Summary

- Majority ownership in this company is held by one of Canada’s top 100 wealthiest families.

- This company has generated a 12.7% compound annual growth in net equity value since inception (1969).

- The company’s stock price is ~61% of net equity value per common share.

- The strategy is to accumulate shareholder value through long-term capital appreciation and dividend income from its investments.

Introduction

If you read my previous articles you will:

- likely be somewhat familiar with most companies or, at the very least, will likely have heard the company name at some point;

- note that I typically analyze US listed companies as there is a very limited number of Canadian publicly listed companies that appeal to me;

- see that my preference is to invest in mid and large cap companies with a sizable daily share float.

The company analyzed in this article, however, differs from the typical company I analyze in that it is a TSX listed company that is thinly traded.

I recognize there are risks associated with thinly traded equities but I have made an exception to the rule in the case of this investment.

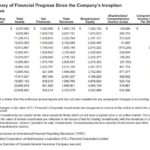

In the Business Overview section of this analysis is an annual summary of this company’s financial progress since its inception in 1969. The results are impressive.

Here are some relatively recent statistics:

- Assets under management (AUM) of ~$6B as at FYE2012 and ~$17B+ as at the end of Q1 2018;

- Net equity value per share of ~$552 as at FYE2008, ~$1,317 at FYE2017, and ~$1,350 as at June 30, 2018;

- the stock price is ~61% of net equity value per common share;

Compound annual growth in net equity value:

- 2008 – 2017 (10 years): 7.7%

- 1969 – 2017 (since inception): 12.7%

I find that companies in which investment in growth has been performed wisely over a prolonged period are oftentimes family-controlled companies for which the street and activists cannot interfere. This company is closely held by one of Canada’s top 100 wealthiest families and by investing in this company you may be able to benefit from their astute management decisions.

Business Overview

E-L Financial (TSX: ELF.TO) operates as an investment and insurance holding company consisting of two operating segments, E-L Corporate and Empire Life. Its strategy is to accumulate shareholder value through long-term capital appreciation and dividend income from its investments (investments in global equities held through direct and indirect holdings of common shares, investment funds, closed-end investment companies and other private companies).

E-L Financial oversees its investments through representation on the boards of directors of the subsidiaries and the other companies in which the Company has significant shareholdings.

Duncan N. R. Jackman serves Chairman on all the Boards within the ELF group of companies. His father, Hal Jackman is ranked as the #1561 wealthiest individual in the world. Hal Jackman also served as the Province of Ontario’s 25th Lieutenant Governor (December 11, 1991 to January 24, 1997).

Before proceeding any further, I encourage you to look at the Summary of ELF’s financial progress since inception in 1969 until FYE 2017.

Source: ELF – FY2017 Annual Report

The Empire Life Insurance Company

ELF holds a 99.3% interest in The Empire Life Insurance Company. Empire Life underwrites life and health insurance policies and provides segregated funds, mutual funds and annuity products.

It was founded in 1923 in Toronto and is now one of the top 10 life insurance companies in Canada.

Significant events in Empire Life’s history can be found here and its corporate structure can be found here.

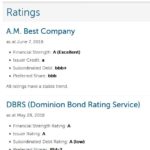

Given that ELF’s value is heavily dependent on its investment in Empire Life I want to ensure Empire Life is not in a precarious financial position. Let’s have a look at Empire Life’s credit ratings.

ELF’s FY2017 Annual Report as at December 31, 2017 reflects the following:

‘On May 24, 2017, DBRS confirmed its ratings of Empire Life including its issuer rating of “A” (sixth highest of 20 categories), its subordinated debt rating of “A (low)” (seventh highest of 20 categories), its financial strength rating of “A” (sixth highest of 22 categories) and its Preferred Share rating of Pfd-2 (fifth highest of 18 categories). All ratings have a stable trend.

On June 1 2017, A.M. Best confirmed its ratings of Empire Life including its “A Excellent” financial strength rating (third highest of 16 categories) its “a” long-term issuer credit rating (sixth highest of 21 categories), its “bbb+” Subordinated Debt rating (eighth highest of 21 categories), and its “bbb” Preferred Share rating (ninth highest of 21 categories). All ratings have a stable trend.’

Source: ELF – FY2017 Annual Report

Subsequent to FYE2017, the ratings agencies have accorded the following credit ratings.

Source: Empire Life website

Another metric of interest to me is Empire Life’s Life Insurance Capital Adequacy Test (LICAT). The purpose of introducing LICAT on January 1, 2018 was to improve the quality of available capital and provide a better alignment of the risk measures with the long-term economics of the life insurance business.

NOTE: LICAT has replaced the Minimum Continuing Capital and Surplus Requirements (MCCSR).

The Office of the Superintendent of Financial Institutions (OSFI) is an independent federal government agency. It regulates and supervises more than 400 federally regulated financial institutions and 1,200 pension plans to determine whether they are in sound financial condition and if they meet supervisory target levels of 70% for Core capital and 100% for Total capital.

