Contents

I last reviewed Lockheed Martin (LMT) in this October 18, 2022 post. LMT has now released Q4 and FY2022 results and its FY2023 outlook on January 24. Despite supply chain headwinds, growth in the order backlog is encouraging. In this post, I look at whether I should add to my LMT exposure.

I have also taken a similar look at Raytheon Technologies (RTX) and have recently published this post.

Business Overview

Investors unfamiliar with LMT should review:

- LMT's 13 Technology & Innovation Highlights from Q4 2022;

- the company's website;

- Part 1 within the 2021 Form 10-K; the 2022 Form 10-K is unavailable as I compose this post.

The Risk Factors section within LMT's Form 10-K provides a good overview of various risks that could impact its business, financial condition, operating results and cash flows.

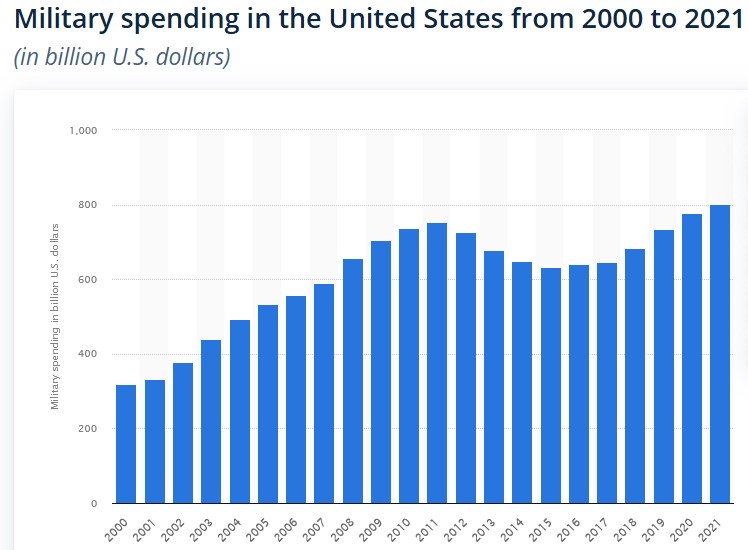

US Military Spending

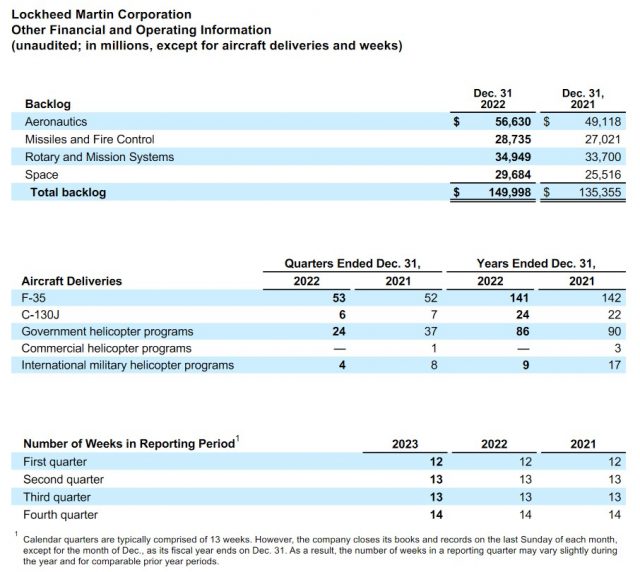

The following reflects US military spending from 2000 to 2021.

Source: Statista Inc.

Each year, the National Defense Authorization Act (NDAA) authorizes funding levels and provides authority for the U.S. military and other critical defense priorities. To be clear, the NDAA does not fund the military but is rather the budget used by the military to direct appropriations made by the U.S. Congress.

