Contents

Summary

- Strategy is to be "the" networking company rather than a maker of individual products.

- Shift to more of a software and subscription-based offering strategy improves revenue predictability.

- Customers exposed to high switching costs which increases CSCO product/service stickiness.

- Strong Balance Sheet and strong Free Cash Flow (~$12.4B, ~$12.9B, and ~$12.8B in FY2016 – FY2018).

- Using GAAP and FY2019 projected EPS, I am of the opinion CSCO is somewhat expensive.

- Analysis of multiple ‘Super Investor’ portfolios suggests I am not the only investor of the opinion CSCO is richly valued.

Introduction

I last wrote about Cisco Systems, Inc. (CSCO) in my August 16, 2018 Exposure to the Tech Sector Without Elevated Risk article.

At the time, I viewed CSCO as being fairly valued despite CSCO’s PE of ~139; one-time charges grossly distorted CSCO’s FY2018 results. Look at page 49 of 141 in CSCO’s Annual Report and you will see CSCO reported Net Income of $0.11B on Revenue of $49.33B which was down from FY2017 Net Income of $9.609B on Revenue of $48.005B.

CSCO’s weak FY2018 results are because it recorded a provisional tax expense of $10.4B related to the enactment of the Tax Cuts and Job Act. This figure was comprised of $8.1B of U.S. transition tax, $1.2B of foreign withholding tax, and $1.1B re-measurement of net deferred tax assets and liabilities.

Were it not for this one-time charge, CSCO’s PE would have been within the historical PE range evidenced in the 2010 – 2017 timeframe (14.8, 15.6, 12.7, 12.2, 18.9, 14.5, 14.5, and 20).

At the time of my August 2018 CSCO article I included the following in my ‘Final Thoughts’:

‘One of the nice things about investing in a cash rich company such as CSCO (~$46.5B in cash and short-term investments as at FYE2018) is that it can make a methodical and calculated transition to more of a software-style focused company without having to be worried how a change of this magnitude will impact its financial stability.’

In addition to being a cash rich company which generates strong Free Cash Flow on an annual basis ($8.9B, $9.2B, $8.9B, $10.4B, $11.7B, $11B, $11.3B, $12.4B, $12.9B, and $12.8B in FY2009 – FY2018), CSCO appeals to me in that its customers would incur significant switching costs by changing vendors. It also possesses strong brand reputation with Information Technology (IT) professionals.

Based on my research, CSCO’s networking products are typically upgraded every 3 – 7 years. Changing network systems is a massive undertaking so, typically, a consumer is apt to retain the existing vendor so as to minimize disruption to its network.

Based on my experience, firms are risk adverse to making enterprise network changes especially if the existing network has kept business operations functional. I recently covered the Big 5 Canadian Banks in this article and I know that these banks still have systems that use COBOL software! Naturally, changes are being made but any change undergoes a rigorous review to assess risk/reward.

Changing network systems is a massive undertaking due to the need to migrate data and infrastructure hardware so the more critical the application, the greater the reluctance to make a change.

Despite the entry of new competitors over the years, CSCO has still managed to maintain gross margins in excess of 60%. Gross margin is typically just above 60% with FY2014 being the only year in the last 10 years in which it dropped below 60% (it was 58.9%).

A large percentage of CSCO’s core customer base continues to rely on its latest innovation and services

for their networking products. In my August 16, 2018 article I indicated that CSCO has been shifting to a subscription-based hardware, software, and services model wherein it offers 3, 5, or 7 year packages. This ties in its customers even further.

With a strategic push to selling new products on a subscription basis, CSCO is also endeavoring to adopt this business model to incumbent products.

In the 2018 Annual Report, CSCO’s Chairman and CEO stated (page 5 of 141):

‘As we integrate our products and services into architectures, we are selling more software and subscription-based offerings. These are designed to provide our customers with flexibility and continuous value, and at the same time they help us to shift our business model to more recurring revenue streams. In fiscal 2018, we delivered strong top-line growth and profitability, reporting our highest-ever revenue of $49.3 billion. Recurring offers accounted for 32% of our total revenue in fiscal 2018, and revenue from subscriptions was 54% of our software revenue. Our intention is to continue to drive recurring revenues by applying a subscription-based model to many of the new products we launch and ultimately across our entire portfolio.’

