My last Genuine Parts (GPC) post was on March 23, 2023 post following my review of GPC’s 2023 Investor Day material.

Fast forward to July 20 at which time GPC released Q2 and YTD2023 financial results and FY2023 guidance. The tumble in GPC’s share price following the release of these results has piqued my interest thereby prompting me to determine if I should add to my exposure.

Business Overview

Part 1 Item 1 in GPC’s FY2022 Form 10-K is a good source of information to learn about the company.

Acquisitions

While GPC has grown organically, mergers and acquisitions are key to its growth. At any given time, GPC has 125 active discussions across its global acquisition pipeline.

On average GPC had deployed ~$0.27B in bolt-on capital per year during the 2015 – 2022 timeframe. YTD2023, GPC has deployed ~$0.106B in acquisitions and more acquisitions are targeted for the remainder of the year.

Financials

Q2 and YTD2023 Results

I provide links to GPC’s Q2 2023 Earnings Release and Earnings Presentation.

GPC is benefiting from sourcing and pricing initiatives thus leading to a ~36% gross margin in Q2 2023 and ~35.5% YTD2023 versus ~35% in Q2 2022 and ~34.8% YTD2022.

This improvement, however, was offset by operating costs reaching ~28.4% of sales in Q2 2023 versus ~26% in Q2 2022; the increase is largely attributed to wage hikes and technology spending.

In the long run, management is targeting an improvement in operating margin (~9% from the current 7%-8% as cost control initiatives take effect).

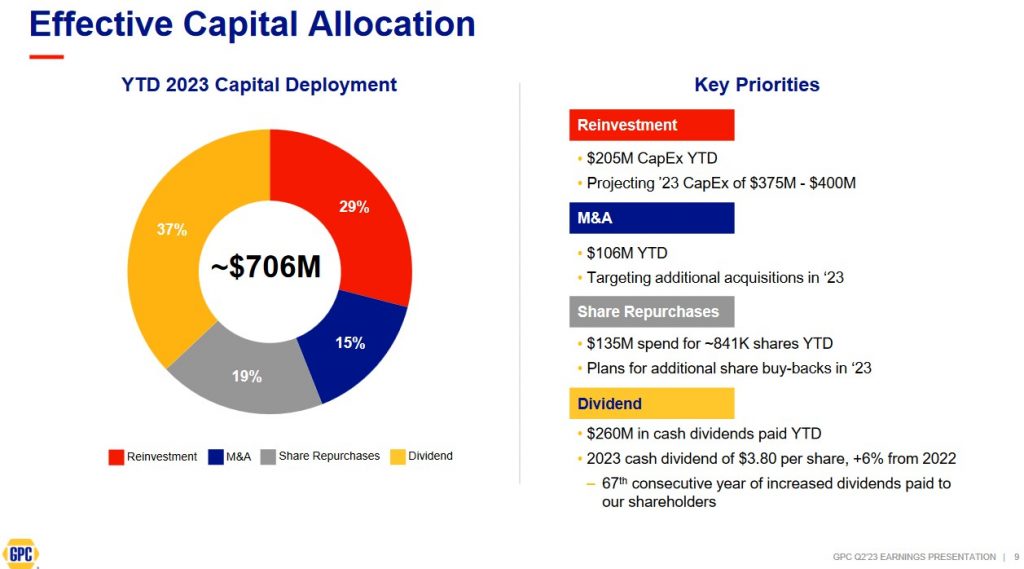

Capital Allocation

This is GPC’s YTD2023 capital allocation. This capital allocation is likely to change over the remainder of the current fiscal year.

