Contents

The asset manager industry is highly fragmented and most asset managers should not, for a variety of reasons, even exist. At the opposite end of the spectrum, however, impressive performance by BlackRock (BLK) continues thereby increasing the probability of it benefiting from inevitable industry consolidation.

One of the conclusions in PwC's '2023 Global Asset and Wealth Management Survey' is that ~1 in 6 asset and wealth management companies globally are likely to disappear or be acquired by 2027; this is twice the normal turnover rate.

The survey of 250 asset managers and 250 institutional investors paints the picture of an industry grappling with a set of challenges:

- digital transformation;

- shifting investor expectations; and

- consolidation.

As a result, 73% of asset managers are considering a strategic consolidation with another asset manager to:

- gain access to new segments;

- build market share; and

- mitigate risks.

Firms are also turning to technology to transform; more than 90% of asset managers already use disruptive technological tools (including big data, AI and blockchain) to enhance investment performance.

At its core, BLK is a passive investment asset manager. This should continue to enable it to minimize many of the secular headwinds facing traditional asset managers.

When I last reviewed BLK in this January 13 post, it had just released its Q4 and FY2023 results. Fast forward to April 12 and we now have BLK's Q1 2024 results. I, therefore, take this opportunity to revisit this existing holding.

Overview

A comprehensive overview of BLK is provided in Part 1 Item 1 in BLK's FY2023 Form 10-K which is accessible through the SEC Filings section of the company's website. I also strongly recommend reviewing the company's website.

Global Infrastructure Partners (GIP) Acquisition

Infrastructure is currently a $1T market and is forecast to be one of the fastest growing segments of private markets in the coming years.

The GIP acquisition is BLK's largest acquisition subsequent to the July 2009 announcement of its decision to acquire Barclays Plc's investment arm (BGI) for $13.5B; this acquisition propelled BLK's growth and created the world's biggest asset manager.

BLK has over $50B of infrastructure client Assets Under Management (AUM) comprised of infrastructure equity, debt and solutions which it has grown both organically and inorganically since inception in 2011. With the impending acquisition of GIP, BLK will increase its infrastructure client AUM to $150B+; GIP, the largest independent infrastructure manager by AUM, has $100B in AUM across infrastructure equity and credit strategies. Its over 40 portfolio companies generate over $75B in annual revenue and employ approximately 115,000 people globally. Details about the firm and some of the major assets within its portfolio are provided on the company's website.

The January 12 Press Release provides a high level overview of the details regarding the acquisition. BLK continues to target Q3 2024 for the closing of the this transaction, which remains subject to regulatory approvals and other customary closing conditions.

The terms of the GIP acquisition include ~30% of the total consideration to be all in BLK stock. The purchase price is comprised of $3B of cash and ~12 million BLK shares; 7 million shares will be paid at closing and 5 million shares will be paid in ~5 years, subject to certain performance measures.

Structuring the acquisition this way means the GIP employees have 'skin in the game' and stand to benefit greatly if BLK shares appreciate in value over the next several years.

Financials

Q1 2024 Results

An overview of BLK's Q1 2024 results is found in the April 12 earnings release and earnings release supplement which are accessible here.

BLK closed out Q1 2024 with a record $10.473T in AUM, a ~15.2% YoY increase. In addition, BLK reported Q1 long-term net inflows of $76B. This increase, however, was partially offset by seasonal outflows from institutional money market funds.

