Summary

Summary

- This Church & Dwight stock analysis is based on Q4 and FY2016 results and outlook for fiscal 2017 which were released February 7, 2017.

- Continued growth is expected through the introduction of innovative new products, aggressive productivity programs, and tight management of overhead costs.

- CHD is also growing through the strategic acquisition of various established brands.

- CHD declared a 7% increase in the regular quarterly dividend from $0.1775/share to $0.19/share payable March 1, 2017.

- This dividend increase marks the 21st consecutive year in which CHD has increased its dividend and the 116th year in which it has paid a regular consecutive quarterly dividend.

Introduction

I recall my mother always keeping an open box of Arm & Hammer baking soda in the fridge when I was much younger. Many years later, my wife keeps an open box of Arm & Hammer baking soda in the fridge.

In late 2005, when I looked into the company which owns the Arm & Hammer brand, I realized I had been remiss in not investing in Church & Dwight Co. Inc. (NYSE: CHD). CHD certainly was not inexpensive when I pulled the trigger in 2005 but without a doubt, CHD has rewarded us over the years; our average cost is $9.524 and the current price is in excess of $47.

Since I like to periodically review the performance of the companies in which we hold shares and CHD released its Q4 and FY2016 results February 7, 2017, I provide this post for your review and feedback.

Industry Overview

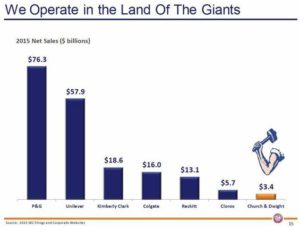

CHD operates in a land of giants. Page 15 of CHD’s 101 page Powerpoint presentation from the September 6, 2016 Barclays Global Consumer Staples Conference gives you some perspective as to where CHD stands in size relative to the companies it considers to be its most significant competitors.

Morningstar has a much longer list of peers which can be found here.

Business Overview

CHD, founded in 1846, has since become one of the leading consumer packaged goods companies in the U.S.. It manufactures and markets a broad range of leading household, personal care and specialty products to consumers and business customers in 115 countries. The company operates under three major divisions:

- Domestic Consumer Products

- International Consumer Products

- Specialty Products

It certainly has a diverse and well-balanced portfolio: Household (48%), Personal Care (44%), and Specialty Products (8%). You have toothpaste, kitty litter, antiperspirant, air filters/cabin filters for vehicles, vitamins, laundry detergent, hair care products, condoms, lubricants, and vibrations. Now there’s an eclectic product mix!

What drew me to this business was the “one-time use” of all its products. If you use some of CHD’s products, I trust you are aware of the one-time use nature of them. Note: An open box of ARM&HAMMER baking soda is not meant to remain in the fridge for a year.

You are likely all familiar with the 80/20 rule. In CHD’s case, the rule is 80/10. 10% of CHD’s Power Brands generate 80% of annual sales and more than 80% of CHD’s overall profit.

CHD has also grown dramatically through the acquisition of key brands; it has acquired 9 brands since 2000.

CHD only has 18% of its sales coming from foreign economies so it has not experienced exposure to FX risk and weak economic conditions in various parts of the globe to the same extent as its larger competitors.

Q4 and FY2016 Financial Results

Highlights of CHD’s results are provided below. Please see its February 7, 2017 Earnings release for more details.

Q4 Results

- Reported 2.6% sales growth and 2.7% organic sales growth.

- Reported gross margin was flat but up 60 bps on an adjusted basis.

- Reported operating margin was flat but up 50 bps on an adjusted basis.

- Reported EPS growth of 2.4% but up 7.3% on an adjusted basis.

FY2016 Results

Reported 2.9% sales growth and 3.2% organic sales growth.

- Reported gross margin up 100 bps but up 120 bps on an adjusted basis.

- Reported EPS growth of 13.6% but up 9.3% on an adjusted basis.

- Cash from operations up 8.1% to $655.3MM, a $49.2MM increase from FY2015.

- Capital expenditures for were $49.8MM, down $12.0MM from FY2015 when CHD was completing the York vitamin plant expansion.

Outlook for Fiscal 2017

On February 7, 2017, CHD declared a 7% increase in the regular quarterly dividend from $0.1775/share to $0.19/share or $0.76/share/year; this new quarterly dividend will be payable March 1, 2017 to stockholders of record at the close of business on February 21, 2017.