In its 62nd consecutive year, the NDAA supports a total of $857.9B for national defense in 2023 representing a ~8% increase relative to FY2022 levels. This consists of ~$816.7B for the Department of Defense (DOD) and $30.3B for national security programs within the Department of Energy (DOE). (Summary of the Fiscal Year 2023 NDAA)

These appropriations have enabled LMT, along with the Joint Program Office, to finalize the contract for the production and delivery of up to 398 F-35 for $30B in Lots 15 and 16, including the option for Lot 17. Further, several other LMT programs received the necessary funding levels necessary to drive LMT's growth outlook. This includes LMT's combat rescue helicopter, the C-130J, Blackhawk, CH-53K and FAAD. LMT's current expectation is that growth will materialize over the longer term, starting in 2024.

The most recent NDAA includes billions in additional funding to help the Pentagon:

- cope with inflation;

- continue certain programs the Biden administration had sought to cancel; and

- bolster critical munitions production and lessen the defense supply chain’s reliance on China.

I question whether every country fully discloses military spending. The Stockholm International Peace Research Institute (SIPRI), a reliable independent resource on global security, has several databases from which we can gauge every country's military budget. I highly question the accuracy of the data for some countries. Nevertheless, I do think the US likely ranks first in military spending. China's military spending in 2020 was estimated to be $252B. I have no idea of this figure's accuracy but even if we double this to $504B, the amount is well below the US's $778B.

These figures are staggering! The combination of LMT being the largest defense contractor with the current geopolitical landscape is a real tailwind.

F-35 Fighter Jet

LMT posted full-year F-35 deliveries of 141 which was below the target of 148; an engine mishap in December caused a temporary suspension of deliveries. Despite this setback, management remains optimistic regarding the company's ability to deliver 156/year F-35s by 2025.

In December, the F-35 Joint Program Office and LMT finalized the contract for the production and delivery of up to 398 F-35s for $30B, including U.S., international partners and Foreign Military Sales (FMS) aircraft in Lots 15 and 16, with the option for Lot 17.

The agreement includes 145 aircraft for Lot 15, 127 for Lot 16, and up to 126 for the Lot 17 contract option, including the first F-35 aircraft for Belgium, Finland and Poland.

LMT has also received authorization to procure long lead items for Lot 18 F-35 aircraft for the U.S. Air Force, Marine Corps, Navy and U.S. allies.

Germany has also been added as the 9th foreign military sales country to the F-35 Lightning II program. In early January 2023, Canada officially became an F-35 operator as it selected the aircraft to replace its aging fighter fleet.

Financials

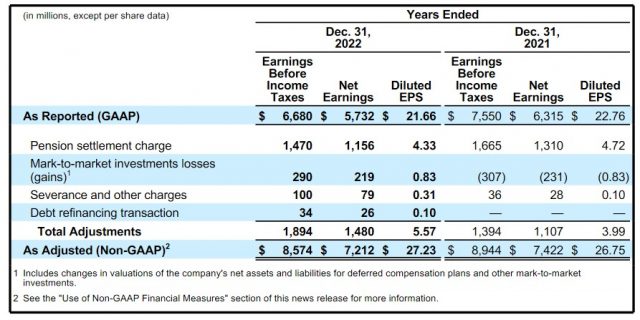

Q4 and YTD2022 Results

LMT's Q4 and YTD2022 results and FY2023 guidance are reflected in its Earnings Release and accompanying material which is accessible here. A recap of FY2022 results, backlog, and deliveries is found below.

Included in the 11% growth in LMT's backlog was a surge in new interest for LMT's industry-leading security solutions (eg. classified programs in Space and in Missiles and Fire Control); LMT booked ~$1.5B in orders, reflecting increased demand to replenish US stocks and enhance security positions globally.

LMT's financial results included more than $1.7B of independent research and development investments (IRAD), a new high for the company.

It also continues to modernize and streamline operations to increase efficiencies and reduce costs. Significant capital projects include the ongoing investment in the One Lockheed Martin transformation or 1LMX. This is a multiyear internal project to transform the business processes and systems from end to end. This entails the implementation of new digital tools in LMT's operations and the expansion of the use of model-based engineering to enhance speed to market and cost competitiveness.

