Having been a shareholder since late 2005, I can attest that Church & Dwight (CHD) creates long-term wealth through the consistent appropriate prioritization of Free Cash Flow. This track record of long-term wealth creation is borne out from its 3, 5, 10, and 15-year returns of 17.4%, 20%, 18%, and 17.9%; the return in FY2021 was 17.9%.

The challenge investors currently face when buying CHD shares, however, is that shares are richly valued. This overvaluation lowers potential long-term investment returns.

I reviewed CHD in this October 29, 2020 post at which time I disclosed the purchase of additional shares at ~$86.

I subsequently wrote a Guest Post at Dividend Power on May 25, 2021.

In my January 7, 2022 post, I disclosed that CHD was my 3rd largest holding. In mid-August 2020, it was my 2nd largest holding after Visa (V) and in mid-April 2021 it was my 3rd largest holding after V and Mastercard (MA).

With the release of Q4 and FY2021 results and FY2022 guidance on January 28, 2022 and the ~$20 share price increase after late September 2022, I take this opportunity to revisit CHD.

Overview

Before 2001, CHD’s only Power Brand was Arm & Hammer. It now has a portfolio of brands that include 14 Power Brands of which 13 were acquired over the past 2 decades. These Power Brands generate more than 80% of CHD’s sales and profits.

In FY2021, CHD generated ~$5.2B of revenue: ~45% Household products, ~49% Personal Care, and ~6% Specialty.

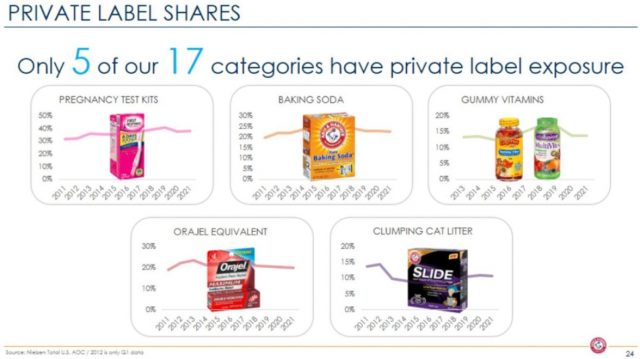

It has low exposure to private labels with the weighted average private label share in CHD’s product categories being ~12%. Only 5 of CHD’s 17 categories have meaningful private label exposure. In general, private label has not been a significant factor in CHD’s categories over the past year.

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

CHD’s website, the FY2020 10-K, and the presentation that accompanied management’s review with analysts at the January 28, 2022 Analyst Day provide investors with a comprehensive overview of CHD.

Financials

Q4 and FY2021 Results

CHD’s Q4 and FY2021 results and FY2022 guidance reflect a year of supply chain disruption, inflation and high consumer demand. CHD, however, quickly reacted by raising prices and adding a significant number of co-packers and suppliers to its network. In addition, consumer demand drove significant sales growth, which enabled it to offset some of the inflationary impacts.

CHD’s business model targets 3% organic sales growth and 8% EPS growth.

In FY2021, CHD achieved:

- organic sales of 4.3%, which was broad-based across all businesses (3.5% the US, 5% International and 12% Specialty Products).

- EPS growth of 7%.

The gross margin was down 160 bps as CHD faced 9% ($0.25B) of COGS inflation YoY. Marketing was down 100 bps to 11.1% and adjusted SG&A was down 50 bps. This led to adjusted EPS growth of 6.7% or $3.02/share (up from $2.83 in FY2020).

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

Outlook

CHD is planning to significantly expand capacity for vitamins, litter and laundry in the next few years.

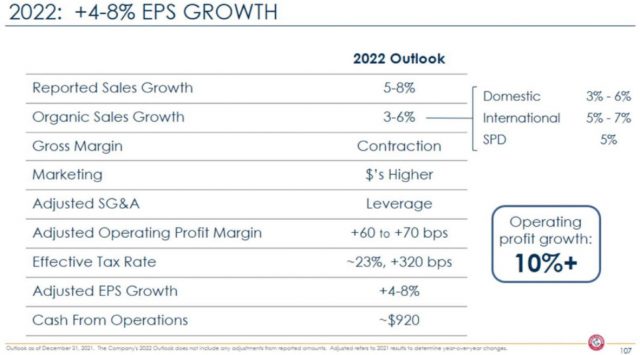

Current guidance is for FY2022 adjusted diluted EPS to grow 4% – 8%. Based on $3.02 in FY2021 adjusted diluted EPS, the FY2022 range is ~$3.14 – ~$3.26.

