Contents

Intercontinental Exchange, Inc.'s (ICE) valuable intangible assets include the New York Stock Exchange brand.

I view ICE as a vendor of proprietary data and anticipate the current ~60% of operating income generated from trading and ~40% generated from information services to move toward a 50-50 split over the next few years.

I currently view ICE as slightly overvalued and have it on my 'Watch List'.

Summary

- ICE operates in a highly competitive and highly regulated industry in which barriers to entry are high.

- It benefits heavily from its valuable intangible assets, which include the New York Stock Exchange brand, the Brent crude futures product, and the data derived from these exchanges.

- I view ICE as a vendor of proprietary data to a greater degree than an exchange. I anticipate the current ~60% of operating income generated from trading and ~40% generated from information services to move toward a 50-50 split over the next few years.

- ICE's decision to acquire complementary fixed-income data sets and ancillary products is enabling it to invest in the creation of additional products which are reliant on its fixed-income data.

- I view an October 2018 acquisition and another within the last few weeks as part of a larger plan of expanding into fixed income via mortgages and asset-backed securities.

Introduction

This is the second in a series of articles in which I touch upon companies where I do not currently have exposure but am watching closely in the hopes of adding it the list of companies in which I have exposure.

In August 2018 I initiated a position in CME Group Inc. (CME) with shares being held in the FFJ Portfolio’s ‘side accounts’; I disclosed this purchase in this August 5, 2018 article.

Although Intercontinental Exchange, Inc. (ICE) does not have a similar attractive dividend policy as CME, ICE appeals to me in that it owns highly desirable ‘sticky’ and proprietary data assets. The extensive data assets can be mined to generate new products/services from which ICE can generate additional income.

Business Overview

While barriers to entry are high, there are several well established competitors ICE must contend with. I draw your attention to page 10 of 152 in ICE’s 2018 Annual Report/10-K where you can access comprehensive information about ICE’s business, competitive strengths, competitors, growth strategy, customer base, and the regulatory environment in which it operates.

2018 marked ICE’s 13th year of record revenues and adjusted EPS. Strong revenue contribution was aided by compounding growth in the subscription business. In addition, in the futures and options markets, ICE’s global exchanges and clearing houses handled record volume in 2018. This was driven by the strength of ICE’s position in the global oil markets, the global natural gas markets, and in the futures markets for financial products.

At the New York Stock Exchange, cash equities volumes increased 14% YoY. ICE also helped 73 corporations raise $30B by way of IPO.

ICE has also benefited from industry participants searching for greater cost efficiencies. Its suite of products is in increasingly greater demand which resulted in 5% top line growth on an organic constant currency basis.

Q1 2019 Results

Despite muted volumes across the entire trading industry in Q1, ICE grew revenues, EPS, and FCF.

ICE’s Q4 2018 Earnings Release of February 7, 2019 can be accessed here and its accompanying Earnings Presentation can be accessed here.

Its Q1 2019 Earnings Release can be accessed here and its accompanying Investor Presentation can be found here.

Additional quarterly detailed information can be accessed by looking at 1Q19 Key Metrics for which a link to the Excel file can be found here.

On May 1, 2019, ICE announced the acquisition of Simplifile to further build its electronic mortgage services business. This company assists with the recording of residential mortgage transactions, and it should work well with Mortgage Electronic Registrations Systems which ICE acquired in October 2018; the mortgage process in the US remains a fairly paper-intensive process.

I initially perceived these acquisitions as noncore but I think they are part of ICE’s larger plan of expanding into fixed income via mortgages and asset-backed securities.

Risk

Moody’s upgraded ICE’s long-term senior unsecured credit rating from A3 to A2 in October 2014. This rating is the middle tier of the upper medium grade credit rating category.

Standard and Poor’s assigned an A2 rating in October 2013 and this rating is comparable to Moody’s rating. S&P placed ICE’s credit rating under review in December 2018 with negative implications but a change has yet to have been made.

Details of ICE’s short-term and long-term debt can be accessed in the 2018 Annual report/10-K starting on page 72 of 152. I view the interest rates and staggered maturity dates of the various long-term liabilities as acceptable and am confident ICE will be able to repay/service its obligations.

Free Cash Flow (FCF)

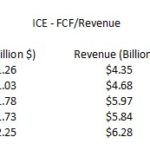

Looking at the following table we see that ICE’s FCF trend over the 2014 – 2018 timeframe is favorable. We also see the extent to which FCF is generated relative to Revenue has also improved in the last few years.

Valuation

On February 7, 2019 when ICE reported FY2018 diluted EPS and adjusted diluted EPS of $3.43 and $3.59, respectively, shares closed at $75.55. Using these figures we see that ICE’s diluted PE and adjusted diluted PE at the time was ~22.03 and ~21.04.

Using FY2019 guidance provided in early February and the $3.77 mean FY2019 adjusted diluted EPS guidance from 16 analysts, we get a forward adjusted diluted PE of ~20.

Fast forward to May 30th and ICE is trading at $82.61. Using the same data from above and the current stock price, and we see that ICE’s forward adjusted diluted PE has risen to ~21.9.

In my opinion, a forward adjusted PE of ~20 seems more reasonable. I would, therefore, like to see ICE retrace to ~$76 or below before I consider initiating a position.

This does not seem to be an unrealistic expectation as in December 2018 and March 2019, ICE retraced to the low $70s.

I am unable to locate ICE’s dividend and stock split history on its website, and therefore, refer you to this external site. The 2018 and 2019 dividends all reflect February 7, 2019 as the declaration date which is incorrect but this error should not impact your investment decision making process.

Click here for the May 2, 2019 dividend Press Release.

In addition, the company’s website does not readily provide details on stock splits. Please click here for the August 3, 2016 Press Release in which ICE announced a 5 for 1 stock split.

With a $0.275 quarterly dividend ($1.10/year) and shares trading at $82.61, ICE provides investors with a ~1.33% dividend yield. As a result, ICE will most likely be excluded as a potential investment by investors focused on generating dividend income from their investment holdings.

Before you completely eliminate ICE as a potential investment because of its low dividend yield I highly encourage you to look at ICE’s investment calculator to ascertain the extent to which an investment would have appreciated over time.

ICE’s dividend payout ratio is typically sub 30% so I am not concerned about ICE’s ability to service its quarterly dividend.

Although ICE repurchases shares on an annual basis, the purchases typically offset the number of new shares issued. The diluted weighted average common shares outstanding in FY2014 – FY2018 amounted to (in millions of shares) 570, 556, 595, 589, and 575.

Final Thoughts

In August 2018 I acquired shares in CME when shares were depressed. While the industry is highly regulated and extremely competitive I like that the barriers to entry are high. My intent is to own shares in two leading operators of regulated exchanges, clearing houses and listings venues and ICE is the second company within this space in which I would like to own shares.

In my opinion, shares are currently overvalued and ~$76 or below is where I would very seriously consider initiating a position.

I hope you found this article helpful and wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not hold a position in ICE and do not intend to initiate a position within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.