As at the end of Q1 2018, Empire Life had a LICAT Core Ratio of 113.9% and a LICAT Total Ratio of 177.5%. While the LICAT Total Ratio dropped to 161% as at the end of Q2, it is well above the requirements set by OSFI.

United Corporations Limited

ELF holds a ~52.0% interest in a closed-end investment corporation, United Corporations Limited (TSX: UNC.TO) as at its most recent fiscal year end (December 31, 2017).

This entity’s objective is to earn an above-average rate of return, primarily through long-term capital appreciation and dividend income. Short-term volatility is expected and tolerated. The investment portfolio is comprised primarily of foreign equities.

Economic Investment Trust Limited

ELF holds a ~24% interest in Economic Investment Trust Limited (TSX: EVT.TO) as at its most recent fiscal year end (December 31, 2017). This is a closed-end investment corporation which is an investment vehicle for long-term growth through investments in common equities.

Algoma Central Corporation

ELF holds a ~36.7% interest in Algoma Central Corporation (TSX: ALC.TO) as at its most recent fiscal year end (December 31, 2017).

ALC.TO owns and operates the largest Canadian flag fleet of dry and liquid bulk carriers operating on the Great Lakes – St. Lawrence Waterway.

Insider Activity

I draw to your attention of the level of Insider activity. As you can see, most of the recent insider activity has been ‘Buy’ as opposed to ‘Sell’.

Source: INK Research Report – August 9 2018

Q2 2018 Financial Results

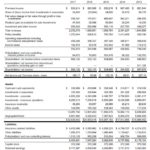

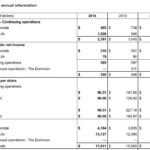

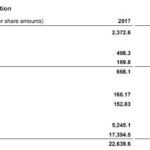

ELF does not have a Corporate website. Its Q2 2018 results released August 10, 2018 can be found through SEDAR. I provide below for ease of reference links to the FY2017 Annual Report and the Q2 Earnings Release as well as an image of a Summary of ELF’s Consolidated Results 2013 – 2017.

ELF – Q2 2018 Results – August 10 2018

The Q2 results fall short of those reported in Q2 2017. The Press Release, however, explains that net income of $51.3 million in Q2 2018 compared to $64.4 million for Q2 2017 was mostly due to a higher amount of earnings attributable to non-controlling interests. ELF’s net gain on investments for Q2 2018 and Q2 2017 contributed to a pre-tax total return of 2% for both periods.

ELF reported Q2 consolidated shareholders’ net income of $108.2 million, or $26.56/share versus $97.5 million, or $23.84/share in Q2 2017.

For the 6 months ended June 30, ELF earned consolidated shareholders’ net income of $173.7 million, or $42.26/share versus $361.6 million, or $90.10/share in 2017.

ELF’s net equity value per common share was $1,349.93 as at June 30, 2018, an increase of 2.5% from $1,316.64 as at December 31, 2017.

These financial results were released after markets closed August 10, 2018. If ELF were your typical publicly traded company, shares would have probably dropped after the markets closed and would likely open down on Monday, August 13. Given that the shares are so thinly traded, there will likely be no material change to ELF’s stock price when markets re-open on Monday.

Valuation

Management does not provide forward earnings guidance.

If I look at ELF’s PE based on FY2017 results I get a trailing PE of ~5.40 ($825 stock price / $152.83 of diluted earnings). ELF’s net income, however, can experience significant swings depending on how the underlying equity investments perform.

Source: ELF Annual Reports

In my opinion, looking at the net equity value per common share is a more appropriate basis on which to make my investment decision. The net equity value per common share of $1,349.93 as at June 30, 2018 relative to the current $825/share stock price gives me some comfort that my investment in ELF has been made at a reasonable valuation.

Dividend, Dividend Yield and Dividend Sustainability

On March 2, 2016, the Board of Directors approved a change to the Company’s dividend policy, increasing its quarterly dividend to $1.25/ Common Share from $0.125/share.

ELF is currently trading at $825/share and on August 10, the Board of Directors declared a $1.25/share dividend payable October 17 for shareholders on the record date of September 28. This provides investors with a ~0.6% dividend yield.

The dividend is certainly sustainable.

Since an investment in ELF is unlikely to be made on the basis of the dividend and dividend yield, I will dispense with any further discussion on this topic.

Final Thoughts

I recognize ELF is very different from the companies I typically analyze and it may hold little appeal to you. I suggest, however, that you not merely cast aside this company in the ‘not interested’ pile of companies.

In my opinion, an investment in ELF provides you with the opportunity to benefit from investments for which the typical retail investor would likely be unable to make.

The Jackman family’s wealth is heavily dependent on the performance of the companies within the ELF family of companies. Given this, I strongly suspect investment decisions are made with the long-term in mind; the Jackmans are in a position where they don’t have to be concerned as to the investment community’s questions regarding quarterly financial results.

I suggest you view an investment in ELF much like you would an investment in Berkshire Hathaway (NYSE: BRK.a and BRK.b). This would be one of those investments you acquire, tuck away, rarely look at, and then several years later you look at the share price and go ‘OMG!’….in a positive way.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long ELF and BRK.b.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.