Summary

Summary

- Brown-Forman is currently undergoing a major transformation. It sold its Southern Comfort and Tuaca trademarks in 2016 and has made some acquisitions in the past couple of years.

- Brown-Forman is a Dividend Aristocrat having increased its dividend for 33 years in a row. It has also paid dividends for 71 years in a row and has occasionally paid special dividends.

- While Brown-Forman certainly has a loyal following from an investment perspective, I suggest that all is not well and a “wait and see” approach is probably wise.

Introduction

Brown-Forman (NYSE:BF.A) (NYSE:BF.B) was founded in 1870 and has become one of the largest American-owned spirits and wine companies and among the top 10 largest global spirits companies, to sells its brands in countries around the world. It has more than 25 brands in its portfolio of wines and spirits and employs more than 4,600 people worldwide.

Brown-Forman is a favorite of many dividend investors because of its track record of paying increasing dividends for the past 33 years. In addition, it pays the occasional “special dividend”.

There are two classes of shares. The Class A shares have voting rights while the Class B shares do not. While both shares track each other closely there can occasionally be a variance of $2 – $3 per share.

I have been monitoring Brown-Forman for the past couple of years as a potential addition to our family’s equity portfolio. I have never “pulled the trigger” as I have felt the Class B shares have always been too richly priced; I would acquire the Class A shares if they were trading at a considerably lower level than the Class B shares but would most likely acquired Class B shares since my few hundred/thousand shares would be insignificant relative to the holdings of the largest shareholders thereby rendering my vote “meaningless”.

The “Brown-Forman 150” long-term strategy was introduced in 2010 as a strategic initiative to focus on what will drive sustainable growth toward its 150th anniversary in 2020.

Given that Brown-Forman’s goal is to “Enrich Life”, I thought it would be prudent to see if their recent performance was such that they could perhaps enrich my family’s life. While their goal is certainly not to enrich my life, it would have been nice if they had asked me; I would have offered them a number of recommendations.

Since the likelihood of Brown-Forman’s senior management accepting my call was remote to non-existent, I undertook the review of the 6 month results as at October 31, 2016, the transcript of the call, and the Earnings Call Slides; this Q2 2016 Earnings Call was held December 7, 2016.

My findings

I like to acquire shares in companies that are fairly valued or which are on sale. I also like it when my investments allow me to sleep at night; when my head hits the pillow I want absolutely no worries about my investments. There is enough to worry about without the added burden of how my hard-earned money is going to work for me.

Recently I noticed that the stock screeners were showing Brown-Forman as having a P/E ratio in the 18 range. I found that bizarre since every other time I had checked, the P/E it was in the 25 – 28 range. My “spiddy” senses went off so I decided to do some digging. This is what I noticed.

I looked at the closing price as at the most recent fiscal year-end (April 30, 2016) and factored in the 2 for 1 stock split that occurred this summer. Doing this, I arrived at a stock price of roughly $51.86 and $48.16 for the Class A and Class B shares; these might not be the exact closing prices but they are reasonably close (I just looked at Google charts to make life easy.

I then looked at the April 30, 2016 financial statements and saw Diluted EPS of $5.22/share. Double the stock prices quoted earlier to account for the stock split and you get $103.72 and $96.32. Divide each figure by $5.22/share and you get P/Es of 19.87 and 18.45. If I use the Basic EPS of $5.26/share, the P/Es are slightly lower.

I then noticed on the Income Statement a $485 Million gain on sale of business which, in my opinion, is a non-recurring gain. I, therefore, backed out this amount to calculate Net Income thus reducing the reported $1.489 Billion Pre-Tax Income to $1.004 Billion. Taking into consideration that I was using a Pre-Tax Income figure, I “ball parked” the P/E ratio to be much closer to the historical 25 – 28 range versus the 18 figure reported in stock screeners.

I don’t know how many people would go through this exercise. I am willing to bet the vast majority of investors would rely on stock screeners to make their investment decisions! People will search for stocks with a P/E under 20 and they will think “OH, MY! Brown-Forman is under 20. I think it is a “buy”. I think it is more like “buyers beware”.

