Contents

In this HEICO stock analysis, I intend to demonstrate the dividend yield fixation many investors have is short-sighted.

In my recent Rollins stock analysis, we see how a very low dividend yield investment generates a total investment return that far outstrips the S&P500 return over a 10-year timeframe.

Information Sources

The following are links to my sources to aid in your own analysis.

Part 1 of the FY2020 10-K has a good overview of HEI's industry, customers, business strategy, solutions and risks. Additional information is also available in the:

HEICO - Stock Analysis - Business Overview

The company's history dates back to 1957.

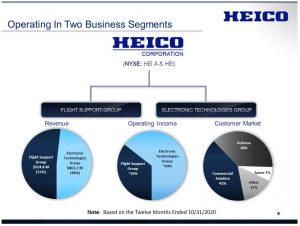

Business is comprised of two operating segments:

- Flight Support Group (FSG) consists of HEICO Aerospace Holdings Corp. and HEICO Flight Support Corp. and their collective subsidiaries. This segment accounted for 52%, 60% and 62% of FY2020, 2019, and 2018 net sales.

- Electronic Technologies Group (ETG), consists of HEICO Electronic Technologies Corp. and its subsidiaries. This segment accounted for 48%, 40% and 38% of FY2020, 2019, and 2018 net sales. Furthermore, ETG derived ~66%, 64% and 65% of its net sales in FY2020, 2019 and 2018 from the sale of products and services to the U.S. and foreign military agencies, prime defence contractors and both commercial and defence satellite and spacecraft manufacturers.

HEI can more than hold its own despite intense competition. In FY2000, for example, HEI's annual revenue was ~$203 million. Fast forward to FY2020 and annual revenue is ~$1.787B.

Equally impressive is that:

- no one customer accounts for more than 10% of net sales;

- the top 5 customers represent ~23% and 24% of consolidated net sales in Q2 2021 and 2020, respectively.

HEI's FSG competes with the leading industry OEMs (Original Equipment Manufacturer) and, to a lesser extent, with many smaller, independent parts distributors. Historically, the three principal jet engine OEMs, General Electric, Pratt & Whitney and Rolls Royce have been the sole source of substantially all jet engine replacement parts for their jet engines. Other OEMs have been the sole source of replacement parts for their aircraft component parts.

Management believes it is the largest independent supplier of non-OEM jet engine and aircraft component replacement parts. In recent years, HEI has been adding new products to its line at a rate of ~300 - 500 Parts Manufacturer Approvals (PMAs) annually. It has developed for its customers ~11,500 parts for which PMAs have been received from the Federal Aviation Administration (FAA).

The pandemic has shifted the overall market for PMA parts, or third-party replacement parts, and the long-term effects remain unclear. Particularly, aircraft lessors have taken a material share of the aircraft market; they now own more than 50% of outstanding passenger aircraft.

Lessors have historically not allowed PMA parts on aircraft as these parts deteriorate aircraft asset value. HEI's management notes that they are making progress on lessor acceptance of PMA parts. It is likely the lessor rate of acceptance of PMA parts bodes well for HEI over the next decade.

Growth has been organic and also by way of multiple acquisitions. Much like ROL which I cover in my previous stock analysis, HEI has a proven growth strategy. It does not need to rely excessively on debt!

Investor Control

In my recent ROL stock analysis, I indicate:

'The company's CEO, Gary W. Rollins who is 76 years old (#539 on Forbes' list of billionaires with an estimated net worth above $5B), and certain companies under his control, controls over 50% of the voting power. As a 'Controlled Company', ROL need not comply with certain NYSE rules.

Furthermore, ROL's executive officers, directors and their affiliates hold directly, or through indirect beneficial ownership, in the aggregate, ~54% of the outstanding common shares.'

In the case of HEI, the Mendelson family and entities controlled by them, the HEICO Savings and Investment Plan (our 401(k) Plan) and members of the Board of Directors beneficially own ~19% of the outstanding Common Stock and ~4% of the outstanding Class A Common Stock. They can, therefore, substantially influence the election of the Board of Directors and control the business, policies and affairs, including proposed business combinations and attempted takeovers.

Some may view this as a risk. I am not concerned given their exemplary track record. I like their degree of control because it means decisions are not made to appease the investment community.

