Summary

- HRL, as with other companies in the Consumer Staples sector, is experiencing headwinds such as changing consumer tastes.

- Its stock price has not been negatively impacted to the same extent as other members of this sector.

- HRL Investors have not experienced significant positive investment returns over the last couple of years. They have, however, been aptly rewarded if they have held their HRL shares over the long-term.

- Shares are currently fairly valued.

Introduction

In my June 17, 2017 Hormel Foods Corporation (NYSE: HRL) article I indicated that I had initiated a position in HRL for the FFJ Portfolio; I acquired 400 shares and established the automatic reinvestment of all dividends.

In hindsight, I was about 2 months premature with my purchase as I could have picked up shares for ~$3 less per share. I don’t get too worked up over this, however, since I make investments with the long-term in mind. I strongly suspect that 10 – 20 years into the future I won’t get hung up about having ‘overpaid’.

The rationale for my HRL purchase was to increase my exposure to the Consumer Staples sector. Participants within this sector (a list of participants can be found in the iShares Global Consumer Staples ETF) are certainly weathering an extremely difficult environment. Organic growth is abysmal, freight costs have appreciated significantly, input costs have increased at a faster rate than industry participants can reasonably expect to recover from customers (participants no longer enjoy the pricing power to which they were accustomed), and consumer preferences have changed as an increasing number of consumers are making ‘healthier choices’.

Given the above, industry participants have been divesting certain aspects of their business and have been making strategic acquisitions to reposition themselves to take advantage of growth areas. I have discussed this in my recent Procter & Gamble and General Mills articles; I do not have exposure to these companies and currently have no intention of initiating a position in either company.

In addition, companies have increasingly resorted to financial engineering. Low priced debt has been taken on to make these acquisitions and also to repurchase shares and to increase dividend distributions. While taking on low cost debt for such purposes may work in the short-term it is not a strategy that is sustainable. At some stage, debt levels reach a stage where ratings agencies start to downgrade credit ratings.

Furthermore, at some stage this debt must be refinanced and/or repaid. I have noted in previous articles about my reluctance to invest in a business that relies heavily on debt as it adds another layer of concern. I am a reasonably risk averse investor who gets an uncomfortable feeling when the company in which I have invested must refinance its debt during a period of adversity.

NOTE: I also encourage you to review my November 22, 2017 and February 22, 2018 articles.

Q2 2018 Financial Results and Re-Affirmation of FY Guidance

HRL’s Q2 results can be found in the May 24, 2018 Earnings Release.

HRL is not immune to the challenges experienced by other Consumer Staples companies (ie. negligible organic growth and lower gross profit and operating margins).

On the May 24th conference call with analysts, management indicated that HRL experienced a double-digit increase in per-unit freight costs due to the lack of availability of trucks and an increase in diesel fuel surcharges. In order to address this, HRL is working with its customers to find mutually agreeable solutions to offset these increases. Rising freight costs, however, are expected to continue to have an impact in the second half of 2018 and into 2019.

Despite challenging business conditions, HRL is expecting a strong finish to the year in many of its businesses. Grocery products, for example, are expected to return to growth mode. For Jennie-O Turkey store, HRL still expects earnings to decline in the second half of FY2018. Signs of supply reductions, however, are encouraging and HRL sees Jennie-O Turkey store returning to growth in the first half of FY2019.

The outlook for the international segment remains positive as HRL continues to capture the benefits from its new plant in Joshing, China. While HRL has been successfully exporting pork around the world, the impact of the tariffs on the pork industry is uncertain. HRL, therefore, expects modestly lower sales and margin in its export business. Favorable performance for its China meat business should, however, offset the weaker projected results in the export business.

In the refrigerated foods segment, HRL expects its value-added businesses in retail and food service and the acquisitions of Fontanini and Columbus to offset declines in commodity profits and freight headwinds.

Despite its challenges, I am comfortable that HRL’s management is taking the appropriate steps to improve performance. Examples of this include key projects to increase bacon capacity at HRL’s Wichita, Kans., facility, a new whole bird facility in Melrose, Minn., modernization of the Austin, Minn., plant, and other projects designed to increase value-added capacity.

While HRL is certainly experiencing challenges in various areas of its businesses, some positive news was reported. Its effective tax rate was 20% compared to 33.2% last year with the lower tax rate having provided a $45 million benefit compared to the prior year.

HRL continues to assess tax reform and has narrowed the range for its full year tax rate to be 17.5% -19.5%.

