HEICO Corporation has two classes of common stock (HEI and HEI.a). Both classes of shares are virtually identical in all economic respects except voting rights. The difference is that each HEI share is entitled to one vote per share while each HEI.a share is entitled to a 1/10 vote per share. This post focuses on the HEI.a shares (non-voting) since these are the shares I own.

I last reviewed HEI in this May 23 post in which I disclosed the purchase of 200 non-voting shares (HEI.a) @ ~$132 on May 23. I disclosed the purchase of another 100 shares at ~$127/share in my May 26 post.

Following the release of Q3 and YTD2023 results after the August 28 market close, the share price plunged to ~$126.50 from the previous day’s ~$135 close. In reviewing HEI’s results, I felt there was no justification for this plunge and acquired another 100 HEI.a shares @ ~$127.75 on August 29.

Business Overview

HEI’s 2022 Annual Report and Form 10-K provide a good company overview.

Additional information is provided in HEI’s Investor Presentation and website.

Growth Through Acquisitions

Acquisitions are an essential element of HEI’s growth strategy. Since 1990, it has completed nearly 100 acquisitions complementing the niche segments of the aviation, defence, space, medical, telecommunications and electronics industries in which it operates.

HEI serves as a unique opportunity for entrepreneurs looking for additional partners to bring into their company. Because of its history, HEI has become an acquirer of choice because management understands what it is to be an entrepreneur and knows what it is like to operate a small business. It is not a private equity firm looking to sell the business nor is it a large corporate acquirer that will eliminate the essential nature of what made the company successful. HEI strives to maintain the uniqueness and individuality of its businesses to ensure it has passionate people who want to listen to their customers and deliver exactly what the customer needs.

HEI typically targets acquisition opportunities that allow it to broaden its product offerings, services and technologies while expanding its customer base and geographic presence. Even though HEI has pursued an active acquisition policy, its disciplined acquisition strategy involves limiting acquisition candidates to businesses that management believes will continue to grow, offer strong

cash flow and earnings potential, and are available at fair prices.

Historically, HEI quickly integrates its acquisitions. This results in them being accretive to earnings in the year following the purchase.

Acquisitions are generally made using cash provided by operating activities, proceeds from the HEI’s revolving credit facility, or the issuance of HEI Class A Common Stock.

On January 5, 2023, HEI closed its acquisition of ~94% of the outstanding shares of leading electronic component maker Exxelia International. At the time of this announcement, Exxelia was HEI’s largest-ever acquisition in terms of purchase price and revenue.

On August 4, however, HEI announced the completion of the Wencor group acquisition, an even larger acquisition from the perspective of purchase price, revenue and income. It was purchased from affiliates of Warburg Pincus LLC and Wencor’s management for $1.9B in cash and $0.15B in HEICO Class A Common Stock, or $2.05B in the aggregate.

Financials

Q3 and YTD2023 Results

HEI’s Q3 and YTD2023 results are accessible in Form 8-K; Form 10-Q has yet to be released.

