Contents

I last reviewed Paychex (PAYX) in this June 30, 2022 post following the release of Q4 and FY2022 results. At the time, I deemed shares to be fairly valued and increased my exposure within one of the 'Core' accounts in the FFJ Portfolio.

Following the December 22 release of Q2 and YTD2023 results and another upward revision of various metrics, I once again revisit this holding.

For the sake of full disclosure, I acquired 50 shares @ $110.63 in one of the 'Core' accounts in the FFJ Portfolio on December 22. This brings my PAYX exposure to 280 shares in a 'Core' account and 428 shares in a 'Side' account.

Business Overview

While I provide a Business Overview in prior PAYX posts, Part 1 of the FY2022 Form 10-K provides a more comprehensive overview.

Financial Review

Q2 and YTD2023 Results

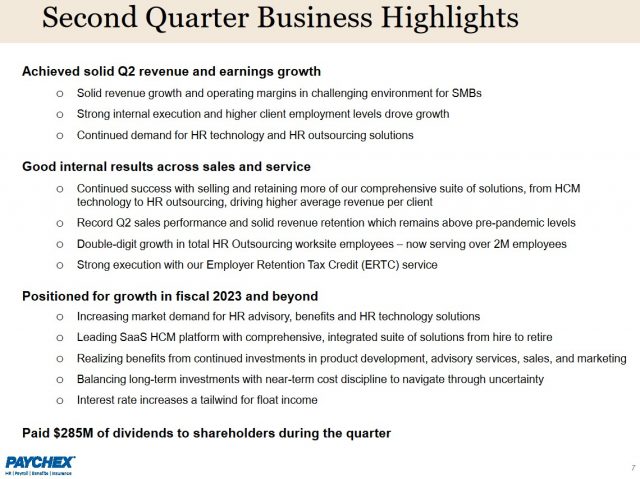

On December 22, 2022, PAYX issued Q2 and YTD2023 results and its amended FY2023 outlook (Form 8-K). The Q2 2023 Form 10-Q is accessible here.