This marks the 21st consecutive year in which CHD has increased its dividend and the 116th year in which it has paid a regular consecutive quarterly dividend.

The increase in the dividend payout from $183MM to approximately $195MM allows CHD to maintain a 40% targeted payout ratio.

CHD expects to generate over $1.8B in FCF over the next three years.

Management expects to experience higher levels of trade promotions, rising commodity costs and worsening foreign currency headwinds in FY2017. To combat these headwinds, CHD will launch innovative new products and will continue with aggressive productivity programs and tight management of overhead costs.

New product launches include:

- ARM & HAMMER CLUMP & SEAL SLIDE cat litter. This is apparently a revolutionary new litter. Just when I thought it wasn’t possible to come up with a new variety of cat litter, CHD goes ahead and does. I wonder if the cats will notice a difference.

- ARM & HAMMER unit dose 3-in-1 POWER PAKS laundry detergent. Strange, I never had an issue dispensing the liquid ARM & HAMMER detergent we use at home.

- VITAFUSION, an energy variant that supports everyday energy needs and alertness.

- TROJAN and its new XOXO upscale condom targeting men and women with a soft touch, aloe lubricated latex in a unique portable carrying case. WOW! A portable carrying case. I really have to run out and buy me some. What’s wrong with carrying them in the pockets of your pants?

In addition to expanding the combinations and permutations of its existing brands, CHD is acquiring additional brands.

Some readers will be pleased to note that on December 22, 2016, CHD acquired the ANUSOL and RECTINOL brands from Johnson & Johnson (NYSE: JNJ) for $130MM. These are the #1 or #2 hemorrhoid care brands mainly sold in the U.K., Canada, Australia and South Africa with 2016 annual sales of $24MM. This will add scale to CHD’s growing international division. No, I don’t need to run out and get some.

On January 17, 2017, CHD acquired the VIVISCAL business from Lifes2Good Holdings Limited for $160MM. This is the #1 non-drug hair care supplement brand mainly sold in the U.S. and the U.K. with annual 2016 sales of $44MM. This brand is complementary to CHD’s global BATISTE dry shampoo (#1 U.S. share position) and TOPPIK hair care business. I have a full head of healthy hair but I might check it out.

2017 projections call for:

- ~3% organic sales growth.

- adjusted gross margin to expand by approximately 60 bps; this is despite rising commodity costs and foreign exchange headwinds.

- an increase in marketing spending to 12.3% of net sales, a 10 bps increase.

- SG&A is expected to increase 180 bps. Once adjusted for the pension settlement and Brazil charges, however, the increase is only 10 bps to 12.7% of sales.

- Operating margin is expected to decline 120 bps basis points, but will expand 40 bps when adjusted to exclude the pension and Brazil charges.

- FY2017 EPS is expected to be $1.72 – $1.74 which includes a $0.02 negative impact from the Brazil charge, $0.16 – $0.18 negative impact from the pension settlement and a $0.03 positive impact from adopting the new options accounting standard.

- Adjusted EPS growth of 7% or $1.89/share is projected which:

- includes incremental marketing spending and $0.01 EPS dilution from transition expenses related to the recently closed acquisitions.

- excludes the $0.03 EPS impact from the accounting change.

- 8% currency neutral adjusted EPS growth excluding a 1% negative impact from foreign exchange.

The all important adjusted FCF is expected to exceed adjusted net income. This is similar to previous years.

In Q1 2017, CHD expects reported and organic sales growth of approximately 1 – 2%, gross margin expansion and a 7% increase in EPS to the $0.46 level. Flat EPS is expected in the first half of 2017 as CHD significantly increases Q2 advertising and marketing expenditures in support of new product launches, in particular the all exciting cat litter innovation that cats have been clamoring for.

Valuation

Today’s earnings announcement has resulted in CHD’s shares jumping almost 3.5% to just over $47. That certainly does not help those who wish to initiate a position or who want to increase their position.

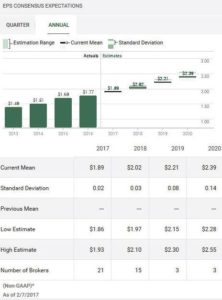

CHD is projecting FY2017 EPS of $1.72 – $1.74 and FY2017 adjusted EPS $1.89; $1.89 is the mean estimate provided by multiple brokers (see below).