While I like the strategic transformation CSCO is undertaking and am of the opinion CSCO is a great company I still want to ensure that any new investment is being made at a fair value.

On this basis, let’s have a look at CSCO following its $12+/share price increase subsequent to its pre-Christmas 2018 low (~$40) to determine whether the current $52.59 as at the close of business on March 13, 2019 is reasonable.

Q2 2019 Financial Results

CSCO’s Q2 2019 results released February 13, 2019 can be accessed here.

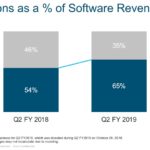

CSCO has repeatedly acknowledged that it continues to operate in a challenging and highly competitive environment. Recognizing these challenges, CSCO made a strategic decision a few years ago to transition its business model to increased software subscriptions. On this basis, it is not surprising to see a 10 bps YoY increase in software subscriptions to the point where this now accounts for 65% of total software revenue.

Source: CSCO – Q2 2019 Earnings Presentation – February 13, 2019

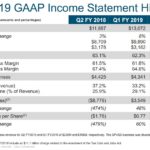

Source: CSCO – Q2 2019 Earnings Presentation – February 13, 2019

I mentioned this in my previous article but bring it to your attention again…

Under new accounting standards, the timing of CSCO’s revenue is changing. Under the old accounting standard, a product sold for $100 would result in ~$75 of this revenue being recognized up front; the remaining $25 would be recognized over a period of 3 years.

Under the new accounting standard, more revenue will be recognized upfront thus boosting sales numbers. There will, however, still be ~10% - 11% of deferred revenue. This revenue recognition change will help make this company’s revenue slightly more predictable.

Q3 2019 Guidance

On the February 13th analyst call, CSCO provided Q3 guidance. Guidance for previous quarters included CSCO’s Service Provider Video Software Solutions (SPVSS) business; CSCO closed the sale of this business in October 2018. With the sale of the SPVSS business, guidance provided below has been normalized to exclude it.

CSCO expects 4% - 6% Q3 revenue growth and anticipates:

- non-GAAP gross margin rate to be in the range of 64% - 65%;

- non-GAAP operating margin rate to be in the range of 31% - 32%;

- non-GAAP tax provision rate of 19%;

- non-GAAP EPS from $0.76 - $0.78;

- GAAP EPS $0.63 to $0.68.

Credit Ratings

There have been no changes to CSCO’s credit ratings subsequent to my last article. Moody’s rates CSCO’s long-term debt A1 (top tier of the upper medium grade range) and S&P Global rates it AA- (bottom tier of the high grade range).

I have no reason to suspect CSCO will be unable to service its obligations.

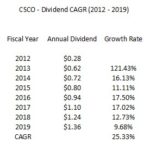

CSCO’s dividend and stock split history can be found here.

The compound annual growth rate of its dividend following the initiation of a dividend in FY2012 can be found below.

On February 13, 2019, CSCO declared a $0.35 quarterly dividend to be paid April 24, 2019. This $0.02 increase from $0.33 (~6.06% increase) was just a shade smaller than the $0.03 - $0.04 increase I anticipated. This slightly lower than anticipated dividend increase is certainly not enough to prompt me to second guess whether CSCO is a stock I should own for the long-term.

On the basis of a forward annual $1.40 dividend ($0.35/quarter) and the current ~$52.59 share price the dividend yield is ~2.67%. At the time of my previous article, CSCO was trading at $45.38 and the quarterly dividend was $0.33 ($1.32/year) thus providing investors with a ~2.9% dividend yield.

