Church & Dwight (CHD) released its Q3 2018 results November 1, 2018. Mr. Market promptly bid up shares over 9% by the close of business.

CHD is a high quality company which focuses heavily on Free Cash Flow and its Cash Conversion Cycle which is more that can be said for other publicly traded companies such as the company about which I posted an article on October 31st.

While CHD is one of my largest holdings and I think highly of the company, I view the shares as now being overvalued. Disciplined investors would be wise to wait for a pullback in CHD’s share price.

Summary

- CHD released Q3 results November 1st and Mr. Market promptly bid up shares over 9% before the end of the business day.

- The company’s compensation structure encourages ALL employees to be focused on Gross Margin.

- CHD focuses heavily on Free Cash Flow and the Cash Conversion Cycle which enables it to effectively compete in a ‘Land of Giants’.

- While CHD is one of my largest holdings and I fully intend to hold shares for the very long-term, I am not naïve to think that shares should be acquired at any price.

Introduction

Before anyone lambastes me regarding the title of this article I want to be perfectly clear that I view mental health issues like any other major health issue. I most certainly do not look down on anyone suffering from mental illness.

With that out of the way, on November 1, 2018 Church & Dwight (NYSE: CHD) released its Q3 2018 results and provided revised guidance for FY2018.

Before you read any further I think it is only fair that I disclose up front that I have been long CHD since 2004 and that it is one of my largest holdings.

I have written various articles on CHD with the most recent being a May 8th article in which I viewed CHD as a better option than Procter & Gamble (NYSE: PG) even though CHD’s ~16B market cap is but a mere rounding error when compared to PG’s ~222B market cap. Don’t just take my word for it….here is a comparison as to how these 2 companies have rewarded shareholders over a 20 year timeframe.

Source: Tickertech

CHD has grown via acquisition over the years and I strongly suspect many investors will be somewhat familiar with the company’s 11 Power Brands from which it derives more than 80% of its sales and profits; 10 of these 11 brands have been acquired subsequent to 2001 (Arm & Hammer baking soda is the exception having been CHD’s core product since 1846).

Source: CHD – Barclays Global Consumer Staples Conference presentation – September 4 2018

I strongly encourage you to review this presentation where management provides an explanation as to why the company is succeeding despite competing in the ‘Land of Giants’.

In my previous Owens & Minor article we saw a company which has been experiencing significant challenges over the last several years. That company’s Gross Margin is typically in the 12% – 13% range and its Operating Margin is typically sub 2.5% with its recent Operating Margin lower than this.

The company also generates abysmal Free Cash Flow. In FY2017 it generated sales of ~$9.3B and its FCF was 6 million! That is what you call ‘trading dollars’.

In the case of CHD, Gross Margin is typically 44% – 46% and its Operating Margin is typically in the 19% – 21% range…at least for the last several years. On the FCF front, CHD generated ~$3.8B of Sales in FY2017 and $0.64B of FCF.

Perhaps the manner in which the CHD employee compensation is structured explains why CHD is able to consistently achieve a relatively attractive Gross Margin.

Source: CHD – Barclays Global Consumer Staples Conference presentation – September 4 2018

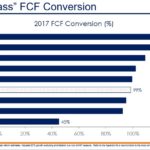

If you look at Section 7 of the September 4th presentation you will see that CHD specifically address its ability to generate strong Free Cash Flow and it addresses its Cash Conversion Cycle. This gives investors some sense as to just how high management views these metrics.

Source: CHD – Barclays Global Consumer Staples Conference presentation – September 4 2018

I fully recognize that OMI and CHD are in totally different industries so an ‘apples to apples’ comparison is not possible. Having said this, investors have a huge database of companies from which to select potential investments. What would possess someone to select OMI and not CHD…well, that just baffles me.

Q3 2018 Results

On November 1st, CHD released Q3 results and provided guidance for the remainder of the current fiscal year.

Readers will note that for the most part, all the numbers are pointing in the right direction. Gross margin, however, took a hit dropping 100 bps from a year ago to 44.3%. On the November 1st analyst conference call, management indicated that this drop included a ‘160 basis point drag for higher commodities, a 70 basis point drag from higher transportation costs, and a 60 basis point drag from other manufacturing’. CHD, however, anticipated these higher costs and reacted accordingly thus resulting in a 100 basis points improvement from its productivity program and a 90 basis point improvement in volume and price.

CHD has certainly benefited from changes due to tax reform. Its effective rate for the quarter was 21.9% compared to 28.7% in 2017. A full year rate of 22% is now expected.

The Press Release for which I have provided a link (see above) provides a bit more information on what income statement line items went up and which went down.

Free Cash Flow (FCF)

I have touched upon this topic in the Introduction of this article and have made reference in all previous CHD articles as to its ability to generate strong FCF.

