Contents

Summary

- Cummins has retraced ~26% from a high of ~$194 set at the end of January 2018.

- The company is forecasting strong revenue growth but warranty costs are taking a bite out of profits and further significant charges (~$400 million) are possible.

- CMI’s 15+ year returns greatly exceed that of the S&P500.

- While CMI has a lengthy history of consecutive dividend payments, dividend increases have been spotty with lengthy periods in which the quarterly dividend has remained unchanged.

Introduction

I have recently analyzed companies in which I would like to initiate/increase my exposure. Regrettably, my findings are such that some of these wonderful companies are too expensive. I have, therefore, elected to patiently wait for better entry points.

In addition, the current geopolitical environment is such that I anticipate that within the next year a major event will transpire which will heighten market volatility. I am cautiously optimistic this heightened volatility will trigger meaningful retracements in stock prices thus providing me with the opportunity to acquire shares at more attractive valuations.

While I await some meaningful pullback in the price of stocks on my ‘radar’, I am still scanning the investment universe for companies which I think are fairly valued based on earnings expectations. In all honesty, however, current market conditions are making it difficult for me to find attractively valued companies which suit my relatively conservative investor profile.

Occasionally I will find companies I view as reasonably attractive. As recently as April I analyzed and wrote about Stanley Black & Decker (NYSE: SWK), 3M (NYSE: MMM), and Illinois Tool Works (NYSE: ITW). In each article I indicated the company appealed to me from a long-term investment perspective so I followed through by initiating a position in SWK and ITW and adding to my existing MMM position.

Most recently, I reviewed multiple companies and noticed that Cummins Inc. (NYSE: CMI) had pulled back ~26% from its end of January 2018 high of ~$194. A pullback of this magnitude piques my interest and hence this article.

The following are my findings and opinion as to whether CMI would be a suitable addition to the FFJ Portfolio.

Business Overview

CMI was founded in 1919 and is one of the first diesel engine manufacturers. An overview of the company and its distinct but complementary business segments can be found here.

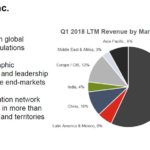

It designs, manufactures, distributes and services diesel and natural gas engines and engine-related component products, including filtration, aftertreatment, turbochargers, fuel systems, controls systems, air handling systems, transmissions and electric power generation systems. Its products are sold to original equipment manufacturers (OEMs), distributors and other customers through a network of ~500 wholly-owned and independent distributor locations and over 7,500 dealer locations in more than 190 countries and territories.

The 4 four complementary operating segments (Engine, Distribution, Components, and Power Systems) share technology, customers, strategic partners, brand recognition and a distribution network in order to compete more efficiently and effectively in their respective markets.

CMI competes primarily on the basis of performance, fuel economy, speed of delivery, quality, customer support and price. Each operating segment competes worldwide with a number of other manufacturers and distributors that produce and sell similar products.

More comprehensive details about CMI’s Operating Segments, Joint Ventures, Alliances, Non-Wholly Owned Subsidiaries and the Risk Factors can be found in the CMI 2017 10-K (refer Part 1 Item 1 starting on page 5 of 142).

Q1 2018 Financial Results

CMI’s Q1 2018 results released May 1, 2018 can be found here.

2018 Guidance

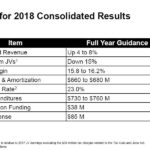

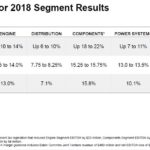

On February 6, 2018, when CMI released its FY2017 results, it also provided the following FY2018 guidance.

Source: CMI Q4 2017 Earnings Conference Call February 6, 2018

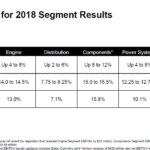

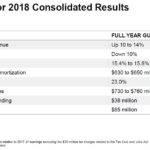

FY2018 guidance was revised when CMI released its Q1 2018 results on May 1, 2018.

Source: CMI Q1 2018 Earnings Conference Call May 1, 2018

While consolidated revenue has been revised upward and earnings from joint ventures will decline less than originally anticipated, the earnings before interest, taxes, depreciation, and amortization margin range has been revised down.

On May 1, 2018, CMI announced that it was widening its field repairs to include engines produced in 2010 – 2015 as it strives to address emissions regulators’ concerns that have already cost ~$190 million.

CMI also warned of further charges of up to ~$400 million if the California Air Resources Board and U.S. Environmental Protection Agency do not accept its proposed solutions or CMI has to order more extensive repairs.

The uncertainty as to the outcome of these potential additional charges gives me cause for concern. If the proposed solutions are not accepted I envision a further pullback in CMI’s stock price.

Credit Ratings

I am a risk adverse investor, and therefore, am encouraged when I see that Moody’s steadily increased CMI’s long-term credit rating from Ba1 (upper tier of the non investment grade speculative category) assigned in September 2005 to A2 (middle tier of the upper medium grade category) in December 2014 (reaffirmed in March 2016); this is a 5 tier increase.

