Contents

On June 5, 2021, I published this Vontier stock analysis in which I disclose a position within one of the 'Side' accounts in the FFJ Portfolio. This position originated by way of the Vontier (VNT) spin-off from Fortive Corporation (FTV) on October 9, 2020.

Following that post, VNT:

- made a major acquisition announcement on July 19; and

- released Q2 and YTD results and provided updated guidance on August 6.

Vontier - Stock Analysis - Business Overview

Part 1 of the FY2020 10-K has a good overview of VNT's industry, customers, business strategy, solutions and risks.

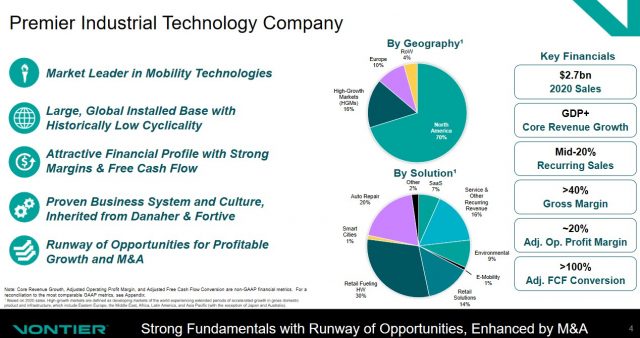

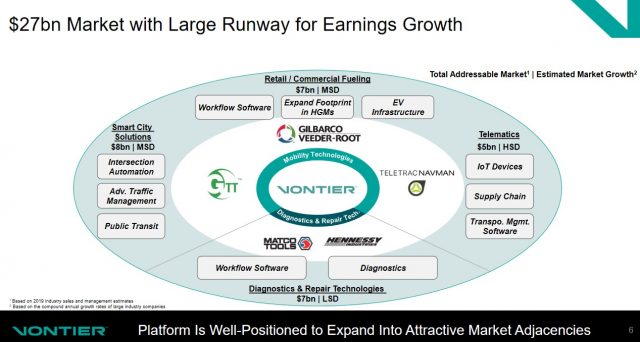

The following images provide a very high-level overview of VNT before the recent DRB Systems, LLC acquisition (see details below) which is expected to close in Q3 2021.

Electric Motor Vehicle (EMV) Headwinds

VNT faces increasing vulnerability from the shift toward electrified passenger vehicle powertrains because it currently generates ~70% of revenue from its retail fueling operations (Gilbarco Veeder Root). GVR provides equipment for retail fueling stations ranging from tank monitoring to fuel dispensers to payment systems; it is the leader in the U.S. with over 50% market share.

Over the long term, vehicle electrification is a credible threat to VNT's GVR business. However, it will likely be the next decade before electric vehicles reach 50% of U.S. auto production. This leads me to believe there will still be a lot of combustion-powered passenger vehicles needing fueling stations for many more years.

In addition, VNT can explore growth opportunities in international markets which have far lower penetration rates of fueling stations. Furthermore, growing personal income should lead to increased car ownership and more demand for fueling stations.

As much as developed countries are transitioning to electric vehicles, my recent Chevron post includes a link to a comment made by India's Energy Minister who lambasted the richer world's carbon-cutting plans at a major climate conference earlier in 2021. He called long-term net-zero targets, 'pie in the sky' and stated that poor nations want to continue using fossil fuels and the rich countries 'can't stop it'.

I think it is no coincide that VNT has reported on page 31 of 44 in its Q2 10-Q that high-growth markets had a 20+% increase in Q2 and the first half of FY2021 primarily due to growth in India and Latin America.

Private Offering of $1.6B of Senior Notes

On March 3, VNT announced the terms of notes issued in a private offering. The intended uses of ~$1.59B in net proceeds, after deducting commissions and before offering expenses payable by VNT, are to repay certain of VNT's existing indebtedness, including the repayment in full of its two-year term loan and $0.4B of its three-year term loan. The remainder of the net proceeds is to be used for working capital and other general corporate purposes. This may include capital expenditures, potential acquisitions, or strategic transactions.

Looking at Note 4 - Financing in the Q2 10-Q, we see the changes in VNT's total long-term debt resulting from the issuance of these senior notes.