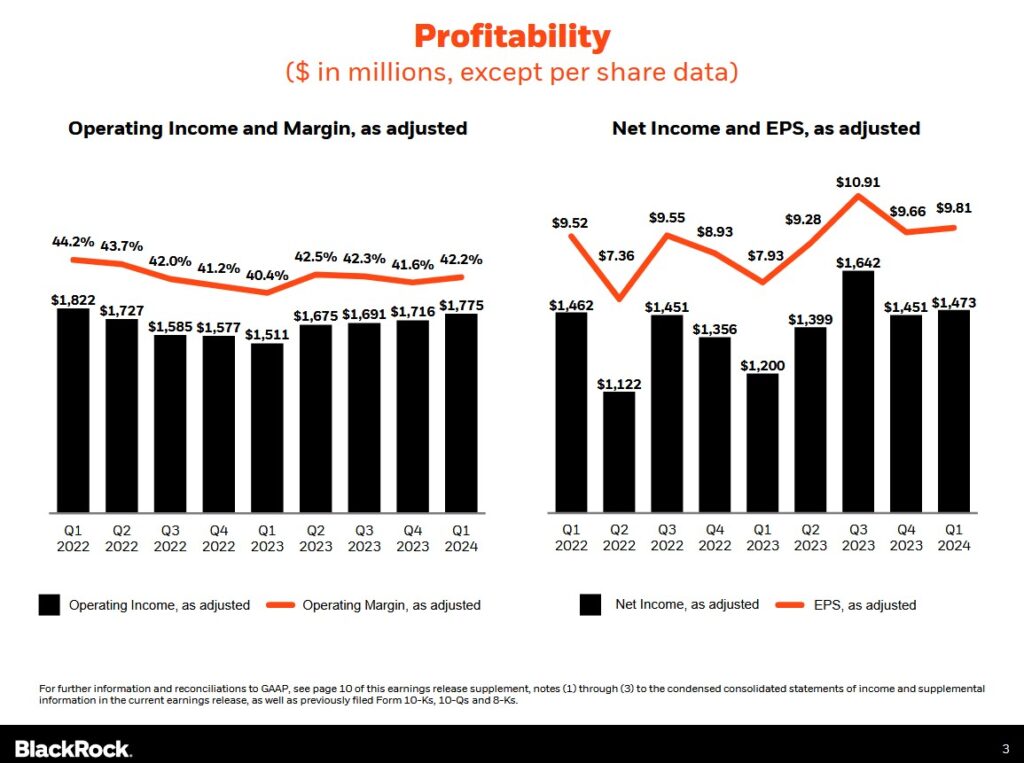

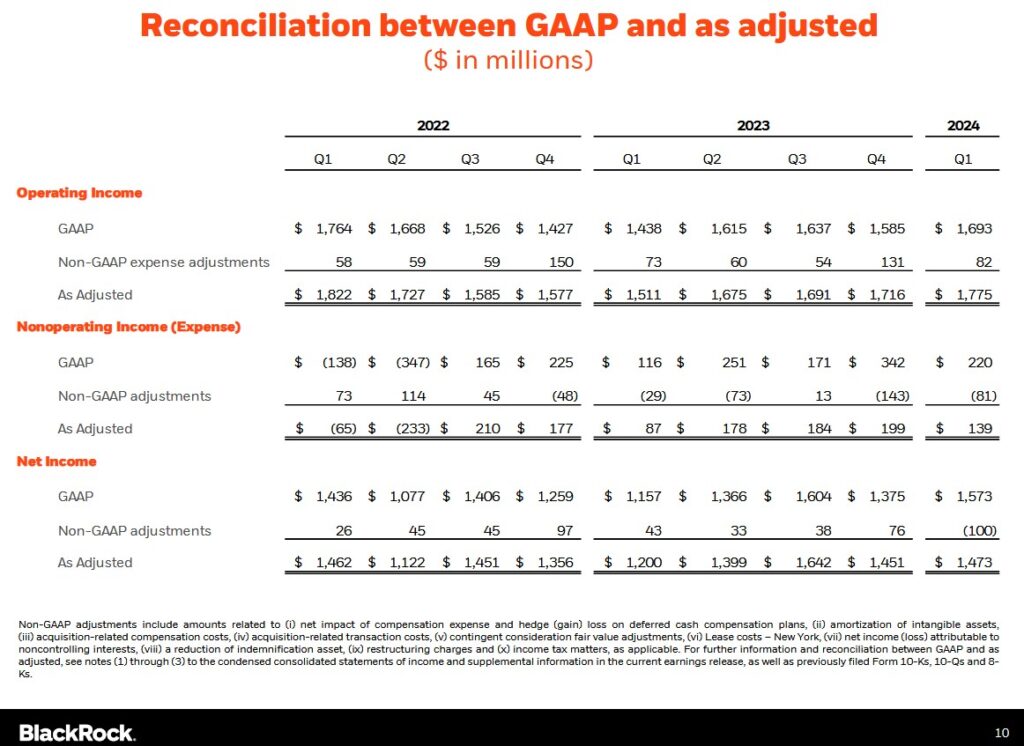

It also posted a 190 bps YoY increase in Q1 GAAP operating margin to 35.8% as expense growth was lower than top-line growth; the 42.2% adjusted operating margin rose 180 bps versus 40.4% in Q1 2023.

