Intercontinental Exchange (ICE) might not be a familiar name to many investors. Most investors, however, recognize The New York Stock Exchange (NYSE); ICE purchased the NYSE as part of the NYSE Euronext acquisition in November 2013 for $11B.

The NYSE, however, is just one regulated marketplace that falls within the Exchanges segment of ICE. In fact, ICE conducts business through three reportable business segments:

- Exchanges;

- Fixed Income and Data Services; and

- Mortgage Technology.

The majority of ICE’s identifiable assets are in the U.S. and the United Kingdom.

Part 1 of ICE’s FY2020 Annual Report and 10-K has a comprehensive overview of ICE’s history, business segments, technology, competitive strengths, competitors, growth strategy, risk factors, and more.

This Investor Presentation also provides a good overview of ICE’s 3 business segments.

In my August 21, 2020 post, I disclosed my purchase of ICE shares in a retirement account and I subsequently wrote this guest post at ValueofStocks.

I now take this opportunity to revisit ICE to determine whether to acquire additional shares.

Intercontinental Exchange – Stock Analysis – Business Overview

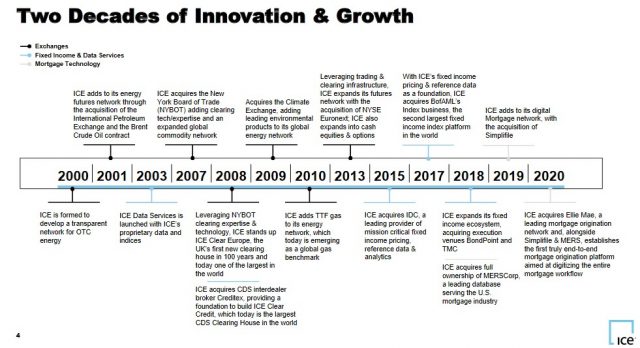

We see from the following timeline that ICE has been actively innovating and growing for the past couple of decades. This growth and innovation have come about through several acquisitions; high-level detail of the most recent transactions is found below.

Acquisitions

Ellie Mae

On September 4, 2020, ICE announced the receipt of regulatory approval and its completion of the $11B acquisition of Ellie Mae from private equity firm Thoma Bravo. My August 21, 2020 post provides a high-level overview of Ellie Mae.

Divestitures

ICE has never viewed itself as a private equity firm or a venture firm. It has, however, made investments in several businesses that are adjacent to its current businesses if it thought there was some strategic advantage by having a relationship with the company, either by partnering with them or by knowledge transfer.

Coinbase

In January 2015, ICE announced that its wholly-owned NYSE subsidiary made a minority investment in Coinbase, a leading bitcoin wallet and platform with over 2.1 million consumer wallets, 38,000 merchants and 7,000 developers. The reason ICE invested in Coinbase in its early rounds is that it was trying to understand the blockchain and the significance of digital currencies in payments.

In May 2015, ICE announced the NYSE Bitcoin Index (NYXBT), the first exchange-calculated and disseminated bitcoin index. The NYBXT initially featured data from transactions from Coinbase Exchange, the leading U.S.-based bitcoin exchange.

In April 2021, ICE elected to sell its 1.4% stake in Coinbase. This generated over $1.2B in gross proceeds and ~$0.9B net of taxes. Proceeds from this sale were used to reduce commercial paper debt that was taken on when ICE acquired Ellie Mae.

Bakkt

This company offers an integrated platform that enables consumers and institutions to transact in digital assets. Bakkt Trust Company, LLC is a qualified custodian that takes custody of bitcoin for physically delivered futures. This creates a fully regulated marketplace for trading, clearing and custodial solutions. It is supported by ICE Futures U.S. and ICE Clear U.S.

In December 2018, Bakkt was capitalized with $0.183B in initial funding with ICE as the majority owner. In March 2020, an additional $0.3B in funding occurred with ICE maintaining its majority ownership.

The investment in Bakkt was for similar reasons to the Coinbase investment. This investment was driven by ICE trying to understand blockchain because a few years earlier, the investment community was inquiring whether blockchain was going to be used for clearing and whether it was going to disrupt the traditional financial services industry. ICE wanted to be on top of that technology and have that knowledge. Hence, the investment in Bakkt.

With a significant appreciation in the value of Bakkt, ICE announced in January 2021 that Bakkt would become a publicly-traded company via a merger with VPC Impact Acquisition Holdings (VIH), a special purpose acquisition company (SPAC) sponsored by Victory Park Capital. The newly combined company will be renamed Bakkt Holdings, Inc. and is expected to be listed on the NYSE.

