Summary

- On April 12, 2018, Genuine Parts (GPC) and Essendant (ESND) announced that the companies had entered into a definitive agreement to combine ESND and GPC’s S.P. Richards (SPR) business.

- On April 19, 2018, GPC reported Q1 results which reflected double digit sales growth but income before taxes experienced some challenges.

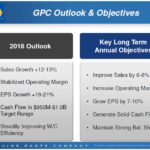

- Management has maintained its sales and earnings guidance provided at the time Q4 2017 results were released. Sales are expected to increase 12% – 13% from FY2017 and adjusted diluted EPS, excluding any Q1 and future transaction-related costs, are still expected to be $5.60 – $5.75.

Introduction

I posted my initial Genuine Parts Company (NYSE: GPC) article on July 24, 2017 at which time I initiated a position in the company.

In my February 21, 2018 post I touched upon GPC’s FCF, Valuation, various Dividend Metrics, and Share Repurchase history. Given that I wrote a relatively recent post on this subject matter, I will provide very limited coverage on these metrics and will focus more on:

- my opinion on GPC’s and Essendant’s (NASDAQ: ESND) recent announcement regarding a definitive agreement to combine SPR with ESND;

- GPC’s valuation.

Proposed Combination of SPR with ESND

In my February 21, 2018 post I wrote:

‘While the Automotive and Industrial segments of GPC generated Operating Profit growth, the smaller Business Products (SPR) group is challenged in that it continues to experience pressures from traditional office supplies competitors. Results reflect the continuation of challenging trends and the changing landscape of the office products industry and GPC is continuing to evaluate the long-term outlook for this business.’

On April 12, 2018, GPC announced the proposed combination of SPR and ESND.

‘The transaction combining ESND and SPR is structured as a Reverse Morris Trust, in which GPC will separate SPR into a standalone company and spin off that standalone company to GPC shareholders, immediately followed by the merger of ESND and the spun-off company. The transaction implies a valuation of SPR of approximately $680 million, reflecting the value of the ESND shares to be issued at closing plus one-time cash payments to GPC of approximately $347 million, subject to adjustments at closing. Upon closing, GPC shareholders will own approximately 51% and ESND shareholders will own approximately 49% of the combined company on a diluted basis, with approximately 80 million diluted shares expected to be outstanding. The transaction is expected to be tax-free to ESND and GPC shareholders.’

This Reverse Morris Trust structure is exactly how the Altra Industrial Motion Corp. and Fortive Corporation transaction about which I recently wrote is to be structured.

This type of Trust in United States law is a transaction that combines a divisive reorganization (spin-off) with an acquisitive reorganization (statutory merger) to allow a tax-free transfer (in the guise of a merger) of a subsidiary.

This Trust is used when a parent company has a subsidiary it wants to sell in a tax-efficient manner. The parent company completes a spin-off of a subsidiary to the parent company’s shareholders.

Under Internal Revenue Code section 355, this could be tax-free if certain criteria are met. The former subsidiary (now owned by the parent company’s shareholders, but separate from the parent company) then merges with a target company to create a merged company. Under Internal Revenue Code section 368(a)(1)(A), this transaction could be largely tax-free if the former subsidiary is considered the ‘buyer’ of the target company. The former subsidiary is the ‘buyer’ if its shareholders (also the original parent company’s shareholders) own more than 50% of the merged company. Thus, the former subsidiary will usually have a bigger market capitalization than the target company.

The SPR and ESND transaction still requires shareholder approval. The plan, however, is to combine both entities to create a company with pro forma 2017 net sales of ~$7B, $0.3B in Adjusted EBITDA, and 4.2% Adjusted EBITDA margins.

Management has indicated that the combined entity will have the enhanced ability to serve customers. In addition, more than $0.075B in annual run-rate cost synergies and more than $0.1B in working capital improvements should be realized. The cost synergies will be driven primarily by sourcing, supply chain and selling, general and administrative efficiencies. Less than $0.05B in one-time cash costs are expected to be incurred to realize the synergies and the combined company expects 90% of the cost synergies to be realized within two years post-closing.