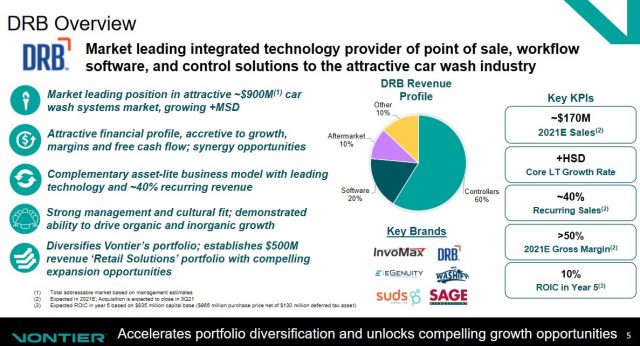

DRB Systems, LLC Acquisition

One of VNT's identified growth drivers is M&A with talk of spending $1.5B over the next 3 years. This amount could easily grow to a cumulative $6B+ over the next 5 - 7 years depending upon the size and free cash flow generating capabilities of the acquisitions.

Not surprisingly, VNT has deployed proceeds from the issuance of the recently issued senior notes toward a major acquisition.

On July 19, 2021, VNT announced that it has entered into a definitive agreement to acquire DRB Systems for ~$0.965B in cash from New Mountain Capital, a New York-based investment firm. The purchase price includes a ~$0.13B deferred tax asset which VNT expects to utilize over the next 15 years. As noted above, this transaction is anticipated to close in Q3 2021.

VNT expects DRB to generate ~$0.17B of revenue in 2021 with mid-20% operating margins and is expected to have a high-single-digit long-term growth rate.

DRB Systems, founded in 1984, employs more than 500 people across North America and is headquartered in Akron, Ohio. It is a leading provider of point of sale, workflow software, and control solutions to the car wash industry.

On the Q2 2021 earnings call with analysts, management indicated this acquisition establishes critical scale and is the first step in diversifying the portfolio toward long-term secular growth drivers in attractive markets. Vehicles will need to be washed regardless of how they are powered!

Vontier - Stock Analysis - Financials

Q2 2021 Results

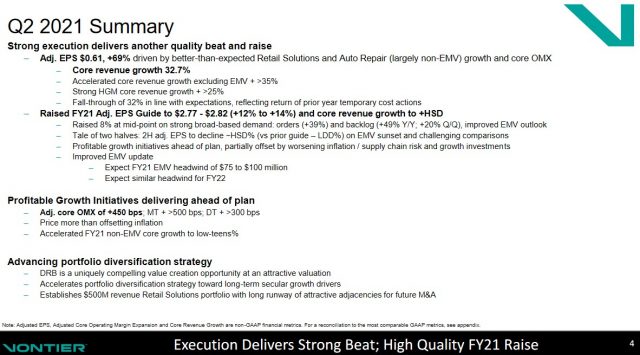

VNT's Q2 and YTD results are reflected in the August 6 Earnings Release and Earnings Presentation, and in the Q2 2021 10-Q.

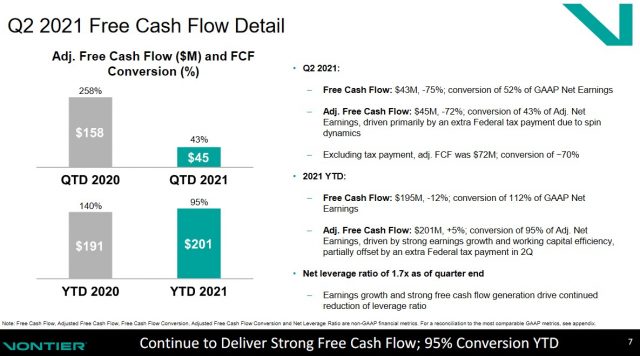

Free Cash Flow (FCF)

In reviewing the Q2 results, we see an uncharacteristically low FCF conversion rate.

On the Q2 earnings call, management indicates this low conversion rate will most likely be the low point for the year. The reason for this low conversion rate is twofold. VNT:

- paid an incremental Federal Tax Payment of ~$30 million which was a dynamic from the spin-off from FTV.

- built ~$30 million of net working capital while continuing to satisfy strong demand conditions. It ended Q2 with the dollar value of working capital at 6.2% of the last 12 month sales. This is an increase from the 5.6% Q1 level.

When we exclude the tax payment, the adjusted FCF is a ~70% conversion rate.

Management expects strong FCF generation to resume commencing Q3 2021.

Q3 and FY2021 Guidance

When VNT released Q1 results, management revised guidance as follows:

- Q2 2021 diluted net EPS of $0.43 - $0.47 and adjusted diluted net EPS of $0.50 - $0.54.