Two Classes of Common Stock

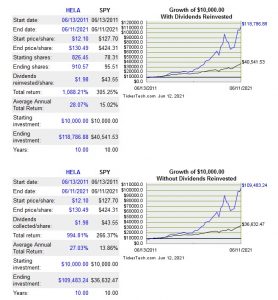

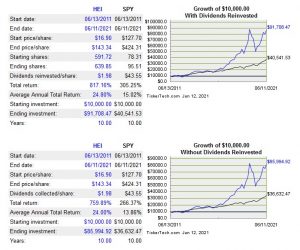

HEI has two classes of common stock: non-voting (HEI.a) and voting (HEI) shares. They are virtually identical in all economic respects except voting rights. Each share of Common Stock is entitled to one vote per share. Each share of Class A Common Stock is entitled to a 1/10 vote per share.

The first image compares the 10-year return of the Class A shares relative to the S&P500 and the second image is that for the Common Stock.

We see the vast majority of the investment return is from the appreciation in the value of the company's shares.

As part of this HEI stock analysis, I have compared HEI's 10-year total return relative to that of several companies that appeal to many 'dividend hungry' investors.

Using a stock screener, I set the search parameters to generate a list of US companies with a market cap over $2B, a dividend yield above 5%, and an average daily volume of over 200,000 shares.

The results?

HEI's total return far outweighs that of the companies with attractive dividend yields.

We each have our respective investment goals and objectives. As a result, some investors seek to maximize dividend income. I, on the other hand, focus on an investment's potential total return. As a result, I do not exclude ROL and HEI / HEI.a from the universe of companies in which to invest.

HEICO - Stock Analysis - Financials

Q2 2021 Results

At the time of my February 24, 2021 review, HEI had just released Q1 20201 results.

After this review, HEI released Q2 results on May 25 and on June 8 it declared its 86th consecutive semi-annual cash dividend and announced a 12.5% increase in its semi-annual cash dividend.

HEI's results of operations in the first 6 months and Q2 continue to reflect the adverse impact from COVID-19. While demand for the company's commercial aviation products and services continues to be negatively impacted by the ongoing depressed commercial aerospace market, management states business is beginning to rebound and return to normal. In addition, management is cautiously optimistic the ongoing worldwide rollout of COVID-19 vaccines will:

- continue to have a positive impact on commercial air travel;

- generate more favourable economic environments in the markets HEI serves.

In the first six months and Q2, the ETG Group reported record quarterly net sales and FSG reported its 3rd consecutive sequential increase in quarterly net sales and operating income.

The ETG Group set a quarterly net sales and operating income record in Q2 2021, improving 11% and 9%, respectively. On the Q2 earnings call, management indicates these increases reflect the impact from the profitable FY2020 and FY2021 acquisitions and 19% organic growth for other electronic products.

The Flight Support Group also reports sequential growth in operating income and net sales in Q2 with 37% and 16% respective increases from Q1.

In FY2021, HEI has completed 1 acquisition and 5 acquisitions over the past year.

In March 2021, HEI acquired all of the business assets and certain liabilities of Pyramid Semiconductor. Pyramid is a specialty semiconductor designer and manufacturer, which offers a well-developed line of processors, static random-access memory, electronically erasable programmable read-only memory and logic products on a diverse array of military, space and medical platforms. This acquisition is expected to be accretive to earnings within the first 12 months.

Page 45 of 142 in the FY2020 10-K reflects HEI's contractual obligations. We see from 'Payments due by fiscal period' that HEI has no significant debt maturities until FY2024. In the Q1 2021 10-Q, it states there have not been any material changes to the amounts presented in the table of contractual obligations included in the 10-K.

Management indicates the plan is to utilize HEI's financial strength and flexibility to aggressively pursue high-quality acquisitions of various sizes to accelerate growth and maximize shareholder returns.

Cash flow provided by operating activities remains strong, increasing 2% to $210.1 million in the first six months of FY2021. This is an increase from $205.9 million in the first six months of FY2020.

FY2021 Guidance

Management is cautiously optimistic the ongoing worldwide rollout of COVID-19 vaccines will continue to have a positive influence on commercial air travel. This should generate favourable economic environments in the markets HEI serves.

The pace of recovery in global travel, however, remains difficult to predict and can be negatively influenced by new COVID variants and varying vaccine adoption rates. Given these uncertainties, HEI is not providing FY2021 net sales and earnings guidance. It is continuing to estimate capital expenditures of ~$40 million for FY2021.

Operating Cash Flow (OCF) Free Cash Flow (FCF)

Looking at the Condensed Consolidated Statement of Cash Flows in the historical 10-Ks we have FY2020 - FY2011 OCF of (in millions of $ rounded):

$409, $437, $328, $288, $260, $173, $191, $132, $139, and $126

In FY2020 - FY2011, HEI's CAPEX (in millions of $ rounded) was:

$23, $29, $42, $26, $31, $18, $16, $18, $15, and $9.