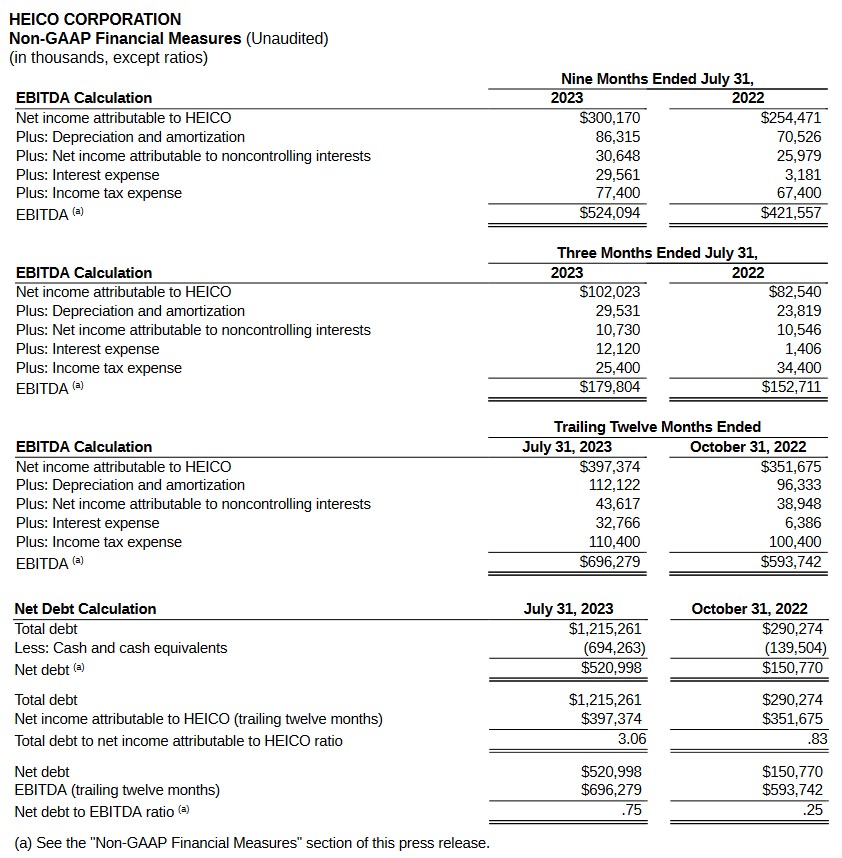

Following the two largest acquisitions in the company’s history, HEI’s leverage has increased substantially from historical levels.

Management expects both highly synergistic acquisitions to be accretive to earnings within the year following closing. In addition, HEI anticipates that it will continue to achieve its often articulated growth objective in the years after the closing. The 3.06:1 total debt to net income attributable to HEI ratio is expected to return to historically low levels within ~12 – ~18 months after acquisition.

On the Q3 earnings call, management indicated it needs to digest these two acquisitions, and therefore, no major acquisitions are planned in the foreseeable future. HEI, however, continues to actively pursue smaller bolt-on acquisitions and has a robust pipeline of acquisition opportunities.

FY2023 Outlook

HEI typically does not provide net sales and earnings guidance. However, management continually states that the company will continue to invest in research and development and execute its successful acquisition program.

Operating Cash Flow (OCF) Free Cash Flow (FCF)

HEI’s FY2022 – FY2011 OCF (in millions of $) is $468, $444, $409, $437, $328, $288, $260, $173, $191, $132, $139, and $126.

Its FY2022 – FY2011 CAPEX (in millions of $) is $32, $36, $23, $29, $42, $26, $31, $18, $16, $18, $15, and $9.

The difference between OCF and CAPEX in FY2022 – FY2011 gives us FCF (in millions of $) of $436, $408, $386, $408, $286, $262, $229, $155, $185, $114, $124, and $117.

In the first 9 months of FY2023, HEI generated ~$300.4 million OCF and ~$266.2 million FCF.

Credit Ratings

Following the Wencor Group acquisition, HEI’s total debt to net income attributable to HEI trailing twelve months ratio was 3.06x as of July 31, 2023; it was .83x as of October 31, 2022. The net debt to EBITDA ratio was .75x and .25x as of July 31, 2023 and October 31, 2022, respectively.

The increase in the net debt to EBITDA ratio in the first nine months of fiscal 2023 primarily reflects HEI’s successful offering of:

- $0.6B of 5.25% Senior Unsecured Notes due August 1, 2028; and

- $0.6B of 5.35% Senior Unsecured Notes due August 1, 2033.

The net proceeds from the sale of the Notes were used to repay the outstanding borrowings under HEI’s revolving credit facility and to fund a portion of the Wencor acquisition purchase price.

Details of these offerings are found in this Form 8-K.

HEI’s domestic senior unsecured long-term debt is now rated by two rating agencies. Moody’s assigns a Baa2 rating and Fitch assigns a BBB rating; S&P Global does not rate HEI’s debt.

Both ratings are in the middle tier of the lower medium-grade investment-grade category. These ratings define HEI as having an adequate capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Dividends and Share Repurchases

Dividend and Dividend Yield

HEI’s dividend history is accessible here.

On June 12, 2023, HEI declared its 90th consecutive semi-annual cash dividend since 1979.

Using my ~$127.75 purchase price, the $0.10/share semi-annual dividend is an insignificant component of HEI’s total investment return and does not factor into my investment decision-making process.

Stock Splits and Share Repurchases

HEI has had six 5 for 4 stock splits over the years.

The weighted average number of common shares outstanding in the FY2022 – FY2016 timeframe is 138.037, 137.854, 137.302, 137.350, 136.696, 135.588, and 133.145 (millions of shares). The weighted average number of common shares outstanding in the first 3 quarters of FY2023 is 138.616. The surge in outstanding shares is primarily the result of the issuance of shares related to the Exxelia and Wencor Group acquisitions.

Details of HEI’s share repurchases commence on page 95 of 133 in the FY2022 10-K. Further high-level information is found in the Consolidated Statements of Shareholders’ Equity within each Form 10-K and Form 10-Q.