Revenue of $4.728B increased ~11% from Q1 2023. Adjusted operating income of $1.775B was up ~17% and adjusted diluted EPS $9.81 was ~24% higher from the $7.93 in Q1 2023; this increase reflects higher non-operating income which included $90 million of net investment gains, driven primarily by mark-to-market non-cash gains on BLK's unhedged seed capital investments and minority investment in Envestnet.

Total expense increased ~8% YoY, reflecting higher compensation, G&A and sales, asset and account expense.

Employee compensation and benefit expense rose ~11%, primarily reflecting higher incentive compensation as a result of higher operating income and performance fees.

G&A expense increased ~6% due to the timing of technology investment spend in the prior year. Sequentially, G&A expense decreased ~12%, reflecting timing of technology investment spend and seasonally higher marketing and promotional expense in Q4 2023. Although quarterly results can be impacted by timing of spend, BLK expects technology to be one of its primary areas of investment within G&A.

BLK's cash management platform saw $19B of net outflows in Q1 which was in line with institutional money market industry trends. This line of business can experience seasonal rotations in the Q1 as many institutional clients withdraw liquid assets for operational purposes, including tax and bonus payments.

Cash management flows were impacted by ~$14B of net redemptions during the last week of March ahead of the Good Friday holiday. Outflows were driven by clients redeeming balances to have cash on hand during a time when many businesses are open, but the financial markets are closed; this phenomenon is not uncommon or unique to BLK. Balances has largely returned with ~$20B of money market net inflows in the first week of April.

Source: BLK - Q1 2024 Earnings Release Supplement

Source: BLK - Q1 2024 Earnings Release Supplement

Operating Cash Flow (OCF) Free Cash Flow (FCF)

In FY2017 - FY2023, BLK generated OCF of (in $B) 3.950, 3.075, 2.884, 3.743, 4.944, 4.956, and 4.165 and FCF of (in $B) 3.795, 2.871, 2.630, 3.549, 4.603, 4.423, and 3.821.

FY2024 Outlook

BLK does not provide an outlook for the entire fiscal year, however, it does state that it will either:

- continue to prioritize investments with differentiated organic growth potential; or

- that will expand operating leverage through enhanced scale.

In line with its January guidance and excluding the impact of GIP and related transaction costs, BLK expects:

- its head count to be broadly flat in 2024; and

- a low to mid-single-digit percentage increase in 2024 core G&A expense.

In March 2024, BLK announced an agreement to acquire the remaining equity interest in SpiderRock Advisors, a leading provider of customized option overlay strategies in the U.S. wealth market. This transaction expands on BLK's minority investment in SpiderRock Advisors made in 2021 and builds on BLK's strong growth in personalized separately managed accounts via Aperio and ETF model portfolios. The expectation is that this transaction will close in Q2 2024, subject to customary closing conditions.

Risk Assessment

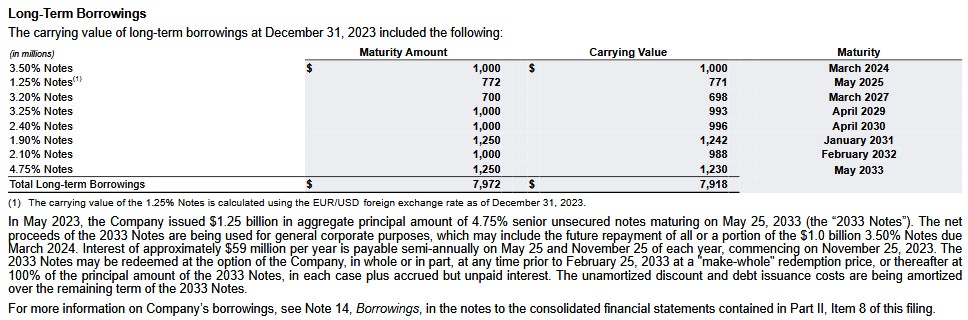

BLK's Q1 2024 Balance Sheet is currently unavailable. The following, however, reflects BLK's long-term borrowings at FYE2023.

Source: BLK - 2023 Form 10-K (page 59 of 120)

BLK repaid the $1B Notes with a March 2024 maturity.

In March, $3B of debt was issued to fund a portion of the cash consideration for the planned acquisition of GIP.

This debt offering consisted of 3 tranches of senior unsecured notes across 5-, 10- and 30-year maturities. The offering was well received by fixed income investors, especially the inaugural 30-year bond. Proceeds are currently invested at substantially the same rate as the cost of borrowing, effectively eliminating incremental cost of carrying additional debt prior to the close of the GIP transaction.