As part of the transaction, Bakkt’s existing equity holders and management will roll 100% of their equity into the combined company. Assuming no shareholders of VIH exercise their redemption rights, current Bakkt equity holders, including ICE, will own ~78% of the combined company, VIH’s public shareholders will own ~8%, VPC will own 2%, and PIPE investors (a group that will also include ICE) will own ~12% of the issued and outstanding common stock of the combined company at closing.

Following the completion of the business combination, which is expected to occur in Q3 2021, ICE is expected to have a 65% economic interest and a minority voting interest in the combined company.

Bakkt revenues and operating expenses continue to be reported within ICE’s consolidated revenues and operating expenses. Following the closing, ICE will deconsolidate Bakkt and treat it as an equity method investment within its financial statements.

Euroclear

ICE owns a 9.8% stake in Euroclear as of December 31, 2020.

Euroclear is a provider of post-trade services, including settlement, central securities depositories and related services for cross-border transactions across asset classes.

ICE classifies its investment in Euroclear as an equity investment and includes it in other non-current assets in the consolidated balance sheet.

In November 2020, ICE became aware of an observable price change in an orderly transaction of a similar Euroclear investment by a third party. The transaction resulted in a fair value adjustment of ICE’s Euroclear investment and ICE recorded a $35 million gain in other income; this includes the impact of foreign currency translation.

As of FYE2020, the adjusted fair value of ICE’s Euroclear investment was $0.666B.

ICE recognized dividend income of $15 million in FY2018 and $19 million in FY2019. This is included in other income.

As a result of the 2020 European regulation limiting dividend payments, ICE did not receive a Euroclear dividend in FY2020.

On the Q2 2021 Earnings call, management indicated ICE is in the early stages of exploring a sale of its stake in Euroclear. The timing of any potential sale remains unclear but ICE’s strategic approach is to continuously evaluate and optimize the allocation of capital across the business. When the sale does occur, the plan is to deploy the sale proceeds to reduce leverage related to the acquisition of Ellie Mae.

Intercontinental Exchange – Stock Analysis – Financials

Q2 2021 and YTD Results

On July 29, ICE released its Q2 and YTD results; the accompanying Earnings Presentation is accessible here. The Form 10-Q provides more comprehensive information.

As noted above, ICE generated just over $1.2B in gross proceeds from the sale of Coinbase in early April. The proceeds were used to reduce commercial paper borrowings.

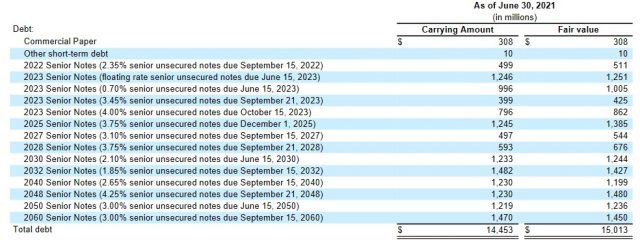

We see from the following schedule (page 27 of 76 in the Q2 10-Q) that ICE does not have any debt maturities of significance until 2023. One of ICE’s priorities, however, is to reduce the debt incurred for the Ellie Mae acquisition.

ICE – Schedule of Fair Value of Debt as of June 30, 2021

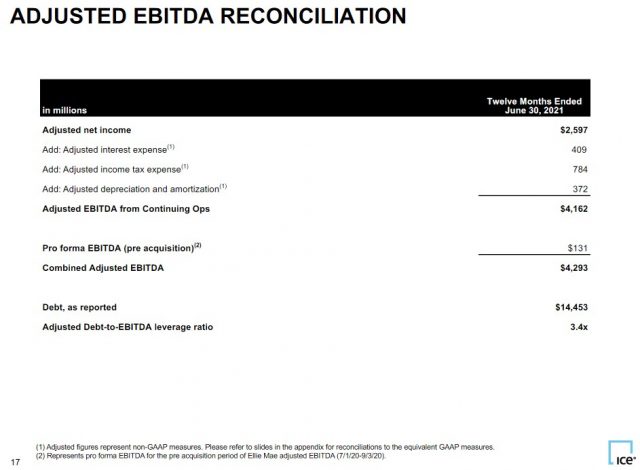

ICE has, in fact, suspended share repurchases until leverage falls below 3.25 times Adjusted Debt-to-EBITDA. I expect the 2022 Senior Notes and some of the 2023 Senior Notes to be repaid before the end of FY2021. At the rate at which ICE has been reducing its leverage, we may see a resumption of share repurchases in early 2022.