In FY2022, LMT completed a majority of the detailed design for the new systems and business processes. In FY2023, the expectation is for the completion of the detailed design and implementation road maps that go with it. The transition to the system build and configuration phase will occur over the following couple of years.

Free Cash Flow (FCF)

Earnings per Share (EPS) can easily be manipulated. I, therefore, look at the extent to which a company generates FCF.

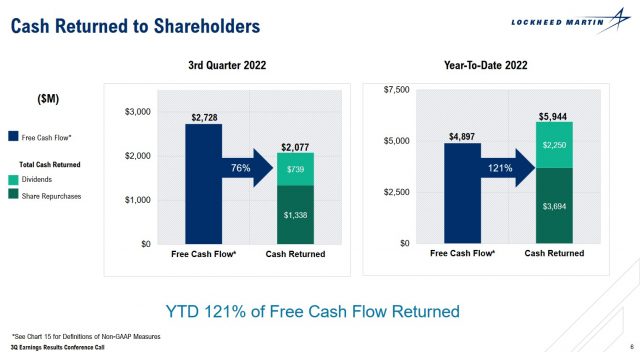

At the time of my previous LMT review, LMT reported the following for Q3 and YTD2022.

Source: LMT Q3 2022 Earnings Presentation - October 18, 2022

At the end of FY2022, we see that LMT returned $4.784B more to shareholders than it generated in FCF. Looking at the FY2022 Consolidated Statements of Cash Flows included in the Earnings Release, we see that LMT repaid $2.25B of long-term debt but issued $6.211B of long-term debt, net of related costs for a difference of $3.961B. The difference between $4.784B and $3.961B shows up in the ~$1.06B reduction in cash and cash equivalents.

Source: LMT - Q4 and FY2022 Earnings Presentation - January 24, 2023

If LMT repeatedly distributes more to shareholders than it generates in FCF, it will need to raise additional debt. At some stage, this could jeopardize LMT's credit ratings. I highly doubt LMT has any intention of jeopardizing its credit ratings.

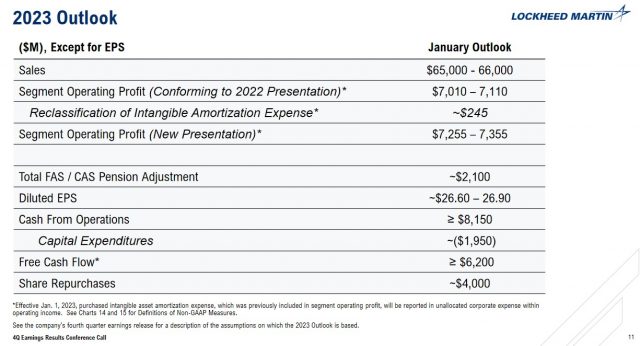

FY2023 Outlook

Much like RTX, LMT is navigating through supply chain challenges. On the bright side, it benefits from rising demand given the geopolitical turmoil thus leading to growth in its backlog.

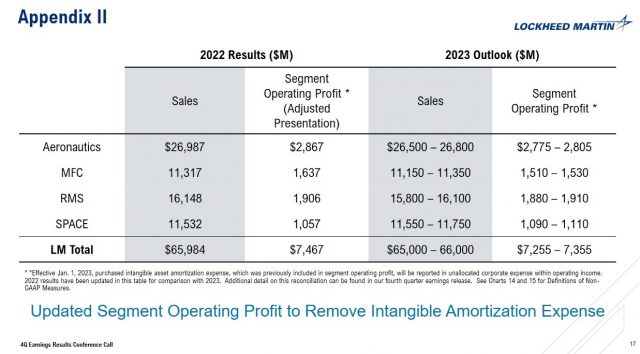

LMT's FY2023 Sales forecast is ~$65B - $66B with the mid-point being slightly below FY2022 revenue. This essentially reflects no growth relative to FY2020 - FY2022 Sales ($65.398B, $67.044B, and $65.984B). Management expects top-line growth to resume in FY2024.

Furthermore, investors can expect a modestly lower segment operating margin due to ongoing production bottlenecks.

