 Earnings Release.

Source: KFY – Q2 Fiscal 2019 Earnings Release – December 6 2018

Credit Ratings

KFY is not rated by the major ratings agencies. As indicated in my September 20th article, however, KFY’s minimal long-term debt relative to its overall financial position is appealing to me.

Valuation

In my September 20th article I wrote that KFY had generated adjusted diluted EPS of $0.78/share in Q1. When I used the $0.80/share mid-point of the Q2 FY2019 forecast I arrived at adjusted diluted EPS of ~$1.58/share for the first half of the year. I then doubled this value to arrive at a projected adjusted diluted EPS of ~$3.16/share for FY2019.

With KFY trading at $49.60 I figured the forward adjusted diluted PE was ~15.7.

Fast forward to the Q2 results. KFY’s low YTD diluted EPS of $0.13 is attributed to the significant Q1 Intangible Asset write-down I discussed in my September 20th article. I view that as a non-recurring event, and therefore, ‘adjusted earnings’ are best used to determine a fair value for KFY shares.

KFY has just reported YTD adjusted diluted EPS of $1.62. Management is projecting Q3 adjusted diluted EPS of $0.77 - $0.85. If I use a $0.81 mid-point for Q3 and also for Q4 then projected adjusted EPS for FY2019 should end up being ~$3.24.

KFY is currently trading at $44.51 and on this basis I get a forward adjusted diluted PE of ~13.74.

Dividends

In keeping with its capital allocation strategy (see below), KFY repurchased $22.7 million of stock during Q2 and has just declared another $0.10/share quarterly dividend payable on January 15, 2019 to stockholders of record on December 20, 2018.

KFY’s has a very brief dividend history; the Board of Directors only adopted a dividend policy on December 8, 2014. This dividend policy reflected an intention to distribute a regular quarterly cash dividend of $0.10/share with the first dividend under this program having been paid on April 9, 2015. The dividend has not changed since it was established.

The fact KFY has never increased its quarterly dividend since instituting a quarterly dividend and because the current dividend yield is sub 1%, I am of the opinion many investors will have limited interest in investing in KFY.

Capital Allocation

KFY’s capital allocation priorities are as follows:

- Invest in growth initiatives, such as the hiring of consultants, the continued development of IP and derivative products and services, and the investment in synergistic accretive M&A transactions that earn a return superior to the Company’s cost of capital.

- A return of a portion of excess capital to stockholders, in the form of a regular quarterly dividend, subject to various factors.

- Share repurchases on an opportunistic basis and subject to the terms of our credit agreement.

On December 8, 2014, KFY’s Board of Directors approved an increase in the stock repurchase program to an aggregate of $150.0 million; common stock may be repurchased from time to time in open market or privately negotiated transactions at the Company’s discretion subject to market conditions and other factors.

KFY’s share count has increased from ~44 million shares as at the end of FY2009 to 56.306 million shares (weighted-average common shares outstanding) as at the end of Q2. The level of shares outstanding has been relatively constant since FY2017 as the company has been repurchasing shares to offset shares issued under its compensation structure.

Final Thoughts

KFY differs from most companies I follow in that it has a much smaller market cap (currently approximately $2.5B).

What appealed to me when I initiated my position is that it is consistently profitable. I viewed the one time Goodwill write-down which knocked ~$19 from KFY’s share price as an opportunity to acquire fairly valued shares; rarely are KFY’s shares fairly valued.

KFY’s share price has softened somewhat subsequent to me initiating my position but I attribute this to overall market conditions rather than any deterioration in the company; KFY just reported record results.

I hold a full position and will not be acquiring additional shares. Were this not the case I would acquire shares based on current valuation and where I envision this company 5 – 10 years into the future.

If KFY appeals to you, please keep in mind that its dividend yield is extremely low and a steadily increasing dividend is not something you can expect from this company; your investment return will come primarily from potential capital gains.

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long KFY.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.