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

Free Cash Flow (FCF)

CHD generated ~$0.994B in cash from operations and reported CAPEX of ~$0.119B resulting in FCF of ~$0.875B.

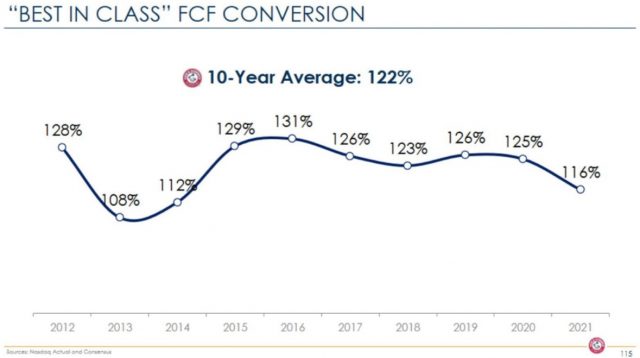

FY2021’s FCF conversion (FCF divided by net income) was ~116% which is below the 10 year historical FCF conversion rate of ~122%.

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

CHD’s cash conversion cycle has significantly improved from 52 days in FY2009 to 15 days in FY2021. Management expects this to increase slightly in FY2022 as the company rebuilds inventory and safety stock.

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

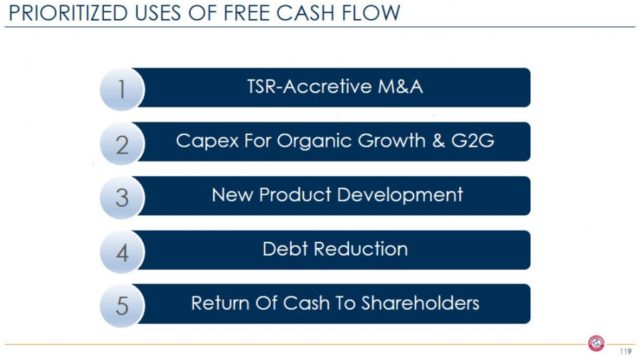

CHD’s consistent strong Free Cash Flow (FCF) and tight cash conversion cycle allow it to prioritize uses as reflected below.

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

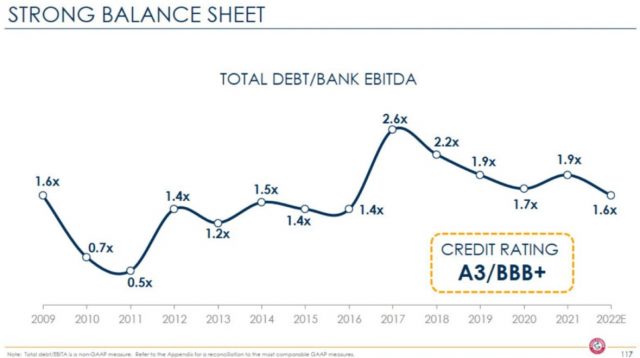

Credit Ratings

When I initiated a CHD position in late 2015, its senior unsecured domestic currency debt ratings were non-investment grade. Moody’s, for example, assigned a Ba2 rating which is the middle tier of the non-investment grade speculative category.

CHD’s impressive performance over the past ~1.5 decades has resulted in investment-grade ratings with a stable outlook.

- Moody’s: A3 (this is the bottom tier of the upper-medium-grade investment-grade category); this rating is 5 tiers higher than in late 2015!

- S&P Global: BBB+ (this is the top tier of the lower-medium-grade investment-grade category).

Moody’s rating defines CHD as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

S&P Global’s rating is one level lower than that assigned by Moody’s. This rating defines CHD as having an adequate capacity to meet its financial commitments. Adverse economic conditions or changing circumstances, however, are more likely to lead to a weakened capacity to meet its financial commitments.

Source: CHD – 2021 Analyst Day Presentation – January 28, 2022

I deem CHD’s financial risk to be acceptable.

Dividend and Dividend Yield

CHD’s dividend history includes an enviable record of dividend distributions for 121 consecutive years.

The recently declared quarterly dividend increase from $0.2525 to $0.2625 is a ~4% increase. The dividend yield based on the current $103 share price is ~1%; this low yield might dissuade some investors from investing in CHD.