On the Q2 Earnings call, ICE’s Founder, Chairman & CEO provided the following additional colour regarding YTD results.

- ICE has been deliberately positioned to have a mix of transaction and compounding subscription revenues to give investors upside exposure while hedging ICE’s downside risk.

- At the heart of ICE’s strategy is its data, technology and network expertise which connect the different businesses across ICE. This enables it to deliver innovative solutions. An example of this is several exchange–traded funds transitioning their benchmarks to ICE.

- ICE is also expanding the reference data constituents it offers. Assets under management that transition to ICE’s indices benefits its Fixed Income and Data Services business. It also provides cross-selling opportunities. Several biotech companies have, for example, selected the NYSE as their listing venue.

- ICE has also combined its expertise in index construction with its global environmental trading markets. This has created the ICE Global Carbon Index which is a benchmark for the universal price of carbon; this is critical to employing market forces to reduce greenhouse gas emissions cost-effectively. The ICE Global Carbon Index is part of a suite of environmental, social, and governance–related services that ICE offers to its customers, which also include green bond indices, climate analytics, and ICE’s ESG reference data.

- In the second half of July, ICE announced the integration of ICE Mortgage Technology’s transaction–based mortgage rates into ICE’s mortgage prepayment model at ICE Data; ICE is a leading provider of price evaluations for mortgage–backed securities. This new offering is the first time that ICE has combined the valuable underlying content from ICE Mortgage Technology with ICE’s expertise in identifying and creating new data offerings. This enhancement will enable the market to more accurately price mortgage prepayments, which are a critical component for fixed-income investors.

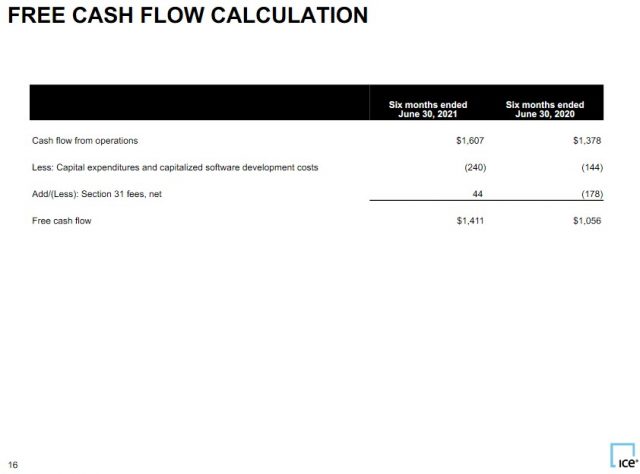

Free Cash Flow (FCF)

YTD FCF slightly exceeded $1.4B thus enabling ICE to increase its dividend by 10% and to reduce leverage to just under 3.4 times adjusted EBITDA.

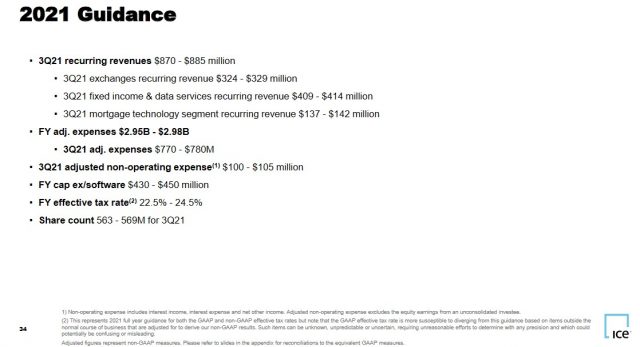

Q3 and FY2021 Guidance

The following guidance has been provided.

Intercontinental Exchange – Stock Analysis – Credit Ratings

Following the Ellie Mae acquisition announcement, Moody’s downgraded ICE’s senior unsecured long-term debt credit rating from A2 to A3; the revised rating is the lowest tier of the upper-medium investment-grade tier.

S&P Global also lowered ICE’s long-term credit rating to BBB+ which is one notch lower than Moody’s rating. It is the top tier of the lower-medium investment-grade tier.

Moody’s rating defines ICE as having a STRONG capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

S&P Global’s rating defines ICE as having an ADEQUATE capacity to meet its financial commitments. It is, however, more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

The outlook from both rating agencies is stable.

