I last reviewed Copart (CPRT) in this November 17, 2023 post at which time the most current financial information was for Q1 2024.

Following that post, I disclosed in my January 2024 FFJ Portfolio report the purchase of CPRT shares for two young investors I am helping on their journey to financial freedom; I do not disclose details of their holdings or transactions.

Given that CPRT is slated to release its Q3 2024 results on May 15, I limit my commentary about Q2 and YTD2024 results. My intent is to cover Q3 and YTD2024 results following the upcoming earnings release.

Business Overview

A brief overview of the company is covered in my November 17, 2023 post. In addition, I strongly encourage you to learn about the company from its website and Part 1 of the FY2023 Form 10-K.

Financials

Q2 and YTD2024 Results

CPRT’s Q2 Form 10-Q is accessible through the SEC Filings section of the company’s website.

In Q2, global unit sales and inventory increased over 7% and 6%, respectively, from Q2 2023. Given the relatively quiet 2023 hurricane season, this growth was a function of a partial recovery, total loss frequency and share gains.

In the US, unit growth was nearly 5%. This reflected fee unit growth over 4% and purchase unit growth of over 10%. Consignment or fee units continue to constitute the vast majority of CPRT’s US unit volumes.

The insurance unit volume was flat YoY and up 9% when excluding Hurricane Ian units in 2023.

The non-insurance unit volume growth has continued to outpace that of CPRT’s insurance business. This volume growth substantially came from dealer units, which increased over 21% and fleet rental and finance units, which increased 35%.

On the international front, CPRT experienced unit growth of over 21% with fee units increasing 22% and purchased units increasing by over 19%.

At the end of Q2, CPRT had:

- Cash, cash equivalents, and restricted cash of $1.257B; and

- Investment in held to maturity securities of $1.411B

The company’s TOTAL liabilities, however, were only $0.786B.

CPRT also has an unused Revolving Loan Facility of $1.25B that matures on December 21, 2026.

Unlike some of its competitors which lease their real estate, CPRT owns its properties; it had net property and equipment of $3.043B at the end of Q2 2024. Keep in mind that CPRT has owned several of its properties for years, and therefore, the value of the real estate held on the books is likely significantly understated.

An extensive list of CPRT’s locations is accessible here.

Capital Allocation Strategy

CPRT’s capital allocation strategy continues to prioritize the deployment of capital to grow the business. This consists of investing in:

- employees;

- operational capabilities including logistics;

- technology;

- real estate; and

- customer experience.

Operating Cash Flow (OCF) and Free Cash Flow (FCF)

Depreciation often serves as an indicator of how much needs to be invested to maintain assets in good operating condition.

In FY2014 – FY2023 and the first half of FY2024, CPRT generated:

- OCF of (in billions of $): 0.263, 0.265, 0.332, 0.492, 0.535, 0.647, 0.918, 0.991, 1.177, 1.364, and 0.537.

- FCF of (in billions of $): 0.181, 0.186, 0.159, 0.320, 0.247, 0.273 0.326, 0.528, 0.839, 0.848, and 0.252.

Annual CAPEX was (in billions of $) 0.082, 0.079, 0.174, 0.172, 0.288, 0.374, 0.592, 0.463, 0.337, 0.517, and 0.285 during the same period. The annual depreciation and amortization, however, is consistently under $0.1B.

CPRT is a cash cow that does not distribute a dividend and share repurchases are almost non existent. By retaining so much free cash flow to grow the company, it has been able to support the growth in annual revenue from $1.163B in FY2014 to $2.041B in the first half of FY2024 without having to rely on debt!

Return On Invested Capital (ROIC)

In FY20214 – FY2023, CPRT’s ROIC (%) was 14.99, 15.86, 18.87, 26.34, 23.28, 29.15, 27.62, 27.03, 25.11, and 22.81.

High quality companies often generate a high ROIC. If a company generates a high ROIC, it needs to invest less to achieve a certain growth rate thus reducing the need for external capital.

A company that generates $0.15/profit for every $1 invested, for example, achieves a ROIC of 15%. I consider a ~15%+ ROIC to be a reasonable minimum threshold because most of the time, a company’s cost of capital will be lower than this level. In the past 7 fiscal years, CPRT’s ROIC has exceeded 20%!

When a company consistently generates a high ROIC over the long term and it is growing its revenue, it can reinvest a portion of its profits under favorable conditions thereby leading to a compounding effect. I would much rather invest in a growing company that can reinvest to create greater shareholder value than to invest in a company that has limited growth opportunities and thus chooses to distribute a growing dividend.