From a timing perspective, Q1 is expected to be the weakest quarter of the year with a quarter-over-quarter ramp-up as in FY2022.

Source: LMT - Q4 and FY2022 Earnings Presentation - January 24, 2023

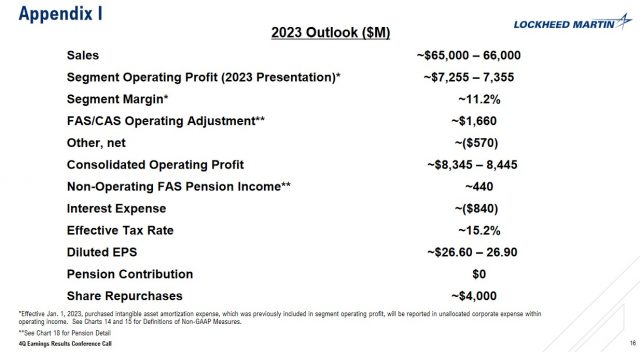

LMT has introduced a reporting change in segment operating profit starting in FY2023. Going forward, it will report purchased intangible asset amortization expense in unallocated corporate expense below segment operating profit as opposed to reporting intangible amortization that was included in segment operating profit; this change will not impact total earnings. The rationale for this change is to provide a more accurate view of operating performance for each of LMT's 4 business areas.

Source: LMT - Q4 and FY2022 Earnings Presentation - January 24, 2023

Management's FY2022 total segment operating profit outlook was ~$7.175B but actual results were ~$7.467B. LMT now forecasts $7.255B - $7.355B.

Source: LMT - Q4 and FY2022 Earnings Presentation - January 24, 2023

FY2023 adjusted diluted EPS is expected to be $26.60 - $26.90 with the YoY reduction to adjusted EPS primarily driven by lower segment operating profit in FAS/CAS income, partially offset by the benefit from a lower share count.

NOTE: The FAS/CAS pension adjustment represents the difference between pension expense under financial accounting standards ('FAS') under U.S. GAAP and U.S. Government cost accounting standards ('CAS').

LMT's FY2023 FCF estimate is greater than or equal to $6.2B (versus ~$6.132B in FY2022) and assumes continued enactment of the R&D tax capitalization. This ~$0.1B increase in cash generation, along with expectations of an additional $4B in share repurchases, highlights LMT's focus on increasing FCF/share. The projected combination of higher free cash flow and a lower share count is expected to lead to a mid-single-digit growth in FCF/share in FY2023.

NOTE: An explanation of how and when to capitalize R&D costs is found here.

Credit Ratings

There is no change to LMT's senior unsecured domestic currency debt ratings after my prior review.

- Moody's: A3

- S&P Global: A-

- Fitch: A-

These ratings are the lowest tier of the upper-medium investment-grade level. They define LMT as having a STRONG capacity to meet its financial commitments. LMT is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

Dividend and Dividend Yield

LMT repeatedly states its commitment to reward shareholders through dividend increases (see dividend history).

The following reflect the dividend yields at the time of prior reviews.

- January 25, 2022: shares were trading at ~$380 and the $2.80 quarterly dividend yielded ~3%.

- April 19, 2022: shares were trading at ~$460 and the $2.80 quarterly dividend yielded ~2.4%.

- July 19, 2022: shares were trading at ~$390 and the $2.80 quarterly dividend yielded ~2.9%.

- October 18, 2022: shares were trading at ~$432 and with the dividend increase to $3.00, the dividend yield was ~2.78%.

Shares currently trade at ~$452.50 as I compose this post; the $3.00 quarterly dividend yields ~2.65%. Following another 3 more quarterly dividends at this level, I expect an increase to $3.20 when the December 2023 dividend is declared in September.

We see from LMT's 2022 cash returned to shareholders that it generates ample FCF to cover the dividend distributions. LMT can not, however, continue to cover its dividend and share repurchases from FCF if it intends to repurchase shares to the same degree.