Treasury Stock

I then looked at the Balance Sheet and noticed a huge number for Treasury Stock. I decided to go back to 2011 to see how these numbers had changed over time and noticed Brown-Forman had spent a considerable amount of money over the last several years acquiring its stock and, in particular, the May 1, 2014 – April 30, 2016 period; I draw to your attention page 19 of the pdf version of Brown-Forman’s 2016 10-K.

What disappointed me was that during the May 1, 2015 – April 30, 2016 period, Brown-Forman acquired:

- 21,041 Class A shares @ an average price of $95.43* = $2,007,943

- 11,357,349 Class B shares @ an average price of $96.98* = $1,101,435,706

If we adjust these prices to reflect the 2 for 1 stock split in the summer of 2016, these prices would be amended to $47.715 for the Class A shares and $48.49 for the Class B shares. The stock price as at December 9, 2016 is below these levels.

Brown-Forman subsequently acquired an additional $442 Million in shares for the first 6 months of the current fiscal year ending April 30, 2017. This most recent 10-Q report does not have the same level of detail as the 10-K so I am unable to ascertain how many Class A and Class B shares were purchased and at what average price.

I, therefore, looked at the stock chart for both classes of shares for the April 30, 2016 – October 31, 2016 period. The lowest price during this period for the Class A and B shares was roughly $47 and roughly $44.67, respectively. I can’t say for certainty that all the shares were purchased at the lowest price but I would suspect this is unlikely.

Given the above noted prices and the December 8, 2016 closing market prices of $48.23 and $45.87 for the Class A and B shares, I don’t think shareholders have come out ahead that much at this point in time with these Treasury Stock purchases.

Where did some of the money come from to acquire these shares?

Now, where did some of the funding come from to acquire these shares? With debt! Look at the jump in debt in fiscal 2016 on page 41 of Brown-Forman’s 2016 10-K. Furthermore, when I look at the October 31, 2016 6 month results, I see that long-term debt has increased even more to $1.917B versus the $1.23B as at April 30, 2016.

I recognize not all this debt was incurred to acquire Treasury Stock. I know Brown-Forman is undergoing a major transformation of its business by divesting itself of certain brands and acquiring new brands, and therefore, a transformation of this magnitude will likely require funding from profits generated through normal business operations and some debt. Brown-Forman’s growth in debt, however, is significant.

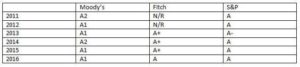

Credit Ratings from the Agencies

Given the growth in debt I thought I would check Brown-Forman’s credit ratings.

How do these ratings stack up on the Corporate Credit Ratings Scale? Only upper medium grade.

What does an upper medium corporate credit rating mean? It means an obligor has STRONG capacity to meet its financial commitments but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

I am certain Brown-Forman’s management has no intent of letting its credit ratings slip into the Lower Medium grade category. Here’s hoping their transformation strategy works out!

December 7, 2016 conference call

I have had an opportunity to review the transcript of the call and was not overly impressed.

If you refer to the slides from the Earning Call you can see there are a lot of negative numbers (links are provided earlier in this article). Things have not gone well in Canada, US, Turkey, UK, Russia and Germany. If you look at slide 15 of the presentation, you will see negative Net Sales growth in the US, Germany, Canada, Turkey, UK, and Russia. Russia is (76%)! Somebody please tell the Russians to start drinking more Brown-Forman products!

Look at slide 20 to view the Sales, Gross Profit, and Operating Income for the first half of Fiscal 2017. They are down 4%, 7%, and 5% relative to the same period in 2016!