Credit Ratings

CPRT has no debt to rate.

Dividend and Dividend Yield

CPRT does not distribute a dividend.

In FY2013 – FY2023, CPRT’s weighted average number of outstanding shares (in millions of shares) was 1,038, 1,050, 1,051, 977, 948, 968, 962, 955, 961, 965, 967. The diluted weighted average common shares outstanding in Q2 2024 was ~973.

CPRT generates ample FCF to repurchase a significant number of its shares. It has not done so in recent years, however, since management deems the retention of funds for growth purposes to be the best means by which to maximize shareholder value.

Valuation

I reference my September 16, 2023 post in which I touched upon CPRT’s valuation at the time of prior reviews.

On September 15, I purchased additional shares at ~$43.80. The following were the forward-adjusted diluted PE levels using the forward-adjusted diluted EPS broker estimates:

- FY2024 – 11 brokers – ~31.1 based on the mean of $1.41 and low/high of $1.35 – $1.54.

- FY2025 – 6 brokers – ~28.1 based on the mean of $1.56 and low/high of $1.40 – $1.75.

When I wrote my November 17, 2023 post, CPRT shares were trading at $50.50. Using this share price and the current broker estimates at the time, the forward-adjusted diluted PE levels were:

- FY2024 – 10 brokers – ~35 based on the mean of $1.44 and low/high of $1.35 – $1.54.

- FY2025 – 10 brokers – ~31 based on the mean of $1.62 and low/high of $1.40 – $1.75.

On April 30, I acquired additional shares at ~$54.60. Using this share price and the current broker estimates, the forward-adjusted diluted PE levels are:

- FY2024 – 11 brokers – ~38 based on the mean of $1.44 and low/high of $1.40 – $1.49.

- FY2025 – 11 brokers – ~33.7 based on the mean of $1.62 and low/high of $1.50 – $1.68.

- FY2026 – 4 brokers – ~30.5 based on the mean of $1.79 and low/high of $1.59 – $1.89.

CPRT is a rapidly growing debt free company that generates strong OCF and FCF. Investors should not, therefore, expect to see a PE level from a mature and capital intensive company. Trying to draw a comparison between CPRT’s valuation and that of a utility or railroad, for example, is foolish.

Final Thoughts

A large number of vehicles CPRT receives is through contracts with large auto insurers which it sells on consignment for high margins.

Recently, severe storms have moved in rapid succession across the Plains and Midwest. Parts of Missouri, Nevada, Kansas, Illinois, Texas, and Louisiana have been hit hard. Property damage in some areas is extensive and you can be assured insurance companies will be sending damaged vehicles to CPRT locations. This bodes well for CPRT’s results!

CPRT consistently generates strong OCF and FCF and has a track record of growth and profitability which should continue. In addition, CPRT has no debt which sets it apart from the smaller RB Global Inc (it acquired IAA in March 2023 for ~$7B) whose credit rating is in ‘junk’ territory.

Investors also need to consider that the value of the properties reflected on CPRT’s Balance Sheet are likely significantly understated because CPRT has been purchasing land for its storage requirements over the past few decades.

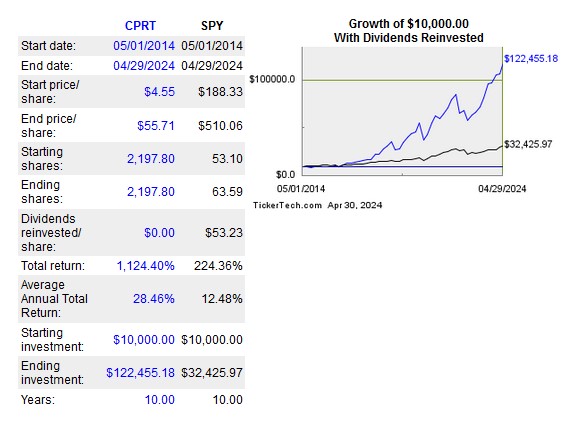

The following reflects how a $10,000 investment in CPRT has performed over the past 10 years.

Historical returns are not indicative of future returns. I am, however, confident CPRT’s future average annual total return will not stray too far from the upper 20% range and am prepared to ‘pay up’ to increase my exposure to this high quality company.

On April 30, 2024, I purchased:

- more CPRT shares for a young investor; and

- 400 shares @ ~$54.60 in one of the ‘Core’ accounts in the FFJ Portfolio thus bringing my exposure to 2800 shares.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long CPRT.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.