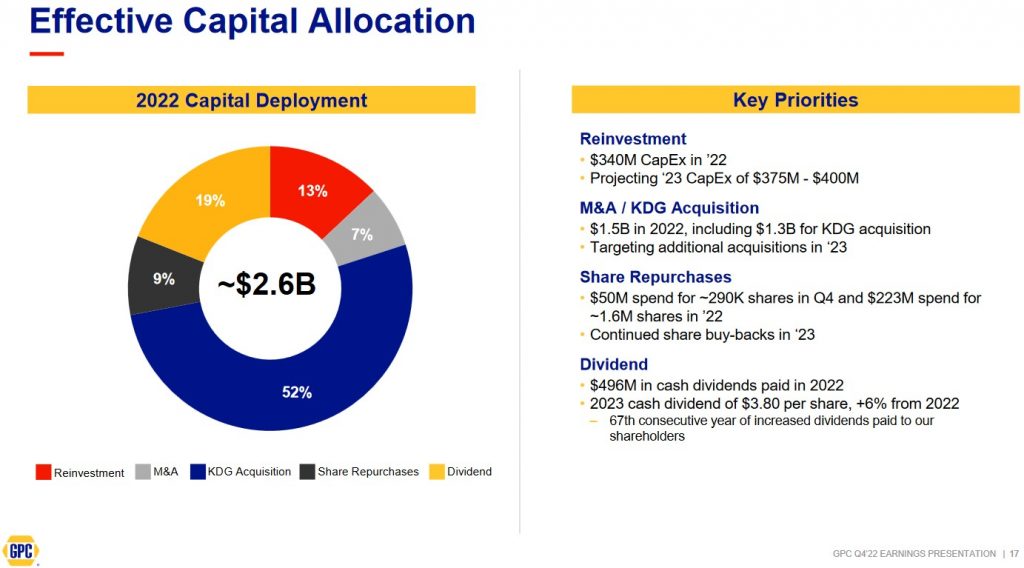

This was GPC’s capital allocation in FY2022.

FY2023 Outlook

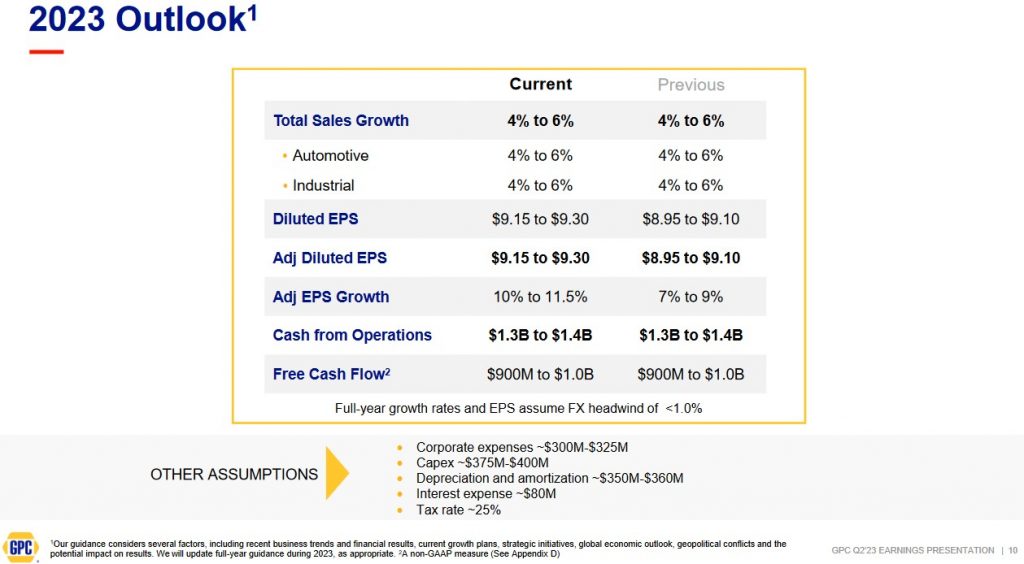

The following revised FY2023 outlook also includes the revisions presented when GPC announced its Q1 2023 results.