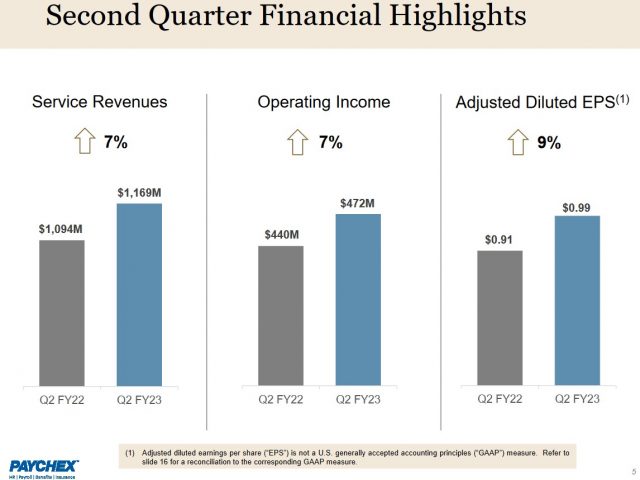

Source: PAYX Q2 2023 Earnings Presentation - December 22, 2022

Source: PAYX Q2 2023 Earnings Presentation - December 22, 2022

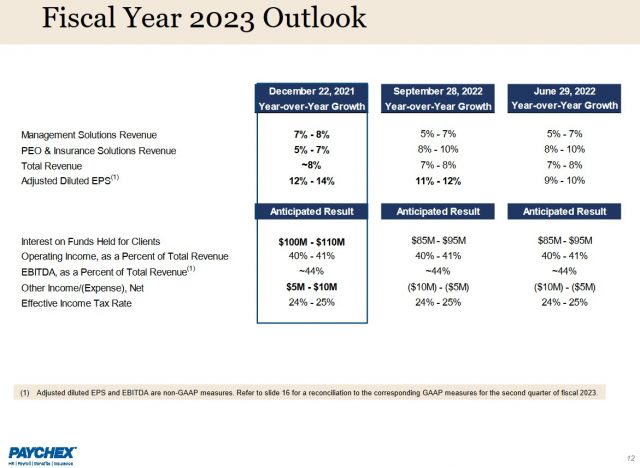

FY2023 Outlook

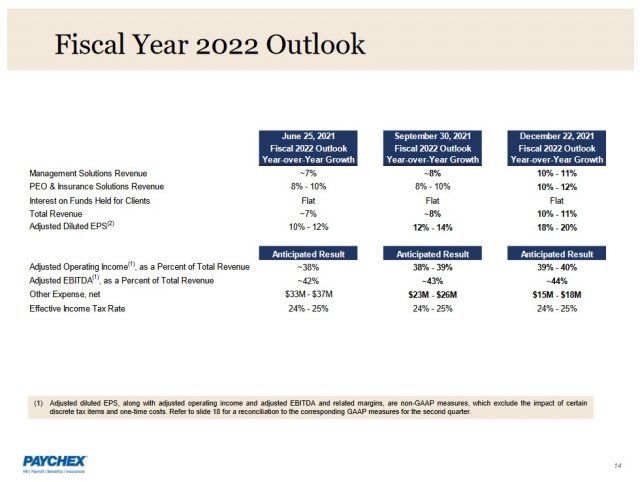

It appears PAYX erred in its Q2 2023 earnings presentation; the header in the leftmost column on the page which covers its FY2023 outlook reflects 2021 versus 2022. On the earnings call held with analysts on December 22, 2022, management repeatedly referred to the column labelled 'December 22, 2021 YoY Growth' when discussing the current FY2023 outlook.

As further evidence of this error, I include the FY2022 Outlook that was provided on December 22, 2021.

PAYX stands to benefit from a rising interest rate environment. This is borne out from the revision in the interest expected to be earned on funds held for clients. In addition, PAYX now expects FY2023 'other income/(expense) net' to go from a negative value to a positive value.

Source: PAYX Q2 2023 Earnings Presentation - December 22, 2022

Risk Assessment

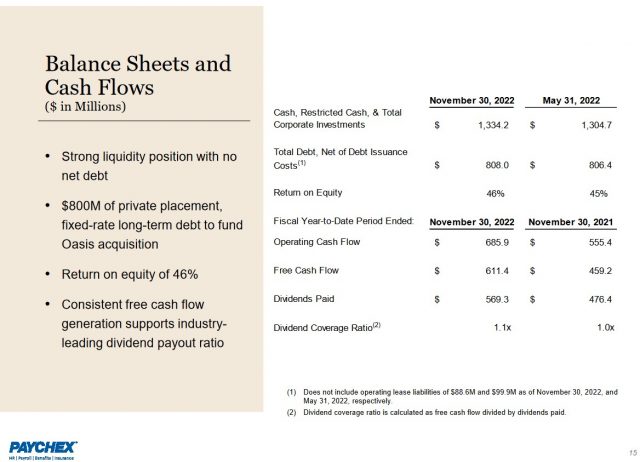

PAYX's debt is not rated but an analysis of its financial statements reveals a strong financial position. At the end of Q2 2023, cash and cash equivalents, restricted cash, and total corporate investments totalled ~$1.32B (~$1.275B at FYE2022); restricted cash amounted to only $57.8 million and $50.3 million. In contrast, total short-term and long-term borrowings amounted to ~$0.808B and ~$0.806B.

Details of PAYX's financing arrangements are found in the Q2 2023 Form 10-Q commencing on page 26.

On March 13, 2019, PAYX completed the private placement of Senior Notes, Series A in an aggregate principal amount of $0.4B due on March 13, 2026, and Senior Notes, Series B in an aggregate principal amount of $0.4B due on March 13, 2029. Proceeds from the Notes were used to pay off $0.8B in short-term borrowings under its JP Morgan credit facilities used to temporarily finance the Oasis acquisition; Oasis was the US's largest privately-owned professional employer organization (PEO) and an industry leader in providing human resources outsourcing services.

I consider PAYX's risk of default to be low.

Dividends and Dividend Yield

At the time of my January 22, 2022 post, shares were trading at $118.67 and the $0.66 quarterly dividend yielded ~2.22%.

On April 29, 2022, PAYX declared a 20% increase in its quarterly dividend from $0.66 to $0.79. When I wrote my June 30, 2022 post, shares were trading at ~$114 thus resulting in a ~2.77% dividend yield. With shares currently trading at ~$112.18, the dividend yield is ~2.82%.

The 4th quarterly $0.79 dividend will likely be declared in mid-January 2023 for distribution near the end of February. I anticipate a ~$0.04 - ~$0.06 dividend increase will be declared toward the end of April for distribution in late May.

The dividend coverage ratio, calculated as free cash flow divided by dividends paid, was 1.1x on November 30, 2022 versus 1.0x on November 30, 2021.