Year-to-date, HRL has generated operating cash flows of $443 million, a 58% increase from YTD2017. This increase is related to higher earnings and improved working capital resulting from one of HRL’s key priorities which is to improve its cash conversion cycle. In the last 12 months, HRL has reduced the cycle by 3 days.

I am also encouraged by HRL’s reduction of short-term debt related to the Columbus Craft Meats acquisition; $70 million in short-term debt was repaid in Q2 and the remaining $185 million in short-term debt is expected to be repaid this year.

HRL has also repurchased $45 million (1.3 million shares) in shares YTD with $20 million repurchased in Q2.

HRL’s Net Annual Sales guidance remains at $9.7B – $10.10B and diluted EPS guidance remains at $1.81 – $1.95.

Credit Ratings

HRL’s credit ratings remain unchanged from those reflected in my February 22, 2018 article. Moody’s rates HRL’s senior unsecured debt A1 and Standard & Poor’s continues to assign an A rating.

Valuation

At ~$35.40/share, HRL is valued at ~18.2 – ~19.6 of projected diluted EPS of $1.81 – $1.95. This level is slightly higher than when I analyzed HRL on February 22, 2018 when HRL closed at $33 (~16.9 – ~18.2 of projected diluted EPS).

Dividend and Dividend Yield

HRL’s dividend ($0.1875/quarter dividend, $0.75/annually) and stock split histories can be found here.

Not much has changed from my February 22, 2018 article other than the forward dividend yield now being ~2.1%; the dividend yield of ~2.27% was based on the February 22, 2018 $33 closing stock price.

Historical Returns

When I initially reviewed HRL I was attracted to its historical dividend track record; on May 21, 2018 HRL announced its 360th consecutive quarterly dividend. The fact it has been able to pay a dividend through various economic conditions suggests to me that rewarding shareholders via dividend payments is one of management’s key priorities. In my opinion, I think the August and November 2018 $0.1875/quarter dividend payment will be increased by at least 12% to $0.21/quarter with the February 2019 dividend payment; I am being conservative with my projected dividend increase in that dividend increases in recent years have been ~17% with the exception of that in 2018 where the increase was just over 10%.

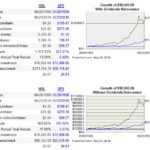

If we just analyze HRL over the short-term, HRL has certainly not rewarded shareholders to any great extent. Returns over the last couple of years are reflected below.

Source: Dividend Channel

I completely agree that HRL’s investment return pales in comparison to that of Visa (NYSE: V), MasterCard (NYSE: MA), and Broadridge (NYSE: BR), etc.. My objective when I acquired HRL shares, however, was not to generate a superior return to that generated by those companies. My intent was to increase exposure to the Consumer Staples sector. If I compare HRL’s total return to that of other companies in this sector then I am satisfied with my investment.

As mentioned in previous articles I am a long-term investor so I don’t get too worked up over short-term investment returns. I also recognize that past performance does not predict future performance. If I do see that a company has managed to generate decent investment returns over 15/20 years of which some of those years experienced challenging business conditions, however, I get some comfort that the company is being managed properly from a long-term perspective.

In this regard, I provide the following images which show how HRL has performed relative to the S&P500 over a 10, 15, and 20 year period.

Source: Dividend Channel

Based on the disparity between HRL’s returns and those of the S&P500 over several years, I am willing to tolerate HRL’s recent low returns since I think HRL will outperform the S&P500 if we ever get a market correction. My rationale for outlook is that HRL sports a negative beta. This implies that the stock tends to decline in value when the market rises, and vice versa.

I honestly do not know when the market will correct but it will correct one day. I am hoping that my HRL investment will offset some of the pullback my other holdings will undoubtedly experience.

In the interim, I am happy just to collect and reinvest the quarterly HRL dividends for the shares held in the FFJ Portfolio. Quite frankly, I much prefer a lower stock price as I can then acquire more shares with the dividend income.

Final Thoughts

HRL is certainly not a company that jumps to mind when looking for an investment that will generate reasonable returns over the long-term. Afterall, it is a company that just sells food. It isn’t a company that is creating a reusable rocket ship, a hyperloop, or an electric car. In other words, HRL is not a sexy business. It is a business, however, that is profitable, generates free cash flow, and rewards shareholders with dividend increases. In fact, it has done this through strong and weak economic periods since becoming a public company in 1928.

In my opinion, HRL is currently fairly valued and represents a good investment in the Consumer Staples sector. You will, however, likely be sorely disappointed if you invest in this company hoping to make a quick buck. I suggest any investment in HRL be held for at least 10 years.

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long HRL, V, MA, and BR.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.