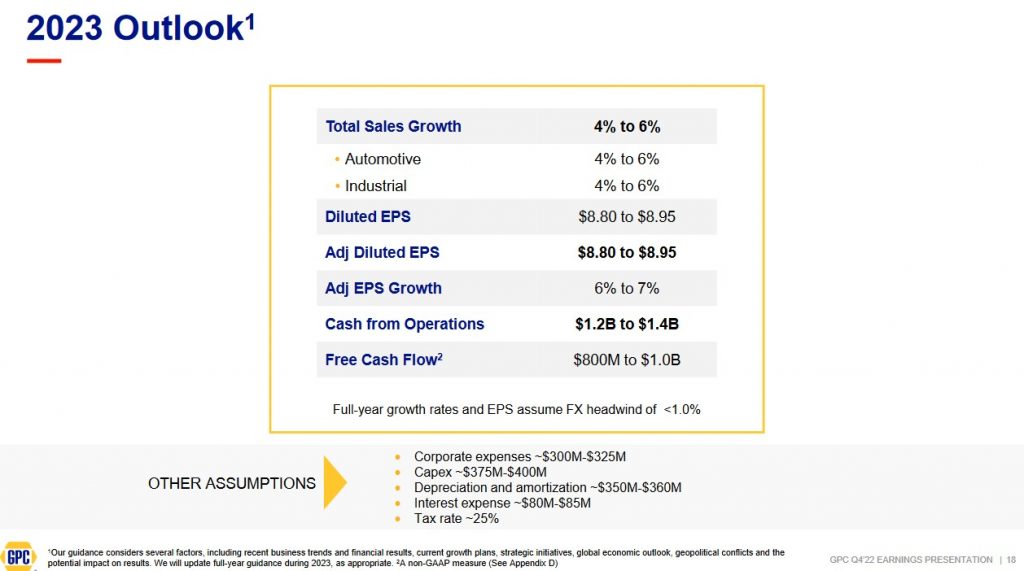

For comparison purposes, I provide GPC’s original FY2023 outlook presented on February 23 when Q4 and FY2022 results were released.

FY2025 Financial Targets

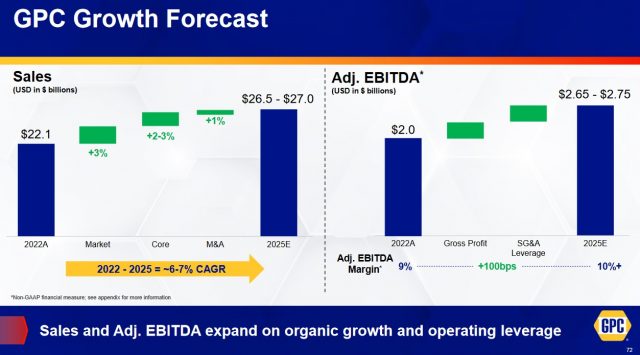

While GPC’s FY2025 financial targets are presented in my March 23 post, I provide them again for ease of reference.

Source: GPC Investor Day Presentation – March 23, 2023

Credit Ratings

GPC’s unsecured long-term debt ratings remain unchanged from the time of my March review.

- Moody’s: Baa1 (stable outlook)

- S&P Global: BBB (stable outlook)

Moody’s rating is the top tier of the lower medium grade. S&P Global’s rating is the middle tier of the lower medium grade. Both ratings are investment grade and are defined as an obligor having ADEQUATE capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Both ratings are satisfactory for my purposes.

Dividends and Share Repurchases

Dividend and Dividend Yield

My interest lies in an investment’s TOTAL potential long-term shareholder return. I, therefore, am indifferent if a company distributes no/little dividend IF retained earnings can improve long-term investor returns.

Having said this, GPC will appeal to investors who fixate on dividend metrics. It has:

- distributed a cash dividend to shareholders every year since going public in 1948; and

- increased its dividend for 67 consecutive years.

As noted in the Capital Allocation section of this post, the dividend was just under 20% of GPC’s capital allocation in FY2022. This has risen to 37% YTD2023.

GPC’s dividend history is accessible here.

At the time of my prior post, I had just acquired additional shares at ~$155.80 and GPC had recently declared an increase in its quarterly dividend to $0.95 from the prior $0.895. On this basis, the dividend yield based on my recent purchase price was ~2.44%.

In mid-August, we can expect the declaration of the 3rd consecutive $0.95 quarterly dividend. On July 20 I acquired additional shares at ~$157.50 so my dividend yield is ~2.41%.

I envision a ~$0.05/share quarterly dividend increase (~5.26%) to be declared in mid-February; the average increase over 20 years slightly exceeds 5.8% and the last increase was ~6.15%. On this basis, the next 4 quarterly dividend payments will amount to ~$3.90 ((2 x $0.95)+ (2 x $1.00)). Using my recent purchase price, the forward dividend yield is ~2.48%.

Share Repurchases

GPC’s weighted average shares outstanding in FY2012 – FY2022 are (in millions of shares) 156, 156, 154, 152, 150, 148, 147, 146, 145, 144 and 142.3.