I think far too many investors fixate on dividend yield and would be better served by looking at total potential return.

The weighted-average diluted shares outstanding (in millions) in FY2009 – FY2021 is 286, 289, 292, 285, 282, 275, 267, 262, 256, 251, 252, 252, and 250.

In FY2018 – FY2020, share repurchases were $0.2B, $0.25B, and $0.3B. Repurchases were briefly paused in 2020 as a result of COVID-19 but CHD’s strong cash position enabled it to resume purchases in FY2021; it repurchased $0.5B in FY2021.

NOTE: Dividends and share repurchases are the lowest priority in the use of FCF.

Valuation

CHD’s diluted PE levels in FY2012 – FY2021 are 21.87, 24.46, 27.36, 28.01, 25.47, 28.83, 20.05, 28.83, 28.23, and 31.25.

At the time of my February 7, 2018 CHD post, I had just acquired another 200 shares on February 6th at ~$48 and CHD’s management had just forecast 2018 adjusted EPS of $2.24 – $2.28. Using this price and earnings forecast, the forward adjusted PE range was ~21 – ~21.4.

When I wrote my May 8, 2018 article, management still had the same adjusted EPS outlook and CHD was trading at $47.73; the forward valuation was roughly the same as in February 2018.

After the Q3 2018 earnings release, CHD’s stock price jumped to $64.87. In my November 1, 2018 article, the EPS and adjusted EPS outlook for FY2018 was $2.27 (a decline of 22% due to 2017 tax law changes and adjusted EPS growth of 17%). This meant CHD’s forward PE and forward adjusted PE was ~28.6.

At the time of my February 2019 article, CHD had just released Q4 and FY2018 results and FY2019 guidance. With the drop in CHD’s share price to $60.46, I arrived at a valuation of ~26.6 based on $2.27 EPS; the forward valuation amounted to ~24.48 – ~24.9 based on $2.43 – $2.47 guidance.

When I wrote my November 1, 2019 post, CHD was trading at ~$68.25 and guidance called for $2.47 in adjusted diluted EPS giving us a forward adjusted diluted PE of ~27.6.

On October 29, 2020, I acquired shares at $86.12. Using FY2020 adjusted EPS guidance of $2.79 – $2.81 ($2.80 mid-point), the forward adjusted PE was ~30.76.

Based on management’s FY2021 adjusted diluted EPS of $3.00 – $3.06 guidance the adjusted diluted P/E is ~28.5 – ~29.1.

At the time of my May 25, 2021 guest post, FY2021 adjusted diluted EPS guidance from 20 analysts was a mean of $3.04 and a $2.97 – $3.07 range. Using the current $87.20 share price, the forward adjusted diluted P/E range was ~28.4 – ~29.4.

Management’s FY2022 guidance is now ~$3.14 – ~$3.26. Shares are trading at $103 thus giving us a forward adjusted diluted P/E range of ~31.6 – ~32.8.

The projected adjusted diluted PE levels based on current broker guidance derived from the two discount broker platforms I use and a ~$103 share price are:

- FY2022 – 19 brokers – mean of $3.21 and low/high of $3.10 – $3.33. Using the mean, the forward adjusted diluted PE is ~32.

- FY2023 – 14 brokers – mean of $3.49 and low/high of $3.40 – $3.62. Using the mean, the forward adjusted diluted PE is ~29.5.

Final Thoughts

Church & Dwight (CHD) creates long-term wealth when shares are acquired at a fair valuation.

The vast majority of the CHD shares I own are held in a tax-efficient account (Registered Retirement Savings Plan). In late 2021, I initiated an RRSP meltdown strategy and at some point will have to sell shares that currently have an average cost under $16.

Knowing this, I initiated a CHD position in a taxable account in October 2020. I plan to increase this position but I consider CHD to currently be too richly valued. I would look to add to my CHD exposure if its forward adjusted diluted PE were to retrace ~28 or less. Using the $3.20 mid-point of management’s FY2022 guidance, a price below ~$90 is a level at which I would add to my position.

I wish you much success on your journey to financial freedom!

Note: Please send any feedback, corrections, or questions to finfreejourney@gmail.com.

Disclosure: I am long CHD.

Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

I wrote this article myself and it expresses my own opinions. I do not receive compensation for it and have no business relationship with any company mentioned in this article.