- FY2021 diluted net EPS of $2.25 - $2.35 and adjusted diluted net EPS of $2.55 - $2.65.

With the release of Q2 and YTD results, management has also provided the following revised guidance as per page 15 of 20.

- Q3 2021 diluted net EPS of $0.63 - $0.66 and adjusted diluted net EPS of $0.71 - $0.74.

- FY2021 diluted net EPS of $2.39 - $2.44 and adjusted diluted net EPS of $2.77 - $2.82.

Vontier - Stock Analysis - Credit Ratings

In my previous post, I indicated that I view VNT's high leverage as a risk an investor should consider before investing in the company.

Moody's, S&P, and Fitch assign the following unsecured long-term debt credit ratings:

- Moody's: Ba1;

- S&P: BBB-; and

- Fitch: BBB-.

Despite the recent increase in leverage, Moody's indicates there is no impact on the current Ba1 rating. In addition, the other two rating agencies reflect a stable outlook.

Moody's rating, the top tier of the non-investment grade speculative category, is 1 notch lower than the ratings assigned by S&P and Fitch. This rating defines VNT as being LESS VULNERABLE in the near term than other lower-rated obligors. However, it faces major ongoing uncertainties and exposure to adverse business, financial, or economic conditions which could lead to an inadequate capacity to meet its financial commitments.

The S&P and Fitch ratings are the lowest tier of the lower medium grade investment-grade category. These ratings define VNT as having an ADEQUATE capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to meet financial commitments.

I generally invest in companies with higher ratings. However, VNT generates robust FCF and the business faces limited cyclicality and is supported by recurring sales. I think VNT will be able to service its debt obligations and envision its performance over the coming years will lead to Moody's upgrading the rating to investment grade.

Dividend and Dividend Yield

On May 24, VNT declared its inaugural quarterly dividend. The $0.025/share quarterly dividend, or $0.10/year, yields 0.3% based on the current ~$33.45 share price.

As indicated in my previous post, VNT's dividend policy is similar to that of Danaher (DHR) and FTV. VNT is most likely to maintain a low dividend payout ratio and retain funds to grow the business. This strategy has proven to be highly successful for DHR and FTV.

On May 19, VNT's Board of Directors approved a share repurchase program authorizing the repurchase of up to $0.5B of common stock from time to time on the open market or in privately negotiated transactions. This share repurchase program may be suspended or discontinued at any time and has no expiration date.

As of July 2, VNT has remaining authorization to repurchase $0.5B of its common stock under the share repurchase program.

Vontier - Stock Analysis - Valuation

At the time of my June 5 post, FTV had increased its FY2021 guidance to reflect diluted net EPS of $2.25 - $2.35 and adjusted diluted net EPS of $2.55 - $2.65. Using the current ~$34.40 share price and the midpoint of these ranges, the forward diluted PE is ~15 and a forward adjusted diluted PE is ~13.23.

In addition, the following was the adjusted diluted EPS guidance from 13 brokers:

- FY2021 - a mean of $2.66 and a low/high range of $2.60 - $2.75. Using the current ~$34.40 share price and the mean estimate, the forward adjusted diluted PE is ~13.

- FY2022 - a mean of $2.74 and a low/high range of $2.55 - $2.94. Using the current ~$34.40 share price and the mean estimate, the forward adjusted diluted PE is ~12.6.

I also indicated:

- my hesitancy to use FY2022 estimates because so much can happen over the next 1.5 years - especially since VNT intends to be active on the M&A front;

- I expect the investment community will begin to take notice of VNT within the next year and we will witness an expansion in VNT's valuation.

While my sources for EPS consensus expectations have yet to be updated at the time I compose this post, we have management's revised FY2021 diluted net EPS range of $2.39 - $2.44 and adjusted diluted net EPS range of $2.77 - $2.82 guidance. Using the midpoint of this guidance and the current $33.45 share price, the forward diluted PE is ~14 and a forward adjusted diluted PE is ~12.

Vontier - Stock Analysis - Final Thoughts

I added 120 shares in one of the 'Side' accounts within the FFJ Portfolio @ $33.826/share immediately following my June 5 post. Now, VNT's current valuation is marginally more favourable than at the time of that post.

If I could, I would add to my position based on my outlook. The impending dividend income generated from the holdings within the account that holds VNT shares, however, must be deployed for purposes other than the acquisition of additional shares.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long VNT.

Disclaimer: I do not know your individual circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.