While HEI repurchases shares annually, it also issues HEI-a shares to the sellers of most of the companies it acquires. This permits the sellers to participate in HEI’s wealth creation model.

Valuation

HEI’s diluted EPS for the FY2022 – FY2016 timeframe is $2.55, $2.21, $2.29, $2.39, $1.90, $1.37, and $1.17. The diluted PE for HEI.a shares during the same timeframe is 47, 58.15, 51.12, 37.46, 33.16, 29.55, and 29.65.

In my previous post, I anticipated HEI would generate at least $2.86 in FY2023 diluted EPS. Using my May 23 ~$132 purchase price and $2.86 in diluted EPS, I determined HEI.a’s forward diluted PE to be ~46.2.

In the first 9 months of FY2023, HEI generated $2.17 in diluted EPS. It needs to generate ~$0.72 of diluted EPS in Q4 to reach $2.86 and I think this is attainable.

When I reviewed HEI in my May 23 post, HEI.a shares were trading at ~$131. Using the current broker-adjusted diluted EPS guidance the following were the forward-adjusted diluted PE levels:

- FY2023 – 14 brokers – mean of $3.01 and low/high of $2.80 – $3.20. Using the mean, the forward adjusted diluted PE is ~43.5.

- FY2024 – 13 brokers – mean of $3.49 and low/high of $3.10 – $3.75. Using the mean, the forward adjusted diluted PE was ~37.5.

- FY2025 – 8 brokers – mean of $3.82 and low/high of $3.30 – $4.11. Using the mean, the forward adjusted diluted PE was ~34.3.

Now, the forward adjusted diluted PE levels using my ~$127.75 purchase price and the current broker-adjusted diluted EPS guidance are:

- FY2023 – 12 brokers – mean of $2.90 and low/high of $2.78 – $3.07. Using the mean, the forward adjusted diluted PE is ~44.1.

- FY2024 – 12 brokers – mean of $3.41 and low/high of $3.13 – $3.58. Using the mean, the forward adjusted diluted PE was ~37.5.

- FY2025 – 9 brokers – mean of $4.08 and low/high of $3.75 – $4.40. Using the mean, the forward adjusted diluted PE was ~31.3.

HEI’s EPS, however, is distorted by non-cash Depreciation and Amortization related to multiple acquisitions. Looking at HEI’s historical Consolidated Statement of Cash Flows, annual depreciation and amortization were ~$96, ~$93, ~$89, ~$85, and ~$77 million in FY2022 – FY2018.

I, therefore, do not rely on HEI’s PE levels to determine whether to acquire additional shares but rather try to gauge HEI’s valuation using Price/OCF.

Net cash provided by operating activities (in millions) in FY2022 – FY2018 was ~$468, ~$444, ~$409, ~$437, and $328.

The weighted average number of common shares outstanding (in millions) in FY2022 – FY2018 was ~138, ~138, ~138, ~137, ~137, and ~137.

Using these figures, we get OCF/share values of ~$3.39, ~$3.24, ~$3, ~$3.20, and ~$2.40 for FY2022 – FY2018.

In the first 9 months of FY2023, HEI generated ~$300.4 of OCF. If HEI generates ~$460 of OCF in FY2023 and the weighted average number of common shares outstanding (in millions) increases to 139 from ~138.6, the FY2023 OCF/share should be ~$3.31.

Using my recent ~$127.75 purchase price, and ~$3.31 in projected FY2023 OCF, the Price/OCF level is ~38.6.

The valuation appears rich but this is typical with HEI.

Final Thoughts

While HEI continues to add space and real estate, machines, and labour, keeping up with the current demand is very difficult.

HEI’s order backlog is extremely strong and in some areas of the business, particularly on the defense side of HEI’s Specialty Products businesses, the backlogs are 2 times the historical rate. Management has stated that if it had the capacity, the Specialty Products businesses could ship significantly more than currently being shipped.

The only concern I have with HEI at the moment is its leverage. However, Moody’s and Fitch have assigned investment-grade credit ratings. Furthermore, HEI is generating very strong cash flow and management remains committed to reducing the total debt to net income attributable to HEI ratio to under 2:1 within 12 – 18 months.

When I completed my mid-2023 Investment Holdings Review, HEI was my 27th largest holding. It remains within my top 30 holdings but is not a top 20 holding.

My exposure now consists of 400 shares in a ‘Core’ account and 400 shares in a ‘Side’ account within the FFJ Portfolio. In hindsight, I should have acquired more than 100 shares on August 29.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long HEI.a.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.