Both ratings are investment grade and are satisfactory for my purposes.

Dividend and Dividend Yield

The Investor Resources section of ICE’s website does not include a dividend history.

Looking at ICE’s dividend history on the NASDAQ site, we see an$0.85/share/quarter to $0.17/share/quarter drop in the dividend in late 2016. This is not a dividend cut but rather NASDAQ not having adjusted ICE’s quarterly dividend to account for the 5 for 1 stock split. Shareholders on record at October 27, 2016, received 4 additional shares on November 3, 2016, for each share held; shares began trading on a split-adjusted basis on Nov 4, 2016.

The current $0.33/share/quarter provides investors with a ~1.1% dividend yield using the current $120 share price. In comparison, ICE’s dividend yield at the time of my March 1, 2021 guest post was ~1.08% ($0.30/share/quarter and ~$110.30 share price).

Share repurchases have been suspended until leverage falls below 3.25 times Adjusted Debt-to-EBITDA.

ICE reduced leverage to 3.8 times by the end of Q1 and just under 3.4 times at the end of Q2.

ICE’s diluted weighted average common shares outstanding in FY2016 – FY2020 was (in millions of shares o/s): 599, 594, 579,565, and 555. This increased in Q1 2021 to 565 for the 6 months ending June 30, 2021.

The weighted average common shares outstanding decreased in 2020 from 2019 primarily due to stock repurchases, partially offset by the ~18.4 million common shares issued in connection with the Ellie Mae acquisition. The weighted average common shares outstanding decreased in 2019 and 2018 compared to 2018 and 2017, respectively, primarily due to share repurchases. In 2016, ICE issued 32.3 million and 12.6 million shares of common stock to Interactive Data and Trayport stockholders, as part of those acquisitions, respectively.

Intercontinental Exchange – Stock Analysis – Valuation

When I acquired shares in August 2020, the low/high and mean adjusted earnings estimates for FY2020 were $4.28 – $.4.81 and $4.40. I erred on the side of caution and used $4.30 with the $103.60 share price to give me a forward-adjusted PE of ~24.

At the time of my March 1, 2021 guest post, ICE had just reported FY2020 adjusted diluted EPS of $4.51. Using the current $110.31 share price, I arrived at an adjusted diluted PE of ~24.5.

In addition, the adjusted diluted EPS FY2021 guidance from 17 brokers was $4.69 – $5.09 and a mean of $4.92. With shares trading at $110.31, the forward adjusted diluted PE was ~22.4 using the mean value and ~21.7 – ~23.5 using the range of estimates.

ICE’s share price is currently $120 and we have the following is FY2021 – FY2023 guidance from the brokers which cover ICE:

- FY2021 – 13 brokers – mean of $4.86 and low/high of $4.66 – $5.01. Using the mean estimate, the forward adjusted diluted PE is ~24.7 and ~24.5 if I use $4.90.

- FY2022 – 13 brokers – mean of $5.22 and low/high of $5.06 – $5.53. Using the mean estimate, the forward adjusted diluted PE is ~23 and ~22.2 if I use $5.40.

- FY2023 – 10 brokers – mean of $5.79 and low/high of $5.41 – $6.05. Using the mean estimate, the forward adjusted diluted PE is ~20.7 and ~20.3 if I use $5.90.

Looking at ICE’s track record of acquisitions and divestitures and I am reluctant to use earnings guidance beyond FY2022.

Intercontinental Exchange – Stock Analysis – Final Thoughts

I think ICE will restore its Adjusted Debt-to-EBITDA to below 3.25 times by the end of FY2021. Once this occurs, I expect share repurchases to resume which could have a positive impact on earnings guidance for FY2022.

In addition, ICE will distribute the 4th consecutive $0.33/share quarterly dividend at the end of December. Looking at ICE’s dividend history, I think ICE will increase its quarterly dividend to ~$0.36/share. The dividend yield will likely remain around the 1% mark. This is not an issue from my perspective because am I not acquiring ICE shares for the dividend income; I expect the majority of any long-term investment return will be from capital appreciation.

The current valuation is relatively similar to that at the time of my previous posts. Given my long-term outlook for ICE, I intend to add to my position at the ~$120 level by acquiring shares in a ‘Core’ account in the FFJ Portfolio within the next 72 hours.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long ICE.

Disclaimer: I do not know your individual circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.