S&P Global has rated CMI’s long-term debt A+ since August 2014; this is the top tier of the upper medium grade category.

Valuation

CMI is currently trading at $143.68 after having retraced from a high of $194 at the end of January 2018. This ~26% pullback certainly makes CMI more enticing but I draw your attention to CMI’s long-term stock chart. CMI’s stock price has certainly evidenced wild swings over the years and some of the pullbacks have been more significant than 26% (especially during economic downturns).

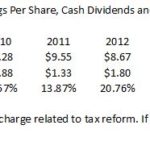

Eighteen analysts have forecast CMI’s 2018 EPS between $12.60 - $14.14 with the mean estimate being $13.23. On this basis, the forward PE ratio is ~10.86 using the current price of $143.68. This is an attractive level but CMI has had a more attractive valuation in 2008, 2011, and 2015.

Dividend, Dividend Yield, and Dividend Payout Ratio

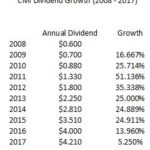

CMI’s dividend and stock split history dating back to the end of 1997 can be found here. While CMI has paid a dividend since 1948, its history of increasing dividends has been somewhat spotty.

CMI has certainly had an impressive dividend growth rate during the 2008 – 2017 timeframe but a 24%+ compound annual growth rate over a prolonged period is not sustainable.

On July 11, 2017, CMI announced an increase in its quarterly dividend from $1.025/share to $1.08/share; the June 1, 2018 $1.08/share quarterly dividend marks the 4th consecutive dividend at this level.

In my opinion, I think CMI will announce in the first half of July a dividend increase between 5% - 7% from the current annual $4.21 dividend; the new annual dividend will likely be in the range of $4.42 - $4.50.

CMI is a cyclical business and times have been reasonably good for CMI in recent years. If we enter an economic downturn, however, I can see CMI’s Board of Directors freezing the quarterly dividend. If you look closely at the dividend history you will see that CMI has previously frozen its quarterly dividend for several consecutive quarters.

If we look at CMI’s dividend payout ratio for 2008 – 2017 we see a steady increase in the payout ratio; in FY2017 CMI’s dividend payout ratio was almost 40%. CMI is a cyclical business and if we enter an economic downturn which negatively impacts CMI’s profitability we could very well see a far higher dividend payout ratio than that evidenced in recent years.

It would not surprise me if CMI were to once again freeze its quarterly dividend come the next severe and prolonged economic downturn.

It would not surprise me if CMI were to once again freeze its quarterly dividend come the next severe and prolonged economic downturn.

CMI’s weighted-average common shares outstanding in 2008 – 2017 amounted to (in millions) 197, 198, 197, 194, 190, 187, 183, 178, 169, and 167. The significant reduction in the number of shares outstanding has certainly enhanced CMI’s diluted EPS results in recent years.

I strongly suspect CMI will be unable to reduce the number of outstanding shares over the next few years to the extent it has in recent years, especially if we encounter a long overdue economic correction. Should this transpire, I expect diluted EPS growth will be somewhat muted.

Historical Returns

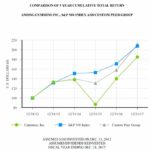

The following graph compares the cumulative total shareholder return on CMI’s common stock for the last five years with the cumulative total return on the S&P 500 Index and an index of peer companies selected by CMI; dividend reinvestment is assumed.

As evidenced from this graph, CMI has underperformed the S&P500 and the peer group for the most recent 5 year period.

Source: CMI 2017 10-K (page 28 of 142)

Members of CMI’s peer group participate in similar end-markets and have similar businesses. The group consists of BorgWarner Inc., Caterpillar, Inc., Daimler AG, Deere & Company, Donaldson Company Inc., Eaton Corporation, Emerson Electric Co., Fortive Corporation, W.W. Grainger Inc., Honeywell International, Illinois Tool Works Inc., Navistar, PACCAR, Parker- Hannifin Corporation, Textron Inc. and Volvo AB.

In addition to the above, the following snapshots show how CMI has performed relative to the S&P 500 over various timeframes based on the reinvestment of dividends and no dividend reinvestment.

Source: Tickertech.com

Looking at these charts we see that CMI has underperformed the S&P500 over the short-term but has greatly outperformed the S&P500 over the long-term (ie. 15+ years). These long-term results certainly suggest CMI would be a worthwhile long-term investment (albeit a volatile investment).

Final Thoughts

The recent pullback from ~$194 at the end of January 2018 to the current $143.68 has restored CMI to a more reasonable valuation. This, and the long-term performance relative to the S&P500, is what prompted me to look into CMI as a possible investment.

Based on my analysis, however, I will continue to monitor CMI but will refrain from initiating a position at this stage. The potential for ~$400 million in additional charges I referenced earlier and the strong probability of further sudden market pullbacks similar to those witnessed earlier this year give me sufficient cause for concern to pass on CMI at this stage and to move on to seek other investment opportunities.

I hope you enjoyed this post and I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected]

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I do not currently own shares in CMI nor do I intend to purchase shares within the next 72 hours.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.