At $47/share and a $1.89 estimated adjusted EPS for FY2017, the forward PE is just under 25. I view this level to be greater than my preferred PE target which is sub 20. Unfortunately, CHD is one of those companies that very rarely witnesses such a low PE. In the last several years, I think CHD was only priced at a reasonable level during the Financial Crisis.

I recognize the markets will likely correct at some stage and CHD’s stock price may be caught in the downdraft. If you think the same way, you may likely decide that you will patiently wait on the sidelines.

My suggestion is that you currently initiate a small position in CHD (yes, even at these elevated values). If/when there is a market correction, you can certainly back up the truck and acquire more shares at lower prices.

As I compose this post, CHD’s PE is above 27 and the dividend yield based on a quarterly dividend of $0.1775 is around 1.51%. We know that the quarterly dividend is being increased to $0.19/quarter so the forward dividend yield is just above 1.6%.

This dividend yield will turn off many investors. If you happen to think this way, may I suggest you quickly read my Low or No Dividend Yield Companies Belong in Your Portfolio post before you completely rule out CHD.

I have absolutely no idea in which direction stock prices are headed. I do know, however, that CHD’s underlying business is sound and that it will most likely continue to grow and to reward shareholders.

Option Strategy

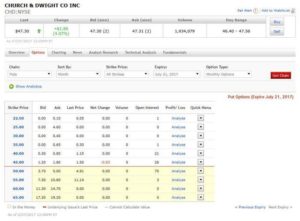

If you are adamant that you do not want to buy CHD at these levels but you would like to own CHD at a slightly lower level, you may want to consider selling a July 21, 2017 put with a $45 strike price. By doing this, you are giving someone the right to sell CHD shares to you at $45 up until expiry.

You will at least earn some premium but it means you will tie up some money for a period of time since your broker will want to ensure funds are available if CHD drops below $45.

While you can certainly sell puts at lower strike prices, the premiums are so low it probably isn’t worth the time and effort. The premium for a July 21, 2017 put with a $35 strike price last traded at $0.30 as I compose this.

The reason the premium is so low is that nobody in their right mind will take you up on your offer to sell their shares to you at $35 if CHD continues to trade at current levels. They will just merely let their right to sell you shares at $35 expire worthless. At such a low strike price, you will likely just end up collecting the option premium but you will never end up owning CHD shares (unless something dramatic occurs in the world to send the markets in a tailspin).

Church & Dwight Stock Analysis – Final Thoughts

One of the things that appealed to me the most about CHD when we decided to initiate a position in this company in 2005 (owned outside the FFJ Portfolio) is that it produces and sells products where strategic meetings are not required. Unlike purchasing large ticket items where the thought process may be extensive and lengthy, purchasing detergent, kitty litter, birth control, and personal hygiene products does not require a family meeting. If you decide that you want to forego the purchase of antiperspirant, for example, it won’t be long before some suggest you address the odour issue. Because CHD’s products are not major capital expenditures, CHD does not need to convince you that you need to buy the product. It just needs to convince you to buy its product.

This company probably flies under the radar screen of most investors because of its size (sub $12B market cap), consistently high PE, and low dividend yield. It is, however a wonderful company that generates strong results, including strong cash flow, year after year.

In all the years we have owned CHD shares we have continually DRIPed our dividends. Had we not done so, it is possible I may have repeatedly hesitated to reinvest the quarterly dividends because I was always concerned that CHD was too expensive. That would have been a real shame.

Don’t concern yourself with the sub 2% dividend yield. I can categorically tell you that with the steady dividend increases and the two “2 for 1” stock splits that have occurred during the period in which we have owned CHD, our quarterly dividend income has increased more than 7 fold to just over $550/quarter.

If you currently own CHD, keep it. If you don’t, you may want to initiate a small position and gradually increase your holding over time with larger purchases on dips.

Disclaimer: I have no knowledge of your circumstances and am not providing individualized advice or recommendations. I encourage you to conduct your own research and due diligence and to consult your financial advisor about your situation.

Disclosure: I am long CHD.

I wrote this article myself and it expresses my opinions. I am not receiving compensation for it and have no business relationship with any company mentioned.