Okay, I understand the need to explain the variances between projections and actual results but is it just me or do all these GAAP and non-GAAP comparisons drive you nuts? I recognize there are instances in which GAAP reporting fails to accurately portray the operations of a business, and therefore, management also uses non-GAAP figures in presentations. Typically these non-GAAP figures exclude irregular or noncash expenses, such as those related to acquisitions, restructuring or one-time balance sheet adjustments so as to smooth out high earnings volatility that can result from temporary conditions. I know the purpose is to provide a clearer picture of the ongoing business but non-GAAP figures are subject to situations in which the incentives of shareholders and corporate management may not necessarily be aligned. I am not suggesting Brown-Forman’s management is doing irregular things with the numbers but look at how a negative 4% Operating Income under GAAP becomes a positive 8% using Underlying numbers.

Before I retired, I wonder what kind of reaction I would have received from upper management if I had presented actual sales results for my team as well as “Underlying” numbers!

And what is with some of the Investment Banking analysts who attend conference calls!? Can’t they ask some hard-hitting questions or, at the very least, not come across as patsies. Here are a couple of actual questions from the call:

- “Great. Thank you very much. I am wondering if you could talk a little bit about tequila and there is a couple of questions I have. Number one, just kind of how you see the market for tequila evolving in the U.S., is your strategy to kind of stick with it, the current brands you have or do you think you need more, a little bit about pricing power for tequila, we are hearing a little bit about some potential shortages for agave and prices for agave going up, so just wondered if you could kind of discuss those questions broadly on your tequila business, please?”

- “Hi, it’s actually Stephanie on behalf of Bill. My first question has to do with flavors in the U.S. kind of acceleration we have seen over the last year, do you guys believe that that’s kind of bottomed out and kind of your outlook going forward. And then secondly, maybe if you just can just provide a little bit more color on why you expect to see the barrel business improve in the second half, just the drivers behind that? Thanks.”

“I am wondering”, “Kind of how”, “Kind of stick”, “”Kind of discuss”, “Kind of acceleration”, “Kind of bottomed”, “Kind of your outlook”, “You just can just”.

Are you kidding me? You’re investment analysts getting paid a lot of money to ask tough questions so you can make investment recommendations to clients which pay you a lot of money. At least ask your questions with some conviction.

Brown-Forman’s senior management makes the comments below and there are no hard-hitting questions such as “So what are you doing to fix things and what target dates have been set by which time certain milestones must be met?”

- “Russia, Brazil and Turkey declined at double-digit rate through the first half as did China and Southeast Asia.”

- “If you think back to a couple of years ago we would have – I know we would have been in more of an investment mode in say, Russia where Jack Daniel’s and Finlandia were – had great momentum. And then as the Russian economy experienced its difficulties and consumers’ affordability associated with our products tempered somewhat. And it’s actually really has hit Finlandia over these last couple of years.”

- “Finlandia declined 4% during the first six months, with mid single-digit growth in Poland, offset by continued pressure in the premium vodka categories in Russia.”

Read the transcript and tell me if you got any value from the questions. As far as I am concerned the questions yielded answers of little additional benefit.

Brown-Forman Stock Analysis – Final Thoughts

I recognize Brown-Forman has been in business for almost 150 years and that it is a favorite for many dividend investors who have held the stock long-term. As a potential new shareholder, however, I see areas of concern.

I think:

- the stock is too richly valued when within the 25 – 28 P/E range.

- the company has taken on considerable debt to repurchase shares AND to finance its strategic repositioning.

- the dividend yield is far too low (currently 1.51% and 1.59% for Class A and B)

- the landscape is becoming increasingly competitive and there are much larger companies with which Brown-Forman must compete.

- the problems in the countries with negative trends need to be reversed.

If you have been a long-time Brown-Forman investor you can certainly afford to be patient. A company which has been around for 150 years has likely gone through many challenging periods and has survived/thrived. I, however, am not in your position and will patiently wait for some event(s) to bring Brown-Forman into a reasonable “buy zone” ($35 and under).

Disclaimer: I have no knowledge of your circumstances and am not providing individualized advice or recommendations. I encourage you to conduct your own research and due diligence and to consult your financial advisor about your situation.

Disclosure: I currently do not own shares in BF.b and have no intention of acquiring shares within the next 72 hours.

I wrote this article myself and it expresses my opinions. I am not receiving compensation for it and have no business relationship with any company mentioned.