In June 2018, Moody's upgraded BLK's domestic senior unsecured credit rating to Aa3 from A1. This Aa3 rating has been in effect since this upgrade and Moody's assigns a stable outlook.

In May 2014, S&P Global upgraded BLK's domestic senior unsecured credit rating to AA- from A+. This AA- rating has been in effect since this upgrade and S&P Global assigns a stable outlook.

Both ratings are the bottom tier in the high-grade investment-grade category. These ratings define BLK as having a very strong capacity to meet its financial commitments. The ratings differ from the highest-rated obligors only to a small degree.

These investment-grade ratings are acceptable for my purposes.

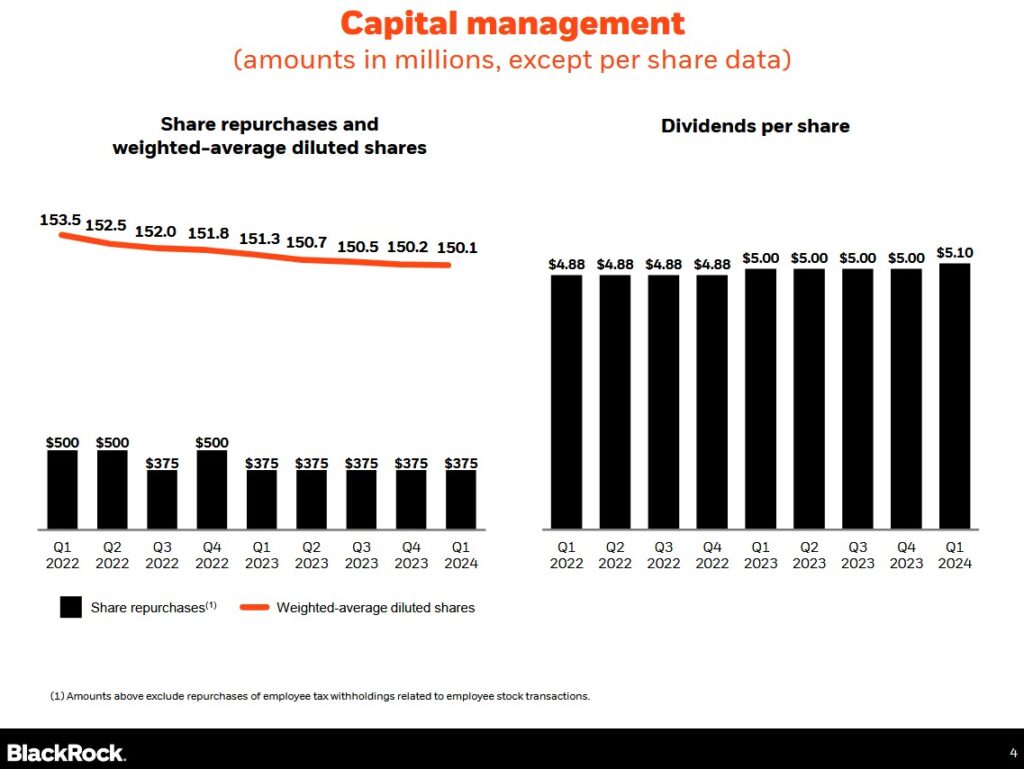

The following reflects BLK's quarterly capital management allocation for the past 2 fiscal years.

Source: BLK - Q1 2024 Earnings Release Supplement

Dividend and Dividend Yield

BLK initiated a quarterly dividend in 2003 (see dividend history).

In late May, we can expect BLK to declare its second consecutive $5.10 quarterly dividend for distribution in late June.

BLK typically declares a dividend increase in mid-late January. If it declares a $0.05/share increase in January 2025, the next 4 dividend payments will total $20.45 ($5.15 + ($5.10 x 3)). Using the current ~$763 share price, the forward dividend yield is ~2.7%.

BLK's capital allocation priority is to invest either to scale strategic growth initiatives or drive operational efficiency. Once this is achieved, BLK returns excess cash to its shareholders through a combination of dividends and share repurchases.

In FY2014, the weighted average number of diluted outstanding shares was ~172 million. This has been reduced to ~150.1 million in Q1 2024.

Based on capital spending plans for 2024 and subject to market conditions, including the relative valuation of BLK's stock price, the target is to repurchase $1.5B ($0.375B quarterly) of shares during FY2024; it repurchased this many shares in Q1.