The weighted average number of shares outstanding (in millions rounded) is 363, 365, 366, 365, 363, 363, 362, 362, 361, 362, and 363 in FY2012 - FY2022. For the 6 months ending on November 30, 2022, the weighted average remains at ~363.

PAYX maintains a program to repurchase up to $0.4B of common stock, with authorization expiring on January 31, 2024. The purpose of this program is to manage common stock dilution. Much like many other companies, PAYX issues shares under its employee compensation structure. This explains why there is very little change in the weighted average number of shares outstanding despite the repurchase of shares outstanding.

No shares were repurchased during Q1 and Q2 2023 and $327.1 million remains available for share repurchases in total under the program.

In comparison, PAYX repurchased:

- 1.2 million shares for a total of $145.2 million in FY2022;

- 1.7 million shares for a total of $155.7 million at an average price of $90.83 in FY2021; and

- 2 million shares for a total of $171.9 million at an average price of $84.68 in FY2020.

Valuation

PAYX's FY2012 - FY2021 diluted PE levels are 20.19, 28.28, 26.08, 26.31, 28.32, 29.34, 23.44, 28.54, 31.80, and 38.78.

At the time of my January 22, 2022 post, the following were the forward-adjusted diluted PE levels using earnings estimates from the two online trading platforms I use.

- FY2022 - 16 brokers - mean of $3.63 and low/high of $3.59 - $3.68. Using the mean estimate, the forward adjusted diluted PE is ~33 and ~32 if I use $3.68.

- FY2023 - 18 brokers - mean of $3.89 and low/high of $3.70 - $4.08. Using the mean estimate, the forward adjusted diluted PE is ~30.5 and ~29 if I use $4.08.

- FY2024 - 10 brokers - mean of $4.20 and low/high of $4.05 - $4.42. Using the mean estimate, the forward adjusted diluted PE is ~28.3 and ~26.8 if I use $4.42.

I concluded that PAYX's current valuation was slightly high.

When I wrote my June 30, 2022 post, PAYX had just reported $3.84 in diluted EPS and $3.77 in adjusted diluted EPS. With shares trading at ~$114, the diluted PE was ~29.7 and the adjusted diluted PE was ~30.2.

Management's FY2023 outlook called for a 9% - 10% increase in adjusted diluted EPS (~$4.11 - ~$4.15). Using the ~$114 share price, the forward adjusted diluted PE range was ~27.5 - ~27.7.

I expected revisions to earnings estimates from the brokers which cover PAYX after my review. Based on currently available estimates, however, the forward adjusted diluted PE levels were:

- FY2023 - 19 brokers - mean of $4.13 and low/high of $4.03 - $4.17. Using the mean estimate, the forward adjusted diluted PE is ~27.6 and ~27.3 if I use $4.17.

- FY2024 - 17 brokers - mean of $4.43 and low/high of $4.10 - $4.62. Using the mean estimate, the forward adjusted diluted PE is ~25.7 and ~24.7 if I use $4.62.

Now, we see that PAYX generated $2.04 in diluted EPS and $2.02 in adjusted diluted EPS in the first half of FY2023. The most current FY2023 adjusted diluted EPS outlook calls for 12% - 14% growth from FY2022 or ~$4.22 - ~$4.30. Using a ~$4.26 mid-point and the current ~$112.18 share price, the forward adjusted diluted PE is ~26.3.

Using the currently available broker estimates, the forward adjusted diluted PE levels are:

- FY2023 - 18 brokers - mean of $4.24 and low/high of $4.13 - $4.28. Using the mean estimate, the forward adjusted diluted PE is ~26.5 and ~26.2 if I use $4.28.

- FY2024 - 18 brokers - mean of $4.53 and low/high of $4.30 - $4.74. Using the mean estimate, the forward adjusted diluted PE is ~24.8 and ~23.7 if I use $4.74.

- FY2025 - 10 brokers - mean of $4.88 and low/high of $4.66 - $5.06. Using the mean estimate, the forward adjusted diluted PE is ~23 and ~22.2 if I use $5.06.

I consider PAYX to currently be fairly valued.

Final Thoughts

PAYX's primary target market is small to medium size companies. Such companies are vulnerable to severe economic downturns thus also making PAYX vulnerable.

However, I initiated a position on July 8, 2009 and in all the years in which I have been a shareholder, it has consistently generated strong free cash flow and earnings. This is a highly disciplined company and I expect it will successfully navigate through what is expected to be a difficult 2023.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long PAYX.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.