I always wondered why GPC owned SPR. Perhaps the acquisition of SPR was a good idea when GPC acquired it in 1975 (SPR was founded in 1848) but this segment of GPC’s business always struck me as being out of place with the rest of GPC. Furthermore, if you look at SPR’s quarterly sales history, it really was not an impressive part of GPC’s business.

Source: GPC Investor Presentation March 2018

Note its very low percentage market share (2017 sales of ~$2B in a $100B+ market)

Source: GPC Investor Presentation March 2018

In fact, SPR’s Q1 2018 revenue was $0.474B versus $0.498B in Q1 2017. Q1 2018 operating profit was $21,601 million versus $31,119 million in Q1 2017.

The company with which SPR is to be combined is even less impressive. Looking at how ESND has performed in recent years I want to have no part in the proposed combined entity.

ESDN’s FY2017 results were dismal and FY2018 projections provided prior to the proposed combination announcement were certainly not encouraging; ESDN is essentially trading dollars.

Source: Essendant Q4 2017 Earnings call Slides February 22 2018

The combination of two struggling entities may generate some synergies but the headwinds are too great to overcome. As a result, I have no intention of retaining any shares if/when the amalgamation is approved. I will take the cash and will either acquire additional GPC shares or I will redeploy same in a far better company.

Q1 2018 Financial Results

GPC’s April 19, 2018 Earnings Release can be found here.

GPC reported diluted EPS of $1.20 and an adjusted diluted EPS of $1.27 excluding transaction-related costs; this is an 18% increase from Q1 2017.

Total sales for Q1 2018 included 2% organic growth, 14% from acquisitions, including Alliance Automotive Group which was acquired Q4 2017, and a 1% benefit from foreign currency translation.

FY2018 Outlook and Objectives

GPC competes in large, fragmented, and growing global markets. Its market share in the regions in which it operates is relatively small and the industry in these markets grows steadily. As a result, I view ample opportunity for GPC to grow its business. The removal of SPR will allow management to be more focused on the areas of GPC with the most promising growth opportunities.

Source: GPC Investor Presentation March 2018

GPC provided the following in March 2018.

Source: GPC Investor Presentation March 2018

Valuation

Management projected FY2018 diluted EPS in the $5.60 – $5.75 range when Q4 2017 results were released and it has now reiterated these projections. This range represents a ~20.7% – ~24% increase from FY2017’s adjusted diluted EPS.

At the time of my February 21, 2018 article, GPC was trading at ~$94.70; toward the end of January GPC had been trading at ~$107.50. Based on a price of ~$94.70 and FY2018’s adjusted EPS range, shares were trading at an adjusted PE of ~16.5 – ~17.

GPC is now trading ~$88.15. Based on management’s $5.60 – $5.75 FY2018 diluted EPS projection, GPC’s forward PE is ~15.3 – ~15.75. GPC is even more attractively valued than as at February 21, 2018.

Dividend and Dividend Yield

GPC’s dividend history can be found here and its stock split history can be found here.

On February 20, 2018, GPC announced a 6.7% increase in the regular quarterly cash dividend for 2018, and increase from $2.70/share annually to $2.88/share annually. The first $0.72/share quarterly dividend was paid April 2, 2018 to shareholders of record March 9, 2018.

GPC highly values its status as a Dividend King; these are companies which have increased their annual dividend for at least 50 consecutive years.

Source: GPC Investor Presentation March 2018

With GPC’s stock now trading at ~$88.15, the forward dividend yield is ~3.26%.

Final Thoughts

I have only owned GPC for ~1 year. When I acquired GPC shares I was puzzled as to how SPR fit within GPC; I certainly did not invest in GPC because of SPR.

In my opinion, the SPR spin-off is beneficial for GPC investors. I intend to exit my SPR position once I receive shares for the combined entity.

I recognize some investors may be dismayed with the ~$19 pullback in GPC’s stock price subsequent to late January 2018. I, however, am not concerned about this pullback and view pullbacks in GPC’s stock price as opportunities in which to acquire more GPC shares at more favorable levels.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long GPC.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.