Back out CAPEX and we end up with FY2020 - FY2011 FCF of (in millions of $ rounded):

$386, $408, $286, $262, $229, $155, $185, $114, $124, and $117.

In the first half of 2021, HEI's OCF is ~$210 million. Back out ~$22 million in CAPEX and FCF is ~$188 million. If HEI is able to replicate this FCF in the 2nd half of the year we are looking at ~$376 million for FY2021.

HEI has clearly demonstrated over many years that it has a sound formula to generate OCF and FCF to finance its growth and to reward shareholders.

HEICO - Stock Analysis - Credit Ratings

HEI's debt is not rated.

Dividend and Dividend Yield

The recent declaration of the 86th consecutive semi-annual cash dividend and the 12.5% increase in the semi-annual cash dividend are impressive. We have to bear in mind, however, that a $0.09 semi-annual dividend means $0.18/year which is a ~0.14% dividend yield; the current share price is ~$130.50 for the Class A shares.

As with ROL, the dividend and dividend yield are not important factors in deciding whether to invest in HEI. The retention of cash flow and profits in the business generates superior long-term returns.

HEI has had various stock splits over the years.

A stock split increases the number of outstanding shares and reduces the share price; the value of the company does not change. As a result, stock splits help make shares more affordable to smaller investors and provide greater marketability and liquidity in the market.

The weighted average number of common shares outstanding in the FY2020 - FY2016 timeframe is 137,302, 137,350, 136,696, 135,588, and 133,145 (millions of shares).

Details of HEI's share repurchases are found on page 96 of 142 in the FY2020 10-K.

HEICO - Stock Analysis - Valuation

HEI's diluted EPS for the FY2020 - FY2016 timeframe is: $2.29, $2.39, $1.90, $1.37, and $1.17. The diluted PE for Class A shares during the same timeframe is 51.12, 37.46, 33.16, 29.55, and 29.65.

As with ROL, HEI's valuation is rich if we rely on EPS and diluted PE to determine valuation. HEI's acquisition strategy, however, results in sizable depreciation and amortization expenses on the Consolidated Statement of Cash Flows (~$24 million in Q1 2021, ~$89, ~$85, and ~$77 million in FY2020 - FY2018). These are expenses that reduce EPS but they do not negatively impact cash flow.

Rather than rely on EPS, let's look at net cash provided by operating activities/weighted average number of common shares outstanding (page 33 of 142 in the FY2020 10-K).

Net cash provided by operating activities in Q2 2021 and FY2020 - FY2018 amounts to (in millions): ~$210, ~$409, ~$437, and $328.

The weighted average number of common shares outstanding in Q2 2021 and FY2020 - FY2018 amounts to (in millions): ~138, ~137, ~137, and ~137.

Using these figures we get OCF/share values of ~$3, ~$3.20, and ~$2.4 for FY2020 - FY2018. I envision the number of outstanding shares for FY2021 will remain at ~138 million and OCF will come in around $376 million. If my estimates materialize then we are looking at ~$2.72 in OCF/share.

HEI's current Class A share price is ~$130.50. Divide this by ~$2.72 and we get a Price/OCF per share of ~48.

FY2021 adjusted diluted earnings estimates from 13 brokers is a mean of $2.18 and a low/high range of $2.08 - $2.25. Based on the current ~$130.50 share price, the forward adjusted diluted PE is ~60 based on the mean estimate and ~58 based on the high end of the range.

HEICO - Stock Analysis - Final Thoughts

No matter how we look at HEI, it appears to be richly valued. Shares, however, are just about always richly valued. That is perfectly fine because it discourages many investors from investing in the company.

I encourage you to read this January 2020 Forbes article about the Mendelson family. If the Mendelson family can generate a 47,500% return over 30 years then I am willing to pay up for their expertise!

I initiated my HEI position in September 2019 after reading this Forbes article and doing some research on the company; shares are held in one of the 'Side' accounts within the FFJ Portfolio.

On June 14, 2021 I intend to acquire additional HEI shares. While the additional shares will be entitled to receive the July 15th semi-annual dividend, my HEI investment completely disregards this dividend.

It is not for me to judge how investors invest their money. If an investor's primary objective is to generate dividend income, high-quality companies like HEI and ROL will be mistakenly overlooked.

I think it is preferable to look at the overall potential investment return. HEI has a great track record in this regard and I fully expect this to continue.

Stay safe. Stay focused.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long HEI.a and ROL.

Disclaimer: I do not know your individual circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your own research and due diligence. Consult your financial advisor about your specific situation.