In reviewing CSCO’s financial statements for the past several years it is clearly apparent the reduction in the number of diluted shares outstanding is a key focus for management. I draw to your attention to page 9 of 84 from CSCO’s FY2009 Annual Report in which we see that the number of diluted shares used in the per-share calculation as at FYE2005 amounted to 6,612 million. Fast forward to page 2 of 7 in CSCO’s Q2 FY2019 Earnings Release and we see the number of diluted shares used in the per-share calculation has dropped to 4,557 million!

As at FYE2018, CSCO had repurchased shares and distributed dividends as follows.

Source: CSCO Q4 2018 Earnings Conference Call – August 15, 2018

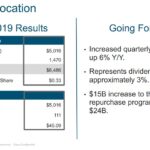

Fast forward to the end of Q2 FY2019 and we see the following YTD repurchased shares and distributed dividends.

Source: CSCO Q2 2019 Earnings Conference Call – February 13, 2019

As evidence of its commitment to returning capital to its shareholders and its confidence in the strength and stability of ongoing cash flows, CSCO announced on February 13, 2019 a $15B increase to its share repurchase program in conjunction with the dividend increase; this announcement raises the remaining share repurchase authorization to approximately $24B.

Valuation

In my August 16, 2018 article I wrote that CSCO had reported $0.02 in GAAP EPS for FY2018 versus $1.90 in FY2017 for reasons noted in the Introduction section of this article. Adjusting for those one-time charges, CSCO’s non-GAAP EPS amounted to $2.60/share versus $2.39/share in FY2017.

At the time of that article, CSCO had only provided guidance for Q1 but 29 analysts had provided a full year mean adjusted EPS estimate of $2.97. On the basis of the current $45.38 stock price I arrived at a forward adjusted PE of ~15.28.

Subsequent to that article, CSCO’s share price experienced a pullback to the low $40s in December 2018. Investor sentiment, however, has reversed sharply and CSCO is now trading at ~$52.59!

We know that CSCO generated $1.40 in diluted EPS in the first half of FY2019 and guidance for Q3 is $0.63 - $0.68. If we use the $0.655 mid-point of this range and the same mid-point for Q4, we would expect CSCO to generate ~$2.71 in FY2019. Using the current stock price we get a forward PE of ~19.41.

YTD adjusted diluted EPS (non-GAAP) is $1.48 and Q3 guidance is $0.76 - $0.78 ($0.77 mid-point). If we use $0.77 for Q3 and Q4 we arrive at projected adjusted diluted EPS of $3.02; the mean adjusted diluted EPS guidance from 30 brokers is currently $3.07. Using the current stock price we then arrive at a forward adjusted diluted PE of ~17.13 - ~17.41.

Regardless of whether we use GAAP or non-GAAP EPS estimates, we are certainly looking at a stock which is not priced as favorably as at the time of my August 2018 article.

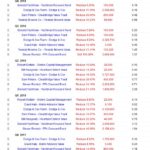

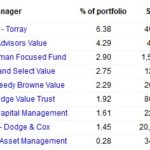

‘Super Investor’ Portfolio Updates

While I do form an independent opinion about the valuation of a company, I also like to double check how some ‘super investors’ also feel about a company I am analyzing.

In reviewing 64 ‘Super Investor’ portfolios, I have noticed none have been acquiring CSCO shares. There certainly, however, have been some sales. Hmmmm! It would appear I might not be the only investor who things CSCO is richly valued.

Source: DATAROMA

Final Thoughts

I initiated a CSCO position in November 2010 and currently hold 811 shares in the FFJ Portfolio; this is not one of my 30 largest holdings.

I certainly do not profess to be able to consistently accurately determine the direction of any particular company’s stock price nor the direction of the overall stock market for that matter. My opinion that CSCO is currently richly valued, as many other companies I follow, is merely based on personal observation.

While I certainly like CSCO and the strategic direction it is taking I do not view this as an opportune time to acquire shares. I am of the opinion a broad market pullback is not out of the realm of possibility within the next 6 – 12 months and will patiently wait on the sidelines.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to [email protected].

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CSCO.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.