LMT is a prolific acquirer of its shares. The weighted average number of issued and outstanding shares in FY2011 - FY2022 (in millions rounded) is 340, 328, 327, 322, 315, 303, 291, 287, 284, 281, 277.4, and 264.6. On December 31, 2022 (FYE2022), this had been reduced to 254.

On October 17, 2022, LMT's board authorized the purchase of up to an additional $14B of LMT common stock under its share repurchase program. This multi-year share repurchase program follows the substantial completion of purchases of common stock under the prior repurchase authorization.

In Q4, LMT entered into a $4B accelerated share repurchase program, bringing the total share repurchases for the year to ~$7.9B. LMT plans to complete the remaining ~$10B repurchase authorization over the next few years with funding of the repurchases coming through a combination of cash on hand and debt.

Valuation

In FY2013 - FY2021, LMT's diluted PE levels were 16.02, 19.47, 19.27, 18.81, 26.04, 24.80, 18.51, 15.16, and 16.38.

Now that LMT has reported $21.66 in diluted EPS for FY2022 and shares currently trade at ~$452.50, the diluted PE is ~21.

When I wrote my October 18, 2022 post, LMT's share price had surged to ~$432 and its valuation using the current forward-adjusted earnings estimates from the two discount brokerage platforms I use was:

- FY2022 - 21 brokers - mean of $21.63 and low/high of $21.44 - $21.91. Using the current share price and the mean, the forward adjusted diluted PE was ~20.

- FY2023 - 21 brokers - mean of $27.48 and low/high of $25.97 - $28.66. Using the current share price and the mean, the forward adjusted diluted PE was ~15.7.

- FY2024 - 17 brokers - mean of $28.53 and low/high of $27.39 - $29.82. Using the current share price and the mean, the forward adjusted diluted PE was ~15.2.

LMT, however, reported $27.23 in FY2022 adjusted diluted EPS which is significantly higher than previous broker estimates. Had broker estimates been similar to LMT's FY2022 adjusted diluted EPS, the forward adjusted diluted PE would have been ~16 versus ~20.

Much of the variance in the adjusted diluted EPS is attributed to a $4.33/share pension settlement charge in Q2. This was a one-time pension settlement charge following the execution of a pension transfer.

I have no idea if there will be a similar pension settlement charge in FY2023 but for now, management's outlook reflects $0 toward a pension contribution in FY2023.

Using the current ~$452.50 share price and management's FY2023 adjusted diluted EPS forecast of ~$26.60 – 26.90, the forward-adjusted diluted PE is ~17 when we use the mid-point of guidance.

Broker guidance is changing and is likely to continue changing over the coming days. For the moment, however, LMT's valuation using the current forward-adjusted earnings estimates from the two discount brokerage platforms I use is:

- FY2023 - 24 brokers - mean of $26.77 and low/high of $22.72 - $27.64. Using the current share price and the mean, the forward adjusted diluted PE is ~16.84.

- FY2024 - 23 brokers - mean of $28.05 and low/high of $24.32 - $29.52. Using the current share price and the mean, the forward adjusted diluted PE is ~16.1.

- FY2025 - 13 brokers - mean of $28.60 and low/high of $25.61 - $32.05. Using the current share price and the mean, the forward adjusted diluted PE is ~15.8.

Final Thoughts

LMT was my 8th largest holding when I completed my Mid 2022 Investment Holdings Review. Although the rankings have changed after that review, I am certain LMT remains a top 20 holding.

Both RTX and LMT are navigating supply chain headwinds and these are likely to persist well into the 2nd half of 2023. While the outlook for 2023 is unappealing, growth in the order backlog is encouraging. If management is correct, FY2024 should be a better year.

As with RTX, I wish to add to my LMT exposure. However, I am reluctant to do so now despite the reasonable valuation because I expect a broad market pullback in 2023. If this materializes, we should hopefully be able to acquire shares in both companies at even more favourable valuations.

I wish you much success on your journey to financial freedom!

Note: Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Disclosure: I am long LMT and RTX.

Disclaimer: I do not know your circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decisions without conducting your research and due diligence. You should also consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this post.