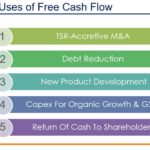

The following image provides a prioritized list of the uses of FCF.

Source: CHD – Barclays Global Consumer Staples Conference presentation – September 4 2018

As you can see, debt reduction is priority #2. This is good because CHD has taken on a lot of debt over the years to acquire additional brands.

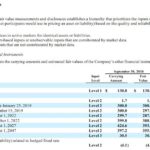

Note the highly attractive rates at which CHD was able to negotiate on the outstanding Senior Notes. Roughly $0.6B of 2.45% debt comes due in 2019 ($0.3B in January and $0.3B in December). I do not envision CHD will have any problem retiring this debt.

Source: CHD Q3 2018 10Q (page 13 of 37)

Credit Ratings

I went into a bit more detail on this subject matter in my May 8th article.

There have been no changes to CHD’s credit ratings subsequent to that article. Moody’s still rates CHD’s long-term debt Baa1 and Standard & Poors rates the debt BBB+. Both ratings are the upper tier of the lower medium grade category; these ratings are investment grade. Neither agency has CHD’s debt under review.

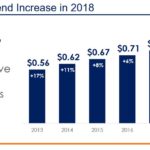

Dividend, Dividend Yield, and Dividend Payout Ratio

CHD’s dividend history can be found here.

Source: CHD – Barclays Global Consumer Staples Conference presentation – September 4 2018

As we saw from my recent OMI article, investors can get burned when they chase high yield stocks. In my opinion, a high yield stock might be a strong indication that all is not well with the company and OMI demonstrated this.

The same investors who chased OMI’s yield will likely overlook CHD as a potential investment because of its chronically low dividend yield (typically sub 1.50%). Investors should note, however, that the Return of Cash to Shareholders is the 5th of 5 priorities when it comes to the use of FCF. Clearly, management is of the opinion that it can add far more shareholder value by deploying funds to grow the business.

With a dividend payout ratio that hovers around the 40% – 43% range, investors can get some degree of comfort that if something goes off the rails at CHD in the short-term there is a remote chance that the dividend will not be negatively impacted.

Share Repurchases

Share count continues to drift lower. In fiscal 2011, the weighted average shares outstanding (Basic and Diluted) amounted to 286.4 million and 291.6 million, respectively. In fiscal 2017, these figures were 250.6 million and 256.1 million. As at the end of Q1 2018 (my previous CHD article) these figures were reduced to 244.9 million and 250 million.

Where do we stand now? 245.2 million and 250.1 million (a slight uptick from Q1) but nothing to worry about. I envision CHD will continue to reduce share count over the long run.

Valuation

At the time of my February 7th CHD article I had just acquired another 200 CHD shares on February 6th at $48.0799 and CHD’s management had just forecast 2018 adjusted EPS of $2.24 – $2.28. Using this range and the stock price of ~$48, I arrived at a forward adjusted PE range of ~21 – ~21.4.

When I wrote my May 8th article, management still had the same adjusted EPS outlook and CHD was trading at $47.73. As a result, there was negligible difference in valuation between February and May.

After the Q3 earnings release, CHD’s stock price has jumped to $64.87; there was a $5.50/share jump on the date of the release of Q3 results! In my opinion, that jump is overdone which explains the title of this article.

The EPS and adjusted EPS outlook for FY2018 is now $2.27 (a decline of 22% due to 2017 tax law changes and adjusted EPS growth of 17%). This means that CHD’s forward PE and forward adjusted PE is ~28.6. This new valuation is much higher than that I reported in my February and May articles. Heck, it is even higher than the 5 year average PE of ~27!

I think CHD is a great company but at some point I think investors need to step back and wait for Mr. Market to settle down.

Final Thoughts

There is no disputing that CHD has amply rewarded long-term shareholders and I fully expect CHD will continue to do so over the long-term.

CHD’s stock price has gone parabolic in the last few months and Mr. Market’s reaction to the release of Q3 results on November 1st reaffirms to me that Mr. Market is bipolar. Unfortunately (or fortunately if you’re optimistic like me) this is a good thing.

At some point in time CHD’s share price will pull back and I would patiently wait for a better valuation.

I wish you much success on your journey to financial freedom.

Thanks for reading!

Note: I sincerely appreciate the time you took to read this article. Please send any feedback, corrections, or questions to charles@financialfreedomisajourney.com.

Disclaimer: I have no knowledge of your individual circumstances and am not providing individualized advice or recommendations. I encourage you not to make any investment decision without conducting your own research and due diligence. You should also consult your financial advisor about your specific situation.

Disclosure: I am long CHD.

I wrote this article myself and it expresses my own opinions. I am not receiving compensation for it and have no business relationship with any company whose stock is mentioned in this article.