In the first half of FY2023, GPC repurchased ~$0.135B of its shares. Share base compensation over the same timeframe is ~$0.037B. The weighted average common shares outstanding for the quarter ending June 30 is ~141.2.

The company expects to remain active in its share repurchase program. However, the amount and value of shares repurchased will vary and is at the discretion of the Board.

Valuation

Before the release of Q3 and YTD2022 results on October 20, 2022 GPC’s share price was ~$155. Management’s adjusted diluted EPS guidance was $7.80 – $7.95 ($7.875 mid-point) thus giving us a forward adjusted diluted PE of ~19.7.

When I reviewed GPC in my December 3, 2022 post, the share price was ~$187.30. Management’s revised guidance for FY2022 was $8.29 – $8.39 of diluted EPS and $8.05 – $8.15 of adjusted diluted EPS. On this basis, GPC’s valuation on a GAAP basis (using the $8.34 mid-point) was ~22.46 and ~23.1 (using the $8.10 mid-point) on an adjusted basis.

GPC’s forward-adjusted diluted PE levels using broker estimates were:

- FY2022 – 13 brokers – mean of $8.17 and low/high of $8.10 – $8.28. Using the mean estimate, the forward-adjusted diluted PE is ~23.

- FY2023 – 13 brokers – mean of $8.60 and low/high of $8.30 – $9.13. Using the mean estimate, the forward-adjusted diluted PE is ~21.8.

- FY2024 – 6 brokers – mean of $9.22 and low/high of $9.00 – $9.68. Using the mean estimate, the forward-adjusted diluted PE is ~20.3.

Fast forward to my March 23 post and GPC’s FY2023 diluted and adjusted diluted EPS guidance was $8.80 – $8.95. Using my ~$155.80 purchase price, the forward diluted and adjusted diluted PE range was ~17.4 – ~17.7.

GPC’s forward-adjusted diluted PE levels using current broker estimates and my purchase price were:

- FY2023 – 11 brokers – mean of $8.93 and low/high of $8.85 – $9.17. Using the mean estimate, the forward-adjusted diluted PE is ~17.45.

- FY2024 – 11 brokers – mean of $9.54 and low/high of $9.31 – $10.09. Using the mean estimate, the forward-adjusted diluted PE is ~16.33.

- FY2025 – 4 brokers – mean of $10.55 and low/high of $10.00 – $11.25. Using the mean estimate, the forward-adjusted diluted PE is ~14.77.

GPC’s FY2023 diluted and adjusted diluted EPS guidance is now $9.15 – $9.30. Using my most recent ~$157.50 purchase price, the forward diluted and adjusted diluted PE range is ~16.9 – ~17.2.

The forward-adjusted diluted PE levels using current broker estimates and my ~$157.50 purchase price are:

- FY2023 – 14 brokers – mean of $9.17 and low/high of $9.01 – $9.39. Using the mean estimate, the forward-adjusted diluted PE is ~17.2.

- FY2024 – 14 brokers – mean of $9.95 and low/high of $9.75 – $10.22. Using the mean estimate, the forward-adjusted diluted PE is ~15.8.

- FY2025 – 6 brokers – mean of $10.99 and low/high of $10.53 – $11.34. Using the mean estimate, the forward-adjusted diluted PE is ~14.33.

At its March 23 Investor Day, GPC stated that it is targeting $11.00 – $11.50 in diluted EPS in FY2025. Using this range and my recent ~$157.50 purchase price, the forward diluted PE range is 13.7 – 14.3.

This valuation is much the same as when I completed my March 23 post at which time my recent ~$155.80 purchase price gave me a forward diluted PE range of 13.55 – 14.16.

Since initiating a position at ~$82.22 on July 27, 2017, I do not recollect GPC’s valuation having been at this level.

Final Thoughts

I continue to look for attractively valued high-quality companies. My search, however, has recently been difficult. Fortunately, GPC’s share price took a hit following the July 20 release of its Q2 and YTD2023 results thus providing me with the opportunity to add to my exposure.

My 458 GPC shares are held in a ‘Core’ account within the FFJ Portfolio. GPC was not a top 30 holding when I completed my Mid-2023 Investment Holdings Review. I do, however, want to increase my exposure when I consider its valuation to be attractive.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long GPC.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.