Valuation

BLK's FY2013 - FY2023 PE levels based on diluted EPS are 19.93, 18.57, 17.58, 20.08, 24.16, 11.30, 19.47, 24.07, 24.45, 19.60, and 34.84.

When I initiated a position in BLK, the forward valuation based on currently available adjusted earnings estimates and a ~$651.28 share price was:

- FY2023 - 16 brokers - mean of $35.04 and low/high of $33.00 - $37.94. Using the mean estimate, the forward adjusted diluted PE was ~18.6.

- FY2024 - 16 brokers - mean of $39.90 and low/high of $36.15 - $42.23. Using the mean estimate, the forward adjusted diluted PE was ~16.3.

- FY2025 - 6 brokers - mean of $45.53 and low/high of $42.32 - $48.66. Using the mean estimate, the forward adjusted diluted PE was ~14.3.

When I wrote my July 20 guest post, BLK had generated $16.70 and $17.21 in diluted EPS and adjusted diluted EPS, respectively in the first half of FY2023.

BLK’s forward valuation based on currently available adjusted earnings estimates and the ~$728 share price was:

- FY2023 – 15 brokers – mean of $35.21 and low/high of $34.10 – $36.47. Using the mean estimate, the forward adjusted diluted PE was ~20.7.

- FY2024 – 15 brokers – mean of $40.49 and low/high of $37.30 – $45.19. Using the mean estimate, the forward adjusted diluted PE was ~17.8.

- FY2025 – 8 brokers – mean of $45.97 and low/high of $41.36 – $49.06. Using the mean estimate, the forward adjusted diluted PE was ~15.3.

I thought it was conceivable that BLK would double its YTD diluted EPS. Using $33.40 as BLK’s FY2023 diluted EPS and a ~$728 share price, the forward diluted PE for FY2023 was ~21.8.

When I wrote my October 15, 2023 post, BLK had reported $10.66 and $10.91 in diluted and adjusted diluted EPS for Q3. In the first 3 quarters of FY2023, it generated $27.36 and $28.12 in diluted and adjusted diluted EPS. Using the current $627.66 share price and the currently available broker estimates to determine BLK forward adjusted diluted PE levels I arrived at the following forward adjusted diluted PE levels:

- FY2023 – 15 brokers – mean of $35.82 and low/high of $34.02 – $37.06. Using the mean estimate: ~17.5.

- FY2024 – 14 brokers – mean of $38.37 and low/high of $35.10 – $41.87. Using the mean estimate: ~16.4.

- FY2025 – 11 brokers – mean of $43.14 and low/high of $39.05 – $46.39. Using the mean estimate: ~14.5.

When I wrote my January 13 post, shares were trading at ~$800 and BLK had just reported FY2023 $36.51 of diluted EPS and $37.77 of adjusted diluted EPS. BLK's diluted PE and adjusted diluted PE were, therefore, ~22 and ~21.2.

Using the ~$800 share price and the currently available broker estimates I arrived at the following forward adjusted diluted PE levels:

- FY2024 – 16 brokers – mean of $39.13 and low/high of $35.09 – $43.16. Using the mean estimate: ~20.4.

- FY2025 – 12 brokers – mean of $44.55 and low/high of $40.50 – $48.73. Using the mean estimate: ~18.

On April 12, BLK shares closed at $763.40. Using this share price and the current broker estimates, the following are the forward adjusted diluted PE levels:

- FY2024 – 15 brokers – mean of $41.28 and low/high of $39.41 – $43.90. Using the mean estimate: ~18.5.

- FY2025 – 15 brokers – mean of $46.57 and low/high of $42.95 – $51.15. Using the mean estimate: ~16.4.

- FY2026 – 7 brokers – mean of $52.39 and low/high of $44.62 – $56.64. Using the mean estimate: ~14.6.

Analyst estimates will likely be revised higher over the coming days. I do not, however, expect the current mean forward adjusted diluted EPS estimates will meaningfully change from the current levels.

Final Thoughts

I initiated a BLK position in one of the 'Core' accounts within the FFJ Portfolio on March 9, 2023. When I completed my 2023 Year End FFJ Portfolio Review, I owned 130 shares and it was my 26th largest holding.

On April 12, 2024, I acquired another 30 shares @ ~$770/share thus increasing my exposure to 160 shares. Although this purchase price is higher than my earlier purchase prices, BLK's valuation based on forward adjusted diluted earnings is comparable to that at the time of prior purchases.

I recommend BLK as a long term investment but caution you that its share price is volatile.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long BLK.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.